The Lima Arizona Trust Agreement of Ameriquest Mortgage Securities, Inc. is a legal contract that governs the trust arrangement between the issuer, Ameriquest Mortgage Securities, Inc., and the beneficiaries of the trust in relation to mortgage-backed securities in Lima, Arizona. This trust agreement provides a framework for the creation, administration, and management of the trust, ensuring transparency and adherence to applicable laws and regulations. Under the Lima Arizona Trust Agreement, Ameriquest Mortgage Securities, Inc. pools together a portfolio of mortgage loans secured by properties located in Lima, Arizona. These mortgages are then packaged into mortgage-backed securities and sold to investors in the secondary market. This arrangement allows investors to gain exposure to the real estate market while providing a means of financing for borrowers in Lima, Arizona. The trust agreement outlines the duties and responsibilities of various parties involved. Key participants include the trustee, who oversees the trust and its operations, the issuer, who creates the mortgage-backed securities and administers the trust, and the investors, who purchase the securities. The Lima Arizona Trust Agreement may encompass different types of mortgage-backed securities, each with its unique characteristics and risk profiles. Some variations could include: 1. Residential Mortgage-Backed Securities (RMBS): These securities are backed by residential mortgages located in Lima, Arizona. They generate cash flows through the repayment of principal and interest from homeowners' mortgage payments. 2. Commercial Mortgage-Backed Securities (CMOS): This type of security is supported by commercial property mortgages in Lima, Arizona. It provides investors with exposure to income-generating properties, such as office buildings, retail spaces, or hotels. 3. Collateralized Mortgage Obligations (CMO): CMOs are structured securities that offer multiple classes or tranches with varying maturities and payment structures. These securities are backed by a pool of Lima, Arizona mortgages and distribute cash flows based on predefined rules. 4. Pass-Through Securities: Pass-through securities offer investors a proportional share of the cash flows generated by the underlying mortgage loans in Lima, Arizona. They are structured to pass the principal and interest payments from the borrowers directly to the investors. The Lima Arizona Trust Agreement of Ameriquest Mortgage Securities, Inc. plays a vital role in the efficient functioning of the mortgage-backed securities market in Lima, Arizona. It establishes the legal framework necessary to safeguard the interests of all parties involved and contributes to the liquidity and stability of the local housing finance market.

Pima Arizona Trust Agreement of Ameriquest Mortgage Securities, Inc.

Description

How to fill out Pima Arizona Trust Agreement Of Ameriquest Mortgage Securities, Inc.?

Laws and regulations in every sphere vary throughout the country. If you're not a lawyer, it's easy to get lost in various norms when it comes to drafting legal paperwork. To avoid pricey legal assistance when preparing the Pima Trust Agreement of Ameriquest Mortgage Securities, Inc., you need a verified template valid for your region. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions online library of more than 85,000 state-specific legal forms. It's a great solution for professionals and individuals looking for do-it-yourself templates for different life and business situations. All the forms can be used multiple times: once you purchase a sample, it remains accessible in your profile for subsequent use. Thus, if you have an account with a valid subscription, you can simply log in and re-download the Pima Trust Agreement of Ameriquest Mortgage Securities, Inc. from the My Forms tab.

For new users, it's necessary to make some more steps to obtain the Pima Trust Agreement of Ameriquest Mortgage Securities, Inc.:

