The Allegheny Pennsylvania Pooling and Servicing Agreement of New Century Mortgage Securities, Inc. is a legal document that outlines the terms and conditions of pooling and servicing mortgage loans in Allegheny County, Pennsylvania. This agreement is specific to New Century Mortgage Securities, Inc., a mortgage-backed securities issuer. The pooling and servicing agreement is a crucial document that governs how the mortgage loans are pooled together to create mortgage-backed securities (MBS) and how they are serviced by the issuer. It establishes the rights and responsibilities of the parties involved, including the issuer, the service, the trustee, and the investors. The agreement typically covers various aspects related to mortgage loans, such as loan eligibility criteria, loan origination procedures, loan servicing requirements, cash flow distributions, and default provisions. It ensures that the mortgage loans are managed and administered in compliance with applicable laws and regulations. Different types or variations of the Allegheny Pennsylvania Pooling and Servicing Agreement of New Century Mortgage Securities, Inc. may exist based on the specific pool of mortgage loans involved. This could include variations in loan types, loan amounts, geographical locations, or other specific characteristics that distinguish one pool from another. New Century Mortgage Securities, Inc. may create multiple pooling and servicing agreements for different securitization transactions, each with its own unique set of terms and conditions. These agreements might be identified by their issuance dates, series numbers, or other designations to differentiate between them. In summary, the Allegheny Pennsylvania Pooling and Servicing Agreement of New Century Mortgage Securities, Inc. is a legal document that governs the pooling, servicing, and administration of mortgage loans in Allegheny County. It ensures compliance with the laws and regulations, while outlining the rights and responsibilities of all parties involved. Different variations of this agreement may exist based on the characteristics of the mortgage loan pools involved.

Allegheny Pennsylvania Pooling and Servicing Agreement of New Century Mortgage Securities, Inc.

