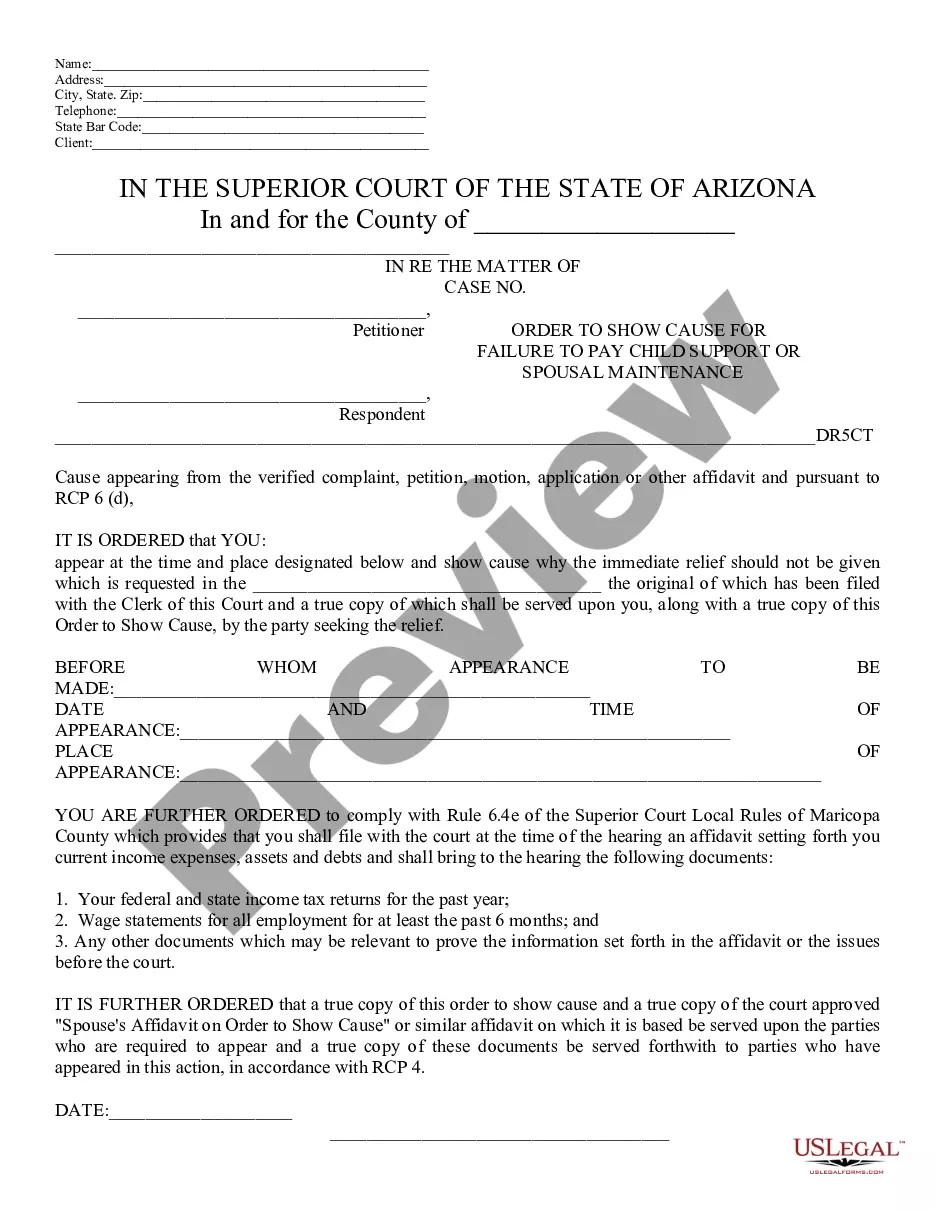

Nassau New York Subsequent Contribution Agreement is a legally binding document entered into by Prudential Securities Secured Financing Corporation (hereinafter referred to as "Prudential") and ABCs Mortgage Loan Trust (hereinafter referred to as "ABCs"). This agreement outlines the terms and conditions for subsequent contributions related to mortgage loans in Nassau County, New York. Keywords: Nassau New York, subsequent contribution agreement, Prudential Securities Secured Financing Corporation, ABCs Mortgage Loan Trust, mortgage loans. The primary purpose of this agreement is to facilitate the ongoing partnership between Prudential and ABCs in managing and financing mortgage loans originated in Nassau County, New York. The following are different types of Nassau New York Subsequent Contribution Agreements that can be established between the parties: 1. Standard Subsequent Contribution Agreement: This type of agreement takes place when Prudential agrees to contribute additional funds to ABCs for the acquisition of mortgage loans in Nassau County. Prudential's contributions are aimed at augmenting the liquidity required by ABCs to sustain and expand its mortgage loan portfolio. 2. Conditional Subsequent Contribution Agreement: This type of agreement sets conditions under which Prudential will make subsequent contributions. These conditions may include meeting specific performance targets or loan quality benchmarks set by Prudential. ABCs must fulfill these conditions to qualify for additional funding. 3. Incremental Subsequent Contribution Agreement: This agreement permits Prudential to incrementally contribute funds to ABCs based on the performance of existing mortgage loans in Nassau County. Prudential may choose to provide additional financing as a result of positive loan performance, thereby encouraging ABCs to maintain high loan quality standards and minimize defaults. 