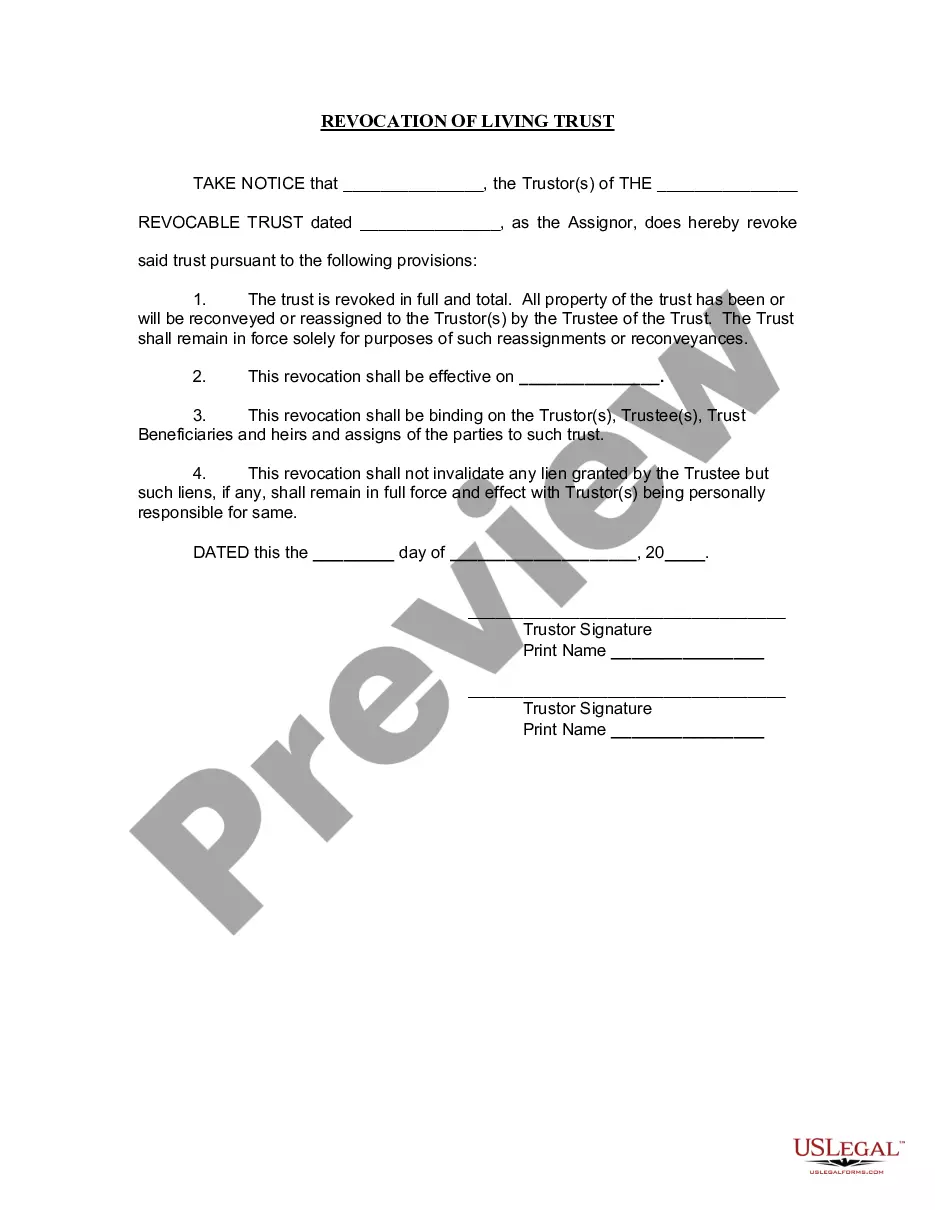

Orange California Trust Agreement of Ameriquest Mortgage Securities, Inc. is a legal document that establishes the terms and conditions under which Ameriquest Mortgage Securities, Inc. operates its trust in Orange County, California. This agreement outlines the rights and responsibilities of both the trust sponsor and the trust beneficiaries. Keywords: Orange California, Trust Agreement, Ameriquest Mortgage Securities, Inc., legal document, terms and conditions, trust sponsor, trust beneficiaries. There are several types of Orange California Trust Agreement of Ameriquest Mortgage Securities, Inc., each serving specific purposes and catering to different needs. Here are some notable types: 1. Residential Mortgage-Backed Securities Trust Agreement: This type of trust agreement is designed to facilitate the securitization of residential mortgage loans in Orange County, California. It outlines the procedures for pooling and servicing the mortgages, as well as the distribution of cash flows to investors. 2. Commercial Mortgage-Backed Securities Trust Agreement: This trust agreement focuses on securitizing commercial mortgage loans in Orange County. It establishes the guidelines for managing and servicing the underlying loans, as well as the allocation of principal and interest payments to investors. 3. Collateralized Debt Obligations Trust Agreement: This type of trust agreement forms the basis for securitizing pools of diverse assets, which can include residential and commercial loans, credit card receivables, and other types of debt. The agreement defines the priority of payments and waterfall of cash flows among various tranches of investors. 4. Mortgage Loan Purchase and Sale Agreement: While not strictly a trust agreement, this document often accompanies Orange California Trust Agreements for Ameriquest Mortgage Securities, Inc. It governs the purchase and sale of mortgage loans between Ameriquest and other entities, enabling the trust to acquire the underlying assets. Overall, Orange California Trust Agreement of Ameriquest Mortgage Securities, Inc. provides a comprehensive framework for managing and administering mortgage-backed securities in Orange County, California. By compounding the trust's assets and facilitating the flow of cash flows to investors, these agreements play a crucial role in the efficient functioning of the mortgage-backed securities market.

Orange California Trust Agreement of Ameriquest Mortgage Securities, Inc.