Description

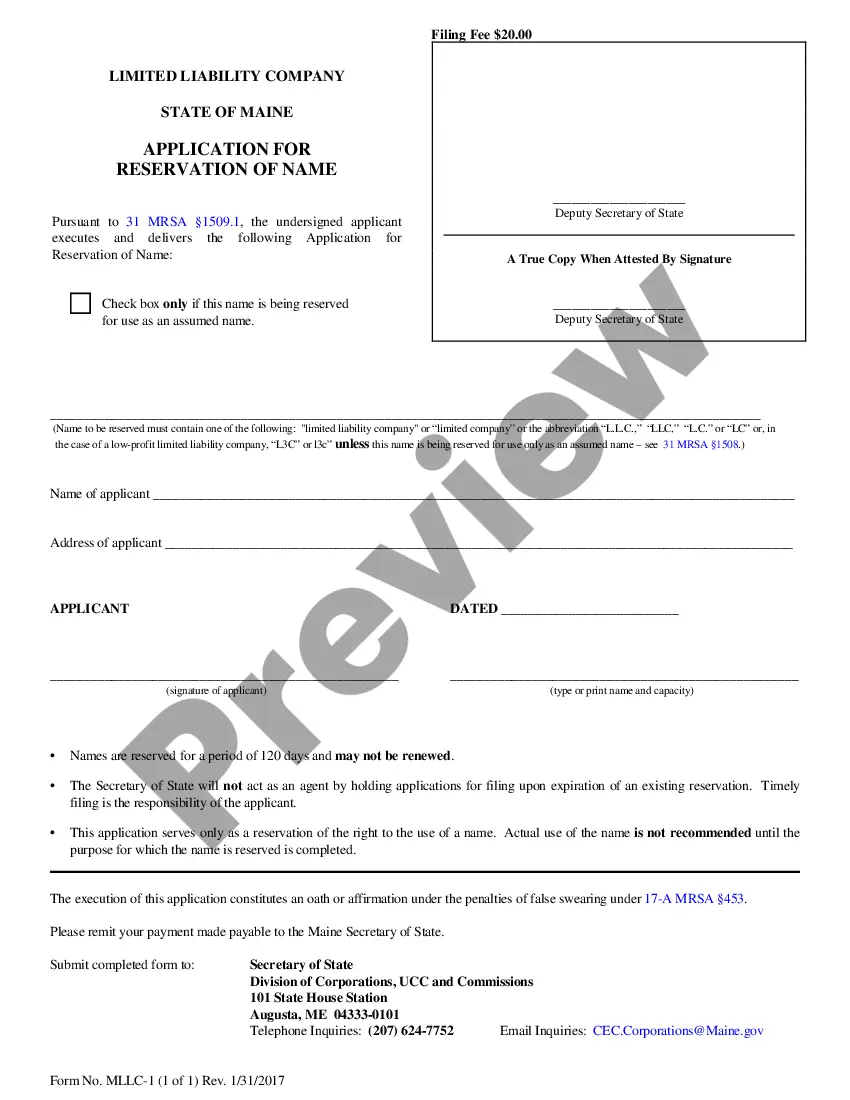

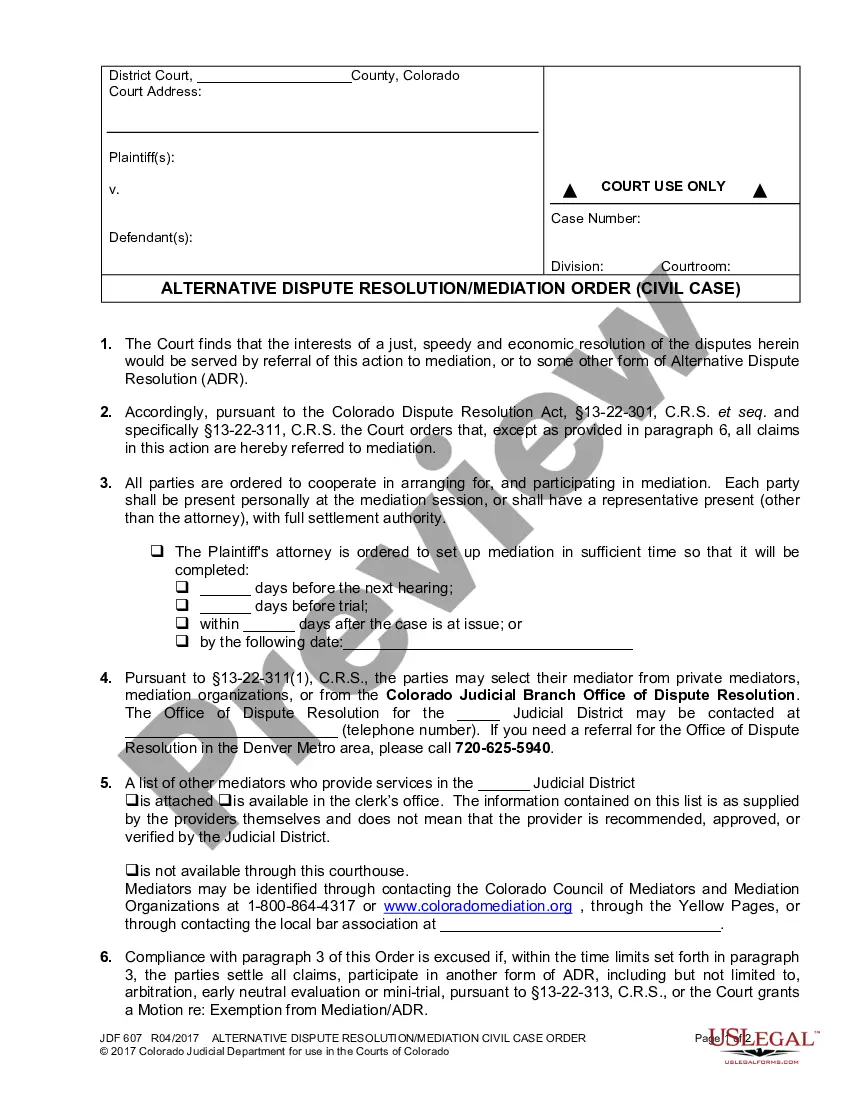

How to fill out Allegheny Pennsylvania Pooling And Servicing Agreement Of New Century Mortgage Securities, Inc.?

How much time does it usually take you to create a legal document? Since every state has its laws and regulations for every life situation, locating a Allegheny Pooling and Servicing Agreement of New Century Mortgage Securities, Inc. meeting all local requirements can be stressful, and ordering it from a professional attorney is often expensive. Many web services offer the most common state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive web collection of templates, grouped by states and areas of use. Aside from the Allegheny Pooling and Servicing Agreement of New Century Mortgage Securities, Inc., here you can get any specific document to run your business or personal deeds, complying with your regional requirements. Professionals verify all samples for their actuality, so you can be sure to prepare your paperwork properly.

Using the service is fairly easy. If you already have an account on the platform and your subscription is valid, you only need to log in, select the needed form, and download it. You can get the file in your profile anytime in the future. Otherwise, if you are new to the website, there will be a few more actions to complete before you get your Allegheny Pooling and Servicing Agreement of New Century Mortgage Securities, Inc.:

- Examine the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Look for another document utilizing the corresponding option in the header.

- Click Buy Now when you’re certain in the chosen file.

- Choose the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the Allegheny Pooling and Servicing Agreement of New Century Mortgage Securities, Inc..

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired template, you can find all the samples you’ve ever saved in your profile by opening the My Forms tab. Give it a try!

Form popularity

FAQ

Brad Morrice's firm, New Century Financial Corp., was the first major subprime lender to go bankrupt in 2007.

In 2008, Bank of America purchased the failing Countrywide Financial for $4.1 billion. In 2006, Countrywide financed 20% of all mortgages in the United States, at a value of about 3.5% of United States GDP, a proportion greater than any other single mortgage lender.

Bringing you home. Family-founded and operated since 1990, Freedom Mortgage is a top mortgage lender. We specialize in mortgages that can help you buy or refinance a home regardless of your unique circumstances.

New Century's mortgage billing and collections unit was sold to Carrington Capital Management, LLC, for $188 million. History: Founded by three subprime industry veterans, New Century went public in 1997, survived the subprime crash of the late 1990s, and rocketed to the top in less than a decade.

LoanDepot is offering what may be the fastest quick-closing mortgage in the race. Their new product, mello smartloan, an end-to-end digital mortgage, offers qualified borrowers a home loan in as few as eight days, a feat that seems almost impossible to long-time players in the real estate industry.

Go to and click on Search for Company Filings under Filing & Forms (EDGAR). Under General-Purpose Searches, click on Companies & other filers. Then, in the Enter your search information box, type in Ameriquest next to Company name and click on the Find Companies button.

As an example, there are several ways for homeowners to find out who owns their mortgages: Contact your mortgage servicer.Run a check on the MERS (Mortgage Electronic Registration System) website.Visit the Ginnie Mae, Fannie Mae and Freddie Mac websites to use their loan lookup tools.

Brad Morrice's firm, New Century Financial Corp., was the first major subprime lender to go bankrupt in 2007.

A loan servicing agreement is a written contract between a lender and a loan servicer that gives the loan servicer the authority to manage most aspects of a particular loan.

The Public Securities Association Standard Prepayment Model (PSA) is the assumed monthly rate of prepayment that is annualized to the outstanding principal balance of a mortgage loan.