An Alameda California Indemnification Agreement is a legally binding document that outlines the terms and conditions under which Financial Security Assurance, ABCs, and American Business Credit (hereinafter referred to as the "Parties") agree to indemnify each other against potential losses, damages, liabilities, and expenses arising from their business activities. This agreement serves as a crucial tool to protect the Parties from financial risks and legal consequences. It establishes a framework for determining the responsibilities of each Party and provides them with a sense of security and protection when entering into business transactions and partnerships. The Alameda California Indemnification Agreement among Financial Security Assurance, ABCs, and American Business Credit is designed to mitigate potential risks and uncertainties. It typically includes clauses related to the following: 1. Scope of Indemnification: This section outlines the circumstances and events under which indemnification will be provided. It may include indemnification for breach of contract, negligence, intellectual property disputes, or any other form of liability arising from the actions or omissions of the Parties. 2. Limitation of Liability: This clause sets a cap on the maximum amount of indemnification that can be claimed by each Party. It establishes a reasonable limit to prevent excessive financial burden on either Party and ensures that the agreement does not become financially unsustainable. 3. Notice and Defense: This section highlights the process by which the Parties should provide notice to each other in case of any potential claims or liabilities. It also outlines the requirements for the defense of claims, including the selection of legal counsel and procedures for allocating defense costs. 4. Cooperation and Mitigation: The Parties agree to cooperate fully and provide necessary assistance, information, and records to facilitate the defense of any claims. They also commit to taking reasonable steps to mitigate damages and prevent any further losses. 5. Insurance: The agreement may require the Parties to maintain appropriate insurance coverage to supplement the indemnification provisions. This ensures that adequate financial resources are available to cover potential liabilities in case of disputes or claims. Different types of Alameda California Indemnification Agreements among Financial Security Assurance, ABCs, and American Business Credit may include variations based on the specific nature of their business activities. These variations could pertain to industries such as finance, real estate, or technology, and may address industry-specific risks and liabilities. It is important to note that the content provided here is for informational purposes only and should not be considered legal advice. Parties involved should consult with legal professionals to tailor an indemnification agreement that suits their specific needs and complies with relevant legal requirements.

Alameda California Indemnification Agreement among Financial Security Assurance, ABFS and American Business Credit

Description

How to fill out Alameda California Indemnification Agreement Among Financial Security Assurance, ABFS And American Business Credit?

Laws and regulations in every sphere vary around the country. If you're not an attorney, it's easy to get lost in countless norms when it comes to drafting legal documentation. To avoid high priced legal assistance when preparing the Alameda Indemnification Agreement among Financial Security Assurance, ABFS and American Business Credit, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online catalog of more than 85,000 state-specific legal templates. It's an excellent solution for specialists and individuals searching for do-it-yourself templates for different life and business situations. All the forms can be used many times: once you purchase a sample, it remains available in your profile for subsequent use. Thus, if you have an account with a valid subscription, you can just log in and re-download the Alameda Indemnification Agreement among Financial Security Assurance, ABFS and American Business Credit from the My Forms tab.

For new users, it's necessary to make a couple of more steps to get the Alameda Indemnification Agreement among Financial Security Assurance, ABFS and American Business Credit:

