Allegheny Pennsylvania Subsequent Pledge Agreement between ABFS Mortgage Loan Trust and The Bank of New York

Description

How to fill out Subsequent Pledge Agreement Between ABFS Mortgage Loan Trust And The Bank Of New York?

Managing legal documents is essential in the contemporary society. However, it is not always necessary to look for professional help to construct certain forms from scratch, such as the Allegheny Subsequent Pledge Agreement between ABFS Mortgage Loan Trust and The Bank of New York, especially with a resource like US Legal Forms.

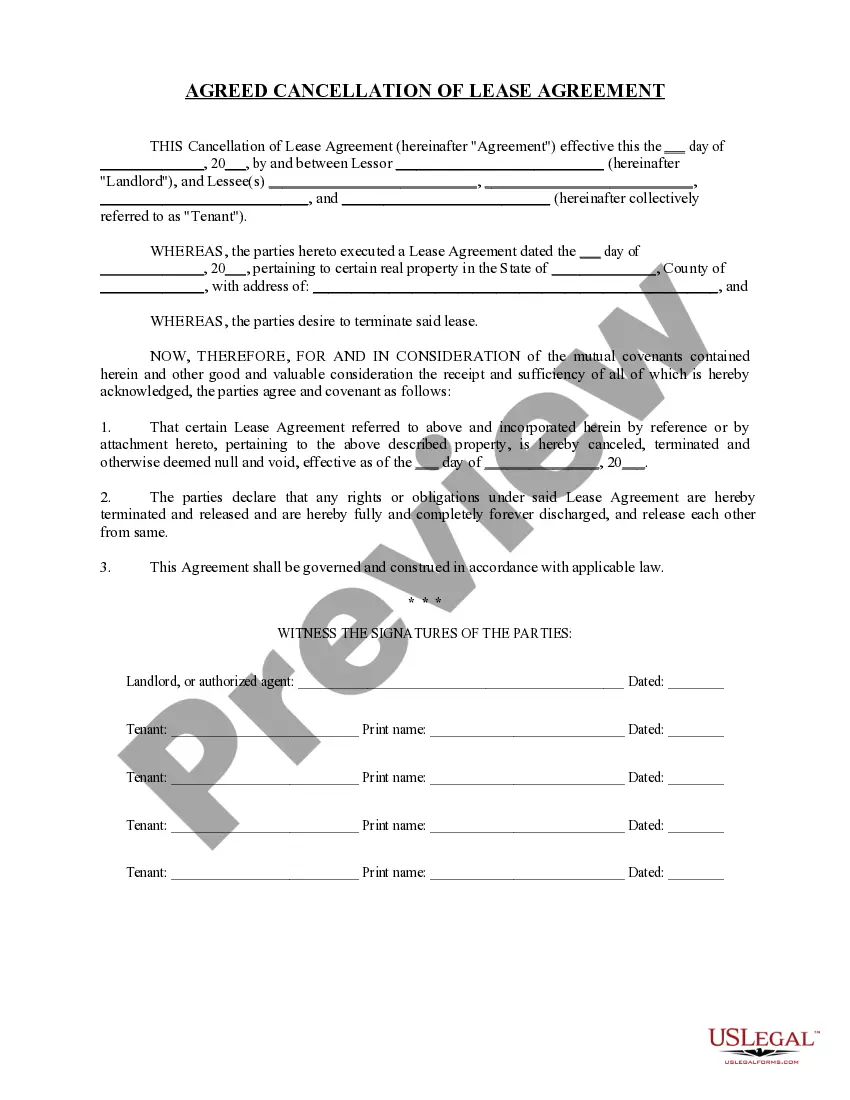

