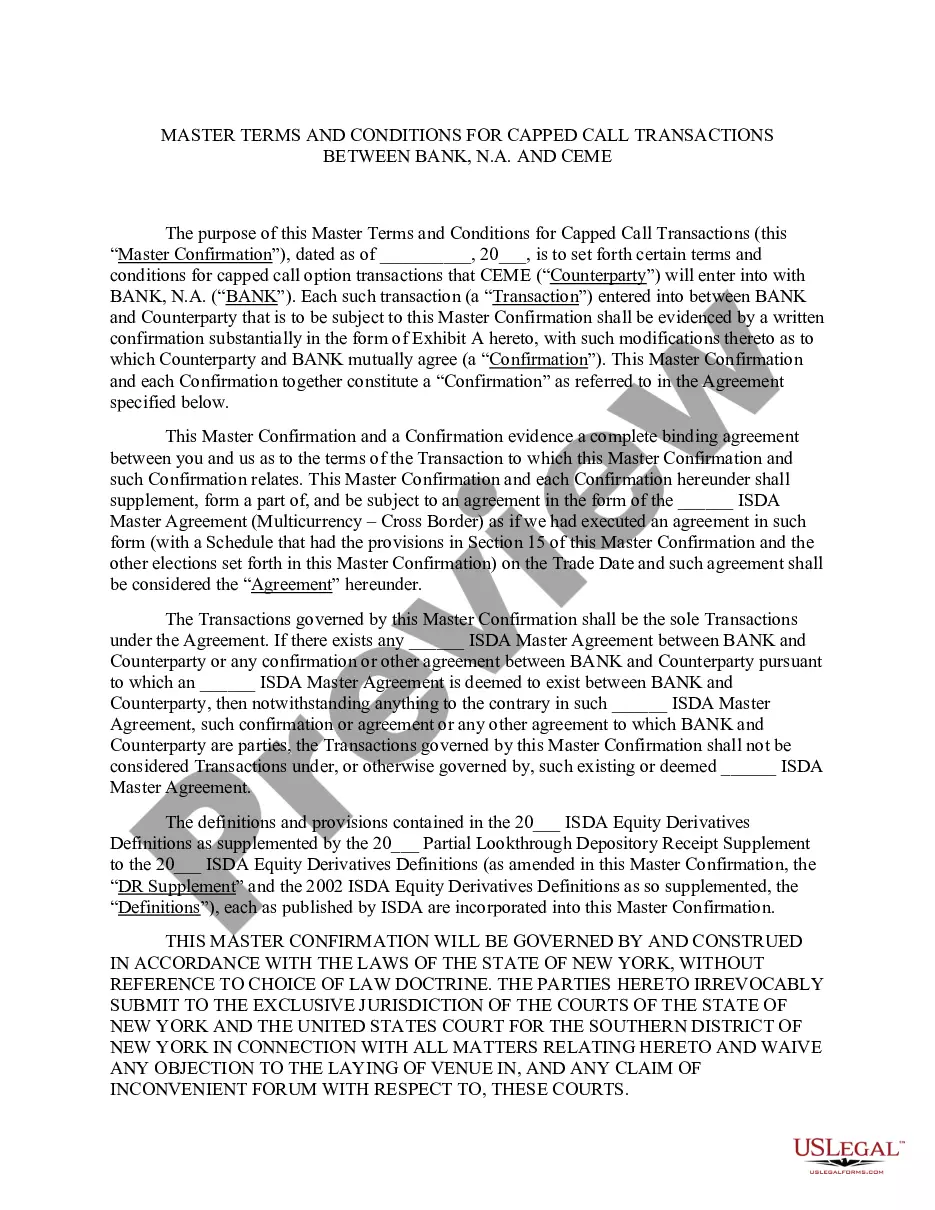

San Jose California Trust Agreement is an important legal document that establishes the terms and conditions under which Nike Securities, L.P., The Chase Manhattan Bank, BASIS Fund Services Ohio, Inc., and First Trust Advisors, L.P. work together. This agreement serves as a framework for the relationship between these entities and outlines their responsibilities, obligations, and rights. The San Jose California Trust Agreement plays a crucial role in managing various types of financial transactions and investments. It ensures transparency, accountability, and compliance with applicable laws and regulations. Here are some key aspects and types of the San Jose California Trust Agreement involving Nike Securities, L.P., The Chase Manhattan Bank, BASIS Fund Services Ohio, Inc., and First Trust Advisors, L.P.: 1. Investment Management Trust Agreement: This type of trust agreement outlines the responsibilities and authority of Nike Securities, L.P. and First Trust Advisors, L.P. in managing investment portfolios on behalf of their clients. It establishes the investment goals, risk tolerance, and investment strategies agreed upon between the parties. The agreement also includes provisions for regular reporting, performance evaluation, and review procedures. 2. Custodial Trust Agreement: In this type of trust agreement, The Chase Manhattan Bank acts as the custodian of the assets and securities held by Nike Securities, L.P., BASIS Fund Services Ohio, Inc., and First Trust Advisors, L.P. The agreement governs the safekeeping, record-keeping, and reporting of these assets. It ensures proper segregation of assets and compliance with applicable laws and regulations. 3. Fund Administration Trust Agreement: This type of trust agreement involves BASIS Fund Services Ohio, Inc., which provides administrative support and services to Nike Securities, L.P., The Chase Manhattan Bank, and First Trust Advisors, L.P. The agreement defines the scope of services, fees, and responsibilities related to the administration of investment funds. It includes provisions for fund accounting, financial reporting, and compliance oversight. 4. Compliance Trust Agreement: This trust agreement ensures that all parties involved comply with legal and regulatory requirements. It defines the compliance procedures, reporting obligations, and review mechanisms to monitor adherence to applicable laws and regulations. Nike Securities, L.P., The Chase Manhattan Bank, BASIS Fund Services Ohio, Inc., and First Trust Advisors, L.P. cooperate to maintain a robust compliance framework. The San Jose California Trust Agreement is a vital instrument that promotes transparency, efficiency, and mutual understanding among Nike Securities, L.P., The Chase Manhattan Bank, BASIS Fund Services Ohio, Inc., and First Trust Advisors, L.P. By establishing clear guidelines and responsibilities, this agreement fosters a collaborative environment focused on safeguarding client assets and achieving investment objectives.

