Title: Understanding the Harris Texas Subsequent Pledge Agreement between ABCs Mortgage Loan Trust and The Bank of New York Introduction: The Harris Texas Subsequent Pledge Agreement is a legally binding contract between ABCs Mortgage Loan Trust (the "Trust") and The Bank of New York (the "Bank"). This agreement outlines the rights and obligations of both parties regarding the pledging and treatment of mortgage loan assets located within the Harris County, Texas region. Let's delve into the details and explore any potential variations of this agreement: 1. Purpose and Scope: The Harris Texas Subsequent Pledge Agreement establishes a framework for the Trust, acting as the pledge, to secure repayment of loans or debts through the pledge of mortgage assets situated in Harris County, Texas. The Bank, referred to as the pledge, agrees to transfer these mortgage assets to the Trust as a collateral arrangement. 2. Responsibilities and Obligations: Both the Trust and the Bank have specific responsibilities under this agreement. The Trust manages and services the mortgage loans, ensuring collection, maintenance, and distribution of payments. The Bank, on the other hand, is responsible for delivering the pledged assets to the Trust promptly and with proper documentation. 3. Transfer of Ownership: The agreement provides guidelines for the transfer of ownership from the Bank to the Trust. It details the requirements for the transfer of the mortgage loans, including the creation and perfection of a valid security interest in favor of the Trust and the accurate documentation of the transfer. 4. Security for Mortgage Loan Trust: The Bank pledges and grants a security interest in the mortgage assets to secure its financial obligations to the Trust. This provides the Trust with a legal claim to the assets in case of any default on the loan. 5. Loan Servicing Arrangements: The Harris Texas Subsequent Pledge Agreement may also outline terms regarding loan servicing. It delineates the obligations of the Trust regarding loan administration, collection, remittance, and any fee or compensation arrangements that may exist. 6. Variations of Harris Texas Subsequent Pledge Agreement: While specific variations under the Harris Texas Subsequent Pledge Agreement between ABCs Mortgage Loan Trust and The Bank of New York are not enumerated, it's possible that certain modifications could exist, depending on the purpose of the agreement, loan types, loan volume, and additional terms negotiated by both parties. These variations could include amendments addressing interest rates, loan-to-value ratios, maturity dates, or other specific conditions. Conclusion: The Harris Texas Subsequent Pledge Agreement between ABCs Mortgage Loan Trust and The Bank of New York is a vital document outlining the lateralization and treatment of mortgage assets in Harris County, Texas. This legally binding agreement ensures the Trust's security while establishing responsibilities and obligations for both parties involved. Although specific variations were not mentioned, it's important to consider the potential for tailored agreements based on specific loan characteristics or unique circumstances.

Harris Texas Subsequent Pledge Agreement between ABFS Mortgage Loan Trust and The Bank of New York