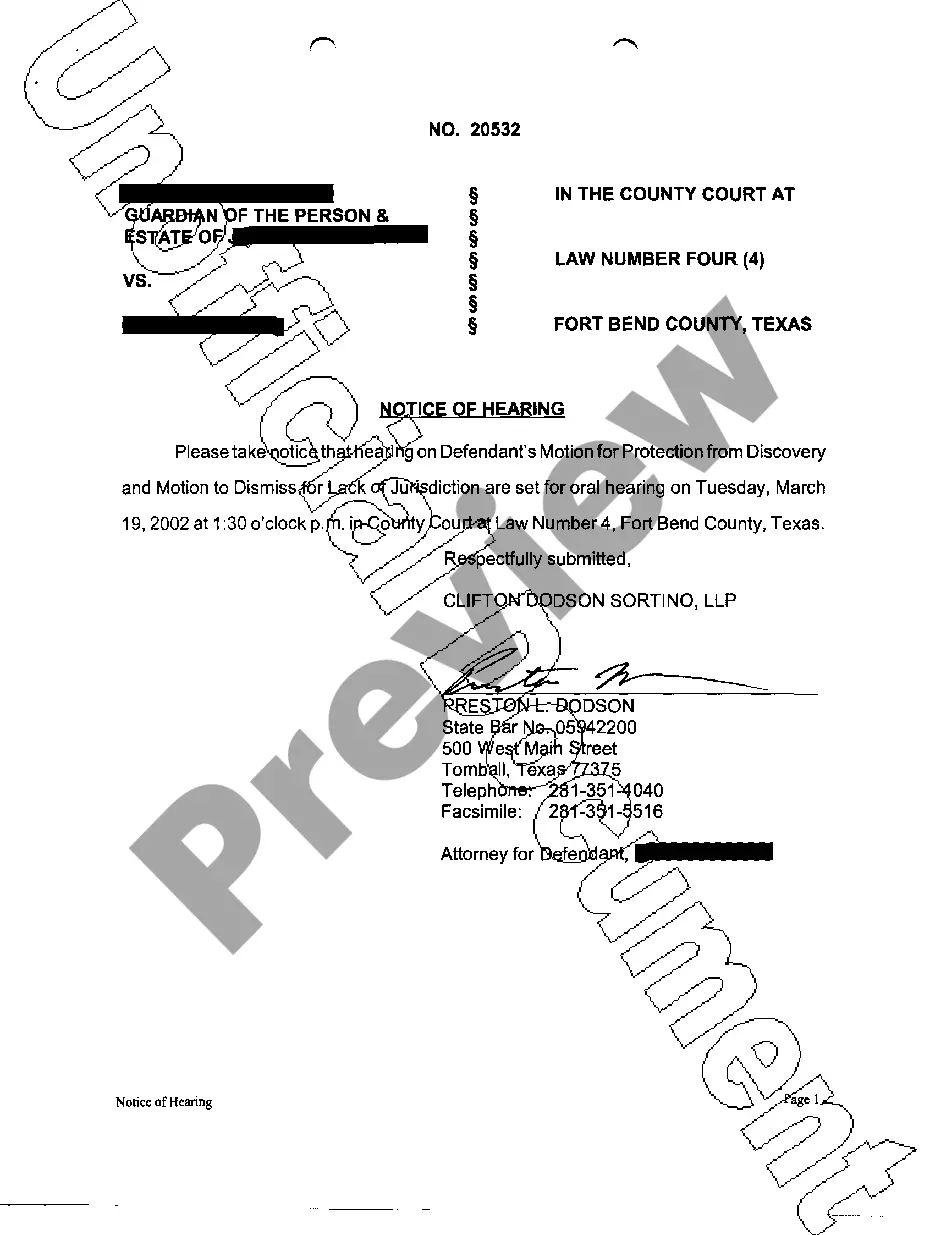

- Analyze the page content to make sure you found the appropriate sample.

- Use the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Use the Buy Now button to get the template once you find the correct one.

- Choose one of the subscription plans and log in or create an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Fill out and sign the template in writing after printing it or do it all electronically.

That's the easiest and most economical way to get up-to-date templates for any legal reasons. Find them all in clicks and keep your documentation in order with the US Legal Forms!

Form popularity

FAQ

The most common example of indemnity in the financial sense is an insurance contract. For instance, in the case of home insurance, homeowners pay insurance to an insurance company in return for the homeowners being indemnified if the worst were to happen.

An indemnity agreement is a contract that protects one party of a transaction from the risks or liabilities created by the other party of the transaction. Hold harmless agreement, no-fault agreement, release of liability, or waiver of liability are other terms for an indemnity agreement.?

Indemnification, also referred to as indemnity, is an undertaking by one party (the indemnifying party) to compensate the other party (the indemnified party) for certain costs and expenses, typically stemming from third-party claims.

Businesses that use these agreements include Real estate, Construction, Events management, Rental car companies, Pet kennels, Rental properties, and Surety bond companies. A party can take the help of business litigation lawyers where its business will stand to benefit from the indemnity agreements.

Modification: As opposed to indemnification and advancement rights created by the company's organizational documents, which may be amended by the board or shareholders, indemnification agreements allow the director or officer to prevent the company from unilaterally terminating or reducing the indemnitee's rights.

In a one-way indemnification, only one party provides this indemnity in favor of the other party. The primary benefit of an indemnification provision is to protect the indemnified party against losses from third party claims related to the contract.

An indemnity agreement is a contract that protects one party of a transaction from the risks or liabilities created by the other party of the transaction. Hold harmless agreement, no-fault agreement, release of liability, or waiver of liability are other terms for an indemnity agreement.?

Indemnity benefits are monetary payments you may be entitled to receive as compensation for lost wages or damages related to your workers' compensation claim.

The most common forms of indemnity agreements are broad form indemnity agreements, intermediate type indemnity agreements, and comparative form indemnity agreements. The usage of these agreements depends on the industry.

An indemnification clause may allow: The indemnified party to recover certain types of losses, such as attorney's fees, which are not typically recoverable under a common law cause of action. The indemnifying party to reduce its liability by incorporating: Liability cap.