Oakland, Michigan is a county located in the state of Michigan, United States. It is part of the Detroit metropolitan area and covers an area of approximately 907 square miles. The county is home to a diverse population and offers a wide range of attractions and amenities for residents and visitors alike. Now let's shift our focus to the Subsequent Pledge Agreement between ABCs Mortgage Loan Trust and The Bank of New York. This agreement is a legal contract that establishes the terms and conditions under which ABCs Mortgage Loan Trust pledges certain assets to The Bank of New York as collateral for a loan or other financial transaction. The Subsequent Pledge Agreement between ABCs Mortgage Loan Trust and The Bank of New York serves to secure the loan and provide the lender with a guarantee that assets of value are available to cover any potential default. This agreement typically outlines the specific assets being pledged, their estimated value, and the conditions under which the lender may exercise its rights in the event of non-payment. The agreement may also include provisions for additional collateral, such as insurance or guarantees, to further protect the lender's interests. Additionally, it may specify the terms for releasing the pledged assets once the loan has been repaid in full or when certain conditions are met. There may be different types of Subsequent Pledge Agreements between ABCs Mortgage Loan Trust and The Bank of New York, depending on the specific circumstances and nature of the transaction. Variations may include agreements for different types of assets being pledged, such as real estate, securities, or other financial instruments. These different types of Subsequent Pledge Agreements may have variations in terms and conditions, valuation methods, and release criteria. It is essential for both parties involved to carefully review and negotiate the terms of the agreement to ensure that their respective interests are protected. In conclusion, Oakland, Michigan is a thriving county in Michigan, and the Subsequent Pledge Agreement between ABCs Mortgage Loan Trust and The Bank of New York is a legal contract that establishes the terms and conditions of pledging assets to secure a loan. The agreement's specifics may vary depending on the type of assets being pledged, and it is crucial for both parties to thoroughly understand and agree upon the terms outlined in the agreement.

Oakland Michigan Subsequent Pledge Agreement between ABFS Mortgage Loan Trust and The Bank of New York

