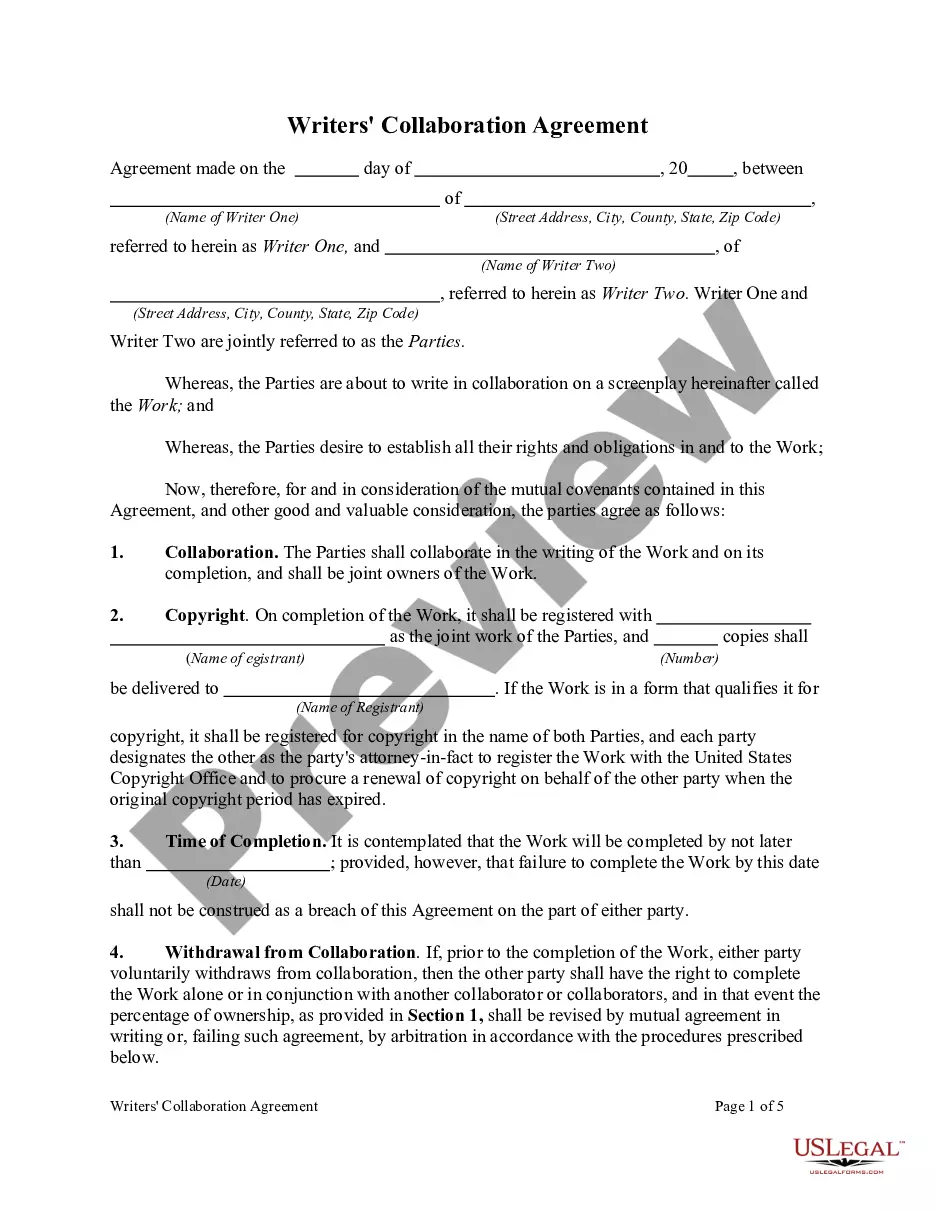

Santa Clara, California Joint Filing Agreement is a legal document used by couples who are married, in a domestic partnership, or who have registered as domestic partners in Santa Clara County, California, to jointly file their taxes. This agreement allows couples to combine their incomes, deductions, and other tax-related information into a single tax return. By filing jointly, couples can take advantage of certain tax benefits, such as lower tax rates, larger standard deductions, and eligibility for various tax credits and deductions. It also simplifies the tax-filing process, as only one tax return needs to be filed instead of two separate returns. There are a few different types of Santa Clara, California Joint Filing Agreements available, depending on the marital status or domestic partnership registration of the couple: 1. Married Couples: This agreement is used by couples who are legally married in accordance with California state laws and regulations. This includes couples who had a traditional marriage ceremony or those who entered into a valid marriage through common-law marriage. 2. Domestic Partnerships: Couples who have registered as domestic partners with the State of California may also utilize the Santa Clara, California Joint Filing Agreement. Domestic partnerships provide legal recognition and benefits similar to marriage. 3. Same-sex Couples: Following the legalization of same-sex marriage in California in 2013, Santa Clara County recognizes same-sex marriages and allows same-sex couples to file joint tax returns using the Joint Filing Agreement. When completing the Santa Clara, California Joint Filing Agreement, couples must carefully provide accurate information about their incomes, deductions, and other tax-related details. This includes reporting any sources of income, such as wages, self-employment earnings, investments, and rental income. Both partners must sign the agreement, indicating their consent to file jointly and their acknowledgement of the accuracy of the information provided. It is essential to review the agreement thoroughly and seek professional advice from tax experts or attorneys if there are any questions or concerns. In summary, the Santa Clara, California Joint Filing Agreement is a legal document that allows married couples and registered domestic partners in Santa Clara County to combine their tax information and file a joint tax return. It offers various benefits, simplifies the tax-filing process, and ensures compliance with tax laws and regulations specific to Santa Clara County.

