The Philadelphia Pennsylvania Agreement and Plan of Merger refers to a specific legal agreement and plan that took place between America Online, Inc. (AOL), ME Acquisition, Inc., and MapQuest. Com, Inc. The purpose of this agreement was to merge the operations and assets of MapQuest. Com, Inc. into the larger structure of AOL and ME Acquisition, Inc. This merger aimed to combine the strengths and resources of all three companies to create a more comprehensive and competitive entity in the online mapping and navigation industry. By integrating MapQuest. Com, Inc.'s expertise and technology with AOL and ME Acquisition, Inc.'s established online platforms and user base, the merger sought to enhance the overall user experience and expand the reach of the combined company's services. The Philadelphia Pennsylvania Agreement and Plan of Merger outlined the legal terms and conditions under which the merger was to take place. It covered various aspects of the merger, including but not limited to: 1. Transaction Details: The agreement specified the details of the merger, such as the number and type of shares to be exchanged between the parties involved, the valuation of MapQuest. Com, Inc.'s assets, and the overall structure of the combined company. 2. Governance and Management: The agreement detailed how the governance and management of the merged entity would be structured. It outlined the composition of the Board of Directors, the appointment of key executives, and their respective roles and responsibilities. 3. Integration of Operations: The agreement established the plan for integrating the operations of MapQuest. Com, Inc. into the existing infrastructure and systems of AOL and ME Acquisition, Inc. It addressed issues such as the integration of technologies, data migration, and the streamlining of business processes. 4. Employee Considerations: The agreement outlined the treatment of MapQuest. Com, Inc.'s employees, including their benefits, employment terms, and any necessary restructuring or redundancies resulting from the merger. 5. Regulatory Approvals: If applicable, the agreement addressed any regulatory approvals required for the merger to proceed, ensuring compliance with relevant laws and regulations. It is important to note that this description specifically refers to the Philadelphia Pennsylvania Agreement and Plan of Merger between AOL, ME Acquisition, Inc., and MapQuest. Com, Inc. There may be other agreements and plans of merger involving these companies in different jurisdictions or timeframes, but this description focuses solely on the Philadelphia Pennsylvania Agreement and Plan. To summarize, the Philadelphia Pennsylvania Agreement and Plan of Merger represents a legal agreement and strategic plan that facilitated the merger between AOL, ME Acquisition, Inc., and MapQuest. Com, Inc. The merger aimed to combine their respective strengths and assets to create a more robust and competitive online mapping and navigation company.

Philadelphia Pennsylvania Agreement and Plan of Merger between America Online, Inc., MQ Acquisition, Inc. and Mapquest.Com, Inc.

Description

How to fill out Philadelphia Pennsylvania Agreement And Plan Of Merger Between America Online, Inc., MQ Acquisition, Inc. And Mapquest.Com, Inc.?

