Maricopa Arizona Pooling and Servicing Agreement of New Century Mortgage Securities, Inc. is a legal contract that outlines the terms and conditions for pooling and servicing mortgage loans in Maricopa County, Arizona. It is specifically related to mortgage securities issued by New Century Mortgage Securities, Inc. The agreement serves as a framework for the management, administration, and distribution of cash flows from the mortgage loans to the investors who hold these securities. The Maricopa Arizona Pooling and Servicing Agreement of New Century Mortgage Securities, Inc. governs the rights and responsibilities of various parties involved in the securitization process. These parties typically include the mortgage originators, loan services, investors, trustees, and issuers. The agreement sets forth the obligations and duties of each party, ensuring compliance with applicable laws and regulations. Some specific types or variations of Maricopa Arizona Pooling and Servicing Agreement of New Century Mortgage Securities, Inc. may include: 1. Residential Mortgage-Backed Securities (RMBS) Agreement: This agreement pertains to mortgage loans secured by residential properties in Maricopa County. It outlines the specific terms and conditions for pooling these residential mortgages and administering the cash flows generated from them. 2. Commercial Mortgage-Backed Securities (CMOS) Agreement: This type of agreement focuses on pooling and servicing commercial mortgage loans in Maricopa County. It caters to properties such as office buildings, hotels, retail spaces, or industrial properties. The terms of this agreement may differ from those in RMBS agreements due to the unique characteristics and risks associated with commercial mortgages. 3. Collateralized Mortgage Obligation (CMO) Agreement: A CMO is a mortgage-backed security that is divided into separate classes or tranches, each with varying levels of risk and maturity. The CMO Agreement within the Maricopa Arizona Pooling and Servicing Agreement of New Century Mortgage Securities, Inc. defines the rights and obligations of the different classes of CMO investors regarding how cash flows from the mortgage loans are distributed across these classes. In summary, the Maricopa Arizona Pooling and Servicing Agreement of New Century Mortgage Securities, Inc. is a comprehensive legal contract that governs the pooling, servicing, and distribution of cash flows from mortgage loans in Maricopa County. It ensures compliance with regulations and establishes the rights and obligations of various parties involved in the securitization process. Different types of agreements may exist within this framework, such as RMBS, CMOS, or CMO agreements, each catering to specific categories of mortgage-backed securities.

Maricopa Arizona Pooling and Servicing Agreement of New Century Mortgage Securities, Inc.

