Title: Understanding the Harris Texas Servicing Agreement: An In-Depth Overview Keywords: Harris Texas servicing agreement, types, detailed description, mortgage, loans, contract, terms, conditions, obligations, benefits, roles, responsibilities, parties. Introduction: The Harris Texas Servicing Agreement is a crucial document that establishes the terms and conditions under which a mortgage or loan is serviced within the Harris County, Texas area. This comprehensive agreement outlines the rights, obligations, and responsibilities of all parties involved in the servicing process, ensuring a transparent and smooth relationship between borrowers, lenders, and servicing entities. Types of Harris Texas Servicing Agreement: 1. Mortgage Servicing Agreement: This type of agreement is specifically designed for the servicing of mortgage loans within Harris County, Texas. It encompasses the various aspects of mortgage servicing such as payment processing, escrow management, insurance tracking, collections, foreclosure procedures, and more. 2. Loan Servicing Agreement: Harris Texas also offers loan servicing agreements for various types of loans, such as personal loans, auto loans, student loans, and commercial loans. These agreements outline the specific terms and conditions related to the servicing of each type of loan, ensuring compliance with relevant state and federal regulations. Detailed Description: 1. Parties Involved: The Harris Texas Servicing Agreement specifies the roles and responsibilities of the primary parties involved in the loan servicing process, which usually include the borrower, the lender or investor, and the servicing entity. The agreement defines each party's obligations, rights, and protections. 2. Payment Processing: The agreement details the mechanisms and procedures for accepting, processing, and crediting borrowers' payments. It outlines acceptable payment methods, due dates, late payment policies, and any associated fees or penalties. 3. Escrow Management: For mortgages, the Harris Texas Servicing Agreement typically covers the management and disbursement of funds held in escrow accounts designated for taxes, insurance premiums, and other relevant expenses. It stipulates how the escrow funds are to be collected, maintained, and disbursed on behalf of borrowers. 4. Customer Service and Communication: The agreement emphasizes the importance of effective communication between the servicing entity and the borrower. It establishes the channels for inquiries, complaint resolution, and transparency in addressing concerns related to loan services or account maintenance. 5. Reporting and Record keeping: The Servicing Agreement outlines the requirements for accurate and timely reporting of loan balances, payment history, and other essential details to the borrower, the lender, and any necessary regulatory bodies. It also covers the maintenance and retention of records as mandated by state and federal laws. 6. Default and Foreclosure Procedures: In cases of default, the agreement outlines the steps and procedures to be followed by the servicing entity, including the initiation of foreclosure proceedings in compliance with Harris County and Texas state laws. Conclusion: The Harris Texas Servicing Agreement governs the relationship between borrowers, lenders, and servicing entities within Harris County, Texas. Whether it pertains to mortgages or other forms of loans, this agreement establishes the framework for fair and efficient loan servicing operations. By providing clarity and transparency, the servicing agreement safeguards the rights of all involved parties and promotes a harmonious borrower-lender relationship within the jurisdiction of Harris County, Texas.

Harris Texas Servicing Agreement

Description

How to fill out Harris Texas Servicing Agreement?

Whether you plan to open your company, enter into a deal, apply for your ID update, or resolve family-related legal concerns, you must prepare certain paperwork meeting your local laws and regulations. Finding the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and verified legal documents for any individual or business case. All files are collected by state and area of use, so picking a copy like Harris Servicing Agreement is quick and simple.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you several more steps to obtain the Harris Servicing Agreement. Follow the instructions below:

- Make sure the sample meets your personal needs and state law requirements.

