The Los Angeles California Pooling and Servicing Agreement of New Century Mortgage Securities, Inc. is a legal document that governs the creation and operation of mortgage-backed securities (MBS) issued by New Century Mortgage Securities, Inc. in Los Angeles, California. This agreement outlines the rights and responsibilities of various parties involved in the securitization process. Also known as a securitization agreement, the Los Angeles California Pooling and Servicing Agreement (PSA) of New Century Mortgage Securities, Inc. specifies how the underlying mortgage loans are pooled together and ultimately converted into tradable MBS. The PSA plays a crucial role in ensuring the proper functioning and compliance of MBS transactions. Key terms and conditions specified in the Los Angeles California Pooling and Servicing Agreement may include: 1. Pooling of Mortgage Loans: The agreement defines the criteria for selecting and pooling mortgage loans from borrowers in a specific geographical area, such as Los Angeles, California. These loans are then used to create the MBS. 2. Servicing of Mortgage Loans: The PSA outlines the obligations and duties of the mortgage service responsible for collecting borrowers' payments and managing other loan-related activities. It also establishes guidelines for the distribution of interest and principal payments to MBS investors. 3. Allocation of Cash Flow: The agreement provides details on the allocation of cash flow generated by the mortgage loans, including interest, principal, prepayment penalties, late fees, and other related payments. It specifies how these funds are distributed among investors and service providers. 4. Representations and Warranties: The PSA includes various representations and warranties made by the originator of the mortgage loans, ensuring the quality and accuracy of the underlying assets. These representations protect the investors against potential losses caused by defective loans. 5. Credit Enhancement and Risk Mitigation: The agreement may incorporate provisions for credit enhancement mechanisms, such as reserve accounts or third-party guarantees, designed to mitigate credit risk and provide additional security to the investors. It's important to note that while the Los Angeles California Pooling and Servicing Agreement of New Century Mortgage Securities, Inc. is specific to mortgage-backed securities issued by this particular company, similar agreements can exist for other issuers in Los Angeles or beyond. These agreements may have variations based on the issuer's specific requirements and the nature of the underlying mortgage loans. In summary, the Los Angeles California Pooling and Servicing Agreement of New Century Mortgage Securities, Inc. is a legally binding document that governs the securitization of mortgage loans into tradable MBS. It ensures proper structuring, servicing, and distribution of cash flow to MBS investors, while protecting their interests through representations, warranties, and risk mitigation mechanisms.

Los Angeles California Pooling and Servicing Agreement of New Century Mortgage Securities, Inc.

Description

How to fill out Los Angeles California Pooling And Servicing Agreement Of New Century Mortgage Securities, Inc.?

