The Harris Texas Investment Advisory Agreement between BNY Hamilton Large Growth CRT Fund and The Bank of New York is a comprehensive document that outlines the terms and conditions of the advisory services provided to the fund by the bank. This agreement is essential for ensuring a clear understanding between both parties and establishing a framework for the investment advisory relationship. The primary objective of this agreement is to outline the roles, responsibilities, and obligations of both BNY Hamilton Large Growth CRT Fund and The Bank of New York. The bank, as the investment advisor, is responsible for providing professional and knowledgeable advice regarding the management and investment of the fund's assets. The fund, on the other hand, agrees to follow the investment guidelines and directions provided by the bank. This agreement defines the services to be provided by The Bank of New York, which may include portfolio management, investment research, risk assessment, and performance reporting. The specific terms and conditions of these services, such as fees, compensation, and reporting frequency, are also detailed within the agreement. Furthermore, the Harris Texas Investment Advisory Agreement addresses important aspects such as the scope of authority granted to the bank, any limitations on investment strategies, and the standards of care and fiduciary duty expected from the bank. It also covers provisions related to confidentiality, compliance with applicable laws and regulations, and dispute resolution. There may be different types or variations of the Harris Texas Investment Advisory Agreement between BNY Hamilton Large Growth CRT Fund and The Bank of New York, which can be tailored to meet specific requirements or preferences of the fund. These variations may include agreements with different fee structures, performance benchmarks, or additional provisions based on the nature of the fund and the investment objectives. In conclusion, the Harris Texas Investment Advisory Agreement is a crucial document that establishes the framework for the investment advisory relationship between BNY Hamilton Large Growth CRT Fund and The Bank of New York. It ensures transparency, clarity, and accountability in the investment management process, benefiting both the fund and the bank.

Harris Texas Investment Advisory Agreement between BNY Hamilton Large Growth CRT Fund and The Bank of New York