Description

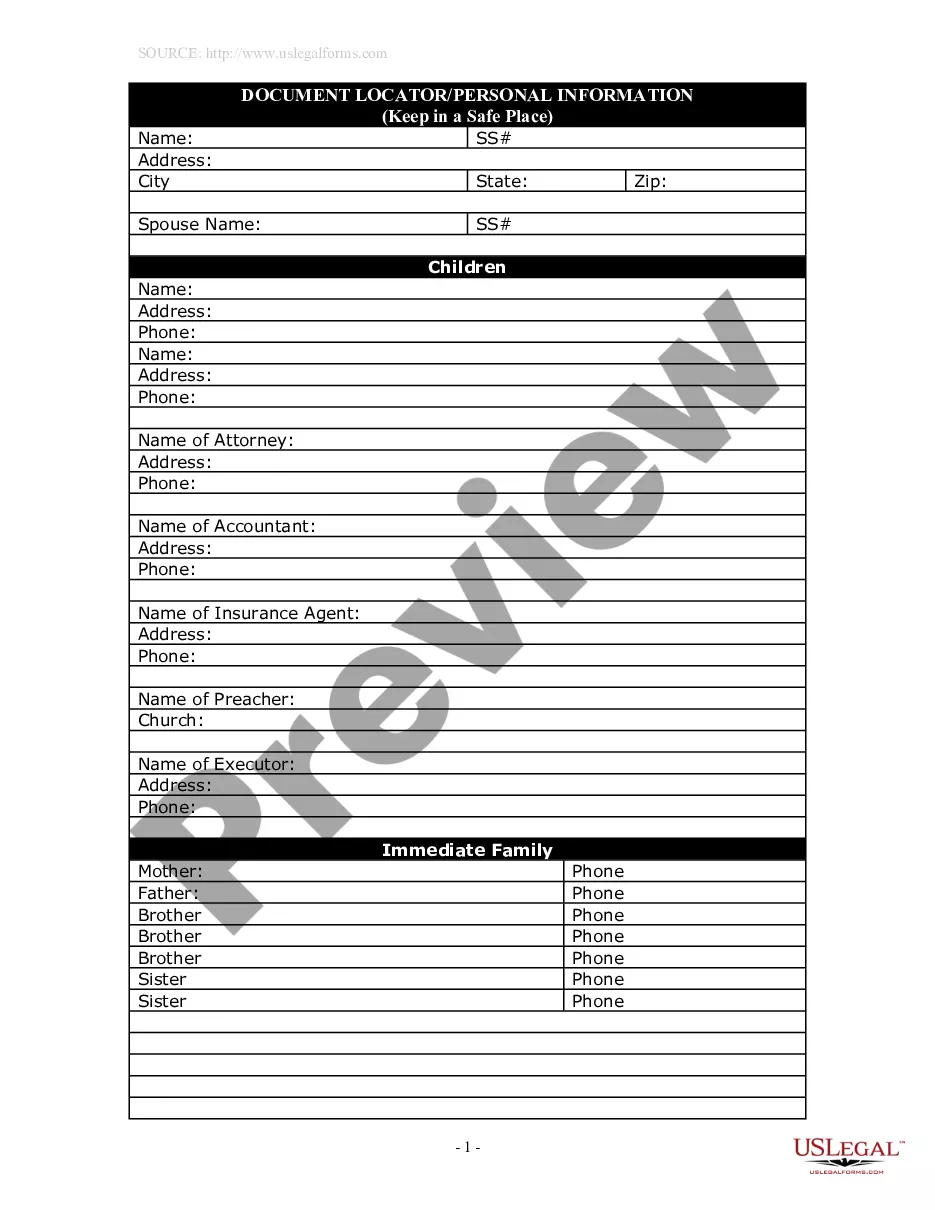

How to fill out Oakland Michigan Subsequent Pledge Agreement Between ABFS Mortgage Loan Trust And The Bank Of New York?

Preparing documents for the business or individual demands is always a big responsibility. When drawing up a contract, a public service request, or a power of attorney, it's important to consider all federal and state laws of the particular area. However, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it burdensome and time-consuming to create Oakland Subsequent Pledge Agreement between ABFS Mortgage Loan Trust and The Bank of New York without expert help.

It's possible to avoid spending money on attorneys drafting your paperwork and create a legally valid Oakland Subsequent Pledge Agreement between ABFS Mortgage Loan Trust and The Bank of New York by yourself, using the US Legal Forms web library. It is the largest online collection of state-specific legal templates that are professionally verified, so you can be certain of their validity when selecting a sample for your county. Previously subscribed users only need to log in to their accounts to save the necessary form.

In case you still don't have a subscription, adhere to the step-by-step guideline below to obtain the Oakland Subsequent Pledge Agreement between ABFS Mortgage Loan Trust and The Bank of New York:

- Examine the page you've opened and check if it has the sample you need.

- To accomplish this, use the form description and preview if these options are presented.

- To locate the one that fits your needs, utilize the search tab in the page header.

- Recheck that the template complies with juridical criteria and click Buy Now.

- Select the subscription plan, then log in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever obtained never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and easily obtain verified legal templates for any scenario with just a couple of clicks!

Form popularity

FAQ

A pledged asset is a valuable possession that is transferred to a lender to secure a debt or loan. A pledged asset is collateral held by a lender in return for lending funds. Pledged assets can reduce the down payment that is typically required for a loan as well as reduces the interest rate charged.

What does a pledge mean? In connection with a pledge, the debtor or another person gives his or her assets as collateral for a loan. If the loan is not repaid, the creditor may sell the assets given as collateral and use the sales proceeds to repay the loan.

A security agreement is a document that provides a lender a security interest in a specified asset or property that is pledged as collateral. Security agreements often contain covenants that outline provisions for the advancement of funds, a repayment schedule, or insurance requirements.

A pledged asset is a valuable possession that is transferred to a lender to secure a debt or loan. A pledged asset is collateral held by a lender in return for lending funds.

Pledge means bailment of goods as security against the loan. Hypothecation is creation of charge on movable property without delivering them to the lender. It is transfer of an interest in specific immovable property as security against loan. Type of Security / Property.

To pledge assets as collateral (or Pledging) is the act of offering assets as collateral to secure loans. Assets pledged can be in the form of security holdings and act as assurance for recovering the borrowed amount should a borrower fail to pay up.

WHAT IS PLEDGING OF SECURITIES? Pledging here refers to an activity in which the borrower (pledgor) of funds uses securities as a form of collateral to secure the funds it borrows or takes from the lender (Pledgee).

A stock pledge agreement is a legal contract used when a party wants to transfer stocks against a debt. In this agreement, when a debtor owes money to a lender, they pledge stocks against the amount of money owed as a form of security.

Under the UCC, a pledge agreement is a security agreement. The nature of the pledged assets means that a pledge agreement may contain different representations and warranties and covenants than a security agreement over business assets (for example, voting rights).

A pledged asset is collateral held by a lender in return for lending funds. Pledged assets can reduce the down payment that is typically required for a loan as well as reduces the interest rate charged. Pledged assets can include cash, stocks, bonds, and other equity or securities.