Collin Texas Pooling and Servicing Agreement is a legal contract executed between IMPACT Secured Assets Corp., iMac Funding Corp., and Northwest Bank Minnesota, National Assoc. This agreement serves as a framework for the pooling, servicing, and management of mortgage loans in Collin County, Texas. Keywords: Collin Texas, Pooling and Servicing Agreement, IMPACT Secured Assets Corp., iMac Funding Corp., Northwest Bank Minnesota, National Assoc., mortgage loans, Collin County. Under this agreement, IMPACT Secured Assets Corp., iMac Funding Corp., and Northwest Bank Minnesota, National Assoc. Collaborate to bundle residential mortgage loans originated in Collin County. Through the pooling of these loans, a new security is created, commonly known as a mortgage-backed security (MBS). This security is then sold to investors in the secondary market, allowing for the efficient financing and management of these loan portfolios. The Collin Texas Pooling and Servicing Agreement outlines various crucial aspects, including: 1. Loan Criteria: The agreement defines the specific eligibility criteria for the inclusion of mortgage loans in the pooling process. This criterion focuses on factors such as loan type, loan-to-value ratio, credit scores, occupancy status, and documentation requirements. 2. Pooling Process: The agreement outlines the process of pooling mortgage loans. It defines the minimum pool size, the time frame for inclusion, the allocation of loans to different tranches, and the methodologies for determining the allocation of principal and interest payments. 3. Servicing Responsibilities: The agreement establishes the roles and responsibilities of each party involved in the servicing of the mortgage loans. It outlines the obligations related to loan administration, collection of payments, tax and insurance management, delinquency and default management, and foreclosure procedures. 4. Cash Flow and Distribution: The agreement details the cash flow mechanics of the mortgage loans and the distribution of funds to various parties involved. It outlines how the principal and interest payments from borrowers are collected, allocated, and distributed to investors and other entities involved, such as the master service and trustee. 5. Representations and Warranties: The agreement includes provisions related to representations, warranties, and covenants made by the parties involved. These provisions ensure that the mortgage loans meet certain quality standards and protect the interests of investors. 6. Termination and Default: The agreement specifies the conditions under which the pooling and servicing agreement can be terminated and the corresponding procedures. It also outlines the consequences and remedies in the event of a default by any of the parties. Different types of Collin Texas Pooling and Servicing Agreements may exist, depending on the specific terms and conditions agreed upon between IMPACT Secured Assets Corp., iMac Funding Corp., and Northwest Bank Minnesota, National Assoc. These agreements may vary based on factors such as loan types, geographic focus, loan sizes, and investor preferences.

Collin Texas Pooling and Servicing Agreement between IMPAC Secured Assets Corp., IMAC Funding Corp. and Northwest Bank Minnesota, National Assoc.

Description

How to fill out Collin Texas Pooling And Servicing Agreement Between IMPAC Secured Assets Corp., IMAC Funding Corp. And Northwest Bank Minnesota, National Assoc.?

Whether you intend to start your business, enter into a contract, apply for your ID renewal, or resolve family-related legal concerns, you need to prepare certain documentation meeting your local laws and regulations. Locating the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and checked legal documents for any personal or business occurrence. All files are collected by state and area of use, so opting for a copy like Collin Pooling and Servicing Agreement between IMPAC Secured Assets Corp., IMAC Funding Corp. and Northwest Bank Minnesota, National Assoc. is fast and simple.

The US Legal Forms website users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you a few additional steps to get the Collin Pooling and Servicing Agreement between IMPAC Secured Assets Corp., IMAC Funding Corp. and Northwest Bank Minnesota, National Assoc.. Adhere to the guide below:

- Make sure the sample meets your individual needs and state law regulations.

