Los Angeles California Underwriting Agreement of Ameriquest Mortgage Securities, Inc. is a legally binding contract between Ameriquest Mortgage Securities, Inc. (ANSI) and underwriters involved in the sale and distribution of mortgage-backed securities (MBS) in the Los Angeles, California area. This agreement outlines the terms and conditions under which the underwriters will purchase and sell the MBS issued by ANSI. Most commonly, there are three types of Los Angeles California Underwriting Agreements offered by Ameriquest Mortgage Securities, Inc.: 1. Initial Public Offering (IPO) Underwriting Agreement: This agreement pertains to the first-time sale of MBS by ANSI to the public in the Los Angeles area. The underwriters are responsible for assessing market demand, pricing the securities, and ensuring a successful distribution of securities to potential investors. 2. Seasoned Offering Underwriting Agreement: In the case of a seasoned offering, ANSI issues additional MBS after the initial public offering. Under this agreement, the underwriters assist ANSI in the sale and distribution of these additional securities to the Los Angeles market. 3. Specialized Underwriting Agreement: This type of agreement may arise when ANSI plans to issue MBS with specific features or tailored to a particular market segment in Los Angeles. For example, ANSI might design MBS targeting low-income borrowers or those seeking adjustable-rate mortgages. The specialized underwriting agreement ensures the successful sale and distribution of these customized MBS to interested investors. Regardless of the type of agreement, the Los Angeles California Underwriting Agreement of Ameriquest Mortgage Securities, Inc. typically contains several key provisions: a. Terms and Conditions: The agreement outlines the terms that govern the relationship between ANSI and the underwriters, including the duration of the agreement, the number of MBS to be issued, and the pricing methodology. b. Representations and Warranties: ANSI provides assurances regarding the accuracy and completeness of the information provided in connection with the MBS offering. This protects the underwriters against any misrepresentation or deceitful practices. c. Underwriters' Commitment: The underwriters commit to purchasing a certain number of MBS from ANSI and agree to use their best efforts to distribute the securities to potential investors in Los Angeles. d. Compensation: The agreement specifies the underwriters' compensation, which may include underwriting fees, discounts on the purchase price of the MBS, or a percentage of the securities' proceeds. e. Indemnification: ANSI agrees to indemnify the underwriters for any losses or claims arising from any misrepresentation, breach of warranty, or non-compliance with applicable laws and regulations. f. Conditions Precedent: The agreement may include certain conditions that need to be met before the underwriters' obligation becomes effective. These conditions may include regulatory approvals, market conditions, or other stipulations agreed upon by ANSI and the underwriters. In summary, the Los Angeles California Underwriting Agreement of Ameriquest Mortgage Securities, Inc. is a crucial document that governs the sale and distribution of mortgage-backed securities by ANSI in the Los Angeles market. It ensures a mutually beneficial relationship between ANSI and the underwriters, protecting the interests of both parties while facilitating the smooth execution of MBS offerings.

Los Angeles California Underwriting Agreement of Ameriquest Mortgage Securities, Inc.

Description

How to fill out Los Angeles California Underwriting Agreement Of Ameriquest Mortgage Securities, Inc.?

Dealing with legal forms is a must in today's world. However, you don't always need to look for qualified assistance to draft some of them from the ground up, including Los Angeles Underwriting Agreement of Ameriquest Mortgage Securities, Inc., with a platform like US Legal Forms.

US Legal Forms has over 85,000 templates to select from in different categories varying from living wills to real estate papers to divorce documents. All forms are organized based on their valid state, making the searching process less challenging. You can also find information resources and guides on the website to make any tasks associated with document completion straightforward.

Here's how you can locate and download Los Angeles Underwriting Agreement of Ameriquest Mortgage Securities, Inc..

