Orange, California is a vibrant city located in Orange County, California. It is known for its rich history, cultural diversity, and strong economy. With its favorable business environment and strategic location, Orange has become an attractive destination for investors looking to maximize their investment potential. One notable investment opportunity that draws attention is the Investment Advisory Agreement between Hamilton Small Cap Growth CRT Fund and The Bank of New York. This agreement establishes a partnership between these two prominent entities, allowing them to collaborate and make informed investment decisions. The Hamilton Small Cap Growth CRT Fund, recognized for its expertise in small cap investments, aims to provide growth opportunities for its investors. By partnering with The Bank of New York, one of the leading financial institutions globally, the fund gains access to a vast network of resources, expertise, and market insights that can enhance its investment strategies. This collaborative effort offers several types of Investment Advisory Agreements tailored to meet specific investment objectives. Some different types include: 1. Traditional Investment Advisory Agreement: This type of agreement involves Hamilton Small Cap Growth CRT Fund seeking guidance and advice from The Bank of New York's team of experts to make well-informed investment decisions. 2. Customized Investment Advisory Agreement: With this agreement, the partnership between the two entities is tailored to align with specific investment goals and preferences of the fund. It allows for a more personalized approach to investment advisory services. 3. Active Portfolio Management Agreement: This type of agreement focuses on active management of the investment portfolio. The Bank of New York works closely with Hamilton Small Cap Growth CRT Fund to identify and capitalize on promising investment opportunities, constantly adjusting the portfolio to optimize returns. 4. Passive Investment Advisory Agreement: In contrast to the active management agreement, this type of agreement follows a passive investment strategy. The Bank of New York provides advice and guidance on long-term investment strategies, aiming to achieve consistent returns over time. These Investment Advisory Agreements reflect the commitment of both parties to maximize the growth potential of Hamilton Small Cap Growth CRT Fund's investments. By leveraging the expertise and resources of The Bank of New York, the partnership seeks to navigate the dynamic investment landscape and deliver favorable outcomes for investors. In conclusion, the Investment Advisory Agreement between Hamilton Small Cap Growth CRT Fund and The Bank of New York in Orange, California highlights the city's appeal as an investment hub. Through different types of agreements, the partnership aims to capitalize on growth opportunities in the market and optimize returns for investors.

Orange California Investment Advisory Agreement between Hamilton Small Cap Growth CRT Fund and The Bank of New York