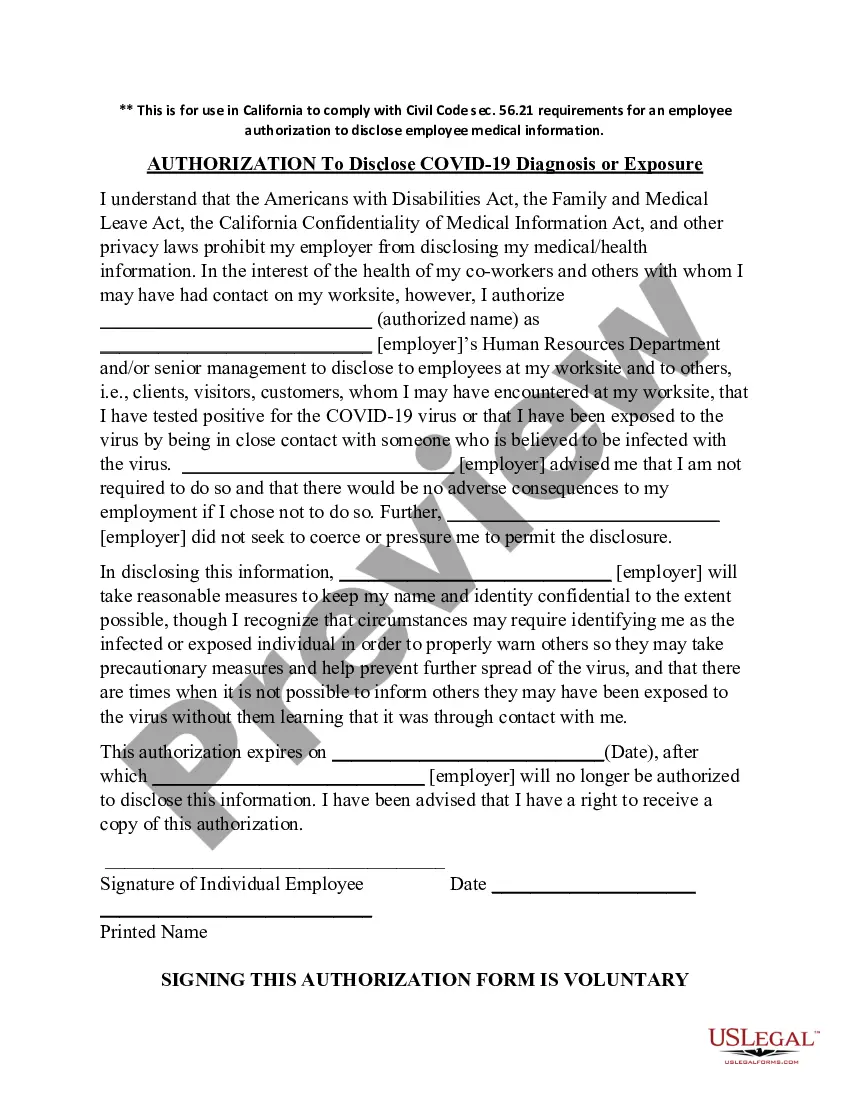

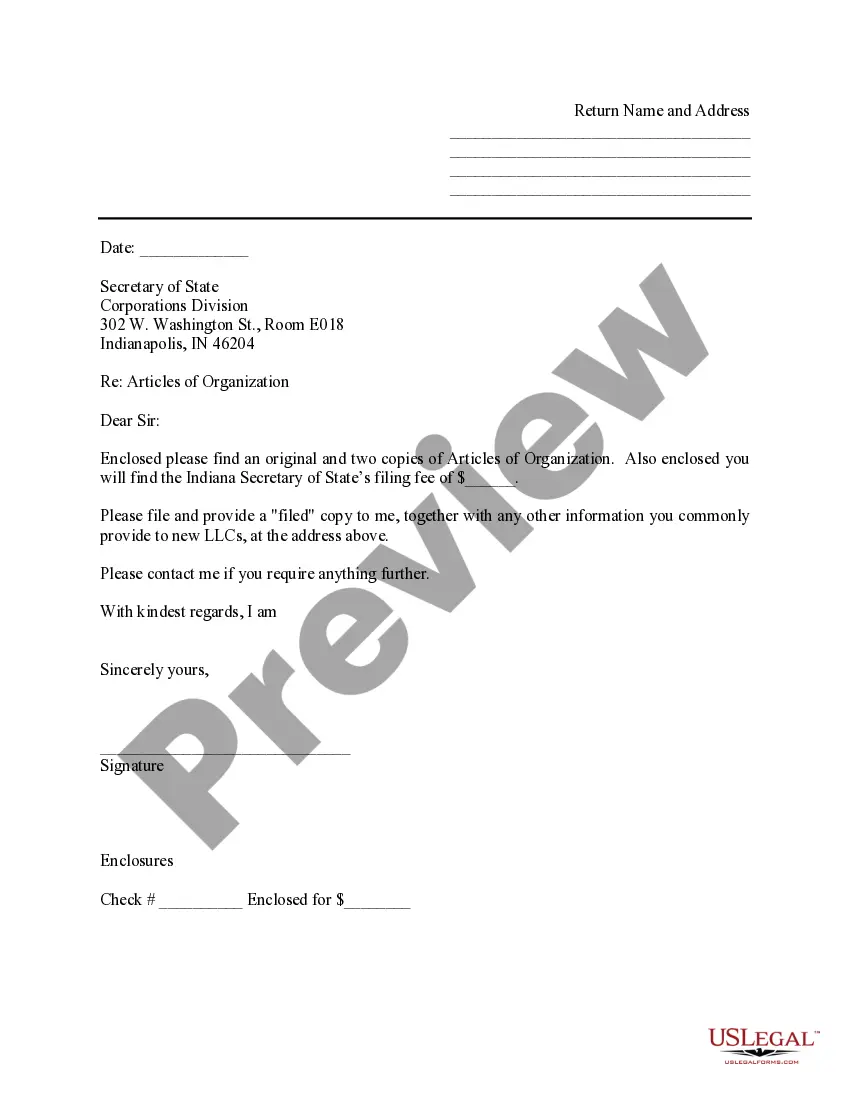

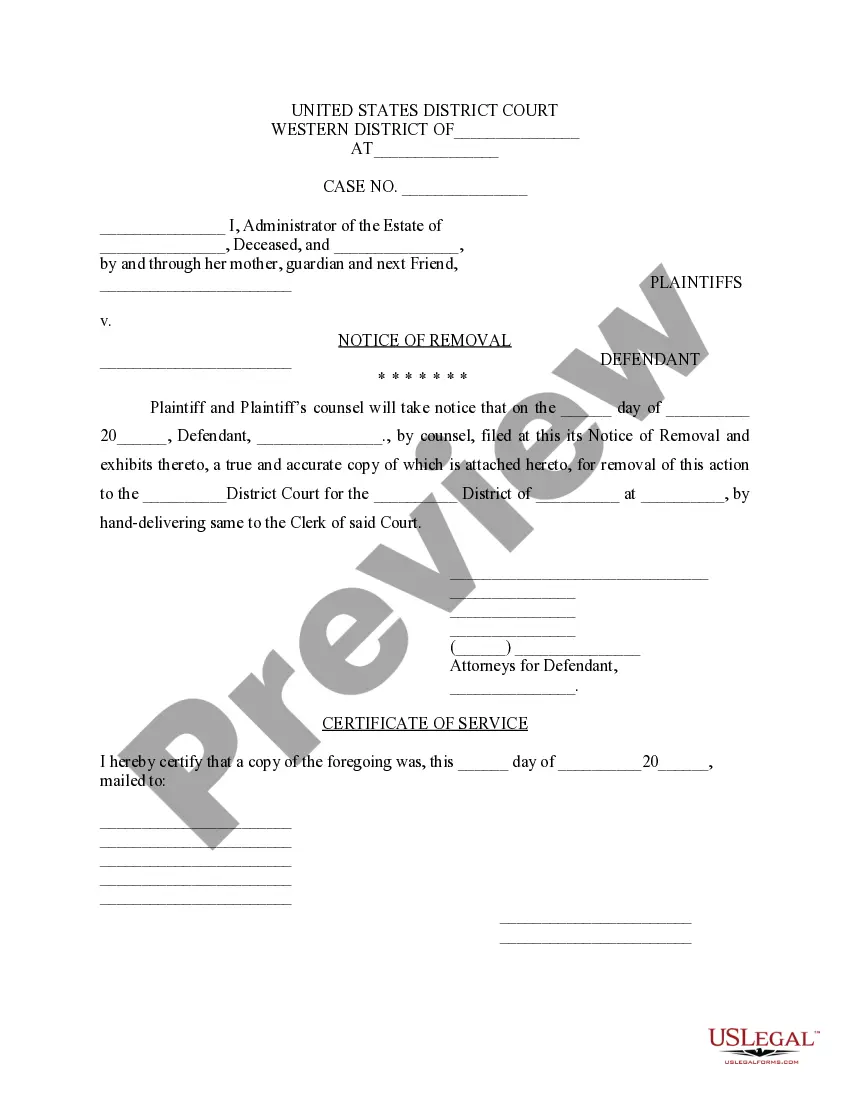

- Examine the page content to make sure you found the appropriate sample.

- Take advantage of the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Utilize the Buy Now button to obtain the template once you find the appropriate one.

- Opt for one of the subscription plans and log in or create an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Fill out and sign the template in writing after printing it or do it all electronically.

That's the easiest and most economical way to get up-to-date templates for any legal purposes. Find them all in clicks and keep your documentation in order with the US Legal Forms!