Wake North Carolina Pooling and Servicing Agreement of New Century Mortgage Securities, Inc. is a legal document that outlines the terms and conditions of the pool of mortgage loans and the servicing responsibilities associated with these loans in the state of North Carolina. This agreement is specific to New Century Mortgage Securities, Inc., a mortgage loans originator and service. The Wake North Carolina Pooling and Servicing Agreement of New Century Mortgage Securities, Inc. governs the relationship between the borrowers, the service, and the investors who have invested in the mortgage-backed securities. It is a crucial document that ensures compliance with state and federal laws and protects the interests of all parties involved. Key provisions included in this agreement involve the loan origination process, loan servicing responsibilities, payment collection, investor distribution, reporting requirements, and dispute resolution mechanisms. It provides guidelines for the timely and accurate transfer of loan payments, handling of escrow accounts, tax reporting, insurance requirements, and foreclosure procedures. Different types of Wake North Carolina Pooling and Servicing Agreements of New Century Mortgage Securities, Inc. exist based on the various mortgage loan products that New Century Mortgage Securities, Inc. offers. These products may include fixed-rate mortgages, adjustable-rate mortgages (ARM's), jumbo loans, government-backed loans such as FHA or VA loans, or specialized loan programs for specific borrower categories like first-time homebuyers. The agreement may also include provisions related to loan modifications, loss mitigation procedures, and default management. It outlines the steps to be taken in case of borrower delinquency or default, including foreclosure and loan workout options. The specific terms and requirements of these agreements may vary depending on the type of mortgage loans being serviced. In summary, the Wake North Carolina Pooling and Servicing Agreement of New Century Mortgage Securities, Inc. is a comprehensive legal document that governs the mortgage loan pooling and servicing activities of New Century Mortgage Securities, Inc. in the state of North Carolina. It ensures compliance with regulations, protects the interests of borrowers and investors, and provides guidelines for loan origination, servicing, and potential default scenarios.

Wake North Carolina Pooling and Servicing Agreement of New Century Mortgage Securities, Inc.