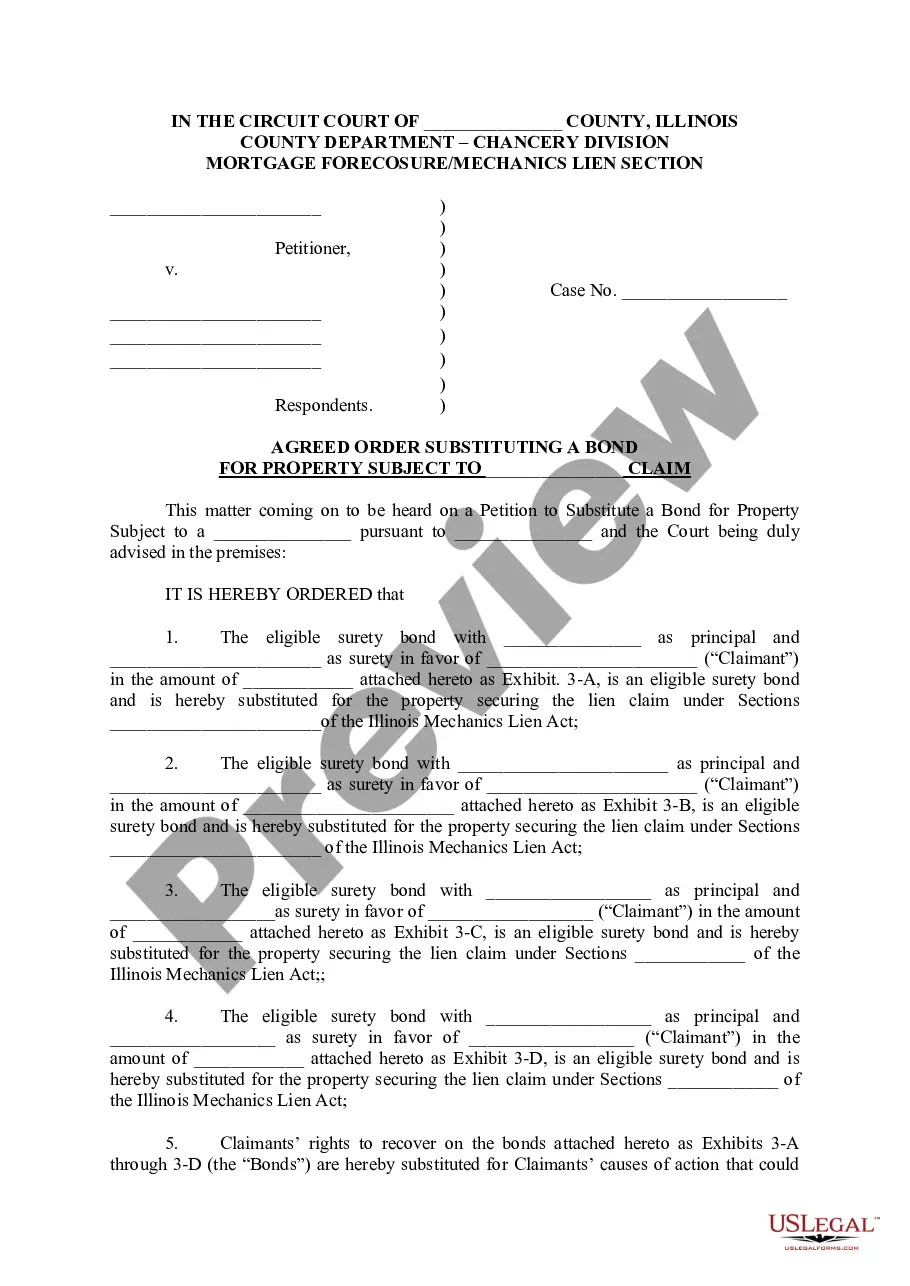

Description

How to fill out Orange California Investment Advisory Agreement Between Hamilton Small Cap Growth CRT Fund And The Bank Of New York?

Creating documents, like Orange Investment Advisory Agreement between Hamilton Small Cap Growth CRT Fund and The Bank of New York, to take care of your legal matters is a tough and time-consumming process. A lot of cases require an attorney’s involvement, which also makes this task expensive. However, you can acquire your legal issues into your own hands and deal with them yourself. US Legal Forms is here to save the day. Our website features more than 85,000 legal forms created for different cases and life situations. We make sure each form is compliant with the laws of each state, so you don’t have to be concerned about potential legal issues compliance-wise.

If you're already aware of our website and have a subscription with US, you know how effortless it is to get the Orange Investment Advisory Agreement between Hamilton Small Cap Growth CRT Fund and The Bank of New York form. Go ahead and log in to your account, download the form, and customize it to your needs. Have you lost your form? No worries. You can get it in the My Forms tab in your account - on desktop or mobile.

The onboarding flow of new customers is just as easy! Here’s what you need to do before getting Orange Investment Advisory Agreement between Hamilton Small Cap Growth CRT Fund and The Bank of New York:

- Ensure that your template is compliant with your state/county since the regulations for writing legal documents may differ from one state another.

