San Diego, California is a vibrant city located on the Pacific coast of the United States. Known for its stunning beaches, perfect climate, and rich cultural heritage, San Diego offers a unique blend of urban excitement and coastal relaxation. Ameriquest Mortgage, one of the leading mortgage lenders in the country, provides various mortgage loan purchase agreements tailored to meet the diverse needs of homeowners in San Diego. One such agreement is the San Diego California Sample Subsequent Mortgage Loan Purchase Agreement, which addresses the specific requirements and regulations applicable to mortgage loans in this region. This agreement outlines the terms and conditions for the purchase of subsequent mortgage loans in San Diego, ensuring both the lender and the borrower are protected. It covers crucial details such as loan amount, interest rates, repayment schedule, foreclosure procedures, and other important considerations. In addition to the general San Diego California Sample Subsequent Mortgage Loan Purchase Agreement, Ameriquest Mortgage offers a range of specialized agreements to cater to specific loan programs or borrower qualifications. These may include the San Diego California Sample Subsequent Mortgage Loan Purchase Agreement — FHA, which adheres to the guidelines set forth by the Federal Housing Administration (FHA), providing financing options to individuals who may have limited credit history or a lower down payment. Another type of agreement is the San Diego California Sample Subsequent Mortgage Loan Purchase Agreement — VA, which caters to veterans and their families by aligning with the requirements of the U.S. Department of Veterans Affairs (VA). This agreement offers favorable terms and benefits, such as lower interest rates and no down payment requirements. Furthermore, the San Diego California Sample Subsequent Mortgage Loan Purchase Agreement — Jumbo caters to individuals seeking larger loan amounts that exceed the conventional loan limits. This agreement addresses the specific guidelines and considerations associated with jumbo mortgages, allowing borrowers to secure financing for higher-priced properties in the San Diego area. Each San Diego California Sample Subsequent Mortgage Loan Purchase Agreement of Ameriquest Mortgage is carefully crafted to ensure compliance with local, state, and federal regulations, as well as to meet the unique needs of borrowers in San Diego. These agreements provide a comprehensive framework that safeguards the interests of both parties involved, facilitating a smooth and transparent mortgage lending process.

San Diego California Sample Subsequent Mortgage Loan Purchase Agreement of Ameriquest Mortgage

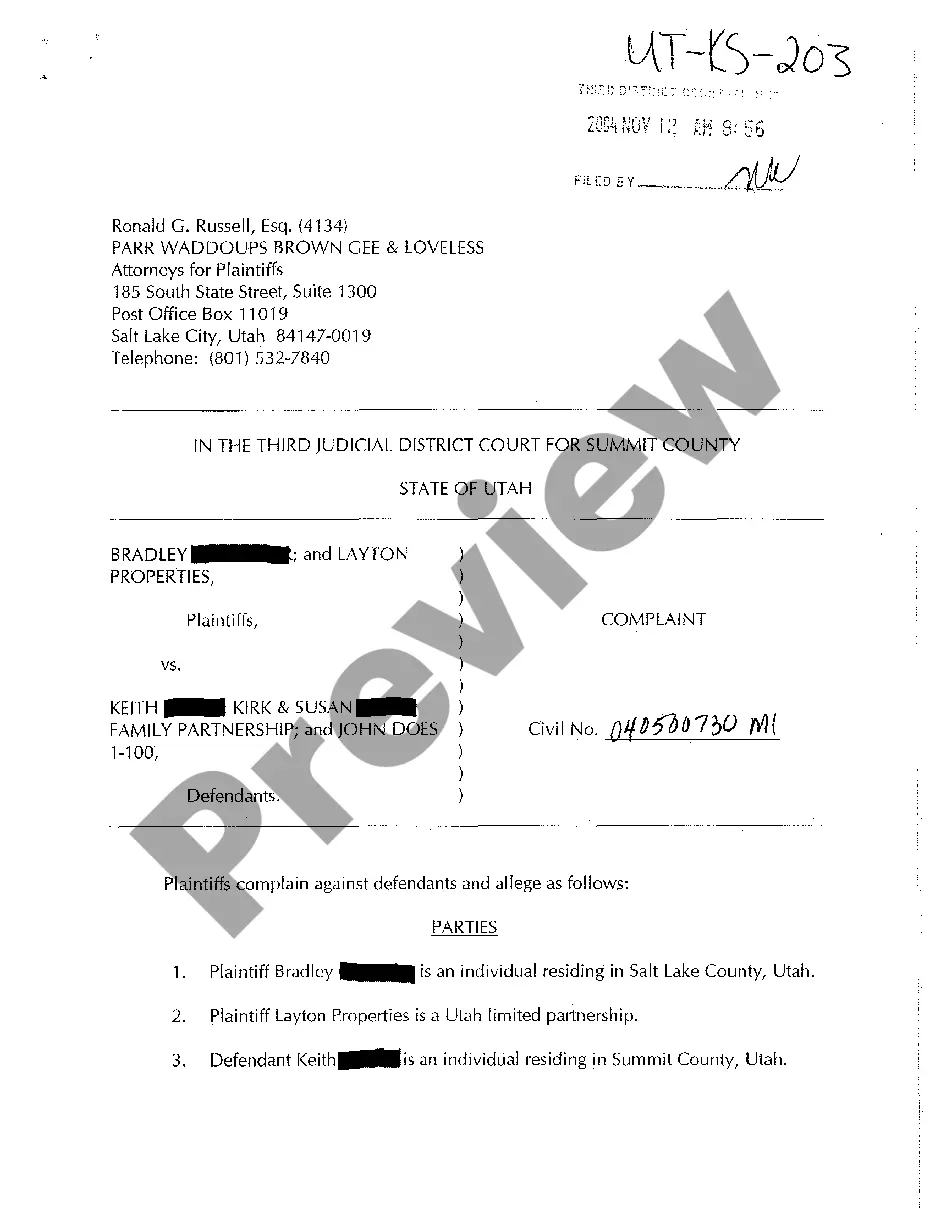

Description

How to fill out San Diego California Sample Subsequent Mortgage Loan Purchase Agreement Of Ameriquest Mortgage?

How much time does it usually take you to draft a legal document? Because every state has its laws and regulations for every life situation, finding a San Diego Sample Subsequent Mortgage Loan Purchase Agreement of Ameriquest Mortgage meeting all local requirements can be exhausting, and ordering it from a professional lawyer is often expensive. Numerous web services offer the most common state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most extensive web catalog of templates, gathered by states and areas of use. Aside from the San Diego Sample Subsequent Mortgage Loan Purchase Agreement of Ameriquest Mortgage, here you can find any specific document to run your business or individual deeds, complying with your county requirements. Experts check all samples for their actuality, so you can be sure to prepare your paperwork correctly.

Using the service is fairly easy. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the required sample, and download it. You can get the file in your profile at any moment in the future. Otherwise, if you are new to the platform, there will be a few more steps to complete before you obtain your San Diego Sample Subsequent Mortgage Loan Purchase Agreement of Ameriquest Mortgage:

- Examine the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Search for another document using the corresponding option in the header.

- Click Buy Now when you’re certain in the selected file.

- Select the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the San Diego Sample Subsequent Mortgage Loan Purchase Agreement of Ameriquest Mortgage.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased template, you can locate all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!