4. Emergency Subsequent Contribution Agreement: In critical situations where ABCs faces unexpected financial hardship or liquidity constraints, an emergency subsequent contribution agreement can be established. This type of agreement allows Prudential to provide immediate financial assistance to ABCs to ensure uninterrupted mortgage loan operations. Regardless of the type of subsequent contribution agreement, each agreement will include vital clauses and provisions such as: a. Funding terms: Clear guidelines regarding the amount, frequency, and timeline of subsequent contributions from Prudential to ABCs. b. Loan criteria: Explicitly defined criteria specifying the acceptable mortgage loans eligible for subsequent contributions, including borrower qualifications, loan-to-value ratios, and property types. c. Confidentiality and compliance: Measures ensuring the confidentiality of sensitive borrower and loan information, as well as adherence to applicable laws and regulations. d. Indemnification: Mutual indemnification clauses protecting each party from potential claims arising from actions or omissions related to subsequent contributions and mortgage loan operations. e. Term and termination: The agreed-upon term of the agreement and provisions for termination by either party in case of breach, non-compliance, or mutual agreement. In conclusion, a Nassau New York Subsequent Contribution Agreement between Prudential Securities Secured Financing Corporation and ABCs Mortgage Loan Trust serves as a pivotal document in facilitating their ongoing collaboration in managing and financing mortgage loans in Nassau County, New York.

Nassau New York Subsequent Contribution Agreement between Prudential Securities Secured Financing Corporation and ABFS Mortgage Loan Trust

