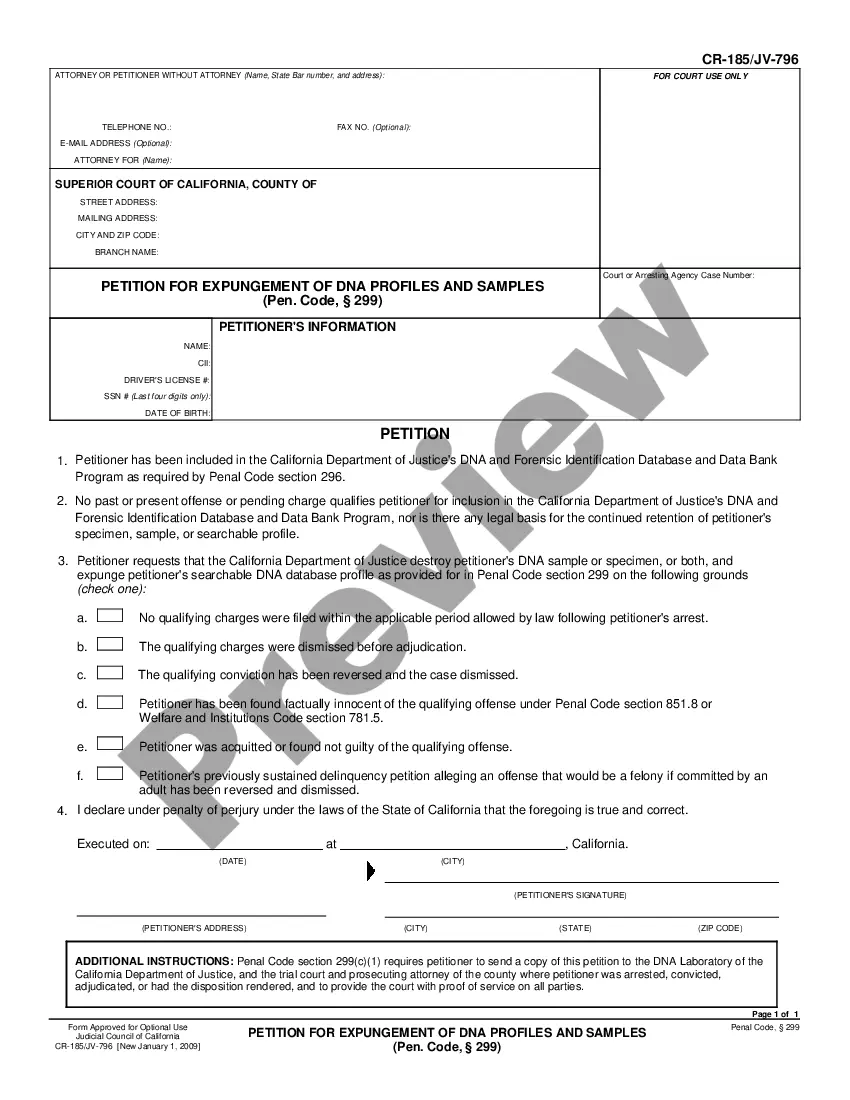

The Maricopa Arizona Investment Advisory Agreement is a legal document that outlines the terms and conditions of the business relationship between Hamilton Small Cap Growth CRT Fund and The Bank of New York. This agreement establishes the framework for investment advisory services provided by The Bank of New York to the fund. Keywords: Maricopa Arizona, Investment Advisory Agreement, Hamilton Small Cap Growth CRT Fund, The Bank of New York. The agreement covers various aspects, including the scope of investment advisory services, responsibilities, compensation, termination provisions, and confidentiality. It serves as a binding contract between the two parties, ensuring that all parties involved understand and agree upon the terms and conditions. 1. Basic Description: The Maricopa Arizona Investment Advisory Agreement between Hamilton Small Cap Growth CRT Fund and The Bank of New York is a comprehensive agreement that defines the investment advisory relationship between the two entities. It establishes the roles and responsibilities of each party and sets the framework for investment decision-making. 2. Scope of Services: This agreement outlines the specific investment advisory services that The Bank of New York will provide to Hamilton Small Cap Growth CRT Fund. These services may include portfolio management, investment analysis, research, risk assessment, and asset allocation strategies. The scope of services will be tailored to the fund's unique investment goals and requirements. 3. Responsibilities: The agreement clearly defines the responsibilities of both parties. Hamilton Small Cap Growth CRT Fund is responsible for providing accurate and up-to-date information about its investment goals, risk tolerance, and any specific investment guidelines or limitations. The Bank of New York, as the investment advisor, is responsible for using its expertise and judgment to provide suitable investment advice and manage the fund's portfolio in line with its objectives. 4. Compensation: The compensation structure is an essential aspect of the agreement. It outlines how The Bank of New York will be remunerated for providing investment advisory services. This may be a percentage of the assets under management, fixed fees, or a combination of both. The agreement will also specify any additional fees or expenses that the fund may incur. 5. Termination Provisions: The agreement includes provisions for termination by either party. This section outlines the conditions under which the agreement can be terminated, such as breach of contract or mutual agreement. It also specifies the notice period required for termination and any associated costs or penalties. Different Types of Maricopa Arizona Investment Advisory Agreements between Hamilton Small Cap Growth CRT Fund and The Bank of New York: 1. Fixed-Term Agreement: This type of agreement has a predetermined duration, after which it will automatically terminate unless renewed by both parties. 2. Open-Ended Agreement: An open-ended agreement do not have a fixed duration and can be terminated by either party with proper notice. 3. Customized Agreement: The parties may opt for a tailored agreement that includes specific provisions and clauses designed to meet their unique needs and preferences. In conclusion, the Maricopa Arizona Investment Advisory Agreement between Hamilton Small Cap Growth CRT Fund and The Bank of New York is a crucial document governing the investment advisory relationship. It sets out the rights, responsibilities, and compensation terms, ensuring a transparent and mutually beneficial partnership.

Maricopa Arizona Investment Advisory Agreement between Hamilton Small Cap Growth CRT Fund and The Bank of New York

Description

How to fill out Maricopa Arizona Investment Advisory Agreement Between Hamilton Small Cap Growth CRT Fund And The Bank Of New York?

Drafting documents for the business or personal demands is always a big responsibility. When drawing up a contract, a public service request, or a power of attorney, it's crucial to consider all federal and state regulations of the specific area. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it tense and time-consuming to generate Maricopa Investment Advisory Agreement between Hamilton Small Cap Growth CRT Fund and The Bank of New York without expert assistance.

It's possible to avoid wasting money on lawyers drafting your documentation and create a legally valid Maricopa Investment Advisory Agreement between Hamilton Small Cap Growth CRT Fund and The Bank of New York on your own, using the US Legal Forms web library. It is the largest online collection of state-specific legal documents that are professionally cheched, so you can be certain of their validity when selecting a sample for your county. Earlier subscribed users only need to log in to their accounts to save the needed form.

In case you still don't have a subscription, follow the step-by-step guideline below to obtain the Maricopa Investment Advisory Agreement between Hamilton Small Cap Growth CRT Fund and The Bank of New York:

- Look through the page you've opened and verify if it has the sample you need.

- To accomplish this, use the form description and preview if these options are available.

- To find the one that fits your needs, utilize the search tab in the page header.

- Recheck that the sample complies with juridical criteria and click Buy Now.

- Choose the subscription plan, then log in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever purchased never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and easily obtain verified legal templates for any situation with just a couple of clicks!