The Philadelphia Pennsylvania Pooling and Servicing Agreement of Ameriquest Mortgage Securities, Inc. is a legal document that outlines the terms and conditions for the pooling and servicing of mortgage loans in the Philadelphia, Pennsylvania region. This agreement is specific to the mortgage securities issued by Ameriquest Mortgage Securities, Inc. The pooling and servicing agreement (PSA) is a crucial component of the securitization process, where mortgage loans are bundled together and sold as securities to investors. It establishes the obligations and responsibilities of various parties involved, including the mortgage originator, service, trustee, and investors. The Philadelphia Pennsylvania PSA governs the operation, administration, and distribution of cash flows related to the bundled mortgage loans within the region. It outlines how payments from borrowers are collected and allocated to investors, as well as the process for handling defaulting loans, foreclosures, and loan modifications. The agreement also provides details on the mortgage loan characteristics, such as interest rates, maturity dates, and loan-to-value ratios. It may include provisions for prepayment penalties, delinquency reporting, and other terms specific to the Philadelphia, Pennsylvania market. Additionally, the Philadelphia Pennsylvania PSA may have different versions or types, depending on the specific mortgage loan pools or tranches within Ameriquest Mortgage Securities, Inc.'s portfolio. These variations could correspond to different risk profiles, interest rates, or loan terms, offering investors a range of investment options. In conclusion, the Philadelphia Pennsylvania Pooling and Servicing Agreement of Ameriquest Mortgage Securities, Inc. is a legal document that governs the pooling and servicing of mortgage loans in the Philadelphia region. It ensures compliance with regulations and provides transparency for investors, while specifying the obligations and responsibilities of various parties involved in the mortgage-backed securities market.

Philadelphia Pennsylvania Pooling and Servicing Agreement of Ameriquest Mortgage Securities, Inc.

Description

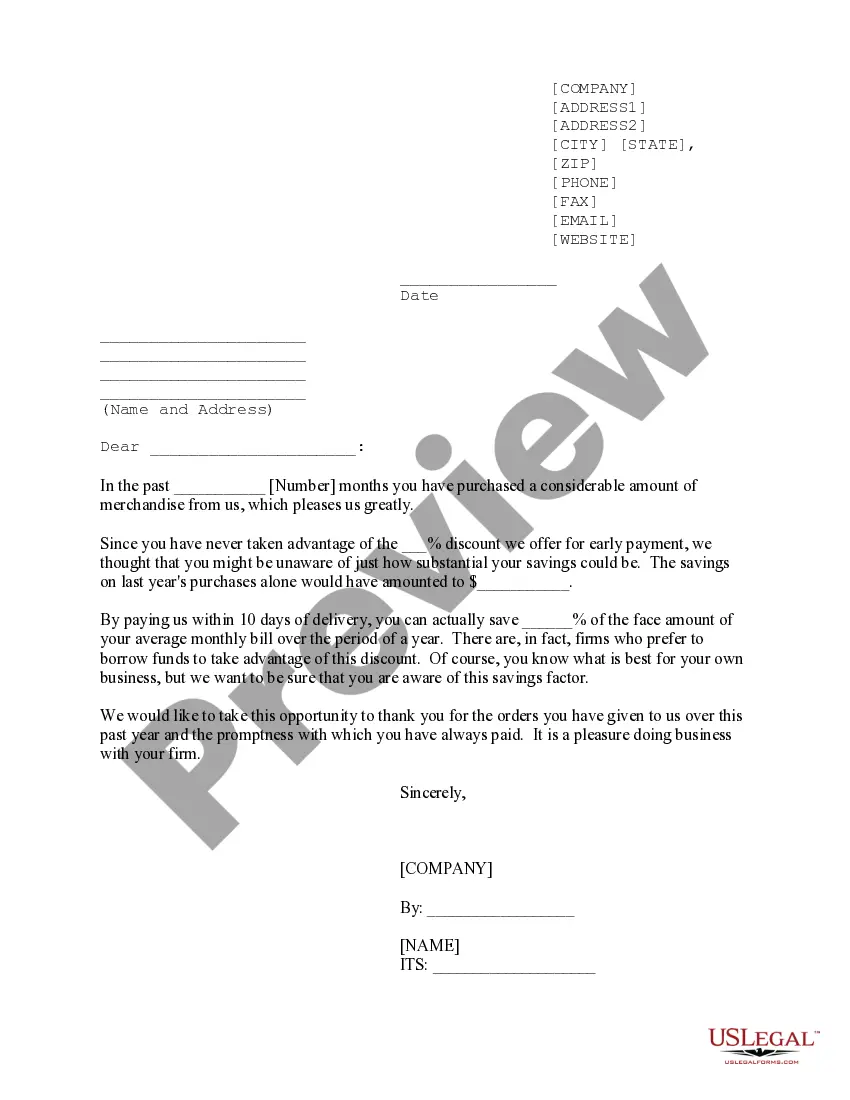

How to fill out Philadelphia Pennsylvania Pooling And Servicing Agreement Of Ameriquest Mortgage Securities, Inc.?

Dealing with legal forms is a necessity in today's world. However, you don't always need to seek qualified assistance to create some of them from scratch, including Philadelphia Pooling and Servicing Agreement of Ameriquest Mortgage Securities, Inc., with a platform like US Legal Forms.

US Legal Forms has more than 85,000 forms to choose from in different types ranging from living wills to real estate papers to divorce documents. All forms are arranged based on their valid state, making the searching experience less overwhelming. You can also find detailed materials and guides on the website to make any tasks related to paperwork completion straightforward.

Here's how to locate and download Philadelphia Pooling and Servicing Agreement of Ameriquest Mortgage Securities, Inc..

- Go over the document's preview and outline (if provided) to get a basic information on what you’ll get after getting the document.

- Ensure that the template of your choice is specific to your state/county/area since state regulations can affect the legality of some records.

- Check the related forms or start the search over to find the correct document.

- Hit Buy now and create your account. If you already have an existing one, select to log in.

- Choose the pricing {plan, then a needed payment gateway, and buy Philadelphia Pooling and Servicing Agreement of Ameriquest Mortgage Securities, Inc..

- Choose to save the form template in any offered format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can find the needed Philadelphia Pooling and Servicing Agreement of Ameriquest Mortgage Securities, Inc., log in to your account, and download it. Needless to say, our platform can’t replace an attorney completely. If you have to cope with an extremely difficult case, we advise using the services of a lawyer to examine your form before signing and submitting it.

With more than 25 years on the market, US Legal Forms became a go-to provider for various legal forms for millions of customers. Join them today and get your state-specific paperwork with ease!