Los Angeles, California Sub-Advisory Agreement — Exploring the Collaboration Between BNY Hamilton International Equity Fund and IndyCar, a Subsidiary of Crédit Agricole Introduction: The Los Angeles, California Sub-Advisory Agreement is a strategic partnership entered into between BNY Hamilton International Equity Fund and IndyCar, a subsidiary of Crédit Agricole. This collaboration aims to leverage their respective strengths and resources to optimize investment strategies and provide enhanced financial services to clients. 1. Background and Scope: The Sub-Advisory Agreement encompasses a range of investment management services, including global equity research, portfolio management, risk assessment, and compliance. The primary purpose of this collaboration is to maximize returns on investment and achieve client-specific financial goals. 2. BNY Hamilton International Equity Fund: BNY Hamilton International Equity Fund is a renowned global investment management firm based in Los Angeles, California. With a diverse portfolio and an extensive network of industry professionals, BNY Hamilton specializes in identifying opportunities across international markets and developing tailored investment strategies. 3. IndyCar — A SubsidiarcreditdiAgricolaleIndyCaram, a subsidiary of Crédit Agricole, brings exceptional expertise and financial resources to the table. With a strong focus on delivering client-centric solutions, IndyCar operates as an asset management subsidiary, providing comprehensive investment services to both individual and institutional clients. 4. Objectives: The Los Angeles, California Sub-Advisory Agreement outlines several core objectives that both parties seek to achieve jointly. These include improving investment research capabilities, streamlining portfolio management processes, implementing effective risk management strategies, and ensuring compliance with regulatory standards. 5. Types of Sub-Advisory Agreements: a) Equity Research Collaboration: BNY Hamilton and IndyCar collaborate on conducting in-depth equity research to identify potential investment opportunities across global markets. This agreement focuses on leveraging their combined research capabilities to enhance overall portfolio performance. b) Portfolio Management Partnership: The Sub-Advisory Agreement also covers portfolio management, wherein BNY Hamilton International Equity Fund and IndyCar work closely to design and manage investment portfolios customized to the preferences and risk profiles of clients. c) Risk Assessment and Mitigation Agreement: Recognizing the significance of comprehensive risk assessment, BNY Hamilton and IndyCar establish protocols for identifying, analyzing, and mitigating investment risks. This type of Sub-Advisory Agreement emphasizes the implementation of effective risk management strategies. d) Compliance Partnership: In order to meet regulatory requirements and maintain industry best practices, BNY Hamilton and IndyCar collaborate on ensuring compliance at every stage of investment management. Such agreements focus on establishing a robust compliance framework to protect investor interests. Conclusion: Overall, the Los Angeles, California Sub-Advisory Agreement between BNY Hamilton International Equity Fund and IndyCar represents a significant collaboration that combines the strengths of two financial powerhouses. Through this partnership, both entities seek to provide exceptional investment management services, tailored portfolios, and robust risk management strategies to their clients, enabling them to achieve their financial objectives effectively.

Los Angeles California Sub-Advisory Agreement between BNY Hamilton International Equity fund and Indocam, a subsidiary of Credit Agricole

Description

How to fill out Los Angeles California Sub-Advisory Agreement Between BNY Hamilton International Equity Fund And Indocam, A Subsidiary Of Credit Agricole?

