The Bexar Texas Pooling and Servicing Agreement of New Century Mortgage Securities, Inc. is a legal document that outlines the terms and conditions regarding the pooling and servicing of mortgage loans in Bexar County, Texas. This agreement is specific to New Century Mortgage Securities, Inc., a financial institution that specializes in mortgage-backed securities. The Bexar Texas Pooling and Servicing Agreement is designed to protect the rights and interests of both investors and borrowers. It establishes the responsibilities and obligations of the service, who is responsible for collecting and distributing mortgage payments, as well as managing delinquencies and foreclosures. This agreement provides detailed information about the various types of mortgage loans that are included in the pool. It outlines the criteria for loan eligibility, such as credit scores, loan-to-value ratios, and property types. The agreement also specifies the interest rates and repayment terms for each loan. Furthermore, the Bexar Texas Pooling and Servicing Agreement of New Century Mortgage Securities, Inc. defines the rights of the investors who have purchased the mortgage-backed securities. It clarifies how principal and interest payments are allocated to the investors and establishes guidelines for prepayment penalties and loan modifications. It is important to note that while there may not be different types of Bexar Texas Pooling and Servicing Agreements specific to New Century Mortgage Securities, Inc., variations of this agreement may exist for different mortgage securities issued by other financial institutions operating in Bexar County, Texas. These agreements would differ in terms of the parties involved, the specific mortgage criteria, and the unique terms and conditions negotiated between the parties. In conclusion, the Bexar Texas Pooling and Servicing Agreement of New Century Mortgage Securities, Inc. is a comprehensive legal document that governs the pooling and servicing of mortgage loans in Bexar County, Texas. It outlines the responsibilities of the service, protects the rights of investors and borrowers, and establishes the criteria for loan eligibility and repayment terms.

Bexar Texas Pooling and Servicing Agreement of New Century Mortgage Securities, Inc.

Description

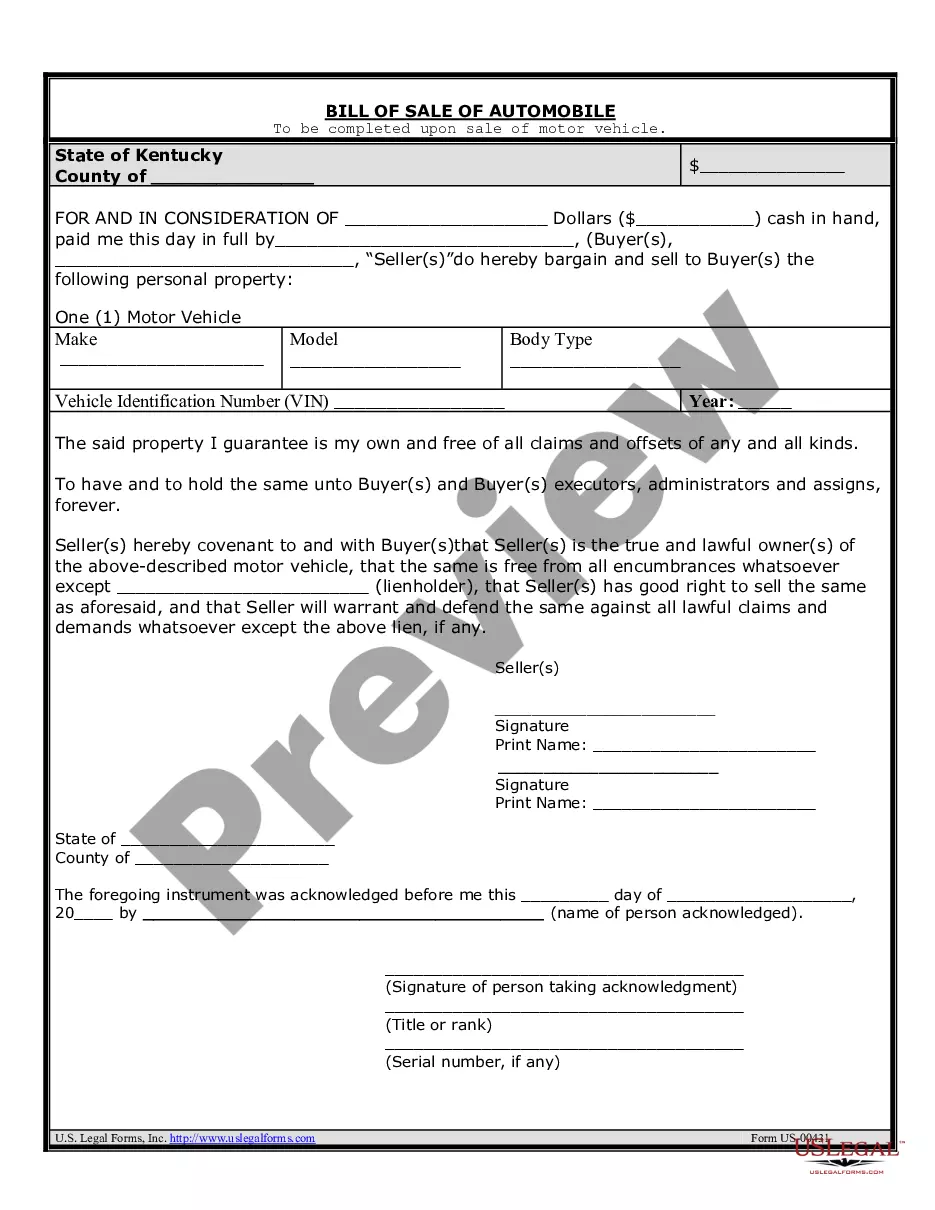

How to fill out Bexar Texas Pooling And Servicing Agreement Of New Century Mortgage Securities, Inc.?

If you need to get a trustworthy legal paperwork supplier to obtain the Bexar Pooling and Servicing Agreement of New Century Mortgage Securities, Inc., consider US Legal Forms. Whether you need to start your LLC business or manage your asset distribution, we got you covered. You don't need to be well-versed in in law to find and download the needed template.

- You can search from over 85,000 forms categorized by state/county and situation.

- The self-explanatory interface, number of learning materials, and dedicated support make it simple to find and complete different paperwork.

- US Legal Forms is a reliable service offering legal forms to millions of customers since 1997.

You can simply select to search or browse Bexar Pooling and Servicing Agreement of New Century Mortgage Securities, Inc., either by a keyword or by the state/county the form is created for. After locating required template, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's simple to start! Simply find the Bexar Pooling and Servicing Agreement of New Century Mortgage Securities, Inc. template and take a look at the form's preview and description (if available). If you're confident about the template’s language, go ahead and hit Buy now. Create an account and choose a subscription plan. The template will be immediately available for download as soon as the payment is completed. Now you can complete the form.

Taking care of your law-related affairs doesn’t have to be expensive or time-consuming. US Legal Forms is here to demonstrate it. Our rich variety of legal forms makes these tasks less expensive and more affordable. Set up your first company, organize your advance care planning, create a real estate agreement, or execute the Bexar Pooling and Servicing Agreement of New Century Mortgage Securities, Inc. - all from the comfort of your sofa.

Join US Legal Forms now!