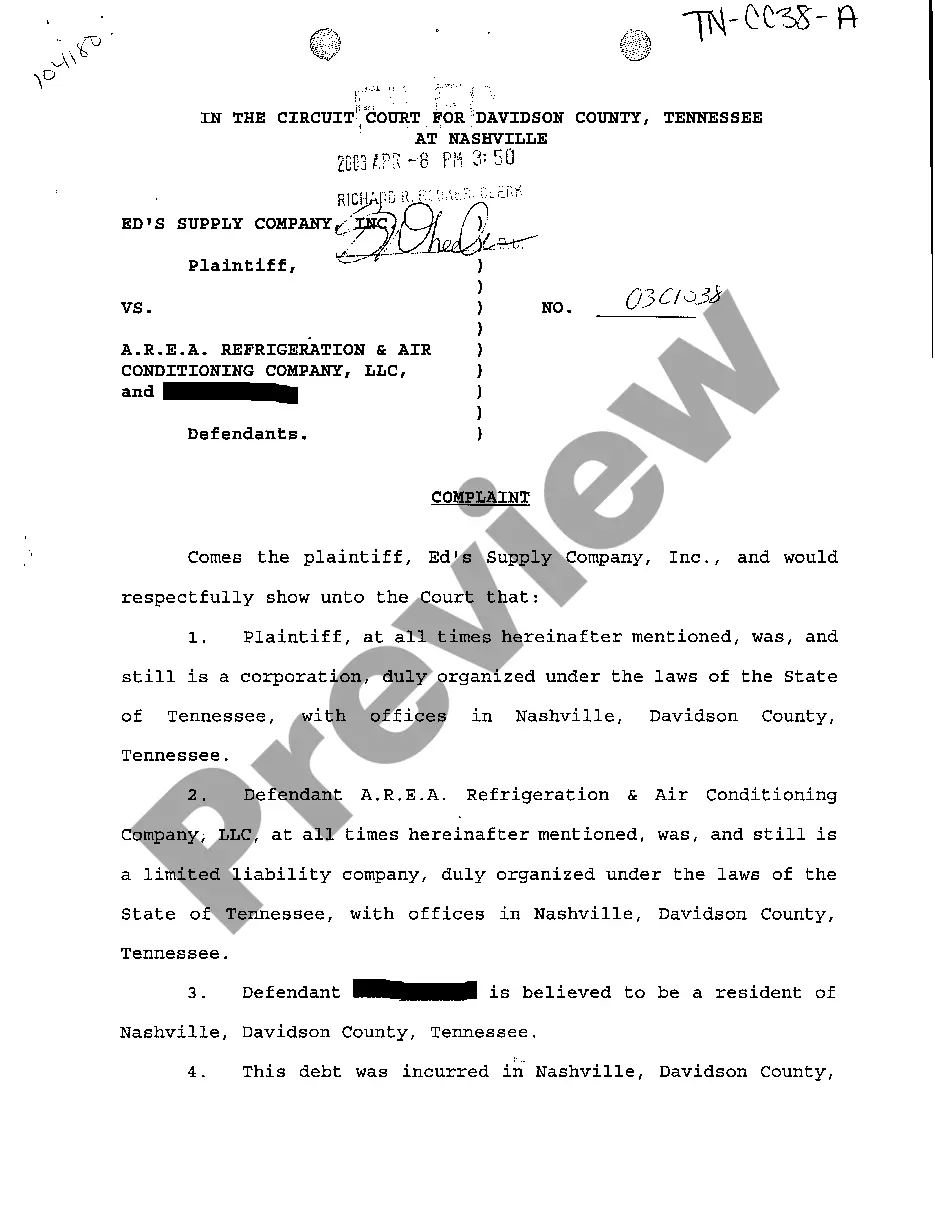

- Read the form description and check the Preview if available on the page.

- Make use of the search tab specifying your state above to find another template.

- Click Buy Now to obtain the file once you find the proper one.

- Select the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Collin Pooling and Servicing Agreement between IMPAC Secured Assets Corp., IMAC Funding Corp. and Northwest Bank Minnesota, National Assoc. in the file format you require.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our website are multi-usable. Having an active subscription, you are able to access all of your previously purchased paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documents. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form collection!

Form popularity

FAQ

The Public Securities Association Standard Prepayment Model (PSA) is the assumed monthly rate of prepayment that is annualized to the outstanding principal balance of a mortgage loan.

Your loan servicer typically processes your loan payments, responds to borrower inquiries, keeps track of principal and interest paid, manages your escrow account (if you have one). The loan servicer may initiate foreclosure under certain circumstances.

By definition a Mortgage Servicing Right, herein referred to as MSR(s), is a contractual agreement where the right, or rights, to service an existing mortgage are sold by the original lender to another party who, for a fee, performs the various functions required to service mortgages.

Mortgage servicing rights (MSR) refer to a contractual agreement in which the right to service an existing mortgage is sold by the original mortgage lender to another party that specializes in the various functions involved with servicing mortgages.

As an example, there are several ways for homeowners to find out who owns their mortgages: Contact your mortgage servicer.Run a check on the MERS (Mortgage Electronic Registration System) website.Visit the Ginnie Mae, Fannie Mae and Freddie Mac websites to use their loan lookup tools.

A servicing agreement is a contract between a servicer and a special purpose vehicle (SPV) or an assignee under which the servicer is responsible for administering a lease and acting as a conduit for all payments over the lease term in return for a periodic servicing fee .

Go to and click on Search for Company Filings under Filing & Forms (EDGAR). Under General-Purpose Searches, click on Companies & other filers. Then, in the Enter your search information box, type in Ameriquest next to Company name and click on the Find Companies button.

A loan servicing agreement is a written contract between a lender and a loan servicer that gives the loan servicer the authority to manage most aspects of a particular loan.