A San Diego California Subsequent Contribution Agreement is a legally binding document that outlines the terms and conditions under which Prudential Securities Secured Financing Corporation and ABCs Mortgage Loan Trust agree to make subsequent contributions to a specified loan agreement. This agreement serves as an addendum to the original loan agreement and ensures that both parties are aware of their obligations and responsibilities regarding any additional contributions that may be required in the future. Keywords: San Diego California, subsequent contribution agreement, Prudential Securities Secured Financing Corporation, ABCs Mortgage Loan Trust. There are two types of San Diego California Subsequent Contribution Agreements between Prudential Securities Secured Financing Corporation and ABCs Mortgage Loan Trust: 1. Subsequent Cash Contribution Agreement: This type of agreement specifies the conditions and terms under which Prudential Securities Secured Financing Corporation agrees to contribute additional cash funds to the mortgage loan trust established by ABCs. This contribution may be necessary to cover any additional expenses or to satisfy the financial requirements of the loan agreement. 2. Subsequent Asset Contribution Agreement: In this type of agreement, Prudential Securities Secured Financing Corporation agrees to transfer or contribute additional assets to the mortgage loan trust. These assets may include real estate properties, securities, or any other valuable assets that can be used to support the loan agreement. Both types of agreements are designed to ensure that the financial needs of the mortgage loan trust are adequately met and that all parties involved are fulfilling their obligations as outlined in the original loan agreement. By entering into a San Diego California Subsequent Contribution Agreement, Prudential Securities Secured Financing Corporation and ABCs Mortgage Loan Trust demonstrate their commitment to maintaining a strong and sustainable financial relationship that benefits all parties involved. The agreement provides a clear framework for subsequent contributions, ensuring transparency and accountability in the management of the loan agreement. It is crucial for both parties to carefully review and understand the terms and conditions of the agreement before signing to avoid any misunderstanding or potential disputes in the future. Seek legal advice if necessary to ensure complete comprehension and compliance with all legal requirements. Overall, a San Diego California Subsequent Contribution Agreement between Prudential Securities Secured Financing Corporation and ABCs Mortgage Loan Trust establishes a solid framework for subsequent financial contributions, ensuring the smooth operation and ongoing success of the mortgage loan trust.

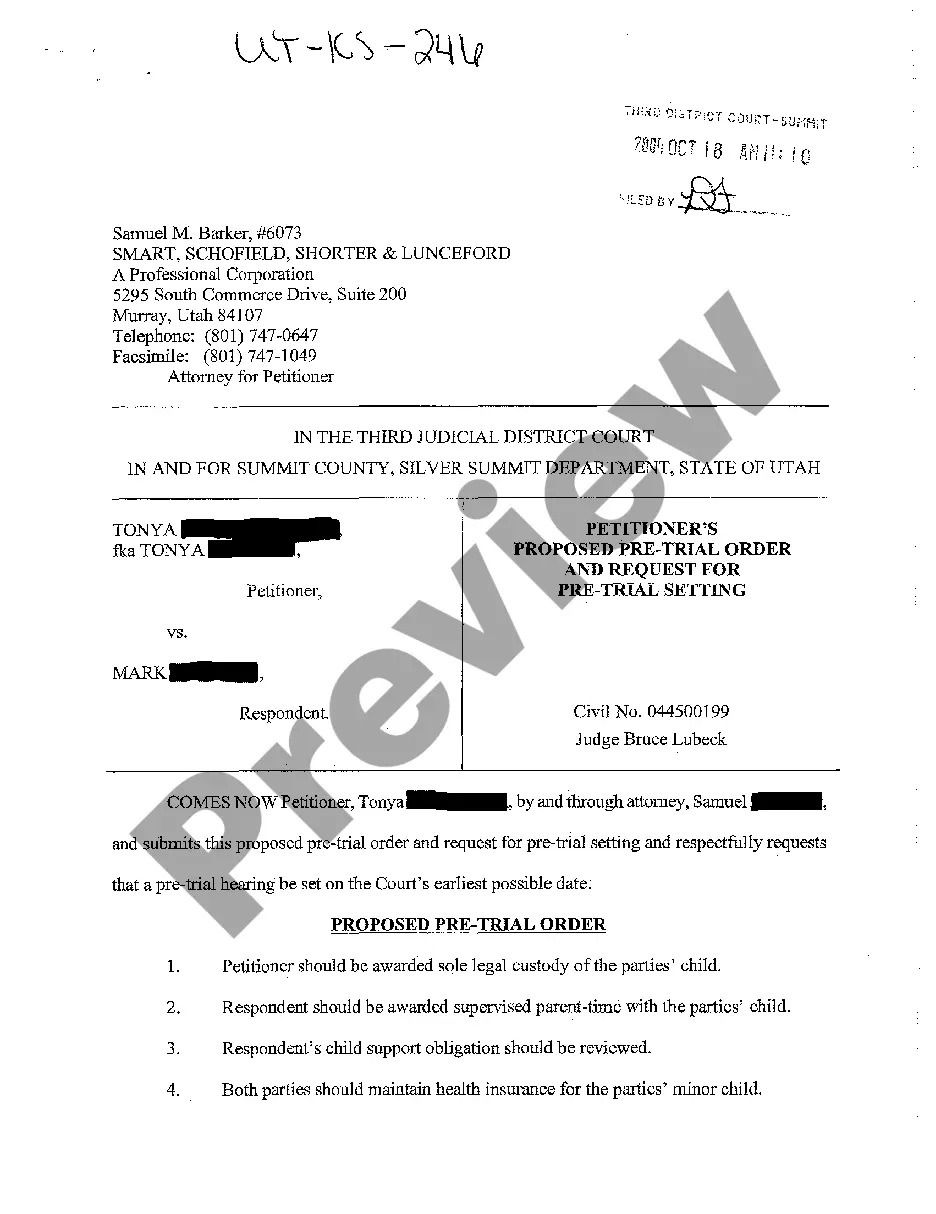

San Diego California Subsequent Contribution Agreement between Prudential Securities Secured Financing Corporation and ABFS Mortgage Loan Trust

Description

How to fill out San Diego California Subsequent Contribution Agreement Between Prudential Securities Secured Financing Corporation And ABFS Mortgage Loan Trust?

How much time does it normally take you to create a legal document? Considering that every state has its laws and regulations for every life situation, locating a San Diego Subsequent Contribution Agreement between Prudential Securities Secured Financing Corporation and ABFS Mortgage Loan Trust suiting all local requirements can be stressful, and ordering it from a professional lawyer is often expensive. Numerous online services offer the most popular state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive online catalog of templates, gathered by states and areas of use. In addition to the San Diego Subsequent Contribution Agreement between Prudential Securities Secured Financing Corporation and ABFS Mortgage Loan Trust, here you can find any specific form to run your business or personal deeds, complying with your county requirements. Professionals check all samples for their actuality, so you can be sure to prepare your documentation properly.

Using the service is pretty straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the required sample, and download it. You can get the document in your profile at any time later on. Otherwise, if you are new to the platform, there will be a few more actions to complete before you obtain your San Diego Subsequent Contribution Agreement between Prudential Securities Secured Financing Corporation and ABFS Mortgage Loan Trust:

- Examine the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another form using the corresponding option in the header.

- Click Buy Now once you’re certain in the chosen document.

- Select the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the San Diego Subsequent Contribution Agreement between Prudential Securities Secured Financing Corporation and ABFS Mortgage Loan Trust.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased document, you can find all the samples you’ve ever saved in your profile by opening the My Forms tab. Give it a try!