Franklin Ohio Underwriting Agreement refers to a legal contract entered into by Ameriquest Mortgage Securities, Inc., a prominent financial institution, and the relevant parties involved in the underwriting process. This agreement outlines the terms, conditions, and responsibilities of all parties regarding the issuance and sale of mortgage-backed securities in Franklin, Ohio. Ameriquest Mortgage Securities, Inc., being the underwriter, takes on the role of facilitating the offering and sale of the securities. The underwriting agreement typically consists of several key components such as: 1. Parties Involved: The agreement identifies the parties involved in the underwriting process, including Ameriquest Mortgage Securities, Inc. Other parties may include the issuer of the mortgage-backed securities, such as a mortgage lender or financial institution. 2. Securities Details: The agreement includes comprehensive information about the mortgage-backed securities to be sold, including their total value, interest rates, maturity dates, and other relevant terms. 3. Underwriter's Responsibilities: It outlines the responsibilities and obligations assumed by Ameriquest Mortgage Securities, Inc. under the agreement, such as conducting due diligence, marketing the securities, and ensuring regulatory compliance. 4. Terms and Conditions: The agreement outlines the specific terms and conditions of the underwriting process, including the timeline, pricing, commission structure, and allocation of securities among potential buyers. 5. Offering and Distribution: This section details the process by which the securities will be offered for sale and distributed to investors. It may outline any restrictions or requirements related to potential buyers, such as accreditation or qualification criteria. 6. Indemnification and Liability: The agreement typically includes provisions related to indemnification and liability for losses incurred during the underwriting process. This protects both Ameriquest Mortgage Securities, Inc. and the issuer from potential legal claims or financial repercussions. Different types of underwriting agreements in Franklin, Ohio, under Ameriquest Mortgage Securities, Inc., may involve variations in terms, conditions, and securities being underwritten. Examples include residential mortgage-backed securities (RMBS), commercial mortgage-backed securities (CMOS), or asset-backed securities (ABS). Overall, the Franklin Ohio Underwriting Agreement of Ameriquest Mortgage Securities, Inc. serves as an essential contract that establishes the framework for the underwriting process, ensuring transparency, compliance, and protection for all parties involved.

Franklin Ohio Underwriting Agreement of Ameriquest Mortgage Securities, Inc.

Description

How to fill out Franklin Ohio Underwriting Agreement Of Ameriquest Mortgage Securities, Inc.?

Whether you intend to open your company, enter into a deal, apply for your ID renewal, or resolve family-related legal issues, you must prepare certain documentation meeting your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and checked legal templates for any personal or business occurrence. All files are grouped by state and area of use, so opting for a copy like Franklin Underwriting Agreement of Ameriquest Mortgage Securities, Inc. is quick and easy.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you a couple of more steps to get the Franklin Underwriting Agreement of Ameriquest Mortgage Securities, Inc.. Follow the instructions below:

- Make sure the sample fulfills your individual needs and state law regulations.

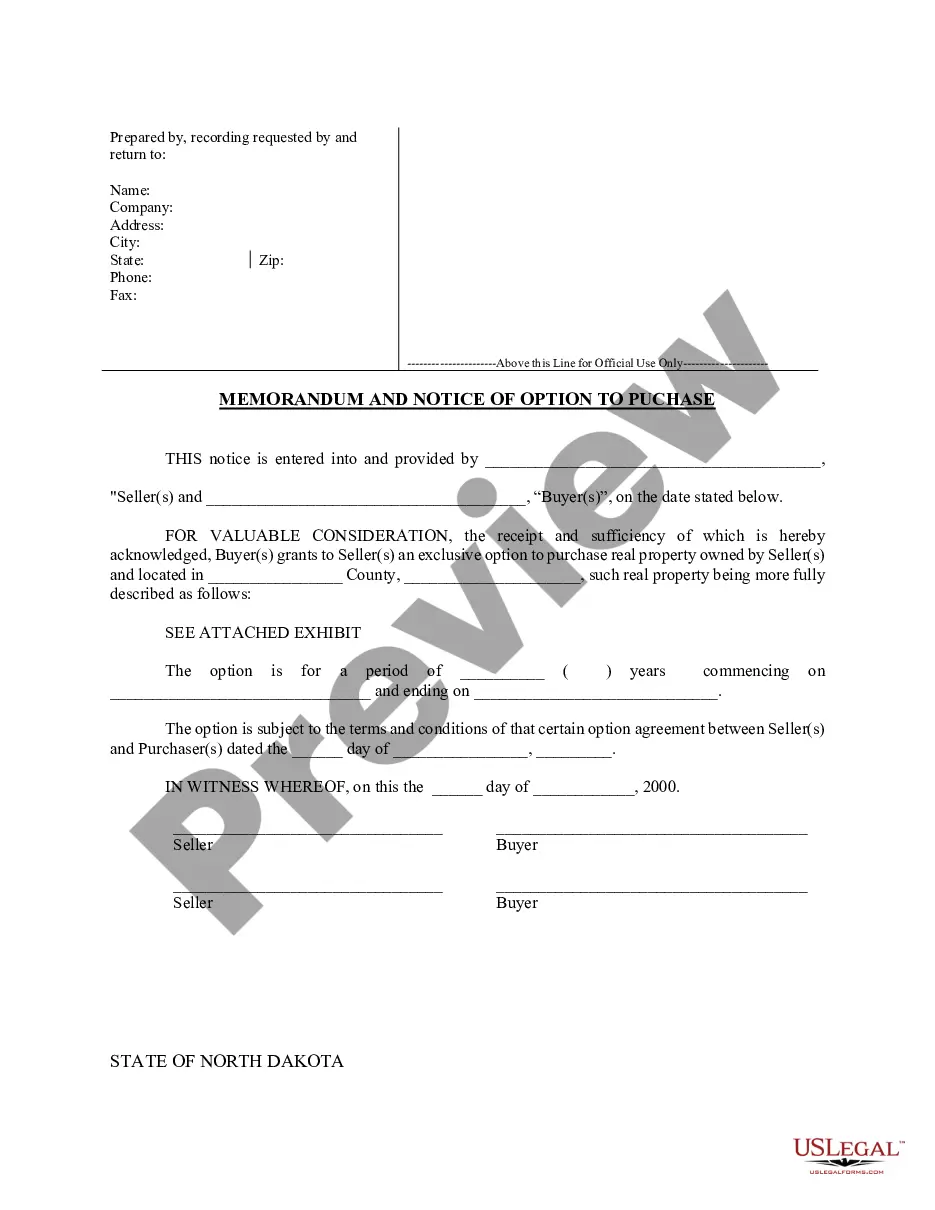

- Look through the form description and check the Preview if there’s one on the page.

- Make use of the search tab specifying your state above to find another template.

- Click Buy Now to obtain the file when you find the right one.

- Choose the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Franklin Underwriting Agreement of Ameriquest Mortgage Securities, Inc. in the file format you need.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our website are reusable. Having an active subscription, you are able to access all of your previously acquired paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date official documentation. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!