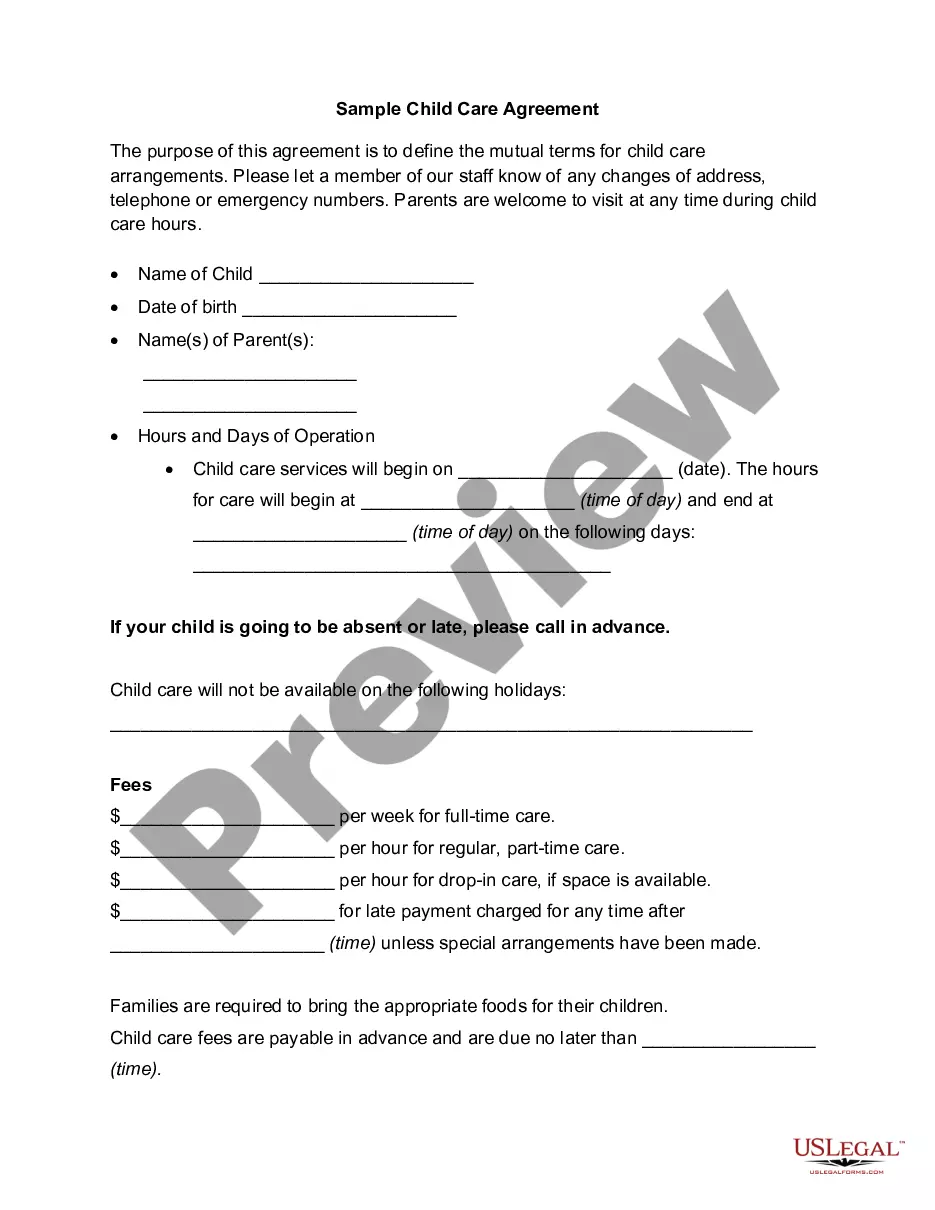

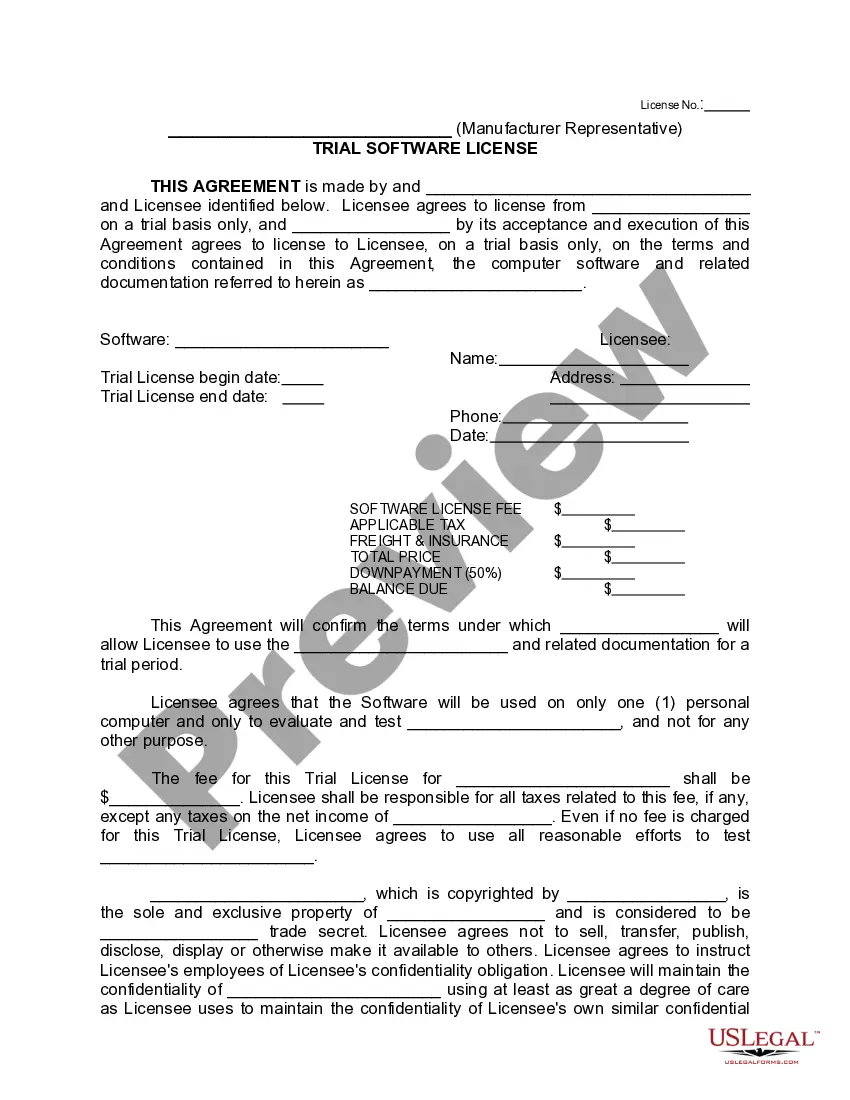

US Legal Forms offers over 85,000 documents to choose from across various categories, including living wills, real estate contracts, and divorce papers. All documents are classified according to their respective state, simplifying the search process.

You can easily locate and acquire the Allegheny Subsequent Pledge Agreement between ABFS Mortgage Loan Trust and The Bank of New York.

If you are already a subscriber to US Legal Forms, you can find the desired Allegheny Subsequent Pledge Agreement between ABFS Mortgage Loan Trust and The Bank of New York, Log In to your account, and download it. It is important to note that our platform cannot fully substitute for an attorney's guidance. For particularly complex cases, we recommend consulting a lawyer to review your form prior to finalizing and submitting it.

With more than 25 years in the industry, US Legal Forms has established itself as a reliable source for a wide range of legal documents for millions of users. Become a part of that community today and acquire your state-specific documents with ease!

