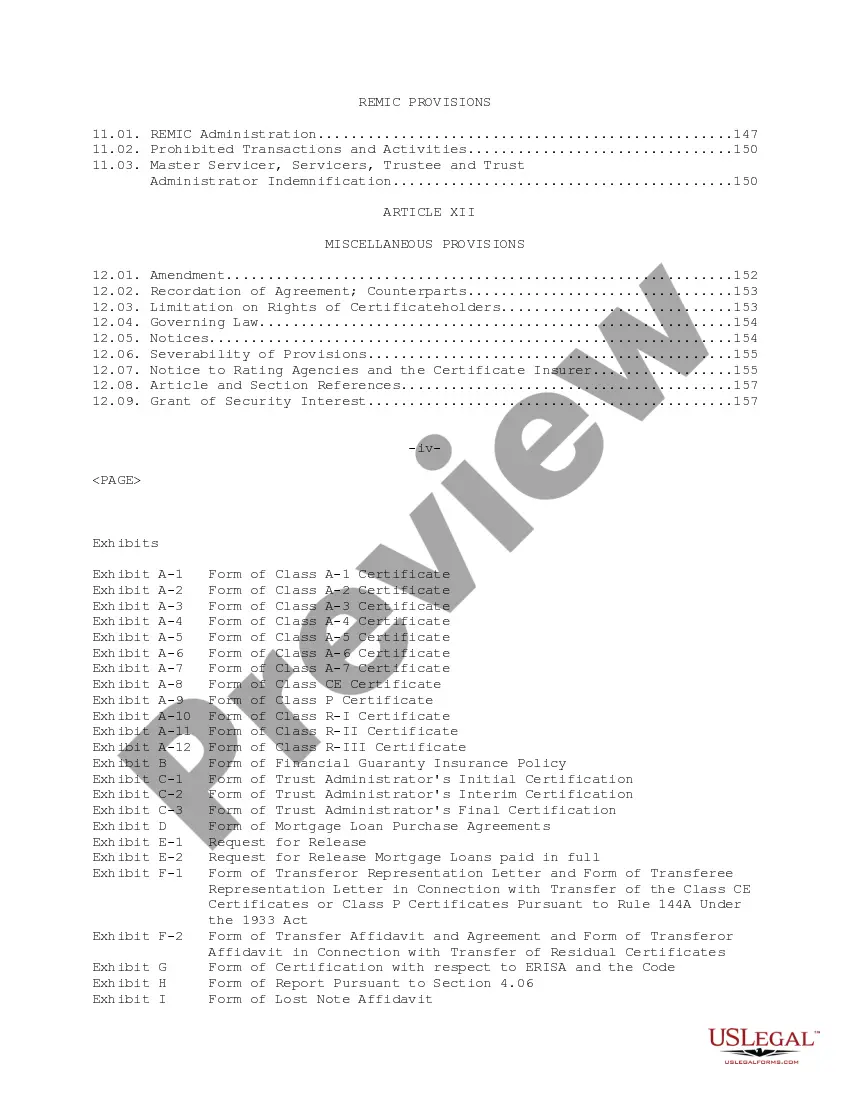

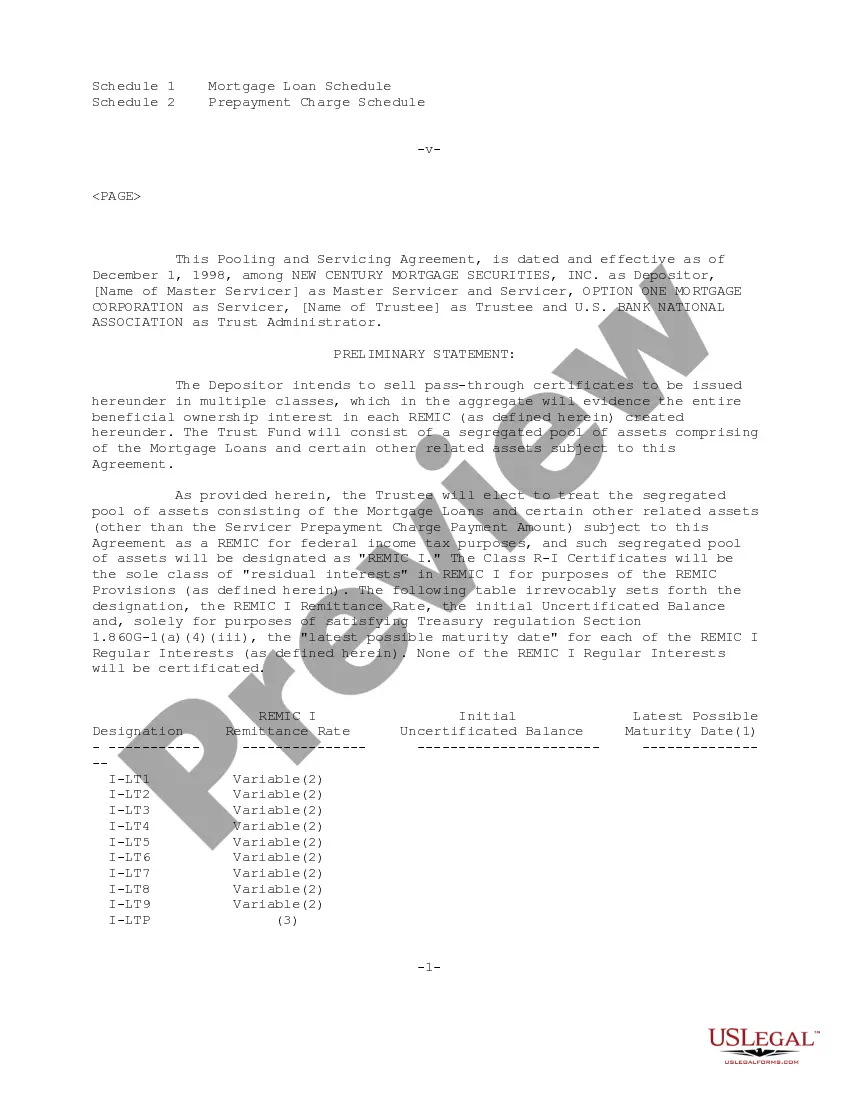

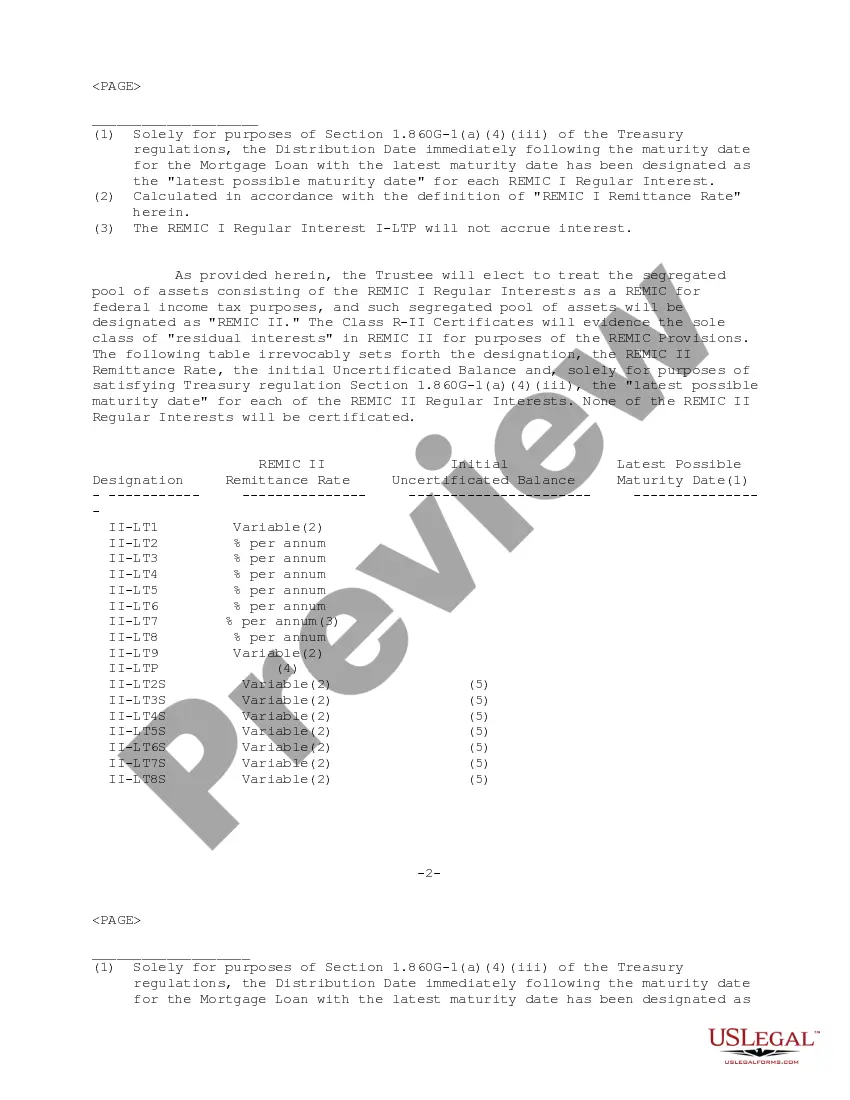

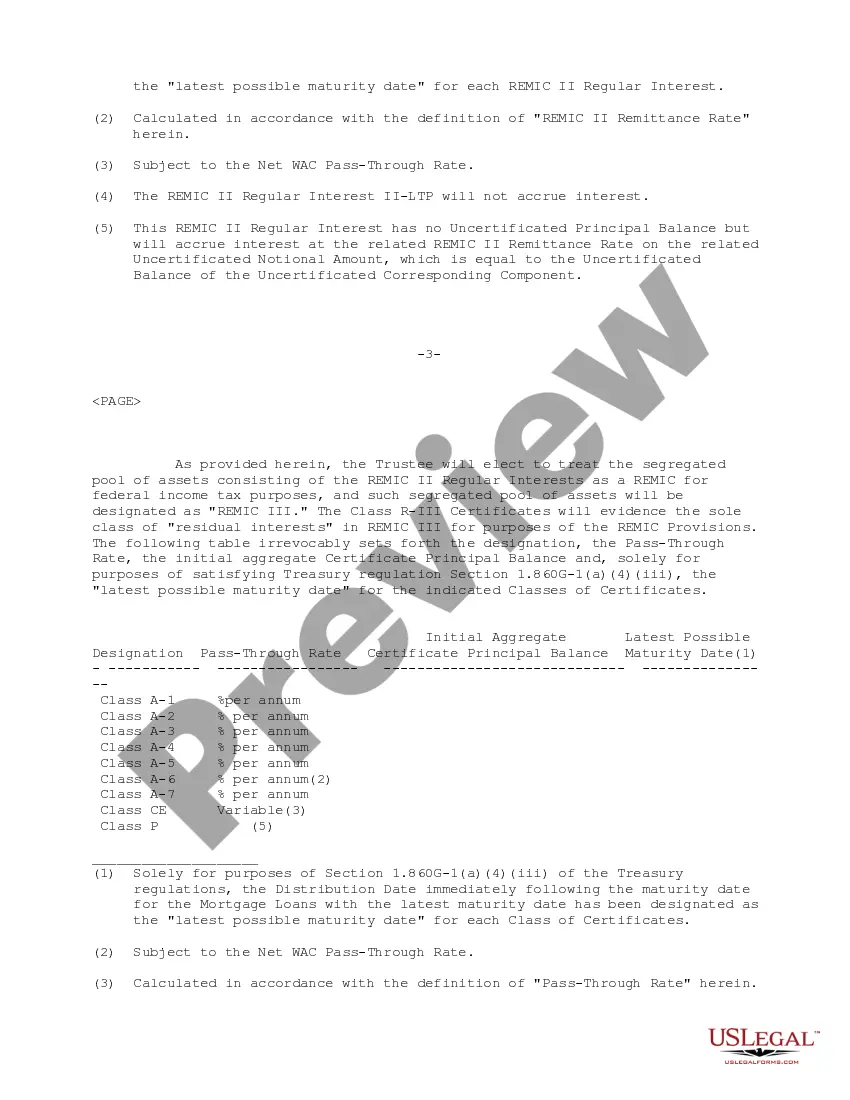

Collin Texas Pooling and Servicing Agreement of New Century Mortgage Securities, Inc. is a legal document that governs the formation, operation, and management of mortgage-backed security (MBS) pools originated by New Century Mortgage Securities, Inc. in Collin County, Texas. This agreement outlines the rights and obligations of various parties involved in the securitization process, including the mortgage originator, the trustee, and the investors. By pooling many individual mortgage loans, New Century Mortgage Securities, Inc. creates MBS pools, which are then sold to investors. The pooling and servicing agreement sets forth the terms and conditions under which these mortgage loans are securitized, ensuring that all parties' rights and responsibilities are clearly defined and protected. The Collin Texas Pooling and Servicing Agreement establishes the duties and obligations of the mortgage originator, such as New Century Mortgage Securities, Inc., which includes properly underwriting the loans, conducting due diligence, and ensuring compliance