The Franklin Ohio Pooling and Servicing Agreement (PSA) is a legal document that establishes the terms and conditions for the pooling of mortgages and the servicing of mortgage-backed securities (MBS) between Credit Suisse First Boston Mortgage Securities Corp., Washington Mutual Bank F.A., and Bank One. This agreement plays a crucial role in the securitization process, allowing these financial institutions to transfer the risk associated with a pool of mortgages to investors. Under the Franklin Ohio PSA, Credit Suisse First Boston Mortgage Securities Corp., Washington Mutual Bank F.A., and Bank One agree to pool a designated group of mortgage loans into a trust. This trust then issues MBS, representing the collective cash flows generated by the underlying mortgage loans. These MBS are sold to investors in the secondary market, allowing the originating institutions to raise additional capital to fund further lending activities. The PSA outlines the responsibilities and rights of each party involved. Credit Suisse First Boston Mortgage Securities Corp., as the sponsor, is responsible for selecting and purchasing the mortgage loans that will be included in the pool. Washington Mutual Bank F.A. and Bank One, as originators, provide the initial mortgages that become part of the pool. The agreement also includes provisions for the servicing of the mortgage loans. This entails the collection of loan payments, customer service, and the administration of the loans on behalf of the investors. Washington Mutual Bank F.A. and Bank One may retain the servicing rights or transfer them to a third-party service. These responsibilities and potential rights transfers are detailed within the PSA. Additionally, the Franklin Ohio PSA may include different variations or tranches, which represent different risk profiles and priorities. These tranches typically correspond to different credit ratings and yield expectations, allowing investors to select the level of risk and return that aligns with their investment strategy. The specific names and terms of the tranches within the Franklin Ohio PSA between Credit Suisse First Boston Mortgage Securities Corp., Washington Mutual Bank F.A., and Bank One would vary based on the specific agreement and associated mortgage pool. Overall, the Franklin Ohio Pooling and Servicing Agreement provides a blueprint for the securitization of mortgage loans, offering a mechanism for financial institutions to efficiently raise capital while reducing risk exposure. This agreement ensures transparency, accountability, and mutually agreed-upon terms among the involved parties, promoting market stability and investor confidence.

Franklin Ohio Pooling and Servicing Agreement between Credit Suisse First Boston Mortgage Securities Corp., Washington Mutual Bank F.A. and Bank One

Description

How to fill out Franklin Ohio Pooling And Servicing Agreement Between Credit Suisse First Boston Mortgage Securities Corp., Washington Mutual Bank F.A. And Bank One?

