Phoenix Arizona Underwriting Agreement of ABCs Mortgage Loan Trust 1999-4 is a legally binding contract between the ABCs Mortgage Loan Trust 1999-4 (the "Issuer") and Prudential Securities, Inc. (the "Underwriter"). This agreement outlines the terms and conditions under which the Underwriter will purchase and sell the mortgage-backed securities issued by the ABCs Mortgage Loan Trust 1999-4 in the Phoenix, Arizona area. Under this Underwriting Agreement, Prudential Securities, Inc. agrees to purchase a specified number of mortgage-backed securities from the Issuer at an agreed-upon price. The securities consist of a pool of mortgage loans originated by ABCs Mortgage Loan Trust 1999-4, which are backed by real estate properties located in the Phoenix, Arizona region. The Underwriter then assumes the responsibility of selling these securities to investors in the market. The purpose of this Underwriting Agreement is to facilitate the issuance and distribution of mortgage-backed securities in the Phoenix, Arizona market, allowing the ABCs Mortgage Loan Trust 1999-4 to raise capital through the sale of these securities. Prudential Securities, Inc. acts as the intermediary between the Issuer and the investors by purchasing the securities from the Issuer and subsequently offering them for sale, mitigating the risk for the Issuer. Various types of Phoenix Arizona Underwriting Agreements of ABCs Mortgage Loan Trust 1999-4 and Prudential Securities, Inc. may exist, depending on the specific terms and conditions agreed upon by the parties involved. These may include: 1. Firm Commitment Underwriting Agreement: In this type of underwriting agreement, Prudential Securities, Inc. commits to purchasing the entire offering of mortgage-backed securities from the ABCs Mortgage Loan Trust 1999-4 and assumes the risk if they cannot sell them in the market. 2. The Best Efforts Underwriting Agreement: With the best efforts' agreement, Prudential Securities, Inc. undertakes to use their best efforts to sell the mortgage-backed securities on behalf of the ABCs Mortgage Loan Trust 1999-4. However, they are not obligated to purchase any unsold securities themselves, so the risk and responsibility primarily lie with the Issuer. 3. Standby Underwriting Agreement: This type of agreement is typically used in situations where the ABCs Mortgage Loan Trust 1999-4 seeks to issue mortgage-backed securities as a secondary offering. Prudential Securities, Inc. commits to purchasing any unsubscribed securities that existing shareholders do not purchase, ensuring the desired level of funding is achieved. In conclusion, the Phoenix Arizona Underwriting Agreement of ABCs Mortgage Loan Trust 1999-4 and Prudential Securities, Inc. is a significant financial agreement that facilitates the issuance and distribution of mortgage-backed securities backed by real estate properties in Phoenix, Arizona. The use of different types of underwriting agreements allows for flexibility in terms of risk allocation and financial outcomes for both parties involved.

Phoenix Arizona Underwriting Agreement of ABFS Mortgage Loan Trust 1999-4 and Prudential Securities, Inc.