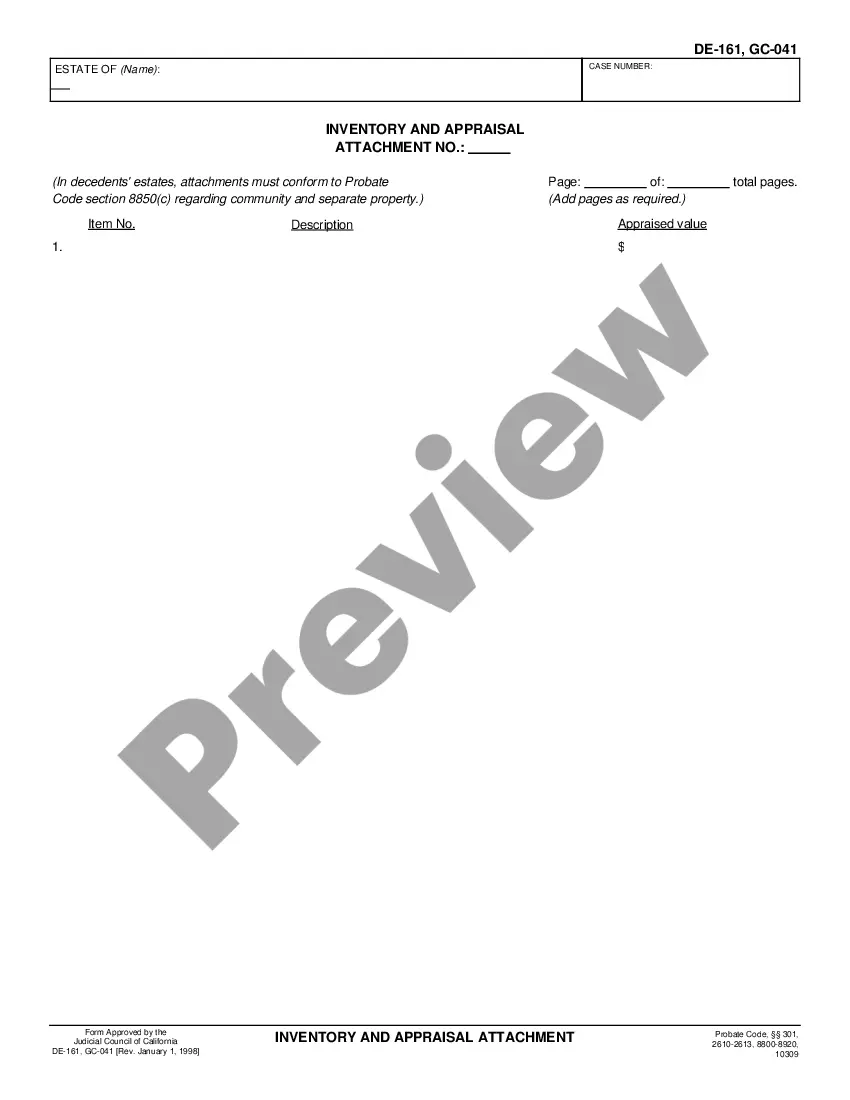

Description

How to fill out Wake North Carolina Pooling And Servicing Agreement Of New Century Mortgage Securities, Inc.?

If you need to get a reliable legal form supplier to get the Wake Pooling and Servicing Agreement of New Century Mortgage Securities, Inc., consider US Legal Forms. Whether you need to start your LLC business or take care of your asset distribution, we got you covered. You don't need to be knowledgeable about in law to locate and download the needed form.

- You can search from over 85,000 forms arranged by state/county and case.

- The self-explanatory interface, number of learning materials, and dedicated support make it simple to locate and execute various paperwork.

- US Legal Forms is a reliable service offering legal forms to millions of users since 1997.

Simply type to look for or browse Wake Pooling and Servicing Agreement of New Century Mortgage Securities, Inc., either by a keyword or by the state/county the document is intended for. After finding the necessary form, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's effortless to get started! Simply locate the Wake Pooling and Servicing Agreement of New Century Mortgage Securities, Inc. template and take a look at the form's preview and description (if available). If you're comfortable with the template’s language, go ahead and click Buy now. Create an account and choose a subscription option. The template will be immediately available for download once the payment is processed. Now you can execute the form.

Handling your law-related affairs doesn’t have to be expensive or time-consuming. US Legal Forms is here to prove it. Our comprehensive collection of legal forms makes these tasks less costly and more reasonably priced. Create your first business, organize your advance care planning, create a real estate contract, or complete the Wake Pooling and Servicing Agreement of New Century Mortgage Securities, Inc. - all from the convenience of your home.

Join US Legal Forms now!

Form popularity

FAQ

Status: CLOSED. Filed for bankruptcy protection April 2, 2007. New Century's mortgage billing and collections unit was sold to Carrington Capital Management, LLC, for $188 million.

Loan Pool means: (a) in the context of a Securitization, any pool or group of loans that are a part of such Securitization; (b) in the context of a Transfer, all loans which are sold, transferred or assigned to the same transferee; and (c) in the context of a Participation, all loans as to which participating interests

The Pooling and Servicing Agreement is the legal document that contains the. responsibilities and rights of the servicer, the trustee, and others over a pool of mortgage. loans.

As an example, there are several ways for homeowners to find out who owns their mortgages: Contact your mortgage servicer.Run a check on the MERS (Mortgage Electronic Registration System) website.Visit the Ginnie Mae, Fannie Mae and Freddie Mac websites to use their loan lookup tools.

Securitization is the process in which certain types of assets are pooled so that they can be repackaged into interest-bearing securities. The interest and principal payments from the assets are passed through to the purchasers of the securities.

The Pooling and Servicing Agreement can be a stand-alone document or it can be part of another paper, usually called the Prospectus. If the securitization is public, these documents must be filed with the Securities and Exchange Commission (SEC), and will be available to the public at .

The Public Securities Association Standard Prepayment Model (PSA) is the assumed monthly rate of prepayment that is annualized to the outstanding principal balance of a mortgage loan.

Brad Morrice's firm, New Century Financial Corp., was the first major subprime lender to go bankrupt in 2007.

In 2008, Bank of America purchased the failing Countrywide Financial for $4.1 billion. In 2006, Countrywide financed 20% of all mortgages in the United States, at a value of about 3.5% of United States GDP, a proportion greater than any other single mortgage lender.

New Century's mortgage billing and collections unit was sold to Carrington Capital Management, LLC, for $188 million. History: Founded by three subprime industry veterans, New Century went public in 1997, survived the subprime crash of the late 1990s, and rocketed to the top in less than a decade.