Description

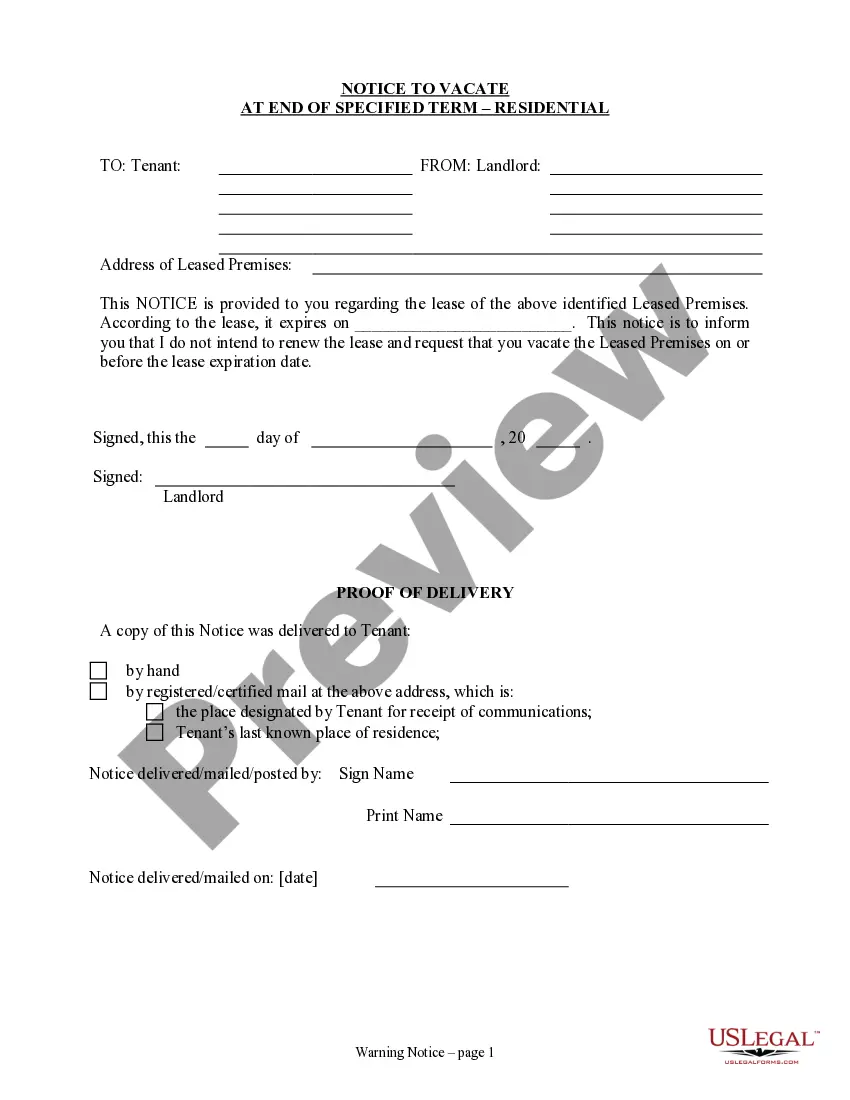

How to fill out Nassau New York Subsequent Contribution Agreement Between Prudential Securities Secured Financing Corporation And ABFS Mortgage Loan Trust?

Creating legal forms is a must in today's world. However, you don't always need to look for qualified assistance to create some of them from scratch, including Nassau Subsequent Contribution Agreement between Prudential Securities Secured Financing Corporation and ABFS Mortgage Loan Trust, with a platform like US Legal Forms.

US Legal Forms has over 85,000 forms to pick from in different types varying from living wills to real estate paperwork to divorce papers. All forms are arranged according to their valid state, making the searching process less frustrating. You can also find detailed resources and tutorials on the website to make any tasks related to paperwork execution straightforward.

Here's how you can locate and download Nassau Subsequent Contribution Agreement between Prudential Securities Secured Financing Corporation and ABFS Mortgage Loan Trust.

- Go over the document's preview and outline (if provided) to get a basic idea of what you’ll get after downloading the form.

- Ensure that the template of your choosing is specific to your state/county/area since state laws can affect the legality of some records.

- Examine the related forms or start the search over to find the correct document.

- Click Buy now and register your account. If you already have an existing one, choose to log in.

- Choose the option, then a suitable payment gateway, and buy Nassau Subsequent Contribution Agreement between Prudential Securities Secured Financing Corporation and ABFS Mortgage Loan Trust.

- Choose to save the form template in any offered file format.

- Visit the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can find the appropriate Nassau Subsequent Contribution Agreement between Prudential Securities Secured Financing Corporation and ABFS Mortgage Loan Trust, log in to your account, and download it. Of course, our website can’t replace a lawyer entirely. If you need to cope with an extremely difficult case, we recommend getting an attorney to review your form before signing and filing it.

With over 25 years on the market, US Legal Forms proved to be a go-to provider for many different legal forms for millions of customers. Join them today and purchase your state-specific paperwork with ease!