Santa Clara California Joint Filing Agreement

Description

How to fill out Santa Clara California Joint Filing Agreement?

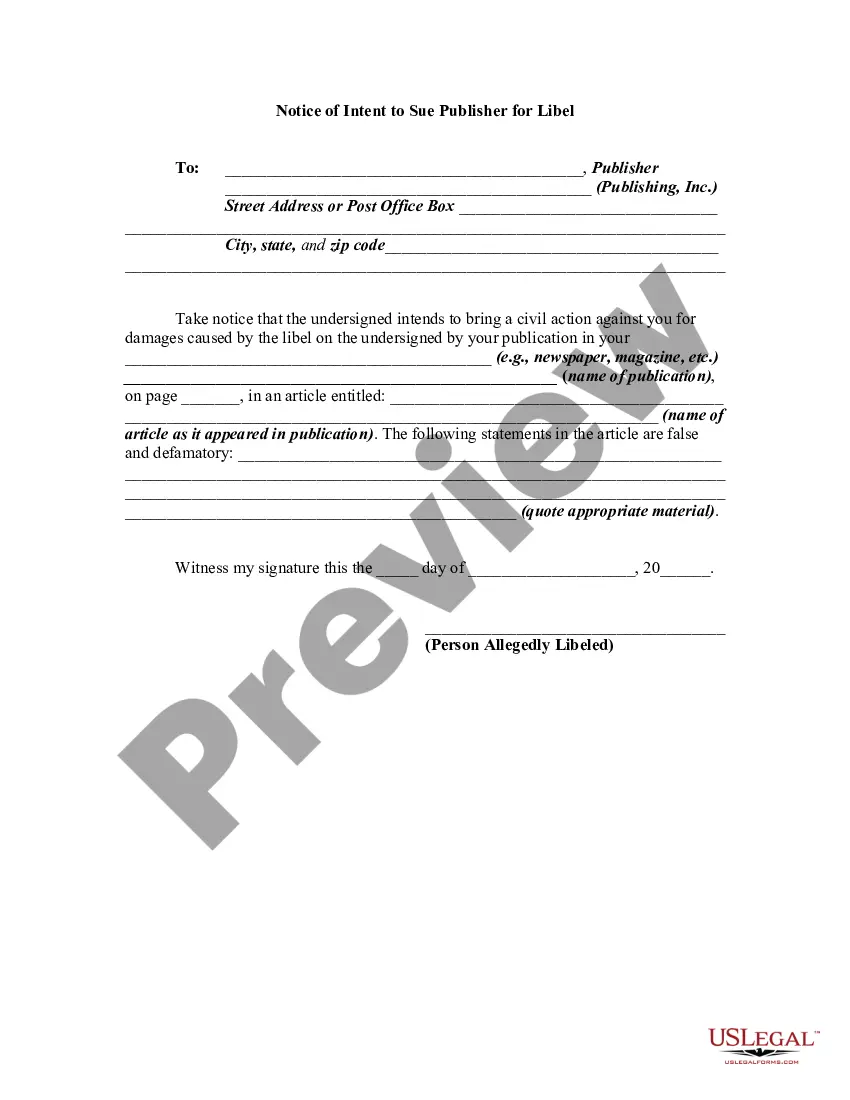

If you need to get a reliable legal paperwork supplier to find the Santa Clara Joint Filing Agreement, look no further than US Legal Forms. No matter if you need to launch your LLC business or take care of your asset distribution, we got you covered. You don't need to be well-versed in in law to find and download the appropriate template.

- You can browse from more than 85,000 forms categorized by state/county and situation.

- The intuitive interface, variety of learning resources, and dedicated support make it easy to locate and complete various paperwork.

- US Legal Forms is a trusted service providing legal forms to millions of customers since 1997.

You can simply select to look for or browse Santa Clara Joint Filing Agreement, either by a keyword or by the state/county the form is created for. After finding the required template, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's simple to get started! Simply locate the Santa Clara Joint Filing Agreement template and take a look at the form's preview and short introductory information (if available). If you're confident about the template’s terminology, go ahead and click Buy now. Create an account and select a subscription option. The template will be immediately ready for download once the payment is completed. Now you can complete the form.

Taking care of your legal matters doesn’t have to be pricey or time-consuming. US Legal Forms is here to prove it. Our extensive variety of legal forms makes these tasks less pricey and more reasonably priced. Create your first company, arrange your advance care planning, create a real estate agreement, or complete the Santa Clara Joint Filing Agreement - all from the convenience of your sofa.

Join US Legal Forms now!