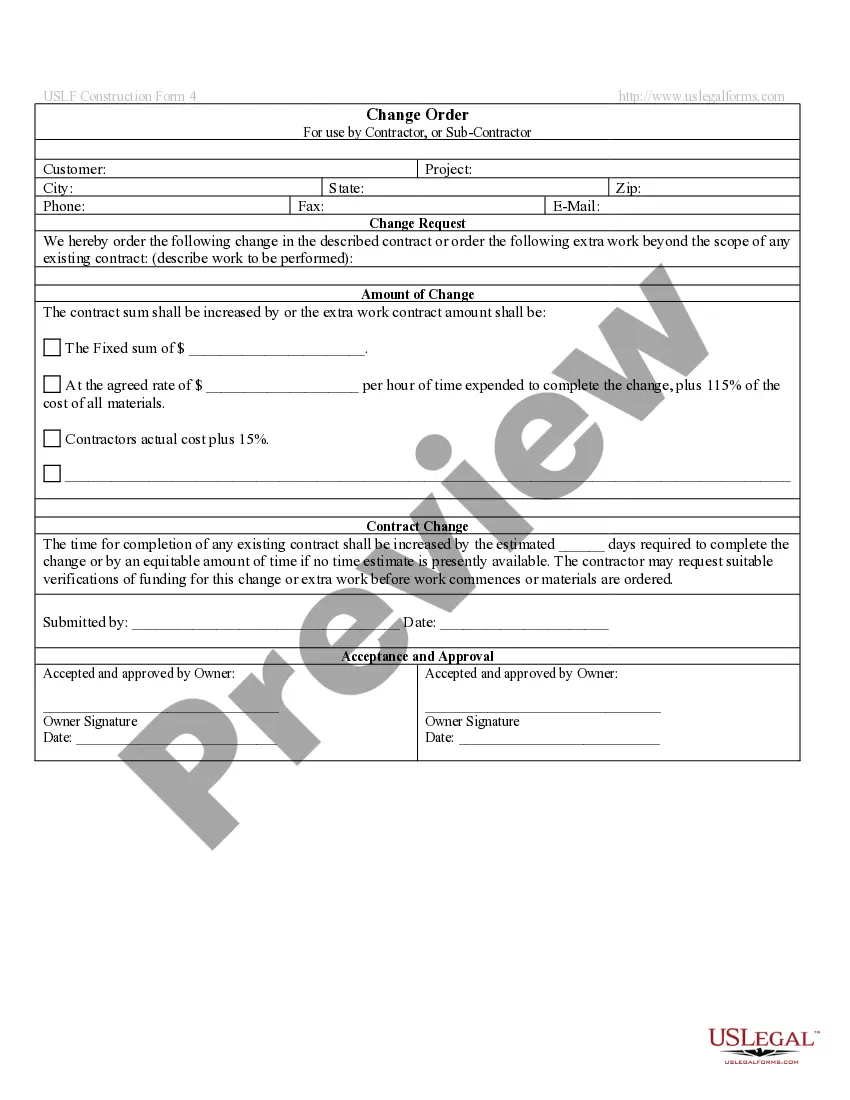

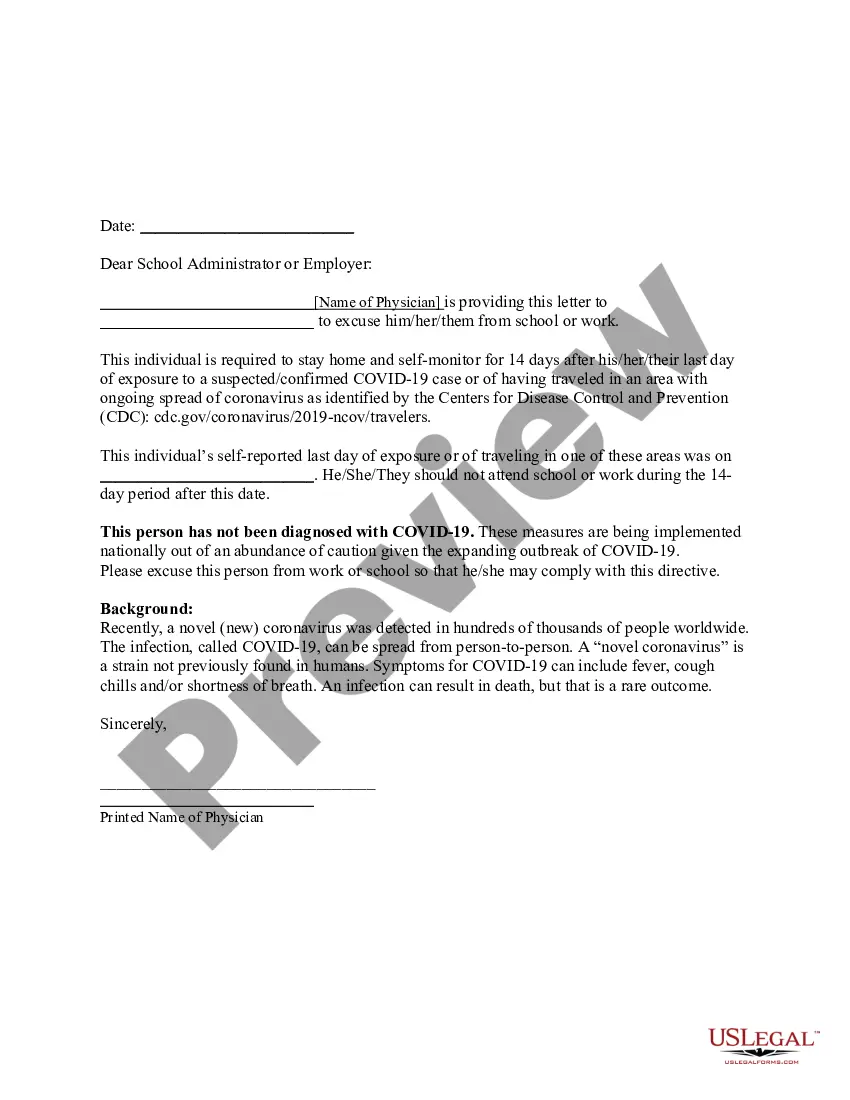

- Read the form description and check the Preview if there’s one on the page.

- Use the search tab specifying your state above to locate another template.

- Click Buy Now to obtain the sample once you find the proper one.

- Opt for the subscription plan that suits you most to continue.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Harris Servicing Agreement in the file format you prefer.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our library are reusable. Having an active subscription, you are able to access all of your earlier purchased paperwork at any time in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documentation. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!