Description

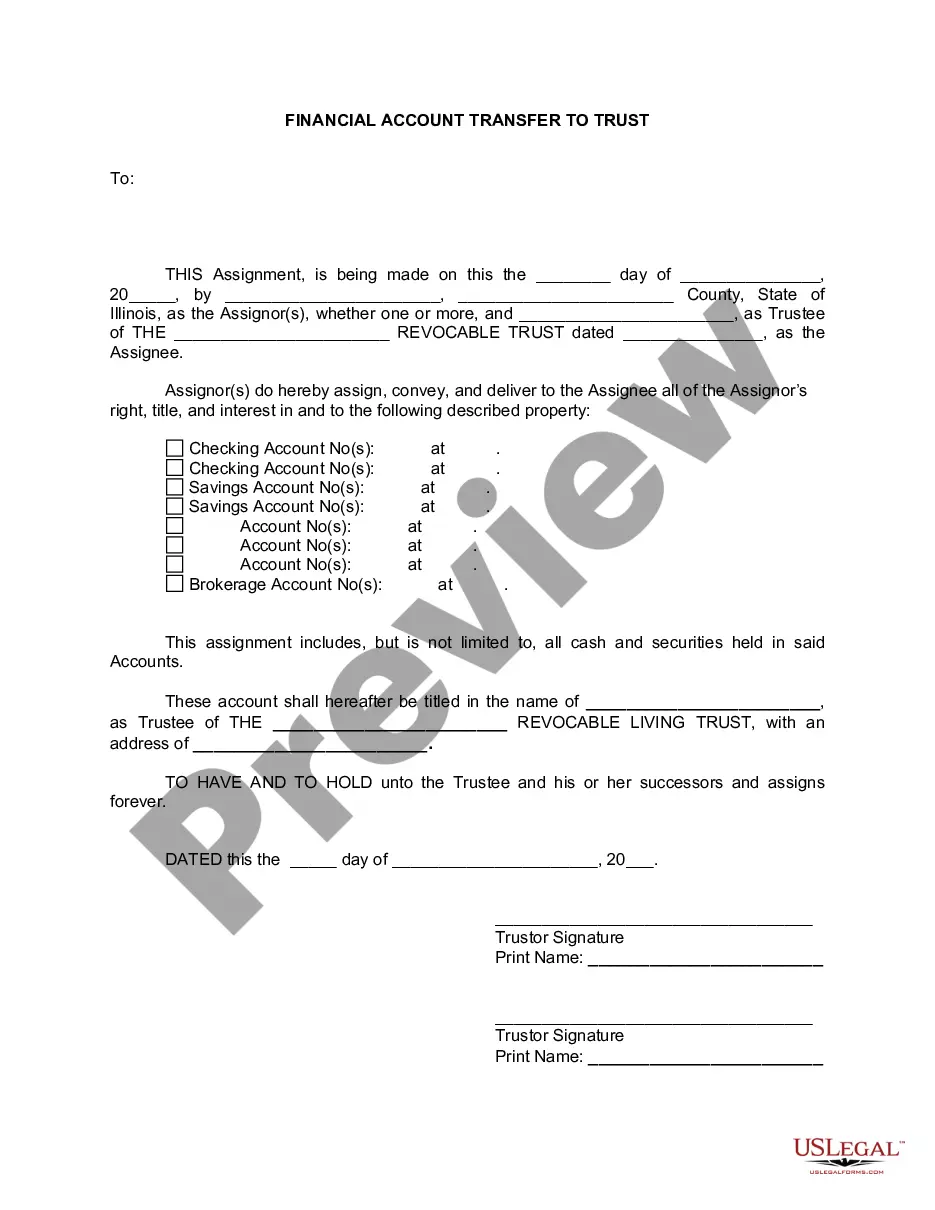

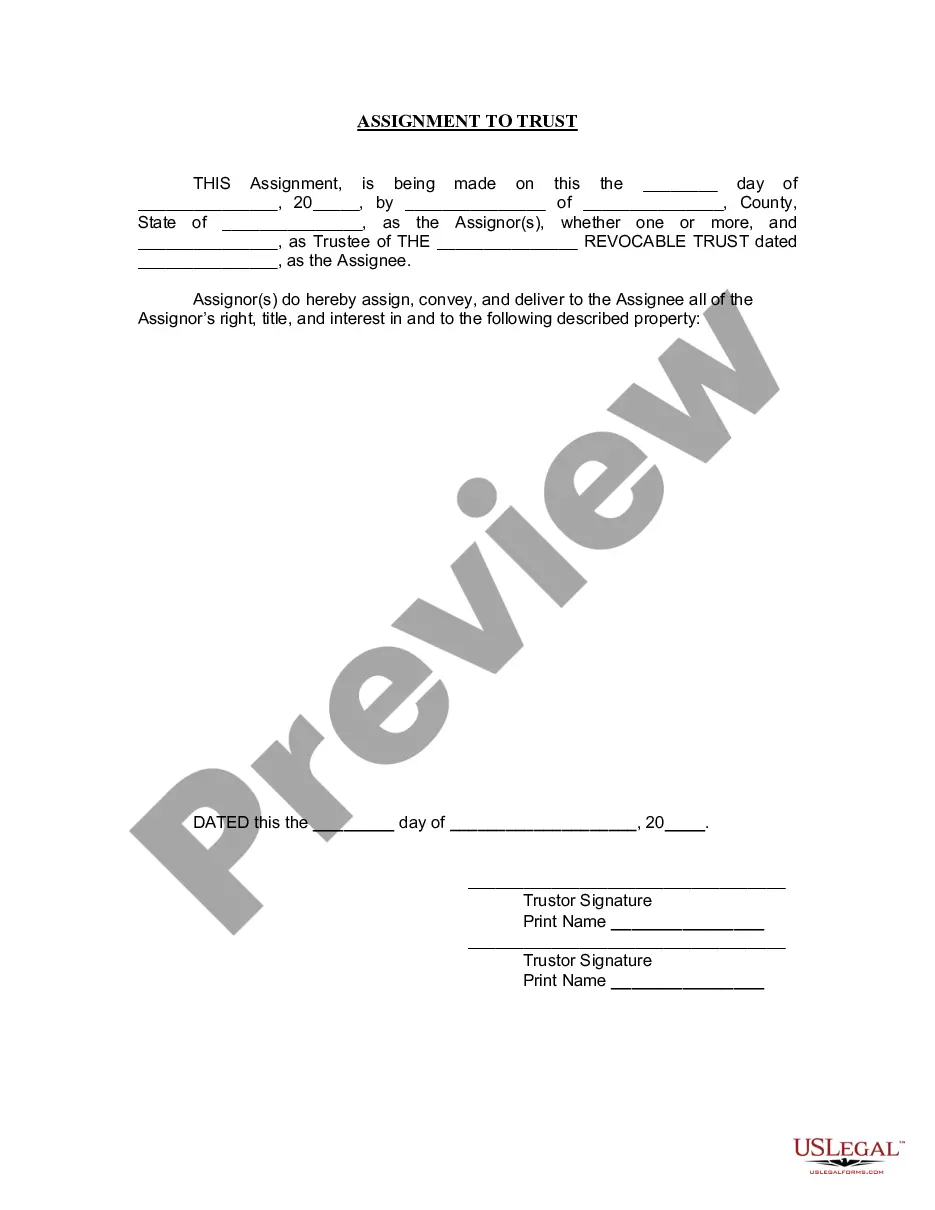

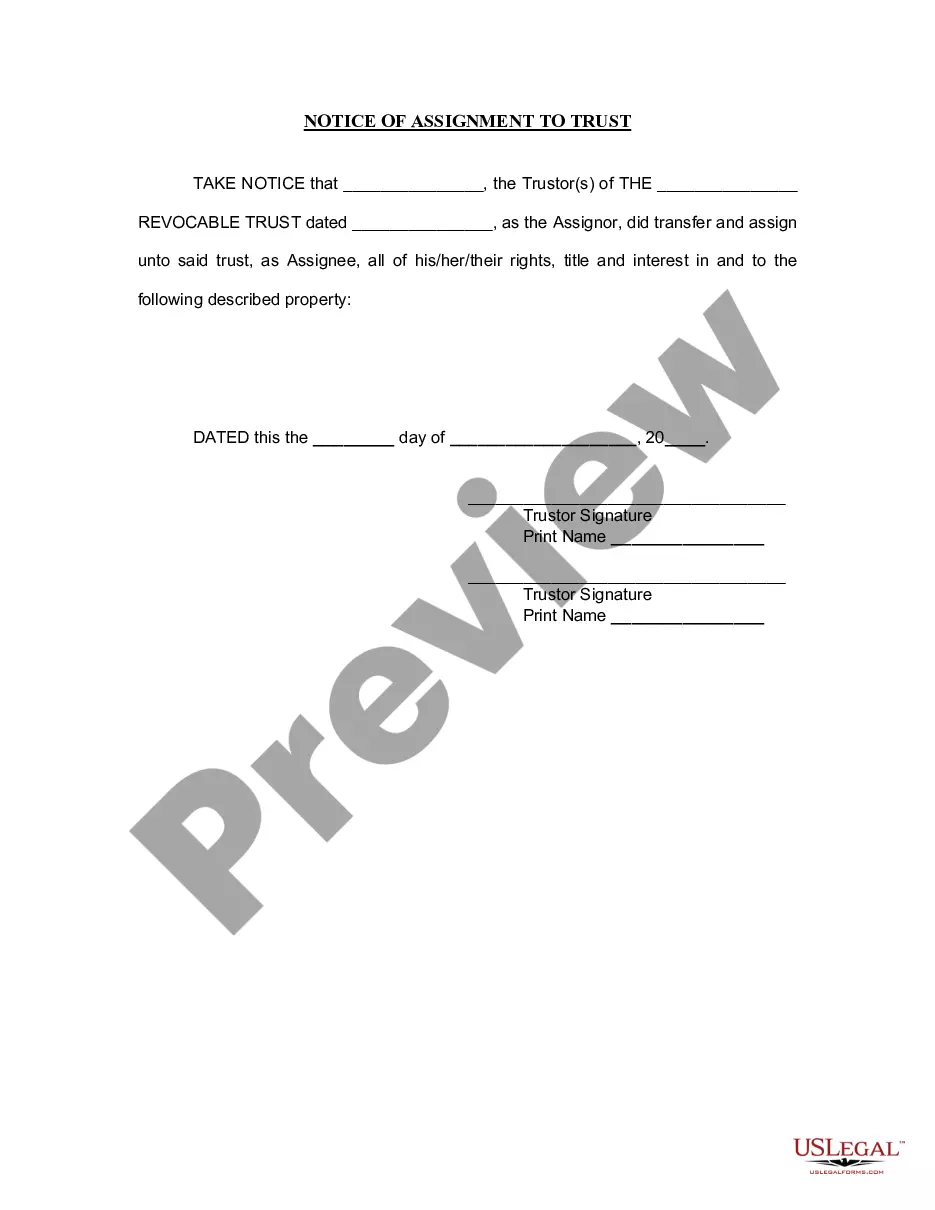

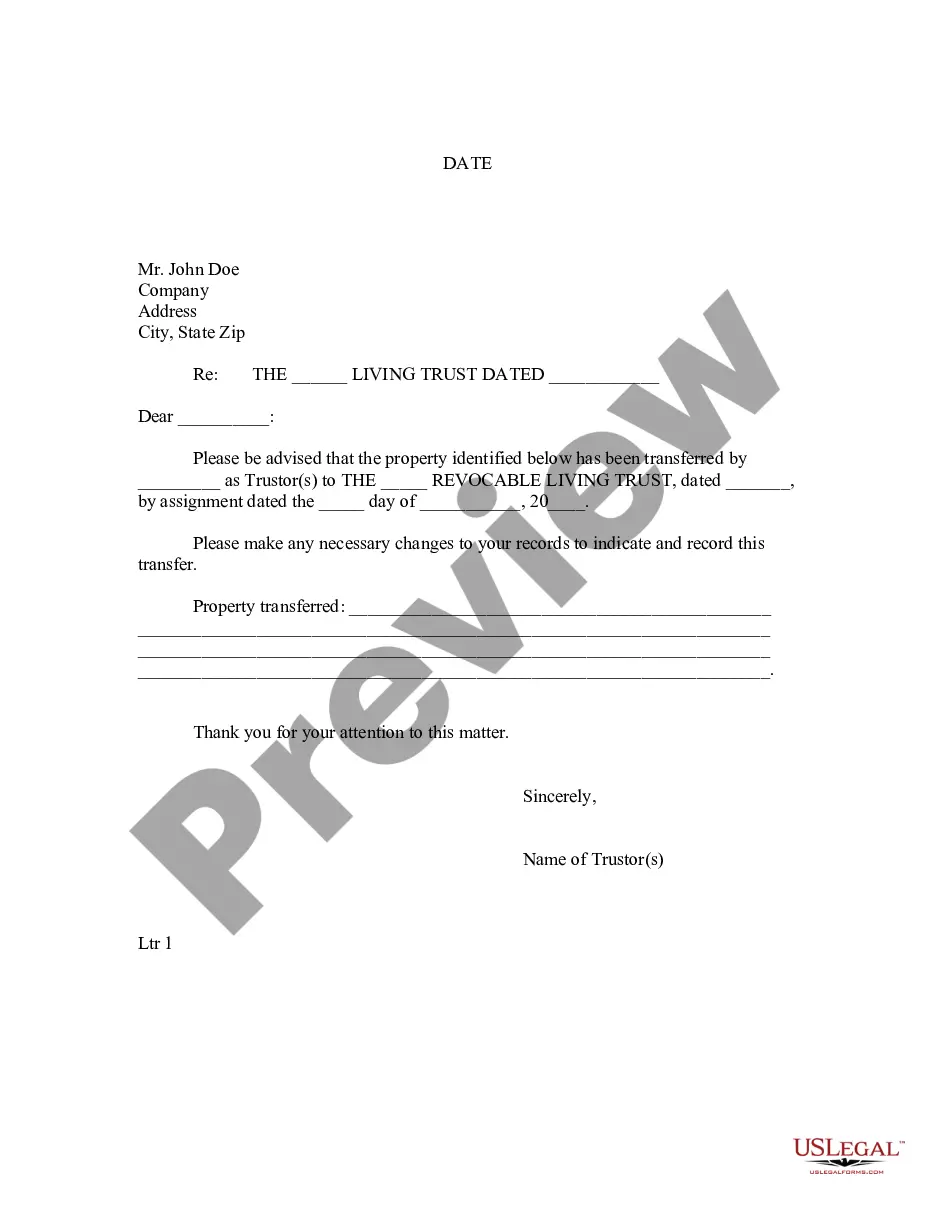

How to fill out Orange California Trust Agreement Of Ameriquest Mortgage Securities, Inc.?

Are you looking to quickly create a legally-binding Orange Trust Agreement of Ameriquest Mortgage Securities, Inc. or probably any other form to handle your own or business matters? You can go with two options: contact a legal advisor to write a valid document for you or draft it completely