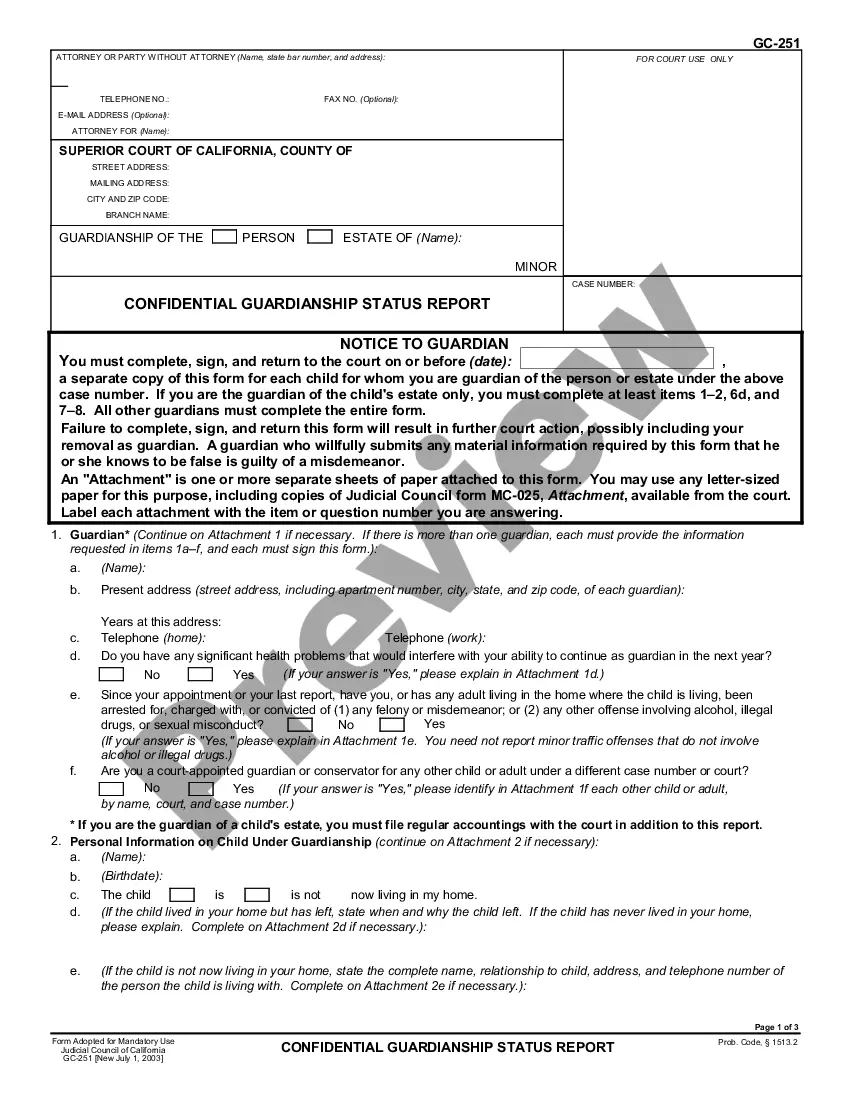

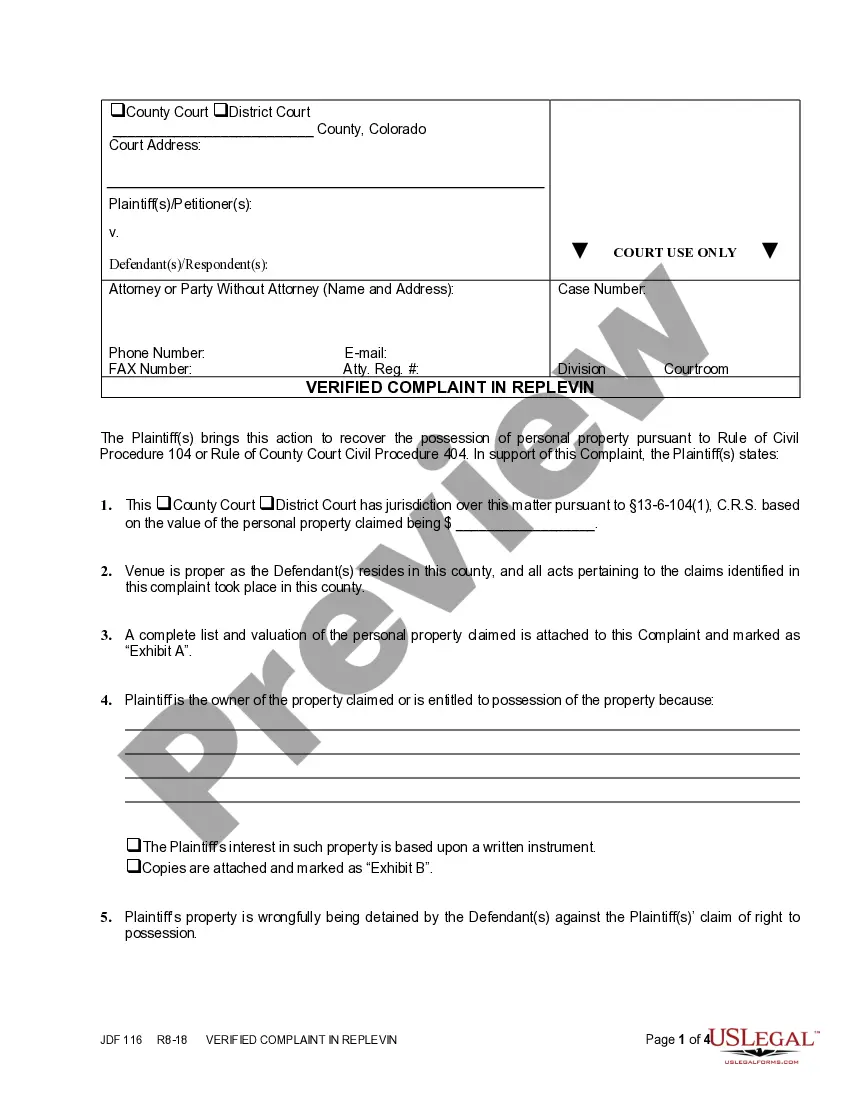

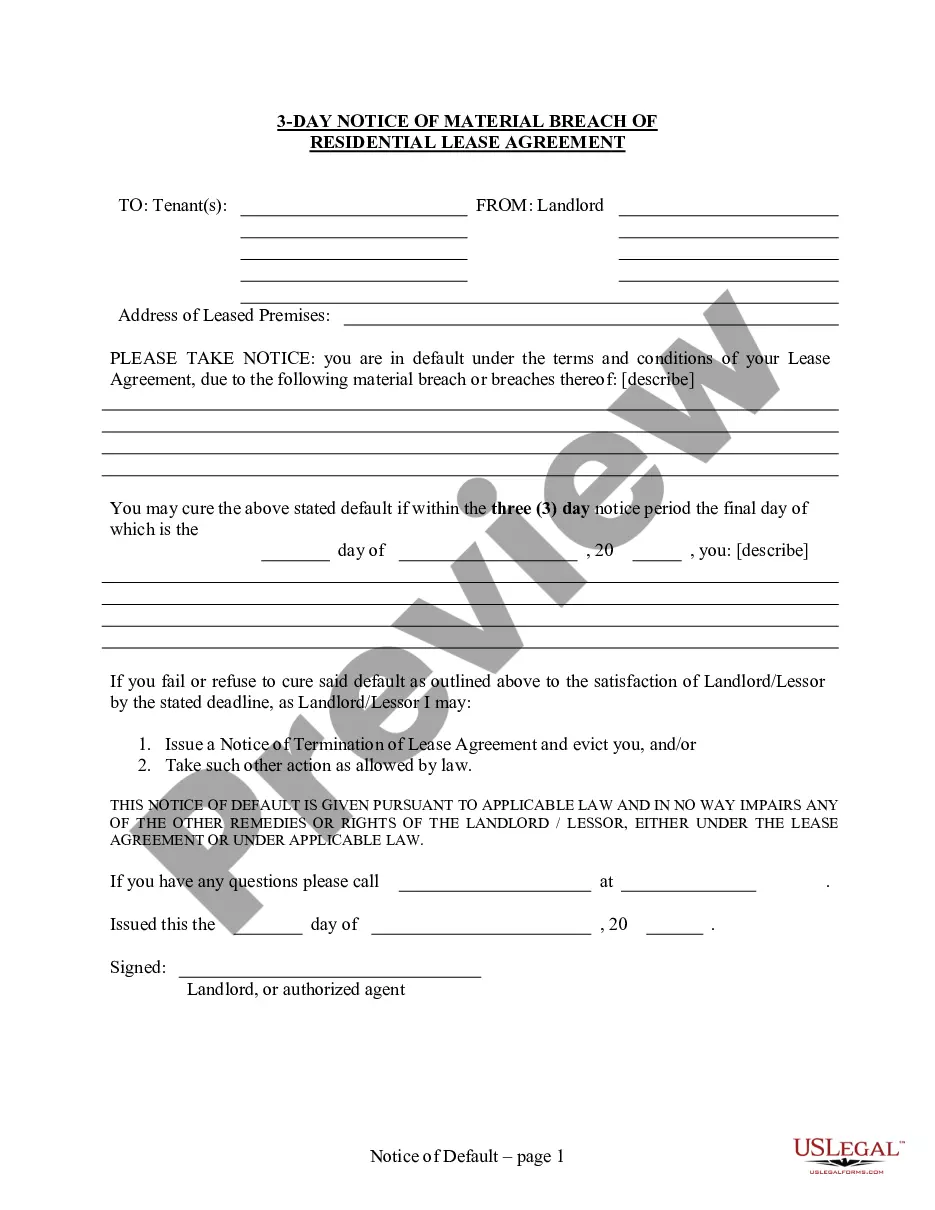

Creating paperwork, like Philadelphia Agreement and Plan of Merger between America Online, Inc., MQ Acquisition, Inc. and Mapquest.Com, Inc., to manage your legal matters is a tough and time-consumming process. A lot of situations require an attorney’s participation, which also makes this task not really affordable. Nevertheless, you can consider your legal affairs into your own hands and handle them yourself. US Legal Forms is here to the rescue. Our website features over 85,000 legal forms intended for a variety of cases and life circumstances. We ensure each form is compliant with the laws of each state, so you don’t have to be concerned about potential legal issues compliance-wise.

If you're already familiar with our website and have a subscription with US, you know how easy it is to get the Philadelphia Agreement and Plan of Merger between America Online, Inc., MQ Acquisition, Inc. and Mapquest.Com, Inc. template. Simply log in to your account, download the template, and personalize it to your needs. Have you lost your form? No worries. You can get it in the My Forms folder in your account - on desktop or mobile.

The onboarding flow of new users is fairly simple! Here’s what you need to do before getting Philadelphia Agreement and Plan of Merger between America Online, Inc., MQ Acquisition, Inc. and Mapquest.Com, Inc.:

- Ensure that your form is specific to your state/county since the rules for writing legal papers may vary from one state another.

- Find out more about the form by previewing it or going through a quick description. If the Philadelphia Agreement and Plan of Merger between America Online, Inc., MQ Acquisition, Inc. and Mapquest.Com, Inc. isn’t something you were looking for, then use the header to find another one.

- Sign in or create an account to begin using our service and get the document.

- Everything looks good on your side? Click the Buy now button and choose the subscription option.

- Select the payment gateway and type in your payment details.

- Your form is all set. You can go ahead and download it.

It’s an easy task to find and buy the needed template with US Legal Forms. Thousands of organizations and individuals are already benefiting from our extensive library. Sign up for it now if you want to check what other advantages you can get with US Legal Forms!