Description

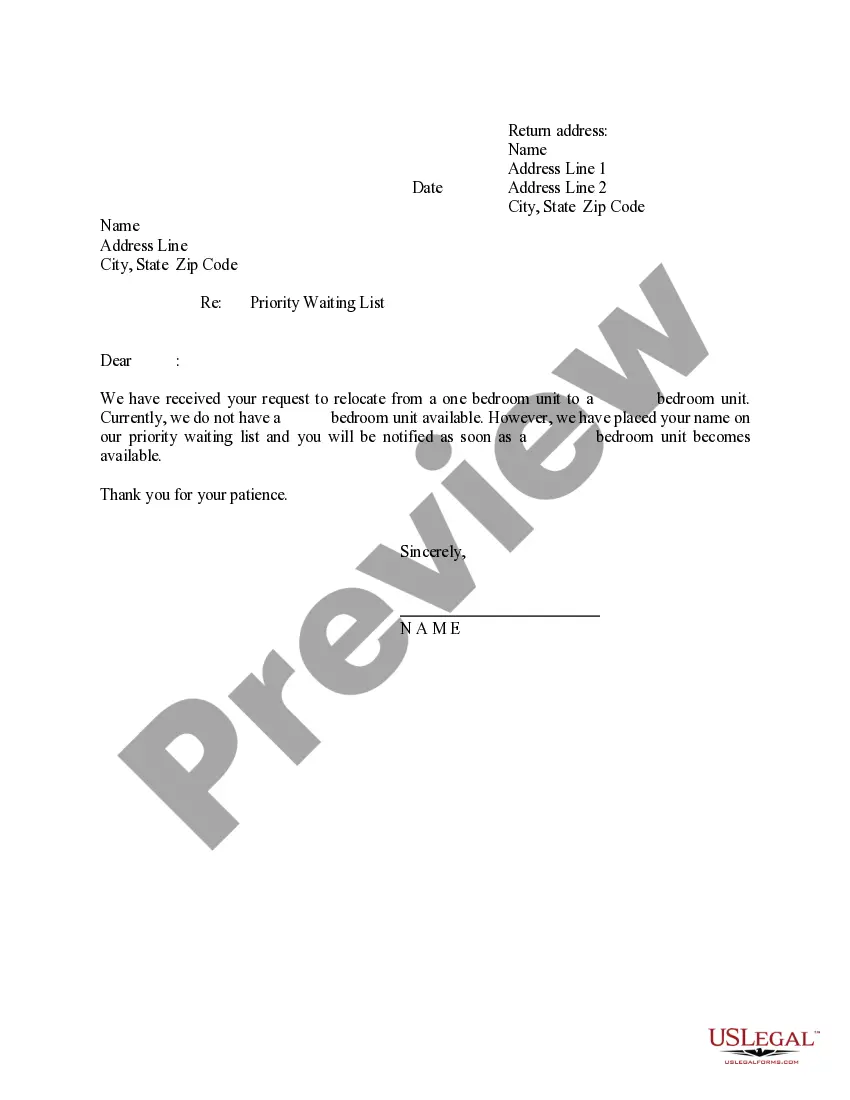

How to fill out Harris Texas Subsequent Pledge Agreement Between ABFS Mortgage Loan Trust And The Bank Of New York?

How much time does it usually take you to draw up a legal document? Because every state has its laws and regulations for every life sphere, locating a Harris Subsequent Pledge Agreement between ABFS Mortgage Loan Trust and The Bank of New York suiting all local requirements can be tiring, and ordering it from a professional attorney is often expensive. Many online services offer the most common state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive online collection of templates, grouped by states and areas of use. In addition to the Harris Subsequent Pledge Agreement between ABFS Mortgage Loan Trust and The Bank of New York, here you can get any specific document to run your business or personal deeds, complying with your county requirements. Specialists verify all samples for their actuality, so you can be sure to prepare your paperwork correctly.

Using the service is pretty straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the required form, and download it. You can retain the document in your profile at any time in the future. Otherwise, if you are new to the website, there will be some extra steps to complete before you get your Harris Subsequent Pledge Agreement between ABFS Mortgage Loan Trust and The Bank of New York:

- Check the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Search for another document utilizing the corresponding option in the header.

- Click Buy Now when you’re certain in the selected document.

- Decide on the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if needed.

- Click Download to save the Harris Subsequent Pledge Agreement between ABFS Mortgage Loan Trust and The Bank of New York.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased template, you can locate all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Try it out!

Form popularity

FAQ

Some examples of pledge are Gold /Jewellery Loans, Advance against goods,/stock, Advances against National Saving Certificates etc. (2) Hypothecation is used for creating charge against the security of movable assets, but here the possession of the security remains with the borrower itself.

Pledged Mortgage means a mortgage, deed of trust, security deed or other instrument securing a Mortgage Loan which creates a Lien on a Mortgaged Property.

A solemn promise or agreement to do or refrain from doing something: a pledge of aid; a pledge not to wage war. something delivered as security for the payment of a debt or fulfillment of a promise, and subject to forfeiture on failure to pay or fulfill the promise.

So, in short, mortgage is a term that is used for fixed assets like land, buildings, apartments etc. When you pledge your shares, they would still remain with you and you would be entitled to dividends etc. However, when you mortgage your apartment, the documents would remain with the lender.

A Pledge Loan means using money you have in savings or a CD as collateral for a loan. If you don't pay back the loan, the lender uses the money you pledged to pay back the loan. You will pay a slightly higher interest rate on the loan than you are earning on your savings.

So, in short, mortgage is a term that is used for fixed assets like land, buildings, apartments etc. When you pledge your shares, they would still remain with you and you would be entitled to dividends etc. However, when you mortgage your apartment, the documents would remain with the lender.

A pledge account, sometimes called a pledged asset, is an account that is transferred to a lender as collateral to secure a debt or loan. Borrowers may use a pledge account or a pledge asset to lower a down payment that may be required for a loan. Pledge accounts can also reduce interest on loan.

A pledged asset is a valuable possession that is transferred to a lender to secure a debt or loan. A pledged asset is collateral held by a lender in return for lending funds. Pledged assets can reduce the down payment that is typically required for a loan as well as reduces the interest rate charged.

Under the UCC, a pledge agreement is a security agreement. The nature of the pledged assets means that a pledge agreement may contain different representations and warranties and covenants than a security agreement over business assets (for example, voting rights).

Pledge is defined as to give something as security for a loan, promise, make an agreement, or accept a potential membership. An example of pledge is to give someone your iPod as a guarantee that you'll return their car by a certain time. An example of pledge is to promise to return a person's car by a certain time.