San Jose California Trust Agreement Nike Securities, L.P., The Chase Manhattan Bank, BISYS Fund Services Ohio, Inc. and First Trust Advisors, L.P.

Description

How to fill out San Jose California Trust Agreement Nike Securities, L.P., The Chase Manhattan Bank, BISYS Fund Services Ohio, Inc. And First Trust Advisors, L.P.?

Preparing papers for the business or individual needs is always a big responsibility. When creating a contract, a public service request, or a power of attorney, it's important to consider all federal and state laws and regulations of the particular area. However, small counties and even cities also have legislative procedures that you need to consider. All these details make it stressful and time-consuming to generate San Jose Trust Agreement Nike Securities, L.P., The Chase Manhattan Bank, BISYS Fund Services Ohio, Inc. and First Trust Advisors, L.P. without expert assistance.

It's possible to avoid wasting money on lawyers drafting your documentation and create a legally valid San Jose Trust Agreement Nike Securities, L.P., The Chase Manhattan Bank, BISYS Fund Services Ohio, Inc. and First Trust Advisors, L.P. by yourself, using the US Legal Forms web library. It is the biggest online collection of state-specific legal templates that are professionally cheched, so you can be sure of their validity when choosing a sample for your county. Earlier subscribed users only need to log in to their accounts to download the required form.

In case you still don't have a subscription, adhere to the step-by-step instruction below to obtain the San Jose Trust Agreement Nike Securities, L.P., The Chase Manhattan Bank, BISYS Fund Services Ohio, Inc. and First Trust Advisors, L.P.:

- Examine the page you've opened and check if it has the document you require.

- To accomplish this, use the form description and preview if these options are available.

- To locate the one that satisfies your needs, use the search tab in the page header.

- Recheck that the sample complies with juridical standards and click Buy Now.

- Pick the subscription plan, then log in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever purchased never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and quickly obtain verified legal forms for any use case with just a few clicks!