Description

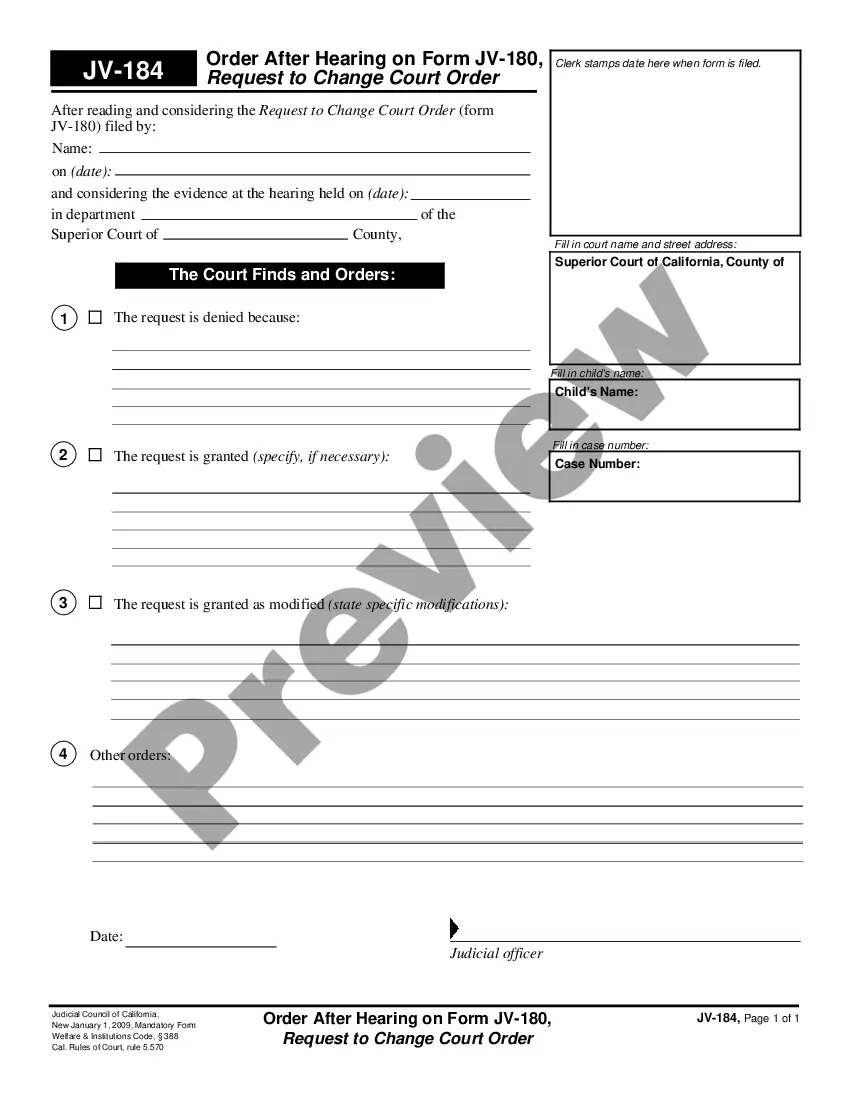

How to fill out Maricopa Arizona Pooling And Servicing Agreement Of New Century Mortgage Securities, Inc.?

A document routine always goes along with any legal activity you make. Opening a company, applying or accepting a job offer, transferring property, and lots of other life scenarios demand you prepare official documentation that varies throughout the country. That's why having it all collected in one place is so helpful.

US Legal Forms is the largest online collection of up-to-date federal and state-specific legal templates. On this platform, you can easily find and download a document for any personal or business objective utilized in your region, including the Maricopa Pooling and Servicing Agreement of New Century Mortgage Securities, Inc..

Locating templates on the platform is extremely simple. If you already have a subscription to our library, log in to your account, find the sample through the search bar, and click Download to save it on your device. After that, the Maricopa Pooling and Servicing Agreement of New Century Mortgage Securities, Inc. will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, adhere to this simple guide to obtain the Maricopa Pooling and Servicing Agreement of New Century Mortgage Securities, Inc.:

- Make sure you have opened the right page with your local form.

- Use the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the form meets your requirements.

- Search for another document using the search tab in case the sample doesn't fit you.

- Click Buy Now once you locate the necessary template.

- Decide on the suitable subscription plan, then sign in or register for an account.

- Select the preferred payment method (with credit card or PayPal) to proceed.

- Choose file format and download the Maricopa Pooling and Servicing Agreement of New Century Mortgage Securities, Inc. on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most reliable way to obtain legal documents. All the samples available in our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs effectively with the US Legal Forms!

