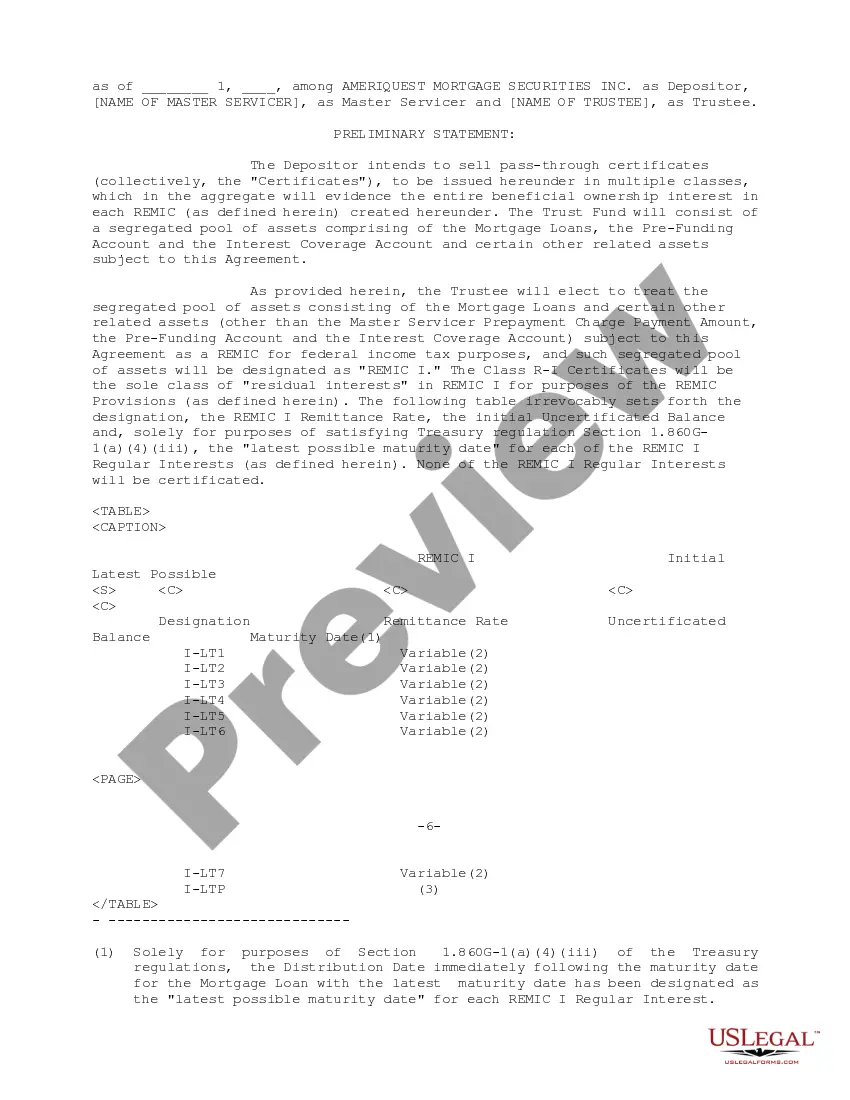

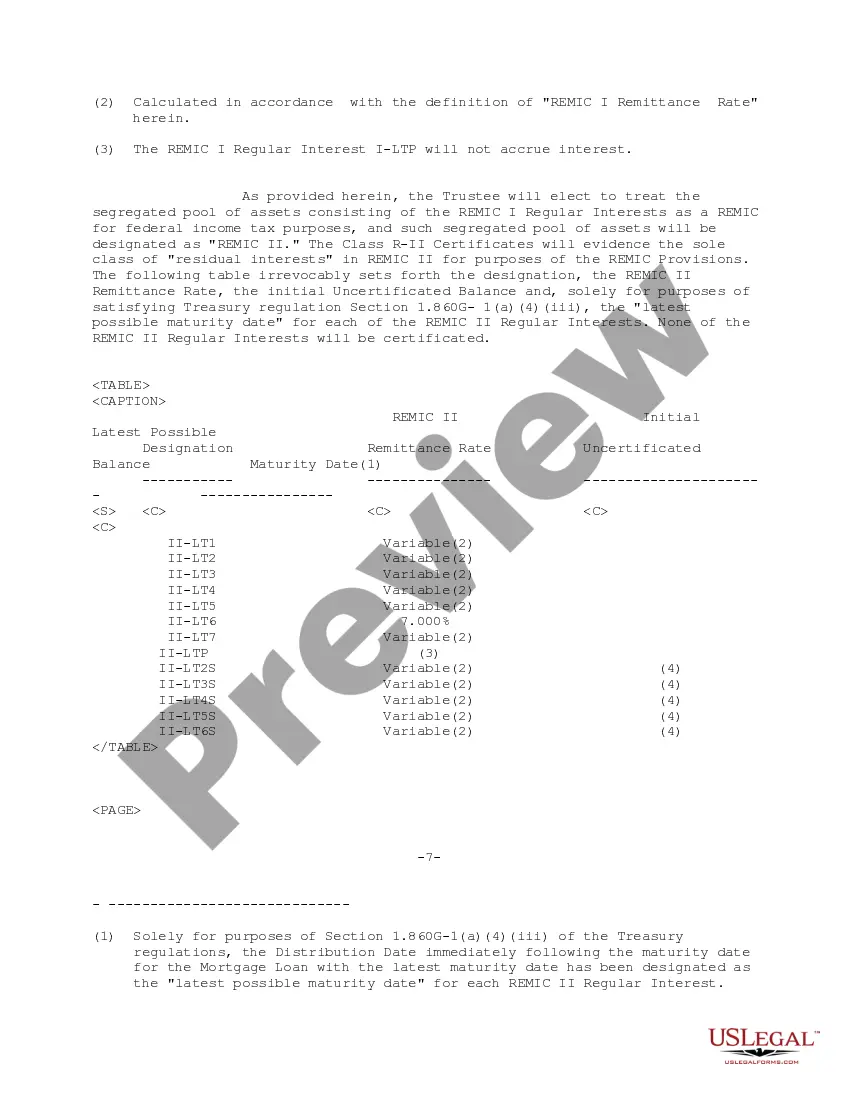

Maricopa Arizona Pooling and Servicing Agreement of Ameriquest Mortgage Securities, Inc. is a financial agreement related to the pooling and servicing of mortgage loans within the Maricopa County in Arizona, United States. This agreement is specifically associated with the Ameriquest Mortgage Securities, Inc., a mortgage-backed securities issuer. A pooling and servicing agreement (PSA) is a legal contract that outlines the rules, obligations, and responsibilities of various parties involved in a mortgage-backed securities transaction. It serves as the framework for managing a pool of mortgage loans and the creation of mortgage-backed securities (MBS). The Maricopa Arizona Pooling and Servicing Agreement of Ameriquest Mortgage Securities, Inc. ensures compliance with regulations set by the Securities and Exchange Commission (SEC) and ensures proper disclosure of information to investors. It minimizes risks associated with residential mortgage loans by providing clear guidelines for loan servicing, reporting, and investor communication. Different types or features of Maricopa Arizona Pooling and Servicing Agreement of Ameriquest Mortgage Securities, Inc. may include: 1. Subordination: The agreement may specify the order in which different mortgage tranches receive payments. Subordinated tranches are paid after senior tranches, thereby assigning different levels of risk and return to investors. 2. Collateralized Mortgage Obligations (CMOs): These are structured MBS where mortgages are divided into multiple classes or "tranches." Each tranche has its own risk profile based on its priority of receiving principal and interest payments. 3. Cash Flow Waterfalls: The agreement may define the sequence and priority of the cash flows generated from mortgage loan payments. It determines the allocation of principal and interest payments to investors, services, and other parties involved. 4. Service Rights and Duties: The agreement outlines the responsibilities of the mortgage service, including collecting payments, managing delinquencies, foreclosure proceedings, and ensuring compliance with investor guidelines. 5. Representations and Warranties: The agreement may contain provisions related to the accuracy and completeness of the information provided by the originator of the mortgage loans. These representations and warranties aim to protect investors from potential fraudulent or misrepresented loans. 6. Reporting and Remittance: The agreement establishes the schedule and requirements for reporting loan-level performance data, investor statements, and remittance of payments to investors. 7. Early Amortization Events: In certain cases, like excessive delinquencies or defaults, the pooling and servicing agreement may trigger an early amortization event. This event can lead to the acceleration of principal payments and may impact the expected return for investors. 