with applicable regulations. It also explains the mechanisms through which mortgage payments are collected from borrowers and subsequently distributed to investors. Under this agreement, a trustee is appointed to oversee the MBS pool on behalf of the investors. The trustee ensures that the mortgage loans in the pool are serviced correctly and that the cash flows from borrowers are collected and distributed in an efficient and timely manner. Additionally, the agreement may include provisions for the replacement of the trustee in case of default or non-performance. Collin Texas Pooling and Servicing Agreement of New Century Mortgage Securities, Inc. may encompass various types and structures of MBS pools. Some examples of these variations include: 1. Fixed-Rate Mortgage Pools: These pools contain mortgage loans with a fixed interest rate for the entire loan term. Payments made by borrowers and interest distributions to investors remain constant throughout the life of the MBS pool. 2. Adjustable-Rate Mortgage Pools: These pools consist of mortgage loans with adjustable interest rates, typically tied to an index. The interest rates on these loans can change periodically, and consequently, the payments made by borrowers and interest distributions to investors can fluctuate accordingly. 3. Hybrid Mortgage Pools: These pools combine the characteristics of both fixed-rate and adjustable-rate mortgage loans. They typically start with an initial fixed-rate period and then switch to adjustable rates for the remaining loan term. In conclusion, the Collin Texas Pooling and Servicing Agreement of New Century Mortgage Securities, Inc. is a comprehensive document that details the formation, operation, and management of MBS pools in Collin County, Texas. It establishes the roles and responsibilities of parties involved, protects investors' interests, and defines the various types of MBS pools, including fixed-rate, adjustable-rate, and hybrid structures.

Collin Texas Pooling and Servicing Agreement of New Century Mortgage Securities, Inc.

Description

How to fill out Collin Texas Pooling And Servicing Agreement Of New Century Mortgage Securities, Inc.?

Whether you intend to start your company, enter into an agreement, apply for your ID renewal, or resolve family-related legal issues, you must prepare specific documentation meeting your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and verified legal templates for any individual or business case. All files are grouped by state and area of use, so opting for a copy like Collin Pooling and Servicing Agreement of New Century Mortgage Securities, Inc. is quick and simple.

The US Legal Forms website users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you a few additional steps to get the Collin Pooling and Servicing Agreement of New Century Mortgage Securities, Inc.. Adhere to the guide below:

- Make certain the sample fulfills your personal needs and state law requirements.

- Look through the form description and check the Preview if there’s one on the page.

- Use the search tab specifying your state above to locate another template.

- Click Buy Now to get the sample once you find the correct one.

- Select the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Collin Pooling and Servicing Agreement of New Century Mortgage Securities, Inc. in the file format you require.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Documents provided by our website are reusable. Having an active subscription, you can access all of your previously acquired paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documentation. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!