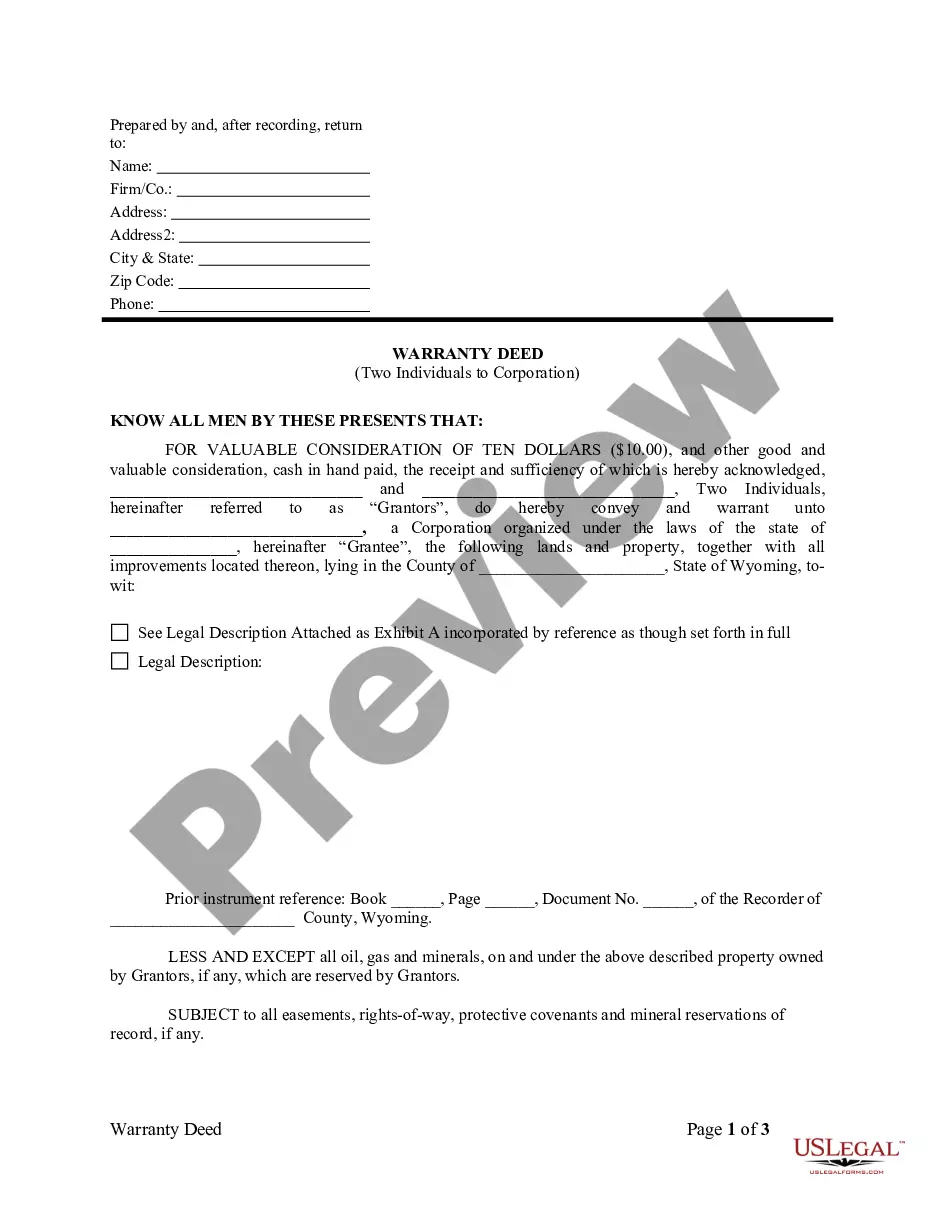

Dealing with legal forms is a must in today's world. Nevertheless, you don't always need to look for professional help to draft some of them from the ground up, including Los Angeles Sub-Advisory Agreement between BNY Hamilton International Equity fund and Indocam, a subsidiary of Credit Agricole, with a service like US Legal Forms.

US Legal Forms has over 85,000 templates to select from in various types ranging from living wills to real estate paperwork to divorce papers. All forms are organized based on their valid state, making the searching experience less frustrating. You can also find detailed resources and guides on the website to make any tasks related to paperwork execution simple.

Here's how to purchase and download Los Angeles Sub-Advisory Agreement between BNY Hamilton International Equity fund and Indocam, a subsidiary of Credit Agricole.

- Go over the document's preview and description (if available) to get a general information on what you’ll get after getting the form.

- Ensure that the template of your choosing is adapted to your state/county/area since state laws can impact the legality of some documents.

- Examine the similar document templates or start the search over to find the right file.

- Click Buy now and register your account. If you already have an existing one, choose to log in.

- Pick the pricing {plan, then a suitable payment method, and purchase Los Angeles Sub-Advisory Agreement between BNY Hamilton International Equity fund and Indocam, a subsidiary of Credit Agricole.

- Select to save the form template in any offered file format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the needed Los Angeles Sub-Advisory Agreement between BNY Hamilton International Equity fund and Indocam, a subsidiary of Credit Agricole, log in to your account, and download it. Of course, our website can’t replace an attorney completely. If you have to deal with an exceptionally complicated situation, we advise using the services of an attorney to examine your form before signing and filing it.

With over 25 years on the market, US Legal Forms proved to be a go-to provider for many different legal forms for millions of users. Become one of them today and purchase your state-specific paperwork with ease!