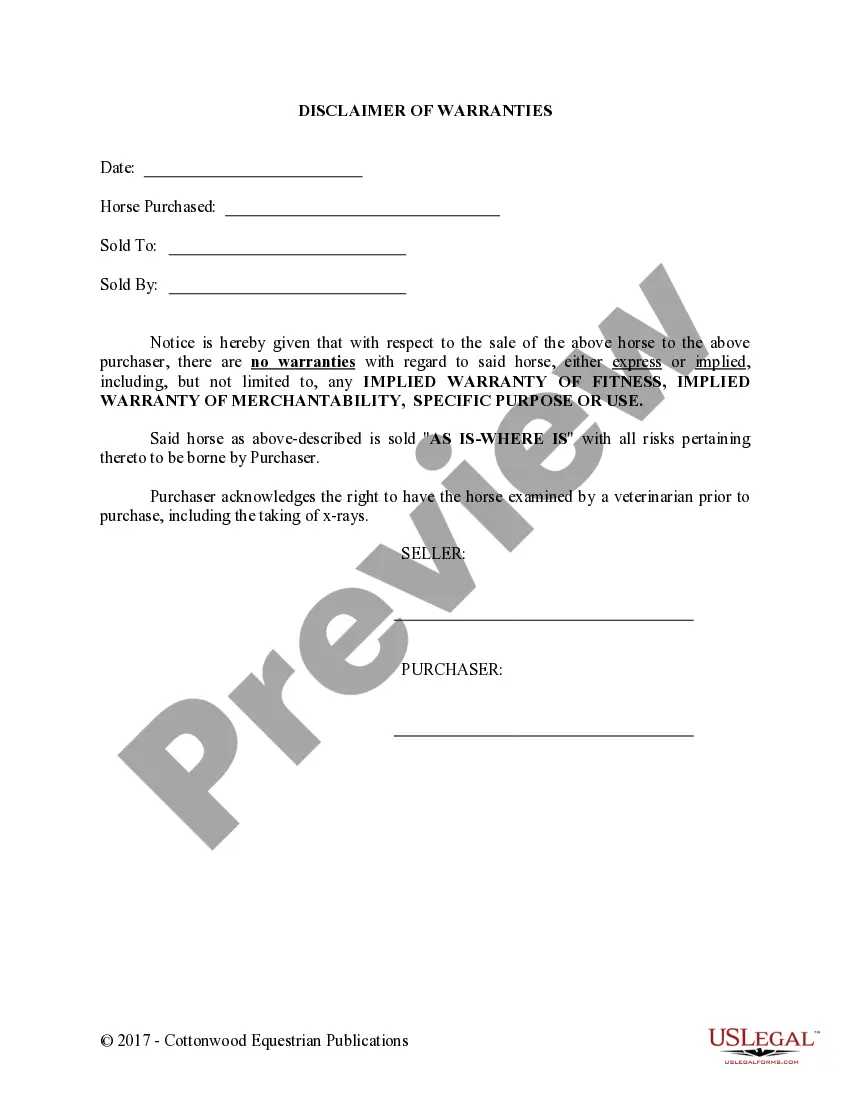

- Take a look at the document's preview and description (if available) to get a general information on what you’ll get after getting the document.

- Ensure that the document of your choosing is specific to your state/county/area since state laws can impact the legality of some records.

- Check the similar forms or start the search over to locate the correct document.

- Click Buy now and register your account. If you already have an existing one, choose to log in.

- Choose the option, then a suitable payment gateway, and buy Los Angeles Underwriting Agreement of Ameriquest Mortgage Securities, Inc..

- Choose to save the form template in any available format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can locate the needed Los Angeles Underwriting Agreement of Ameriquest Mortgage Securities, Inc., log in to your account, and download it. Needless to say, our platform can’t replace an attorney completely. If you need to cope with an extremely difficult case, we advise getting an attorney to check your document before executing and filing it.

With over 25 years on the market, US Legal Forms became a go-to provider for many different legal forms for millions of customers. Become one of them today and get your state-specific paperwork effortlessly!