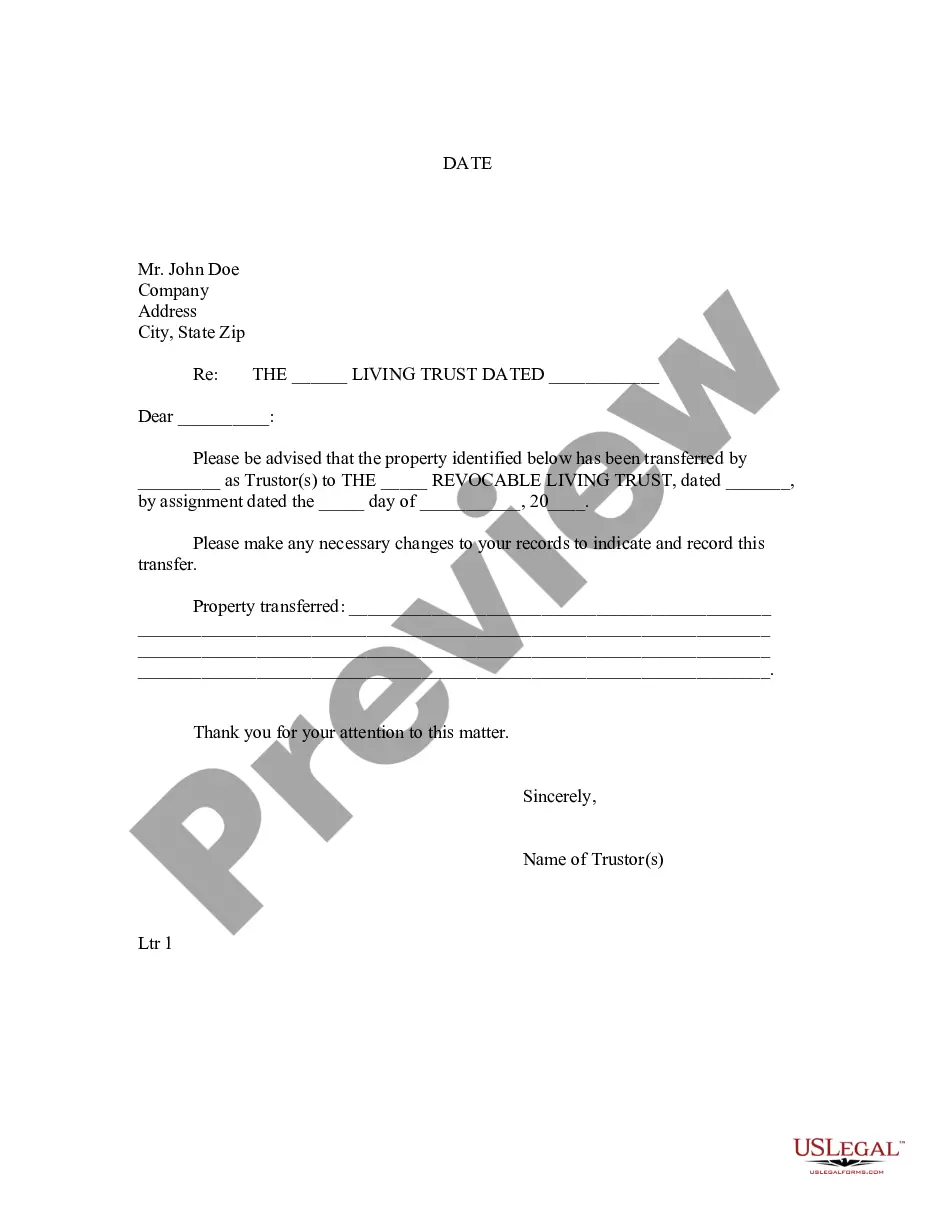

The Clark Nevada Trust Agreement is a legal document that governs the operations and terms of Ameriquest Mortgage Securities, Inc.'s trust arrangements. This agreement is specifically related to the securitization of mortgage assets, allowing Ameriquest Mortgage Securities, Inc. to bundle multiple mortgages into investment products such as mortgage-backed securities (MBS) for sale to investors. This trust agreement outlines the rights and responsibilities of the parties involved, including Ameriquest Mortgage Securities, Inc. (the issuer), the trustee (an independent third party responsible for managing the trust), and the investors who purchase the MBS. It establishes the guidelines for the creation of the trust, the pooling and transfer of mortgage loans, the allocation of cash flows from the underlying mortgage assets, and the reporting requirements. One of the key aims of the Clark Nevada Trust Agreement is to provide a legal framework that ensures transparency and protects the interests of investors. It sets forth detailed guidelines regarding the collateral, payment priority, default procedures, and the distribution of funds. The agreement also includes provisions on the rights and remedies of investors in case of any breach of contract or default. Within the broader scope of the Clark Nevada Trust Agreement, there may be different series or tranches of MBS issued by Ameriquest Mortgage Securities, Inc. These may have unique terms, interest rates, risk profiles, and maturity dates. For instance, there could be various Clark Nevada Trust Agreement Series 2006-1, Clark Nevada Trust Agreement Series 2007-2, and so on. Each series represents a distinct pool of mortgage loans, and investors can select the tranche that aligns with their risk appetite and investment objectives. In conclusion, the Clark Nevada Trust Agreement of Ameriquest Mortgage Securities, Inc. is a document defining the legal framework for creating and managing mortgage-backed securities. It ensures the transparent transfer of assets and protects the interests of investors.

Clark Nevada Trust Agreement of Ameriquest Mortgage Securities, Inc.

Description

How to fill out Clark Nevada Trust Agreement Of Ameriquest Mortgage Securities, Inc.?

Creating forms, like Clark Trust Agreement of Ameriquest Mortgage Securities, Inc., to manage your legal matters is a tough and time-consumming process. A lot of cases require an attorney’s involvement, which also makes this task expensive. However, you can acquire your legal affairs into your own hands and manage them yourself. US Legal Forms is here to the rescue. Our website comes with more than 85,000 legal documents crafted for a variety of cases and life circumstances. We make sure each form is in adherence with the regulations of each state, so you don’t have to be concerned about potential legal pitfalls associated with compliance.

If you're already aware of our website and have a subscription with US, you know how straightforward it is to get the Clark Trust Agreement of Ameriquest Mortgage Securities, Inc. form. Simply log in to your account, download the form, and customize it to your needs. Have you lost your form? No worries. You can find it in the My Forms folder in your account - on desktop or mobile.

The onboarding process of new customers is just as easy! Here’s what you need to do before getting Clark Trust Agreement of Ameriquest Mortgage Securities, Inc.:

- Make sure that your template is specific to your state/county since the rules for writing legal paperwork may differ from one state another.

- Discover more information about the form by previewing it or reading a quick description. If the Clark Trust Agreement of Ameriquest Mortgage Securities, Inc. isn’t something you were looking for, then use the header to find another one.

- Sign in or register an account to start using our service and get the document.

- Everything looks good on your side? Hit the Buy now button and select the subscription option.

- Select the payment gateway and enter your payment information.

- Your form is ready to go. You can go ahead and download it.

It’s an easy task to locate and buy the appropriate template with US Legal Forms. Thousands of businesses and individuals are already benefiting from our rich library. Sign up for it now if you want to check what other advantages you can get with US Legal Forms!