Description

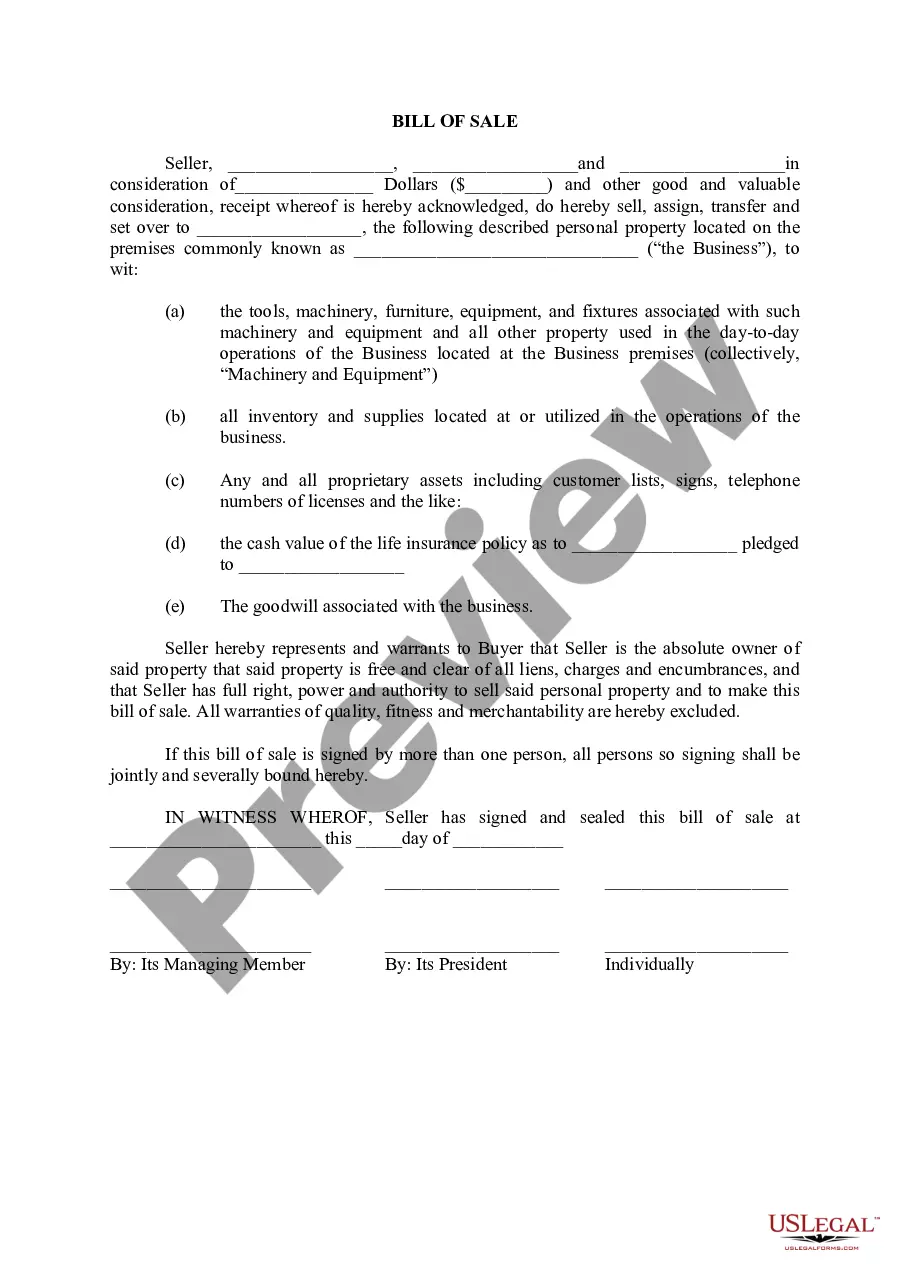

How to fill out Harris Texas Investment Advisory Agreement Between BNY Hamilton Large Growth CRT Fund And The Bank Of New York?

Whether you plan to open your company, enter into an agreement, apply for your ID renewal, or resolve family-related legal concerns, you must prepare specific paperwork meeting your local laws and regulations. Finding the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 professionally drafted and checked legal templates for any personal or business case. All files are collected by state and area of use, so picking a copy like Harris Investment Advisory Agreement between BNY Hamilton Large Growth CRT Fund and The Bank of New York is fast and straightforward.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you a few additional steps to get the Harris Investment Advisory Agreement between BNY Hamilton Large Growth CRT Fund and The Bank of New York. Adhere to the guidelines below:

- Make sure the sample fulfills your personal needs and state law regulations.

- Read the form description and check the Preview if there’s one on the page.

- Use the search tab providing your state above to find another template.

- Click Buy Now to get the sample once you find the right one.

- Opt for the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Harris Investment Advisory Agreement between BNY Hamilton Large Growth CRT Fund and The Bank of New York in the file format you prefer.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our library are reusable. Having an active subscription, you are able to access all of your earlier acquired paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date official documentation. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!

Form popularity

FAQ

An investment adviser is a. firm or person. that, for compensation, engages. in the business of providing investment advice to others about the value of or about investing in securities stocks, bonds, mutual funds, exchange traded funds (ETFs), and certain other investment products.

The average BNY Mellon hourly pay ranges from approximately $18 per hour for a Customer Service Representative to $32 per hour for a Summer Analyst.

In order to file a registered investment adviser application with the state of New York, one must first apply to the Financial Industry Regulatory Authority (FINRA) for an account (Entitlement) to their WebCRD/IARD on-line system (the web application for the registration of RIA's and their representatives).

RRs vs. Registered representatives differ from registered investment advisors (RIAs). Registered representatives are governed by suitability standards while registered investment advisors are governed by fiduciary standards. Registered representatives are transaction-based service providers.

Registered investment advisors (RIAs) manage the assets of high-net-worth individuals and institutional investors. RIAs can create portfolios with individual stocks, bonds, and mutual funds; they may use a mix of funds and individual issues or only funds to streamline asset allocation and cut down on commission costs.

While Brown Advisory's background is in private client wealth advisory, it now encompasses a trust company, mutual funds and multiple RIAs.

The Bank of New York Mellon Corporation, commonly known as BNY Mellon, is an American investment banking services holding company headquartered in New York City.

Minimum account balance for BNY Mellon Managed Asset Program Mutual Fund Series is $25,000. Equity separate account portfolios within the Customized Investment Series require a $100,000 minimum.

A Registered Investment Advisor (RIA) is an individual financial advisor or a company that provides its clients with financial advice. Unlike other types of financial advisors, RIAs have a fiduciary duty to act in your best interest.

An Investment advisory, in financial/investment organizations, is the unit linking the investment professionals in the central asset management unit (Investment Research, Portfolio Management) to the relationship managers and/or to important clients of the asset management organization.