Form popularity

FAQ

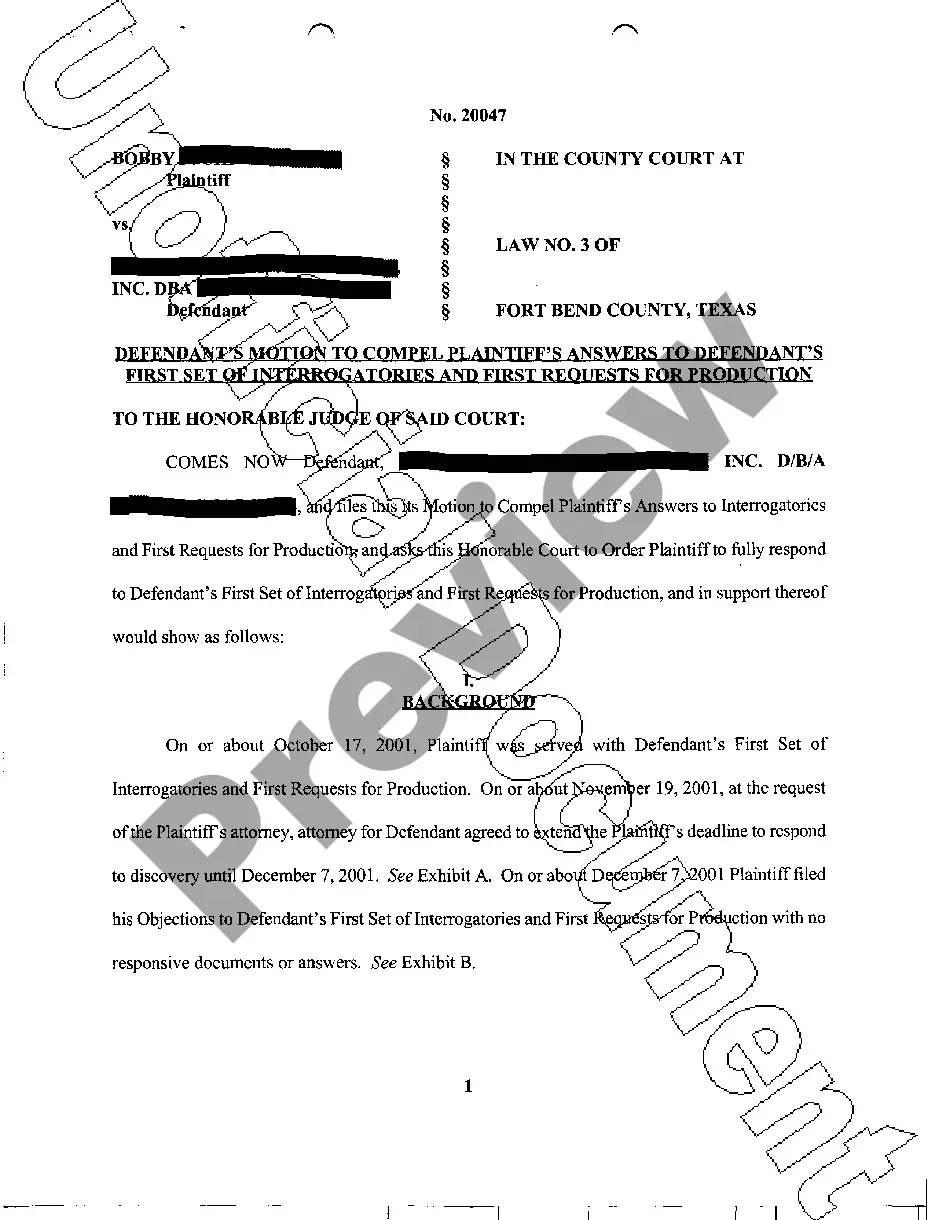

The Pooling and Servicing Agreement can be a stand-alone document or it can be part of another paper, usually called the Prospectus. If the securitization is public, these documents must be filed with the Securities and Exchange Commission (SEC), and will be available to the public at .

The Pooling and Servicing Agreement is the legal document that contains the responsibilities and rights of the servicer, the trustee, and others over a pool of mortgage loans.

How to Get a Copy of the Pooling and Servicing Agreement. If the securitization is public, the PSA will be filed with the Securities and Exchange Commission (SEC), and you can usually find a copy on EDGAR (Electronic Data Gathering, Analysis, and Retrieval) at .

If one of the federal agencies bought your mortgage, then it's a sure bet it's been securitized. If it's owned by some other company, you can contact it and ask to know whether your mortgage has been securitized.

MARKET SIZE OVERVIEW Agency MBS account for 63.4 percent of the total mortgage debt outstanding, private-label securities make up 3.7 percent, and unsecuritized first liens make up 28.9 percent.

Banks may securitize debt for several reasons including risk management, balance sheet issues, greater leverage of capital, and in order to profit from origination fees.

A mortgage pool is a group of mortgages held in trust as collateral for the issuance of a mortgage-backed security. Some mortgage-backed securities issued by Fannie Mae, Freddie Mac, and Ginnie Mae are known as "pools" themselves. These are the simplest form of mortgage-backed security.

Most mortgages are securitized, meaning the loans are sold and pooled together to create a mortgage security that is traded in the capital markets for profit.

As an example, there are several ways for homeowners to find out who owns their mortgages: Contact your mortgage servicer.Run a check on the MERS (Mortgage Electronic Registration System) website.Visit the Ginnie Mae, Fannie Mae and Freddie Mac websites to use their loan lookup tools.

More info

A. Estimating Model and Risk Assumption for the Model and Estimating Model of Other Risk Factors. A. (i) Assumed Mortgages. The LD U.S. Securities and Exchange Commission reporting information is derived from the Company as of June 30, 2004. Based on the Company's estimates and assumptions, the Company estimates that the insured loans in its Pool of Mortgage Loans totaled 2.2 billion at June 30, 2004, with a gross principal balance (including the Insurer's investment on the loans) of 2.6 billion and 1.6 billion as of December 31, 2003. Assuming, as the Company does on the assumption of 750 million of principal balance underwriting risk, that the outstanding uninsured loans in the Pool of Mortgage Loans were all insured, the Company estimated that the Company's risk at June 30, 2004, would be 0.1% for the period of December 31, 2003, through June 30, 2004. B. Assumed Mortgages Not Listed in The New York Times Company.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.