8. Indenture Trustee: The agreement may designate an indenture trustee who acts as a representative for the investors. The trustee ensures compliance with the terms of the agreement and safeguards the interests of the investors. It's essential to review the specific terms and conditions outlined in the Maricopa Arizona Pooling and Servicing Agreement of Ameriquest Mortgage Securities, Inc. as it may vary based on the specific pool of mortgage loans and the associated MBS issuance.

Maricopa Arizona Pooling and Servicing Agreement of Ameriquest Mortgage Securities, Inc.

Description

How to fill out Maricopa Arizona Pooling And Servicing Agreement Of Ameriquest Mortgage Securities, Inc.?

Creating forms, like Maricopa Pooling and Servicing Agreement of Ameriquest Mortgage Securities, Inc., to manage your legal matters is a difficult and time-consumming process. Many circumstances require an attorney’s participation, which also makes this task expensive. Nevertheless, you can take your legal matters into your own hands and deal with them yourself. US Legal Forms is here to the rescue. Our website features over 85,000 legal documents intended for a variety of cases and life situations. We ensure each form is compliant with the regulations of each state, so you don’t have to worry about potential legal pitfalls associated with compliance.

If you're already aware of our website and have a subscription with US, you know how easy it is to get the Maricopa Pooling and Servicing Agreement of Ameriquest Mortgage Securities, Inc. form. Simply log in to your account, download the template, and customize it to your requirements. Have you lost your form? Don’t worry. You can get it in the My Forms tab in your account - on desktop or mobile.

The onboarding process of new users is just as straightforward! Here’s what you need to do before downloading Maricopa Pooling and Servicing Agreement of Ameriquest Mortgage Securities, Inc.:

- Make sure that your template is specific to your state/county since the regulations for creating legal paperwork may differ from one state another.

- Find out more about the form by previewing it or going through a brief description. If the Maricopa Pooling and Servicing Agreement of Ameriquest Mortgage Securities, Inc. isn’t something you were hoping to find, then use the header to find another one.

- Sign in or create an account to begin utilizing our service and download the document.

- Everything looks good on your end? Click the Buy now button and choose the subscription plan.

- Pick the payment gateway and enter your payment information.

- Your template is ready to go. You can go ahead and download it.

It’s easy to locate and purchase the appropriate template with US Legal Forms. Thousands of organizations and individuals are already benefiting from our extensive collection. Subscribe to it now if you want to check what other perks you can get with US Legal Forms!