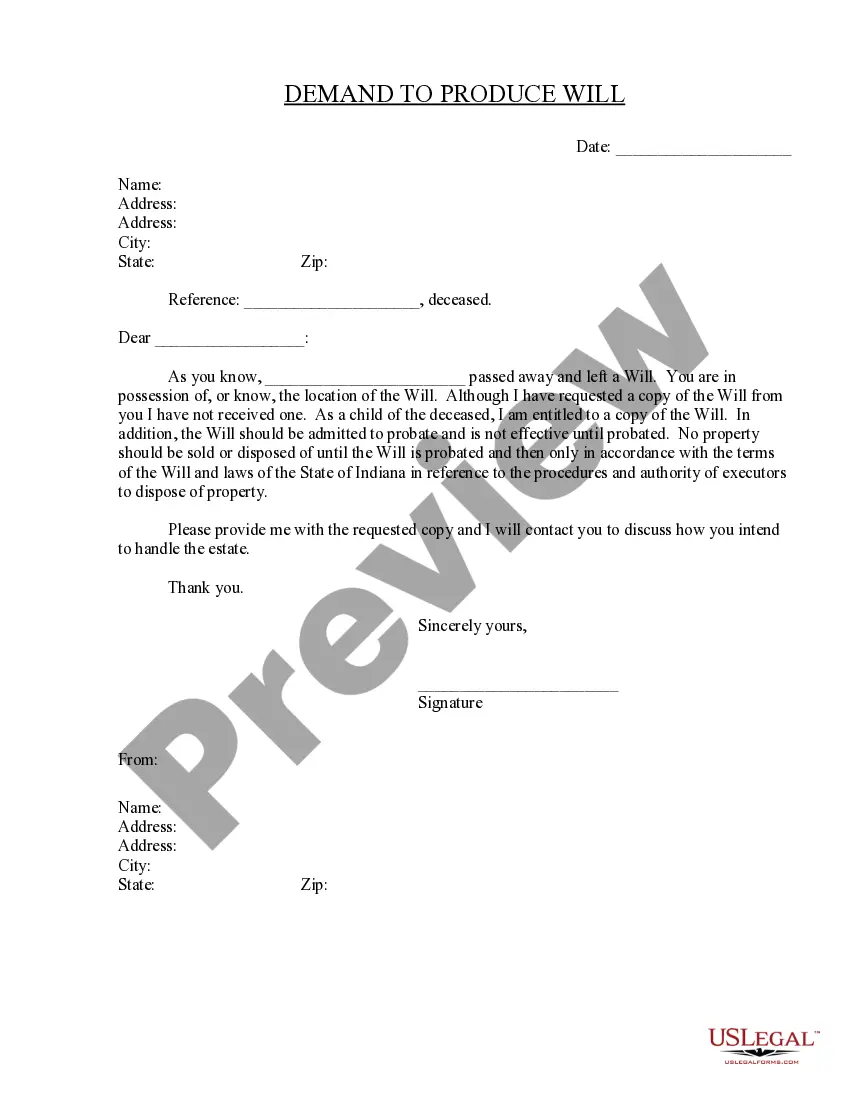

How much time does it usually take you to draw up a legal document? Since every state has its laws and regulations for every life situation, finding a Franklin Pooling and Servicing Agreement between Credit Suisse First Boston Mortgage Securities Corp., Washington Mutual Bank F.A. and Bank One suiting all regional requirements can be stressful, and ordering it from a professional lawyer is often pricey. Many web services offer the most popular state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most extensive web catalog of templates, collected by states and areas of use. Apart from the Franklin Pooling and Servicing Agreement between Credit Suisse First Boston Mortgage Securities Corp., Washington Mutual Bank F.A. and Bank One, here you can find any specific document to run your business or individual affairs, complying with your regional requirements. Specialists check all samples for their validity, so you can be sure to prepare your paperwork correctly.

Using the service is fairly simple. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the required sample, and download it. You can get the file in your profile at any moment later on. Otherwise, if you are new to the website, there will be some extra steps to complete before you obtain your Franklin Pooling and Servicing Agreement between Credit Suisse First Boston Mortgage Securities Corp., Washington Mutual Bank F.A. and Bank One:

- Check the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another document using the corresponding option in the header.

- Click Buy Now when you’re certain in the chosen file.

- Decide on the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the Franklin Pooling and Servicing Agreement between Credit Suisse First Boston Mortgage Securities Corp., Washington Mutual Bank F.A. and Bank One.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased document, you can locate all the files you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!

Form popularity

FAQ

A loan servicing agreement is a written contract between a lender and a loan servicer that gives the loan servicer the authority to manage most aspects of a particular loan.

Go to and click on Search for Company Filings under Filing & Forms (EDGAR). Under General-Purpose Searches, click on Companies & other filers. Then, in the Enter your search information box, type in Ameriquest next to Company name and click on the Find Companies button.

Securitization is the process in which certain types of assets are pooled so that they can be repackaged into interest-bearing securities. The interest and principal payments from the assets are passed through to the purchasers of the securities.

Loan servicing includes sending monthly payment statements, collecting monthly payments, maintaining records of payments and balances, collecting and paying taxes and insurance (and managing escrow funds), remitting funds to the note holder, and following up on any delinquencies.

Loan Pool means: (a) in the context of a Securitization, any pool or group of loans that are a part of such Securitization; (b) in the context of a Transfer, all loans which are sold, transferred or assigned to the same transferee; and (c) in the context of a Participation, all loans as to which participating interests

The Public Securities Association Standard Prepayment Model (PSA) is the assumed monthly rate of prepayment that is annualized to the outstanding principal balance of a mortgage loan.

A servicing agreement is a contract between a servicer and a special purpose vehicle (SPV) or an assignee under which the servicer is responsible for administering a lease and acting as a conduit for all payments over the lease term in return for a periodic servicing fee .

As an example, there are several ways for homeowners to find out who owns their mortgages: Contact your mortgage servicer.Run a check on the MERS (Mortgage Electronic Registration System) website.Visit the Ginnie Mae, Fannie Mae and Freddie Mac websites to use their loan lookup tools.

The Pooling and Servicing Agreement can be a stand-alone document or it can be part of another paper, usually called the Prospectus. If the securitization is public, these documents must be filed with the Securities and Exchange Commission (SEC), and will be available to the public at .

Mortgage servicing rights (MSR) refer to a contractual agreement in which the right to service an existing mortgage is sold by the original mortgage lender to another party that specializes in the various functions involved with servicing mortgages.

More info

Ballot, 435 U.S. 765, 783 (1978). The banks that received the financial help from FSLIC had more questionable practices than the banks that did not receive the financial help from FSLIC. According to the Securities and Exchange Chairman of the Federal Reserve, the banks that received the FDIC guarantee were more likely to use their leverage as leverage, and more likely to engage in transactions that were not in the best interests of the consumer (which can be illegal); and they are also more likely to be involved with securities transactions involving other banks' mortgage-backed securities, such as collateralized debt obligation or CDO. [Source: Senate Committee on Banking, Housing, and Urban Affairs, Hearing, September 28, 2000] “There are no hard and fast lines separating the banking industry in the United States from Wall Street in London or from any other financial center. Financial markets have always tended to be global.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.