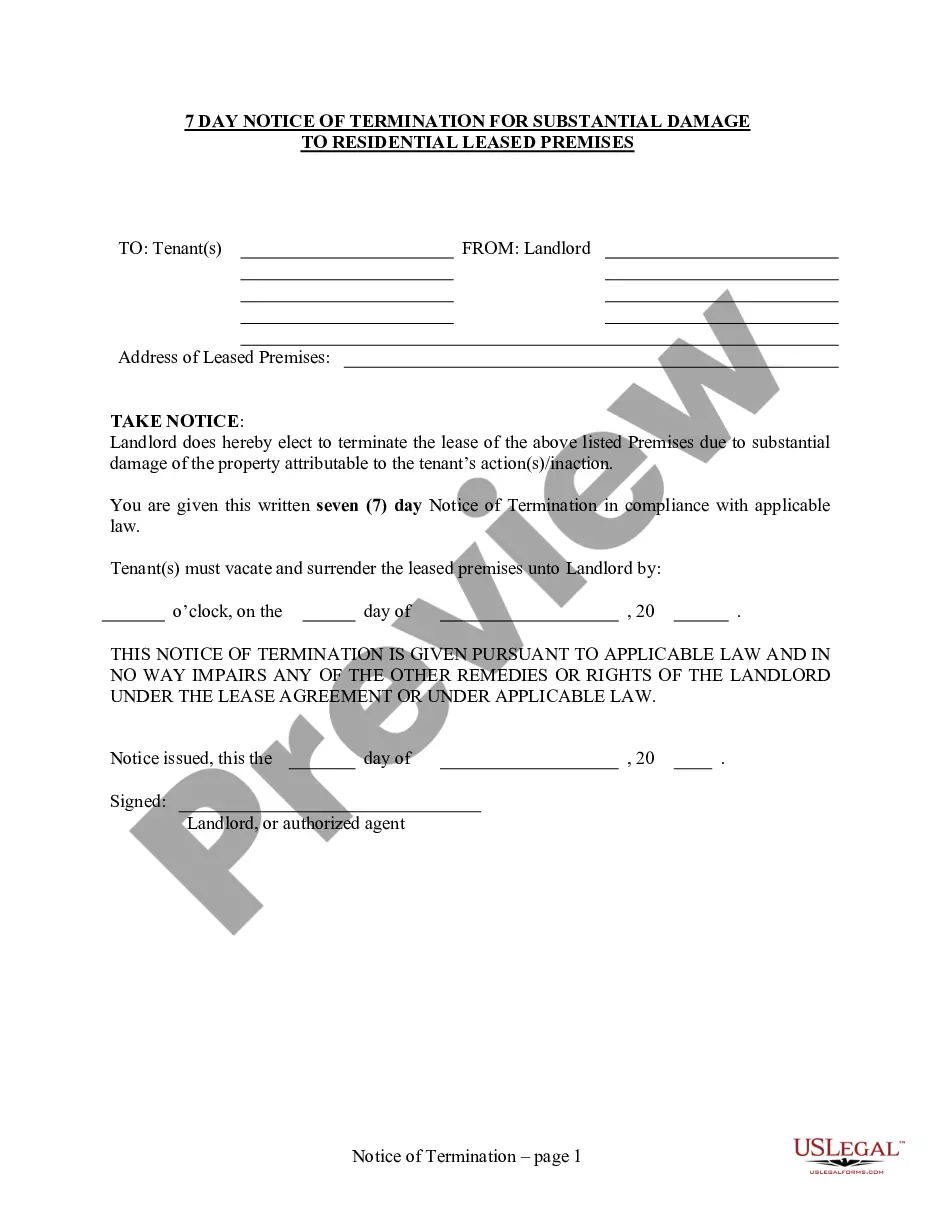

How much time does it usually take you to draft a legal document? Since every state has its laws and regulations for every life scenario, locating a Los Angeles Pooling and Servicing Agreement of New Century Mortgage Securities, Inc. meeting all local requirements can be stressful, and ordering it from a professional lawyer is often pricey. Many online services offer the most popular state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive online collection of templates, grouped by states and areas of use. Apart from the Los Angeles Pooling and Servicing Agreement of New Century Mortgage Securities, Inc., here you can find any specific document to run your business or individual deeds, complying with your county requirements. Specialists check all samples for their actuality, so you can be certain to prepare your paperwork properly.

Using the service is fairly straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the required form, and download it. You can get the document in your profile anytime later on. Otherwise, if you are new to the website, there will be a few more actions to complete before you obtain your Los Angeles Pooling and Servicing Agreement of New Century Mortgage Securities, Inc.:

- Check the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another document utilizing the related option in the header.

- Click Buy Now once you’re certain in the chosen document.

- Choose the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the Los Angeles Pooling and Servicing Agreement of New Century Mortgage Securities, Inc..

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased template, you can locate all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Try it out!

Form popularity

FAQ

On March 12, 2007, the New York Stock Exchange halted trading of New Century Financial Corporation, delisting the company.

In 2008, Bank of America purchased the failing Countrywide Financial for $4.1 billion. In 2006, Countrywide financed 20% of all mortgages in the United States, at a value of about 3.5% of United States GDP, a proportion greater than any other single mortgage lender.

Status: CLOSED. Filed for bankruptcy protection April 2, 2007. New Century's mortgage billing and collections unit was sold to Carrington Capital Management, LLC, for $188 million.