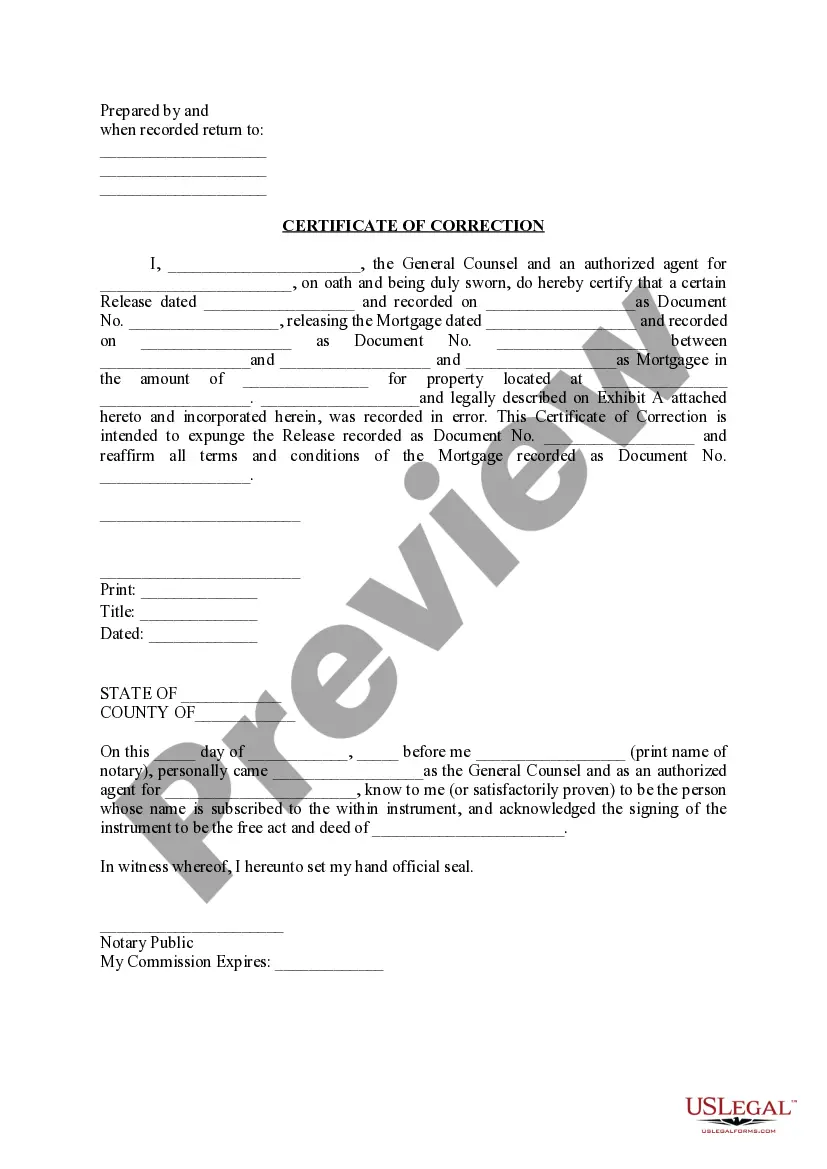

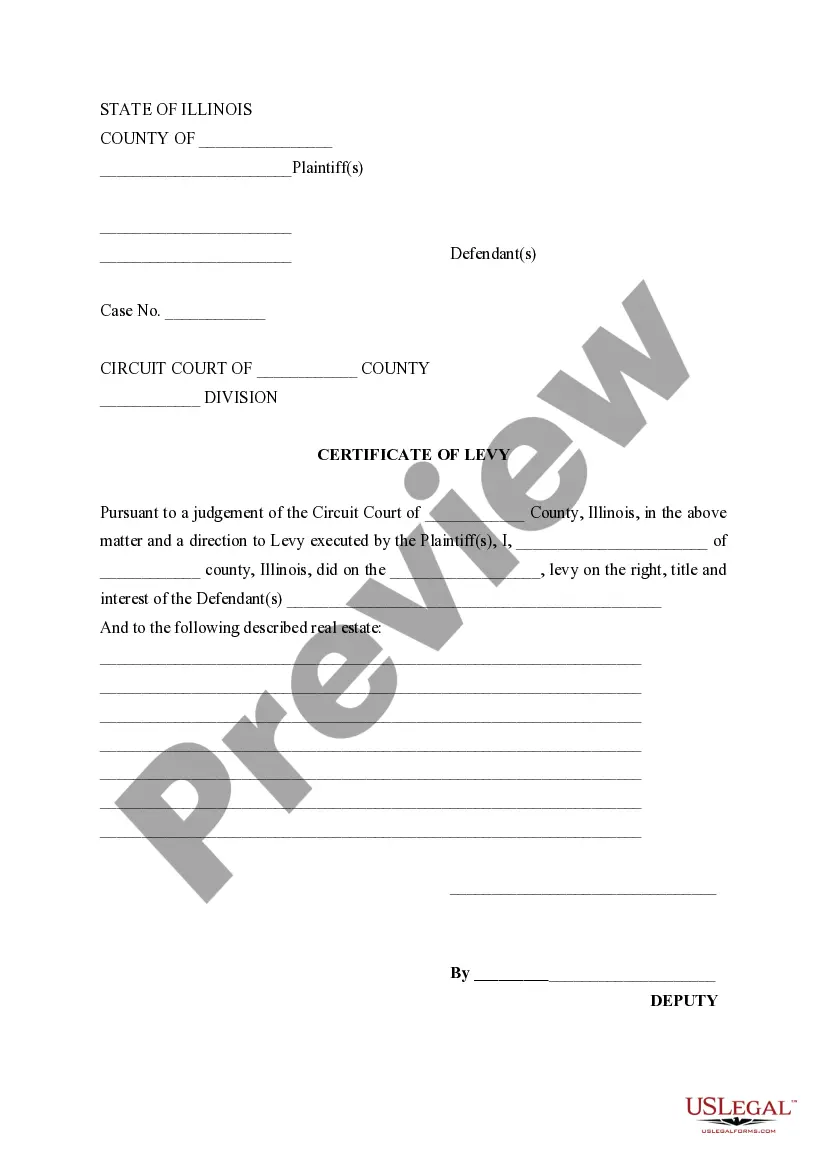

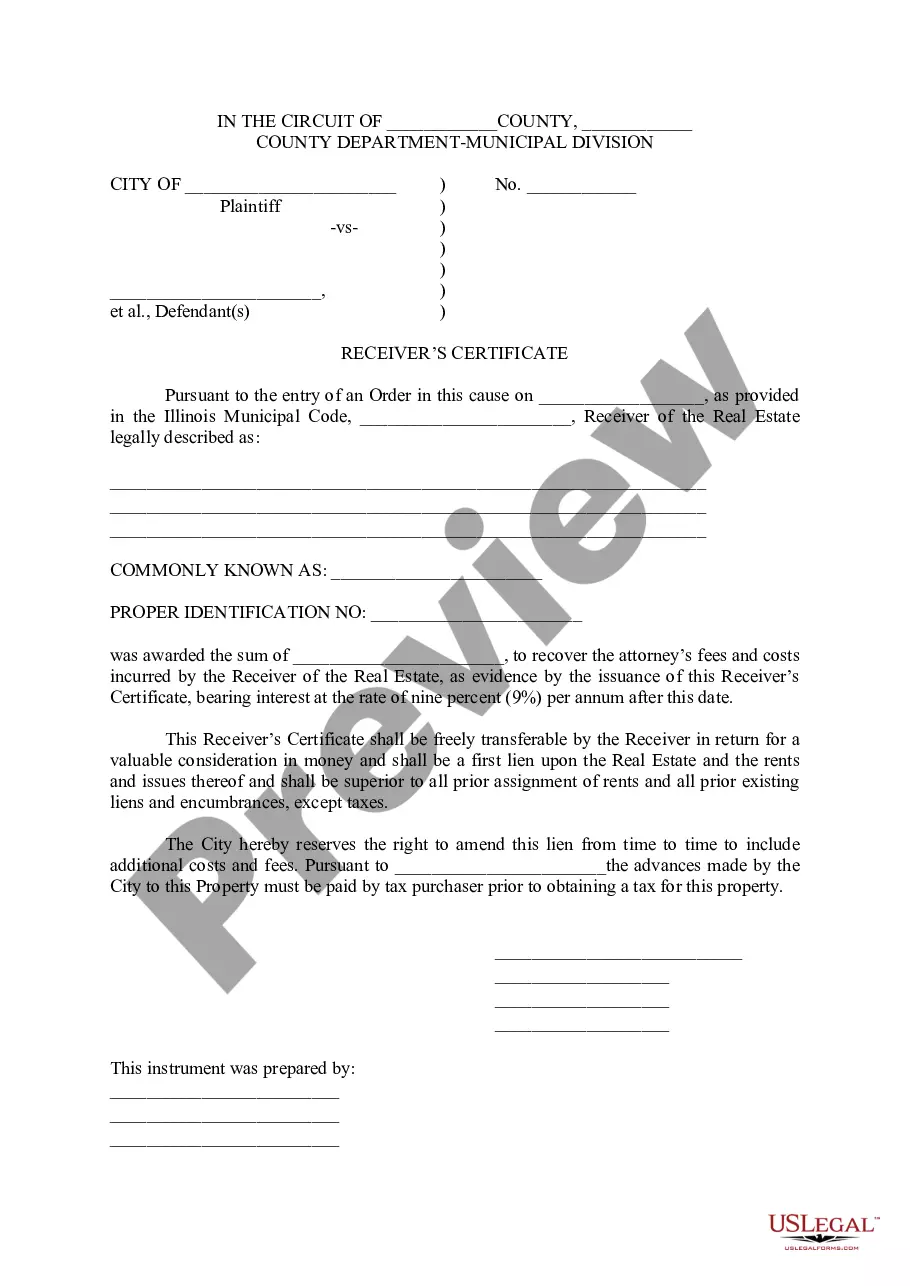

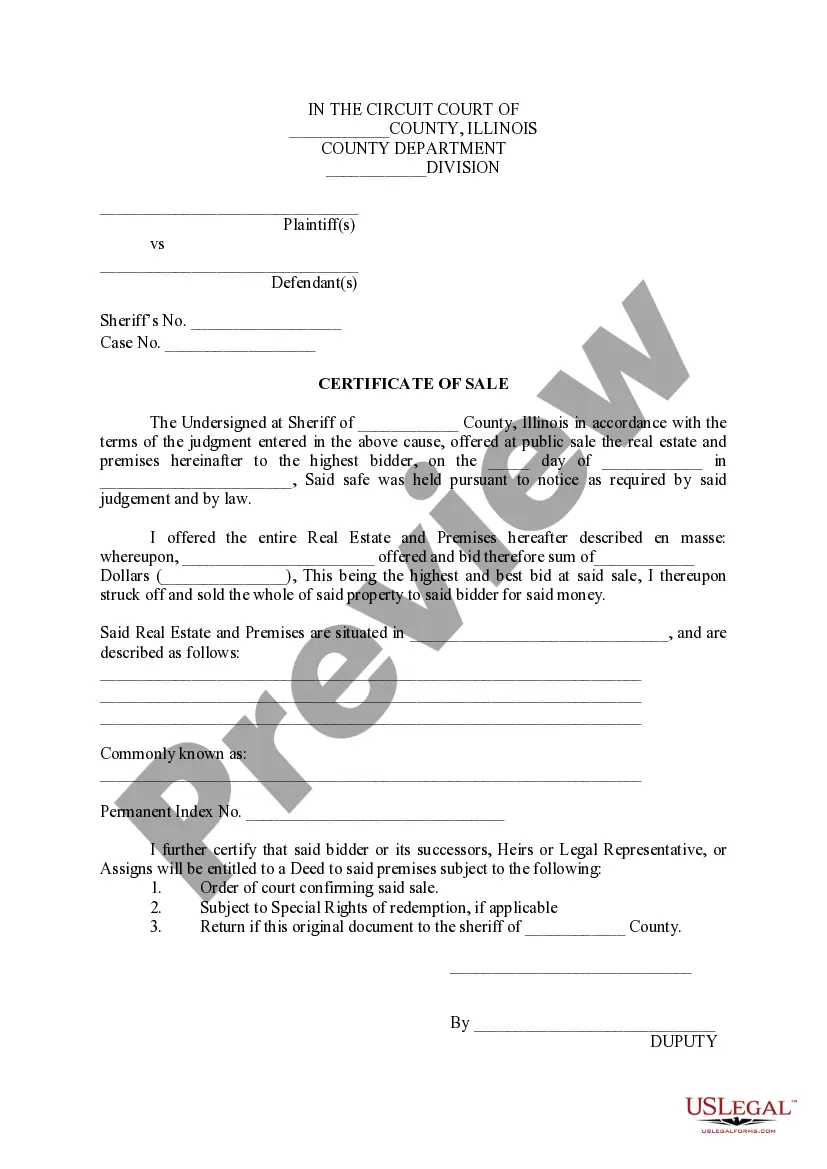

- Find out more about the form by previewing it or reading a quick intro. If the Orange Investment Advisory Agreement between Hamilton Small Cap Growth CRT Fund and The Bank of New York isn’t something you were looking for, then use the header to find another one.

- Log in or register an account to begin using our service and get the form.

- Everything looks good on your end? Click the Buy now button and choose the subscription plan.

- Select the payment gateway and enter your payment details.

- Your form is good to go. You can try and download it.

It’s an easy task to locate and purchase the needed template with US Legal Forms. Thousands of businesses and individuals are already benefiting from our rich collection. Subscribe to it now if you want to check what other perks you can get with US Legal Forms!