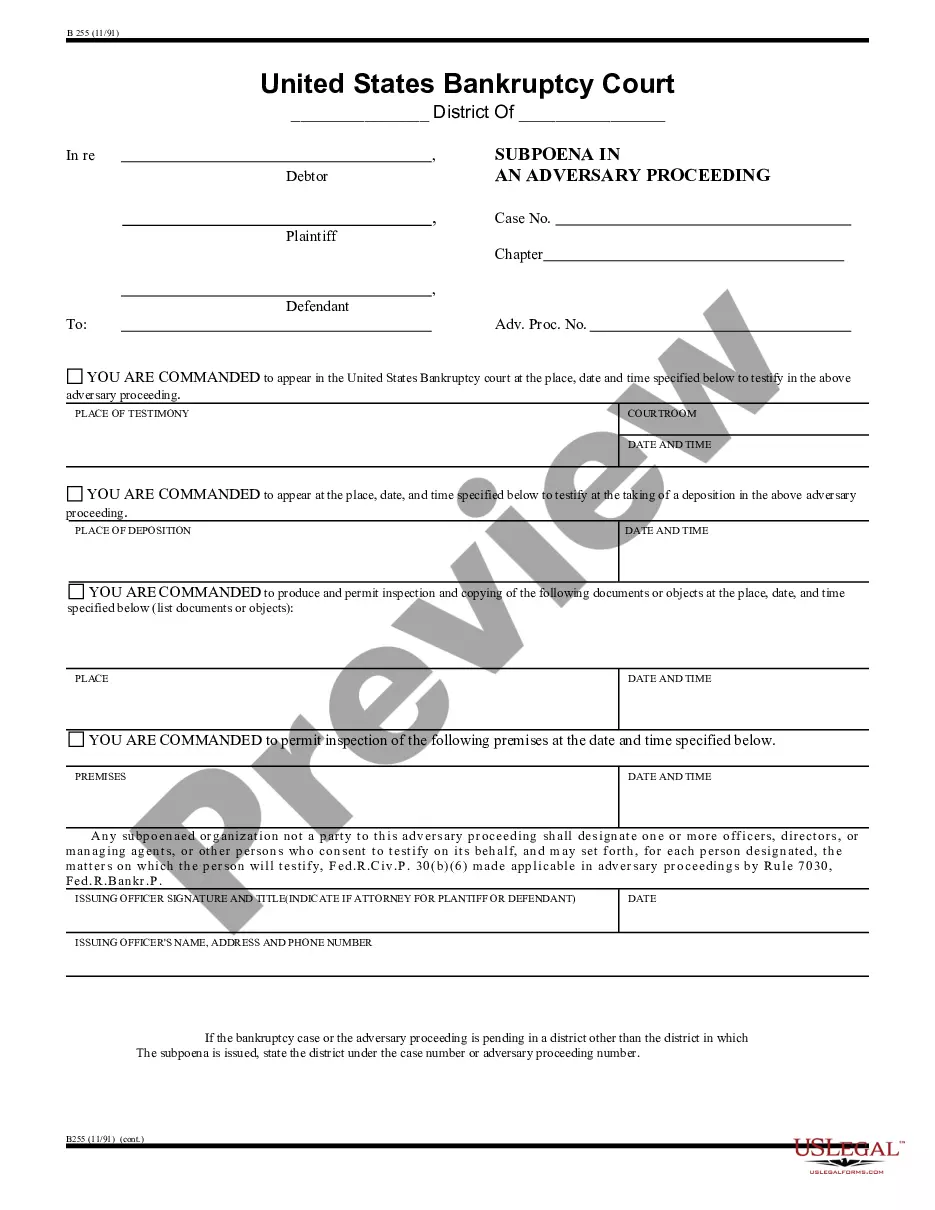

- Review the document's preview and outline (if accessible) to gain a preliminary understanding of what you will receive after obtaining the form.

- Make sure the document you select is tailored to your state/county/region, as local regulations can influence the validity of certain documents.

- Explore similar forms or restart your search to locate the correct document.

- Click Buy now and establish your account. If you already possess an account, choose to Log In.

- Select a pricing {plan, then a suitable payment method, and purchase the Allegheny Subsequent Pledge Agreement between ABFS Mortgage Loan Trust and The Bank of New York.

- Opt to save the form template in any available file format.

- Go to the My documents section to download the document again.

Form popularity

FAQ

An agreement typically used to create a security interest in equity interests (including capital stock, LLC interests, and partnership interests) and promissory notes.

Bank Account Pledge Agreement means the pledge agreement entered into between the Issuer and the Trustee on or about the First Issue Date in respect of a first priority pledge over the Bank Account and all funds held on the Bank Account from time to time, granted in favour of the Trustee and the Bondholders (

Under a security deed, the lender is automatically able to foreclose or sell the property when the borrower defaults. Foreclosing on a mortgage, on the other hand, involves additional paperwork and legal requirements, thus extending the process.

In general, the promissory note is your written promise to repay the loan and a security agreement is used when collateral is given for the loan.

A security agreement is a document that provides a lender a security interest in a specified asset or property that is pledged as collateral. Security agreements often contain covenants that outline provisions for the advancement of funds, a repayment schedule, or insurance requirements.

Under the UCC, a pledge agreement is a security agreement. The nature of the pledged assets means that a pledge agreement may contain different representations and warranties and covenants than a security agreement over business assets (for example, voting rights).

This is a standard form of pledge agreement to be used in connection with a syndicated loan agreement. It is intended to create a security interest over equity interests and promissory notes owned by the grantors. The grantors are usually the borrower, its parent and its subsidiaries.

More Definitions of Cash Pledge Agreement Cash Pledge Agreement means a pledge agreement in form and substance satisfactory to the Bank with respect to a Cash Collateral Account.

A pledge and security agreement is a legal document that outlines an arrangement in which one party (the pledgor) unconditionally transfers the title to a specific property or asset to another person or entity (the pledgee), who accepts it for safekeeping, usually in return for some form of compensation.

The Borrower and Lender agree that the payment and performance of all obligations relating to the Loan will be secured through the pledge to the Lender of all the issued and outstanding shares of capital stock owned or hereafter acquired by the Borrower (the Stock) in Thomasville National Bank, having its main office