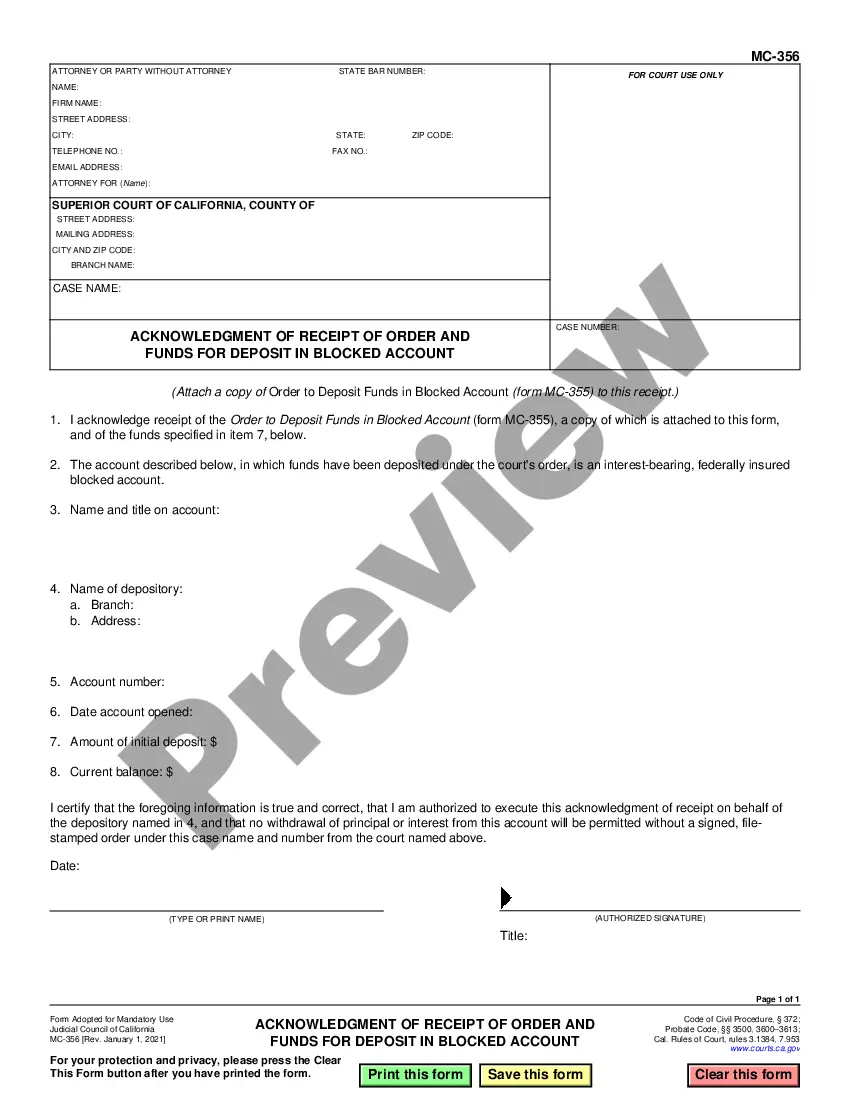

Mortgage servicing rights (MSR) refer to a contractual agreement in which the right to service an existing mortgage is sold by the original mortgage lender to another party that specializes in the various functions involved with servicing mortgages.

A "pooling and servicing agreement" (PSA) is the legal document that lays out the rights and obligations of specific parties over a pool (group) of securitized mortgage loans.

The Public Securities Association Standard Prepayment Model (PSA) is the assumed monthly rate of prepayment that is annualized to the outstanding principal balance of a mortgage loan.

Company overview Status: CLOSED. Filed for bankruptcy protection April 2, 2007. New Century's mortgage billing and collections unit was sold to Carrington Capital Management, LLC, for $188 million.

As an example, there are several ways for homeowners to find out who owns their mortgages: Contact your mortgage servicer.Run a check on the MERS (Mortgage Electronic Registration System) website.Visit the Ginnie Mae, Fannie Mae and Freddie Mac websites to use their loan lookup tools.

LoanDepot is offering what may be the fastest quick-closing mortgage in the race. Their new product, mello smartloan, an end-to-end digital mortgage, offers qualified borrowers a home loan in as few as eight days, a feat that seems almost impossible to long-time players in the real estate industry.

New Century Financial collapsed after a series of defaulting loans and accounting irregularities, leaving the company unable to repurchase bad loans. The level of defaults was higher than what the company had set aside for repurchases, and the accounting irregularities dried up the company's access to financing.