Description

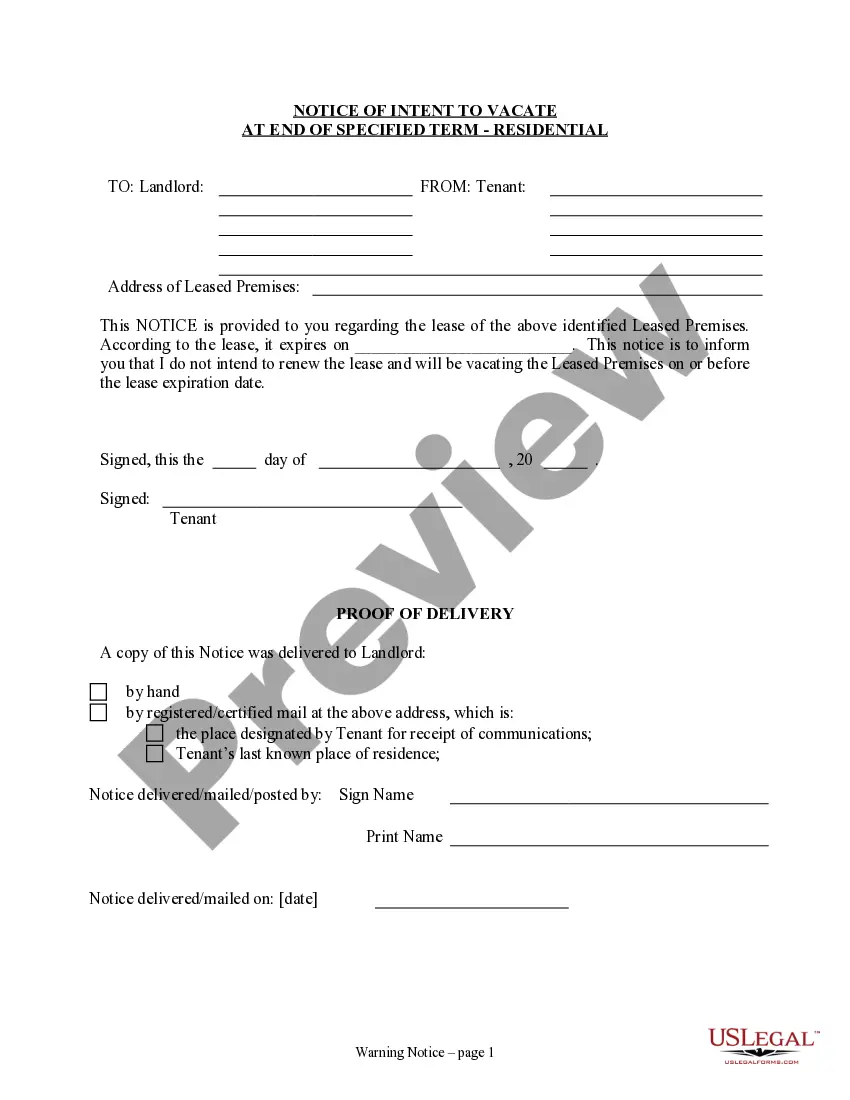

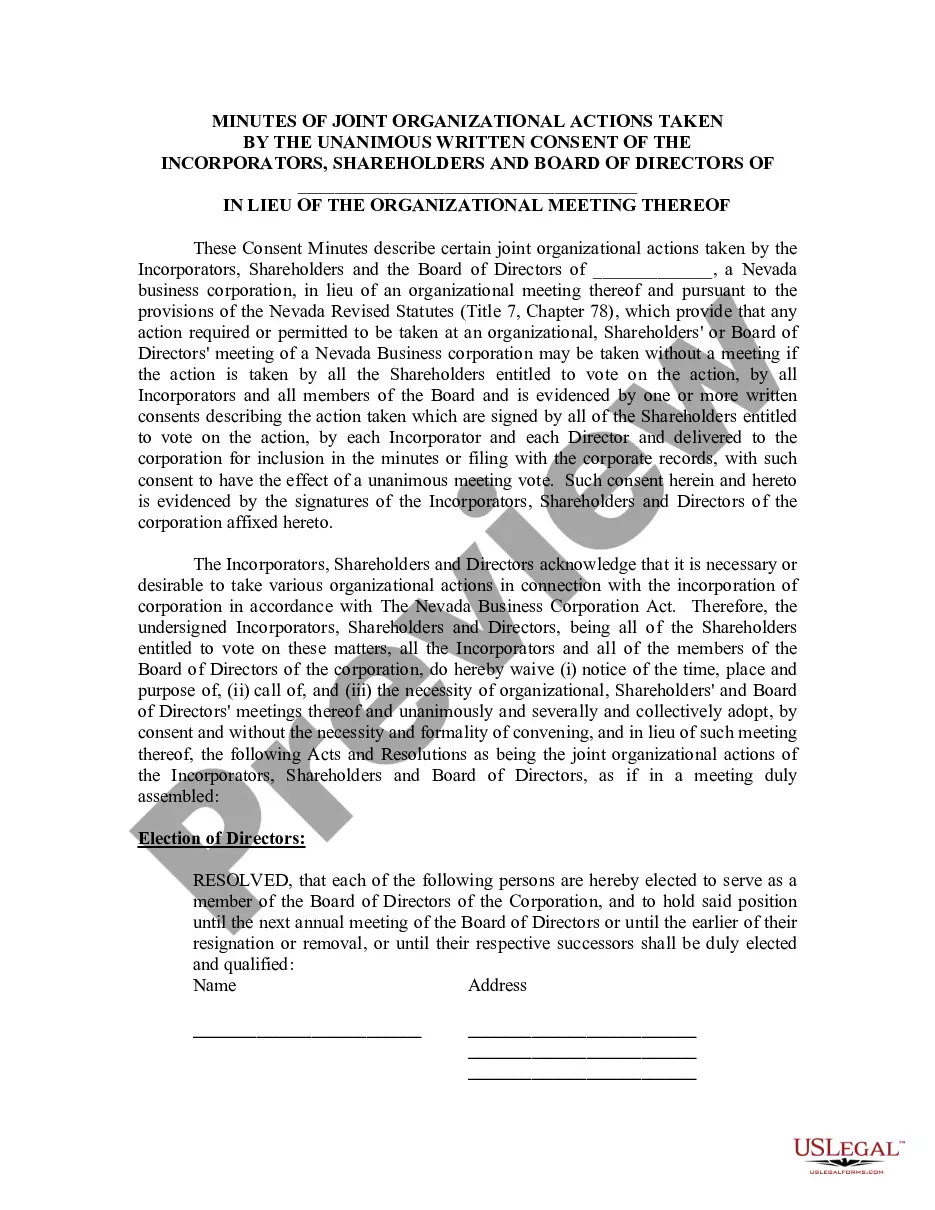

How to fill out Phoenix Arizona Underwriting Agreement Of ABFS Mortgage Loan Trust 1999-4 And Prudential Securities, Inc.?

If you need to get a trustworthy legal paperwork provider to find the Phoenix Underwriting Agreement of ABFS Mortgage Loan Trust 1999-4 and Prudential Securities, Inc., look no further than US Legal Forms. Whether you need to start your LLC business or manage your belongings distribution, we got you covered. You don't need to be well-versed in in law to locate and download the appropriate form.

- You can browse from more than 85,000 forms categorized by state/county and case.

- The self-explanatory interface, number of learning resources, and dedicated support make it simple to get and execute various paperwork.

- US Legal Forms is a trusted service offering legal forms to millions of users since 1997.

Simply type to look for or browse Phoenix Underwriting Agreement of ABFS Mortgage Loan Trust 1999-4 and Prudential Securities, Inc., either by a keyword or by the state/county the document is created for. After locating necessary form, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's effortless to start! Simply locate the Phoenix Underwriting Agreement of ABFS Mortgage Loan Trust 1999-4 and Prudential Securities, Inc. template and take a look at the form's preview and description (if available). If you're comfortable with the template’s terminology, go ahead and click Buy now. Create an account and select a subscription plan. The template will be instantly available for download as soon as the payment is processed. Now you can execute the form.

Taking care of your law-related affairs doesn’t have to be pricey or time-consuming. US Legal Forms is here to demonstrate it. Our extensive variety of legal forms makes this experience less expensive and more reasonably priced. Create your first company, arrange your advance care planning, create a real estate contract, or execute the Phoenix Underwriting Agreement of ABFS Mortgage Loan Trust 1999-4 and Prudential Securities, Inc. - all from the convenience of your home.

Sign up for US Legal Forms now!