The Franklin Ohio Trust Agreement of Ameriquest Mortgage Securities, Inc. is a legally binding agreement that governs the trust created by Ameriquest Mortgage Securities, Inc. to securitize residential mortgage loans. This trust agreement serves as a framework for investors and outlines the rights, responsibilities, and obligations of all parties involved in the securitization process. As a trust agreement, it establishes a legal entity known as the Franklin Ohio Trust, which holds the pool of mortgage loans and issues securities backed by these loans. Investors can purchase these securities, providing them with a stream of income derived from the mortgage loan payments made by borrowers. The Franklin Ohio Trust Agreement includes various key provisions that ensure the proper servicing, administration, and credit enhancement of the securitized loans. These provisions aim to protect investors and maintain the integrity of the securitization structure. Some important topics covered in this agreement include: 1. Loan Pool Composition: The agreement describes the various characteristics of the mortgage loans included in the trust, such as the loan types, interest rates, maturity dates, and borrower credit profiles. 2. Cash Flow Mechanisms: It outlines the procedures for collecting and distributing mortgage loan payments to the investors, as well as how excess cash flows or losses are handled. 3. Servicing and Administration: The trust agreement defines the roles and responsibilities of the loan service, who handles borrower interactions, collection of payments, and loan modifications, if necessary. 4. Trustee's Duties: The agreement appoints a trustee, typically a trust company, who acts as a fiduciary to the investors. The trustee ensures that the terms of the trust agreement are followed and may take certain actions in case of default or fraud. 5. Reporting and Disclosure: The agreement stipulates the reporting requirements, such as the frequency and content of investor reports, as well as any material disclosures related to the mortgage loans or the securitization structure. Different types of Franklin Ohio Trust Agreements may exist based on the specific characteristics of the mortgage loans and the needs of investors. These variations may include agreements for different periods, loan types, geographic locations, or risk profiles. Moreover, certain Franklin Ohio Trust Agreements may have unique names or designations to differentiate them from others within the Ameriquest Mortgage Securities, Inc. portfolio. Overall, the Franklin Ohio Trust Agreement of Ameriquest Mortgage Securities, Inc. plays a crucial role in facilitating the securitization of mortgage loans, providing investors with an opportunity to invest in a diversified portfolio of loans while ensuring compliance with applicable laws and regulations.

Franklin Ohio Trust Agreement of Ameriquest Mortgage Securities, Inc.

Description

How to fill out Franklin Ohio Trust Agreement Of Ameriquest Mortgage Securities, Inc.?

A document routine always goes along with any legal activity you make. Creating a company, applying or accepting a job offer, transferring ownership, and many other life situations demand you prepare formal documentation that differs throughout the country. That's why having it all collected in one place is so valuable.

US Legal Forms is the most extensive online library of up-to-date federal and state-specific legal forms. On this platform, you can easily find and download a document for any individual or business purpose utilized in your county, including the Franklin Trust Agreement of Ameriquest Mortgage Securities, Inc..

Locating forms on the platform is remarkably straightforward. If you already have a subscription to our library, log in to your account, find the sample using the search field, and click Download to save it on your device. Afterward, the Franklin Trust Agreement of Ameriquest Mortgage Securities, Inc. will be available for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, adhere to this quick guideline to obtain the Franklin Trust Agreement of Ameriquest Mortgage Securities, Inc.:

- Make sure you have opened the proper page with your regional form.

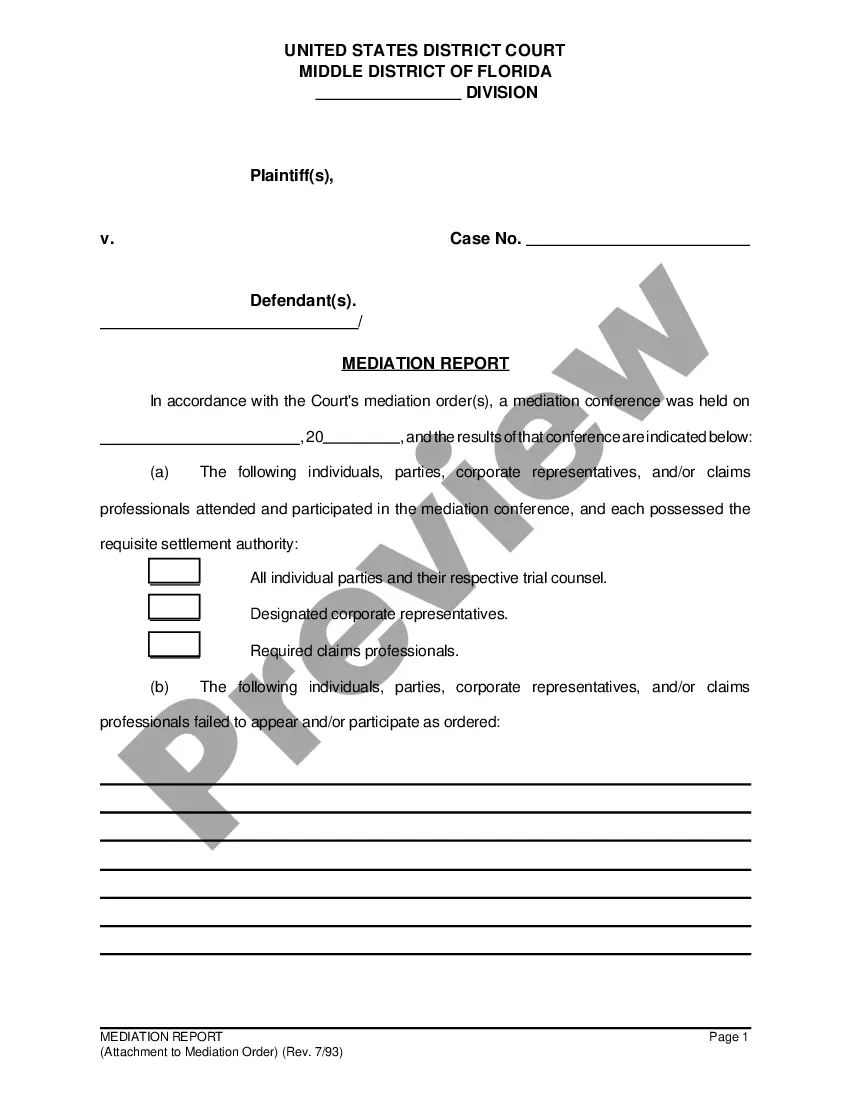

- Utilize the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the form corresponds to your requirements.

- Search for another document using the search tab in case the sample doesn't fit you.

- Click Buy Now once you find the necessary template.

- Decide on the appropriate subscription plan, then sign in or create an account.

- Select the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and save the Franklin Trust Agreement of Ameriquest Mortgage Securities, Inc. on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the simplest and most reliable way to obtain legal documents. All the templates provided by our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs effectively with the US Legal Forms!