The San Antonio Texas Trust Agreement of Ameriquest Mortgage Securities, Inc. is a legal document that outlines the terms and conditions of a trust agreement in San Antonio, Texas. It is specifically related to the operations and dealings of Ameriquest Mortgage Securities, Inc., a major financial institution. This trust agreement serves as a legally binding contract between the parties involved, which may include Ameriquest Mortgage Securities, Inc. as the trust or, a trustee appointed to manage the trust, and beneficiaries who will receive the benefit from the trust. This agreement ensures that the trust property, usually mortgage-backed securities, is managed and distributed in accordance with the agreed-upon terms. There may be various types of San Antonio Texas Trust Agreement of Ameriquest Mortgage Securities, Inc. depending on the specific nature of the trust. These could include: 1. Residential Mortgage Trust Agreement: This type of trust agreement involves residential mortgages that have been pooled together into a trust for the purpose of securitization. The agreement will outline the responsibilities and rights of all parties involved in managing these mortgage-backed securities. 2. Commercial Mortgage Trust Agreement: A commercial mortgage trust agreement applies to commercial real estate loans that are packaged and securitized by Ameriquest Mortgage Securities, Inc. as investments. It specifies how the trust is formed and how the income generated from these assets will be distributed. 3. Asset-Backed Securities Trust Agreement: This type of trust agreement pertains to a broader range of assets such as auto loans, credit card receivables, or student loans. Ameriquest Mortgage Securities, Inc. may pool these assets together to create a trust, and the agreement determines how the income and losses associated with these assets will be allocated among the investors. 4. Collateralized Debt Obligation (CDO) Trust Agreement: In some cases, Ameriquest Mortgage Securities, Inc. may create a trust agreement specifically for collateralized debt obligations, which are complex financial instruments that combine various types of debt securities. The trust agreement will govern the structure and management of the CDO, including how the underlying assets are acquired and distributed. In conclusion, the San Antonio Texas Trust Agreement of Ameriquest Mortgage Securities, Inc. is a comprehensive legal document that establishes the terms and conditions governing different types of trusts involving mortgage-backed securities or other asset-backed securities. These agreements ensure that the assets are managed and distributed in a manner that benefits all parties involved.

San Antonio Texas Trust Agreement of Ameriquest Mortgage Securities, Inc.

Description

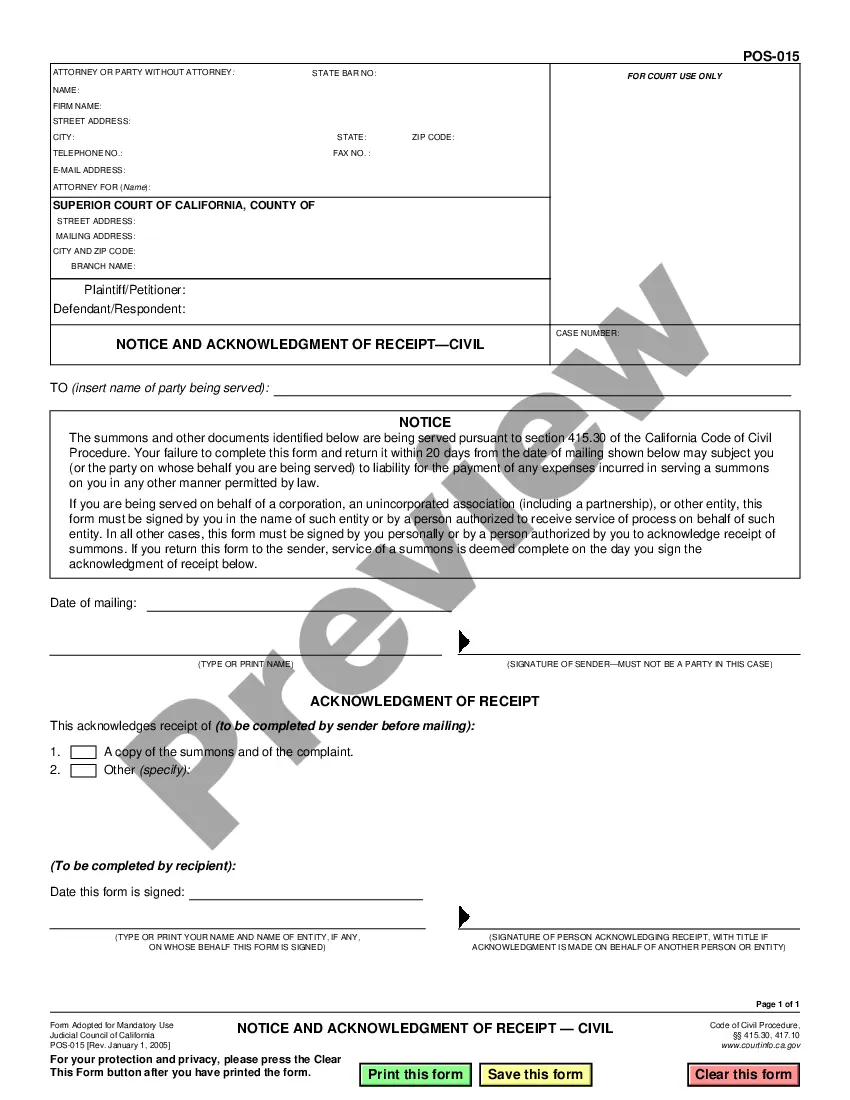

How to fill out San Antonio Texas Trust Agreement Of Ameriquest Mortgage Securities, Inc.?

Creating documents, like San Antonio Trust Agreement of Ameriquest Mortgage Securities, Inc., to manage your legal affairs is a tough and time-consumming process. Many circumstances require an attorney’s involvement, which also makes this task not really affordable. Nevertheless, you can take your legal issues into your own hands and deal with them yourself. US Legal Forms is here to save the day. Our website comes with over 85,000 legal documents created for various scenarios and life circumstances. We ensure each document is in adherence with the regulations of each state, so you don’t have to be concerned about potential legal issues compliance-wise.

If you're already aware of our website and have a subscription with US, you know how easy it is to get the San Antonio Trust Agreement of Ameriquest Mortgage Securities, Inc. template. Go ahead and log in to your account, download the form, and personalize it to your requirements. Have you lost your document? Don’t worry. You can find it in the My Forms tab in your account - on desktop or mobile.

The onboarding flow of new users is fairly easy! Here’s what you need to do before downloading San Antonio Trust Agreement of Ameriquest Mortgage Securities, Inc.:

- Make sure that your form is compliant with your state/county since the rules for writing legal papers may vary from one state another.

- Discover more information about the form by previewing it or reading a brief description. If the San Antonio Trust Agreement of Ameriquest Mortgage Securities, Inc. isn’t something you were hoping to find, then take advantage of the search bar in the header to find another one.

- Sign in or create an account to start utilizing our service and get the document.

- Everything looks great on your end? Click the Buy now button and choose the subscription option.

- Pick the payment gateway and enter your payment information.

- Your template is good to go. You can go ahead and download it.

It’s an easy task to locate and purchase the needed document with US Legal Forms. Thousands of businesses and individuals are already benefiting from our rich collection. Subscribe to it now if you want to check what other advantages you can get with US Legal Forms!