Form popularity

FAQ

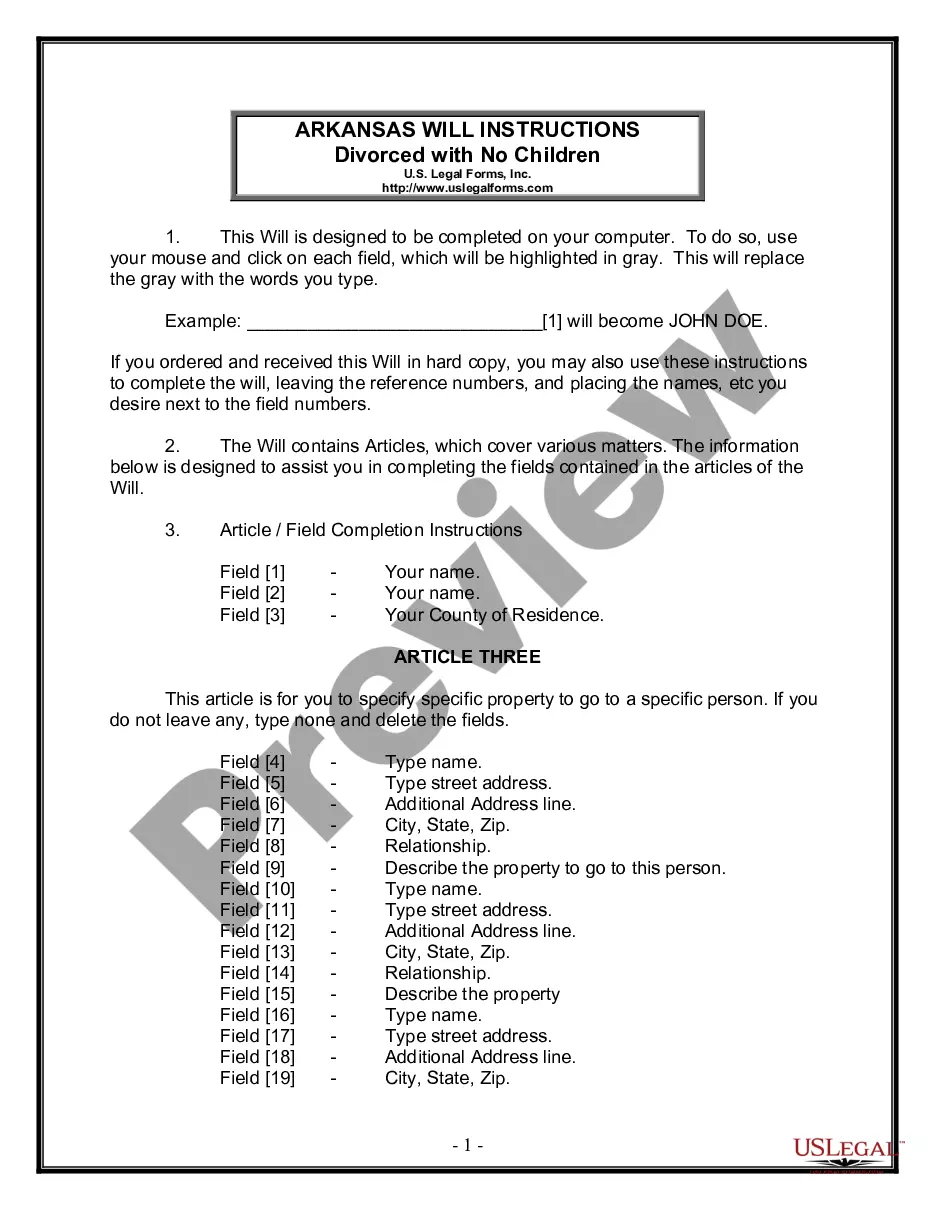

By Practical Law Real Estate. Maintained 2022 USA (National/Federal) A form agreement favoring the investor member for the contribution of vacant land intended for development to a newly-formed joint venture (JV) between two parties, a developer and an investor.

Equity contribution is the financial commitment, always calculated in terms of the percentage of the money to be lent out, is the money which a lending institution, a mortgage bank, that is, demands from somebody seeking loan to enable him buy, build or renovate a residential building.

A contribution agreement, also known as a deed of contribution, is a legal document that provides for the transfer of an asset from one party to another party. It will express the conditions required including liability, indemnities and more.

A capital contribution agreement is a contract between two or more parties that outlines the conditions of an investment made by one party into another. This legal document outlines how the funds will be used and who will benefit from it and what happens if any obligations are not met.

What Is an Equity Contribution Agreement? An equity contribution agreement occurs between two parties that are agreeing to pool together cash, capital, and other assets into a company to conduct business. The capital is provided in exchange for a portion of the equity in the company venture.

Thoroughly describe the assets or materials being contributed, which could be a wide range of items, including money, stocks or shares in a company, real estate property or even computer software or code. The agreement should also specify the nature of the contribution, such as a gift, investment or exchange.

A contribution agreement, also known as a deed of contribution, is a legal document that provides for the transfer of an asset from one party to another party. It will express the conditions required including liability, indemnities and more.

The JGF strives to help Canadian businesses grow their organizations and recover from the COVID pandemic. A contribution agreement is a legal document that will lay out the conditions surrounding the transfer of an asset from one party to another.

A contribution agreement, also known as a deed of contribution, is a legal document that provides for the transfer of an asset from one party to another party. It will express the conditions required including liability, indemnities and more.

A contribution agreement is a legal document that will lay out the conditions surrounding the transfer of an asset from one party to another.