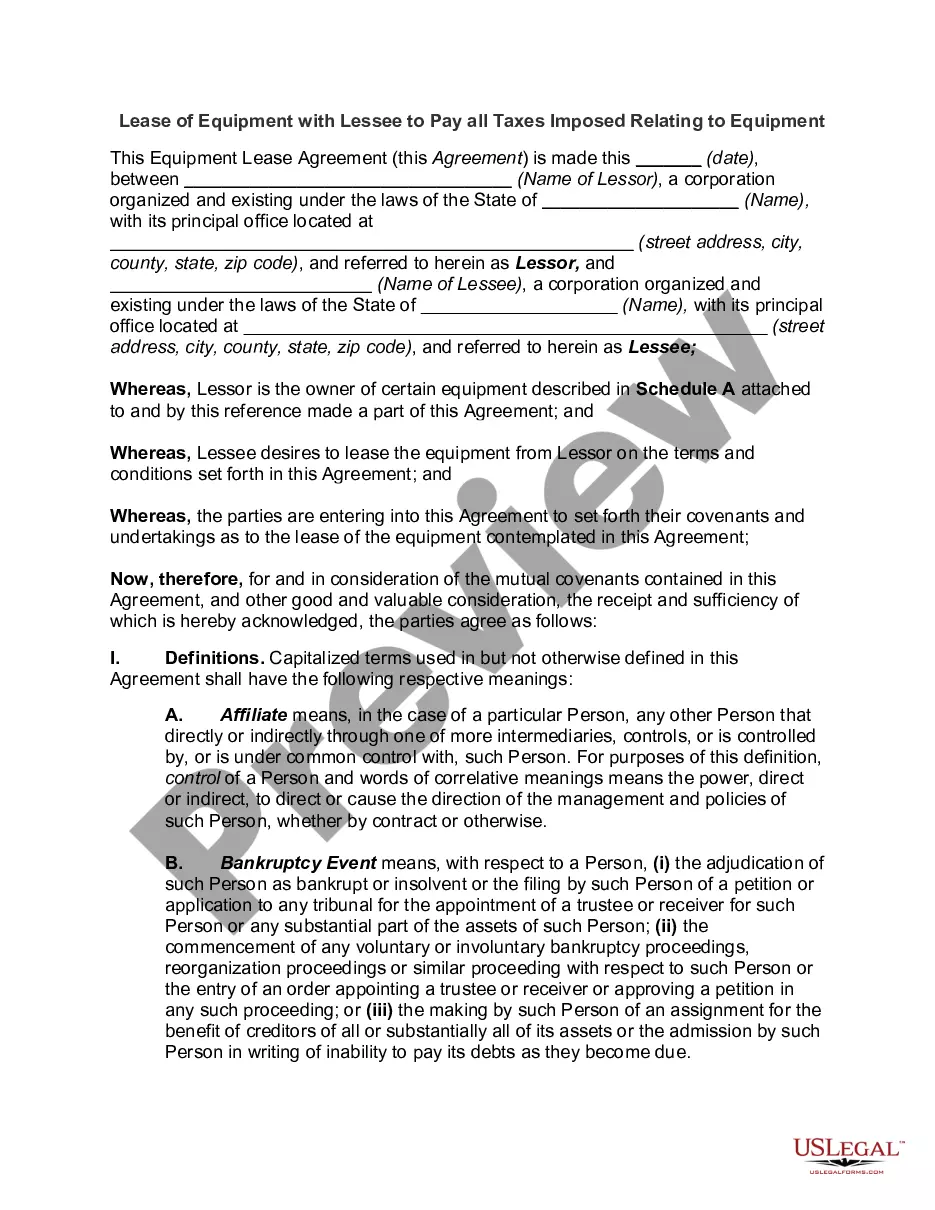

Allegheny Pennsylvania Trust Agreement is a legal document that pertains to the operations and management of mortgage-backed securities issued by Ameriquest Mortgage Securities, Inc. This agreement outlines the rights, obligations, and responsibilities of the various parties involved, including the trustee, issuer, service, and investors. Ameriquest Mortgage Securities, Inc., as the issuer, establishes the Allegheny Pennsylvania Trust Agreement to securitize mortgage loans and create mortgage-backed securities (MBS) out of them. These securities represent an ownership interest in a pool of residential mortgages, generating income for investors through the collection of principal and interest payments. This trust agreement provides a framework for the administration and servicing of the mortgage loans, ensuring compliance with applicable laws and regulations. It establishes guidelines for the selection of eligible mortgage loans, the creation and issuance of MBS, as well as the distribution of cash flows from the underlying mortgage pool. The Allegheny Pennsylvania Trust Agreement of Ameriquest Mortgage Securities, Inc. includes specific provisions to safeguard the rights of investors and provide transparency in the management of mortgage-backed securities. It sets forth the duties and powers of the trustee, who acts as a fiduciary for investors, overseeing the performance of the service and ensuring funds are distributed correctly. Different types of Allegheny Pennsylvania Trust Agreements may exist based on the specific mortgage loans pooled, their characteristics (e.g., fixed or adjustable-rate mortgages), or the risk profiles of the underlying borrowers. These types of agreements can reflect different terms and conditions, such as interest rates, maturity dates, prepayment options, and credit enhancements, tailored to meet the specific needs of investors. In conclusion, the Allegheny Pennsylvania Trust Agreement of Ameriquest Mortgage Securities, Inc. is a crucial legal document governing the creation, administration, and management of mortgage-backed securities. It ensures compliance, protects investor rights, and maintains transparency in the securitization process, enabling investors to participate in the mortgage market and seek returns from the cash flows generated by the underlying mortgage loans.

Allegheny Pennsylvania Trust Agreement of Ameriquest Mortgage Securities, Inc.

Description

How to fill out Allegheny Pennsylvania Trust Agreement Of Ameriquest Mortgage Securities, Inc.?

If you need to find a reliable legal paperwork supplier to obtain the Allegheny Trust Agreement of Ameriquest Mortgage Securities, Inc., consider US Legal Forms. Whether you need to start your LLC business or manage your belongings distribution, we got you covered. You don't need to be knowledgeable about in law to find and download the appropriate template.

- You can search from over 85,000 forms categorized by state/county and situation.

- The intuitive interface, variety of supporting resources, and dedicated support team make it easy to locate and complete various paperwork.

- US Legal Forms is a reliable service providing legal forms to millions of customers since 1997.

Simply select to look for or browse Allegheny Trust Agreement of Ameriquest Mortgage Securities, Inc., either by a keyword or by the state/county the document is intended for. After locating needed template, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's effortless to get started! Simply find the Allegheny Trust Agreement of Ameriquest Mortgage Securities, Inc. template and take a look at the form's preview and short introductory information (if available). If you're comfortable with the template’s legalese, go ahead and click Buy now. Register an account and select a subscription option. The template will be instantly available for download as soon as the payment is processed. Now you can complete the form.

Handling your legal matters doesn’t have to be expensive or time-consuming. US Legal Forms is here to demonstrate it. Our extensive collection of legal forms makes this experience less expensive and more reasonably priced. Set up your first company, arrange your advance care planning, draft a real estate contract, or execute the Allegheny Trust Agreement of Ameriquest Mortgage Securities, Inc. - all from the convenience of your sofa.

Sign up for US Legal Forms now!