on your own. Thankfully, there's an alternative option - US Legal Forms. It will help you get neatly written legal paperwork without having to pay unreasonable fees for legal services.

US Legal Forms offers a rich collection of more than 85,000 state-specific form templates, including Orange Trust Agreement of Ameriquest Mortgage Securities, Inc. and form packages. We provide templates for a myriad of use cases: from divorce paperwork to real estate document templates. We've been out there for more than 25 years and gained a rock-solid reputation among our clients. Here's how you can become one of them and obtain the necessary template without extra hassles.

- First and foremost, carefully verify if the Orange Trust Agreement of Ameriquest Mortgage Securities, Inc. is adapted to your state's or county's regulations.

- In case the form includes a desciption, make sure to check what it's suitable for.

- Start the search over if the document isn’t what you were hoping to find by using the search box in the header.

- Choose the subscription that best suits your needs and proceed to the payment.

- Choose the format you would like to get your form in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already set up an account, you can simply log in to it, locate the Orange Trust Agreement of Ameriquest Mortgage Securities, Inc. template, and download it. To re-download the form, just head to the My Forms tab.

It's stressless to find and download legal forms if you use our catalog. Moreover, the paperwork we offer are updated by industry experts, which gives you greater confidence when dealing with legal affairs. Try US Legal Forms now and see for yourself!