The Hennepin Minnesota Pooling and Servicing Agreement is a legal contract that outlines the terms and conditions governing the pooling and servicing of mortgage loans between Credit Suisse First Boston Mortgage Securities Corp., Washington Mutual Bank F.A., and Bank One. This agreement is crucial in the mortgage-backed securities market, as it defines the responsibilities and obligations of each party involved. Keywords: Hennepin Minnesota, Pooling and Servicing Agreement, Credit Suisse First Boston Mortgage Securities Corp., Washington Mutual Bank F.A., Bank One, mortgage loans, mortgage-backed securities, terms and conditions, responsibilities, obligations. Different types of Hennepin Minnesota Pooling and Servicing Agreements between Credit Suisse First Boston Mortgage Securities Corp., Washington Mutual Bank F.A., and Bank One may include: 1. Traditional Hennepin Minnesota Pooling and Servicing Agreement: This is the standard agreement that establishes the guidelines for pooling and servicing mortgage loans, including the specific terms regarding the allocation of principal and interest payments, default and foreclosure procedures, investor reporting, and other critical aspects related to loan servicing. 2. Hennepin Minnesota Pooling and Servicing Agreement with Credit Enhancements: In some cases, additional credit enhancements may be incorporated into the agreement. These enhancements could involve financial instruments or insurance policies that aim to mitigate credit risk, thus providing additional security to investors. 3. Hennepin Minnesota Pooling and Servicing Agreement for Securitization: This type of agreement would be used when the pooled mortgage loans are intended to be securitized and sold as mortgage-backed securities in the secondary market. It would include provisions specifically related to the creation, issuance, and management of the securities, as well as the ongoing reporting and distribution of cash flows to investors. 4. Hennepin Minnesota Pooling and Servicing Agreement for Specialized Loan Programs: If the agreement involves specific loan programs or initiatives, such as government-backed loans or affordable housing programs, there may be additional provisions addressing the unique requirements and regulations applicable to these programs. In summary, the Hennepin Minnesota Pooling and Servicing Agreement between Credit Suisse First Boston Mortgage Securities Corp., Washington Mutual Bank F.A., and Bank One establishes the guidelines for pooling and servicing mortgage loans and outlines the responsibilities and obligations of each party. Various types of agreements can exist based on the specific needs and circumstances of the parties involved.

Hennepin Minnesota Pooling and Servicing Agreement between Credit Suisse First Boston Mortgage Securities Corp., Washington Mutual Bank F.A. and Bank One

Description

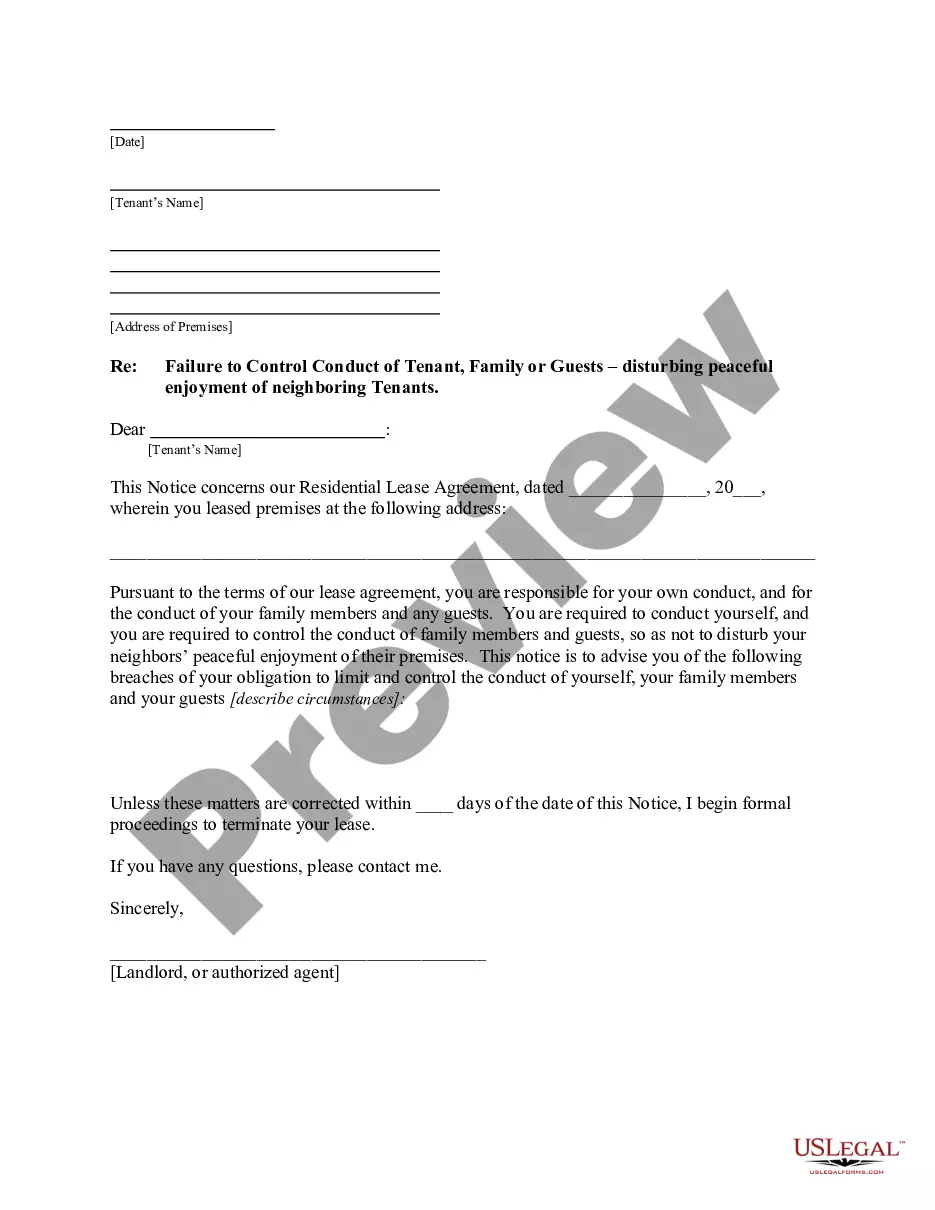

How to fill out Hennepin Minnesota Pooling And Servicing Agreement Between Credit Suisse First Boston Mortgage Securities Corp., Washington Mutual Bank F.A. And Bank One?

Are you looking to quickly create a legally-binding Hennepin Pooling and Servicing Agreement between Credit Suisse First Boston Mortgage Securities Corp., Washington Mutual Bank F.A. and Bank One or maybe any other document to manage your personal or corporate matters? You can select one of the two options: hire a professional to draft a valid document for you or create it entirely on your own. Luckily, there's an alternative solution - US Legal Forms. It will help you receive professionally written legal paperwork without paying sky-high prices for legal services.

US Legal Forms offers a rich catalog of over 85,000 state-specific document templates, including Hennepin Pooling and Servicing Agreement between Credit Suisse First Boston Mortgage Securities Corp., Washington Mutual Bank F.A. and Bank One and form packages. We provide documents for a myriad of use cases: from divorce papers to real estate document templates. We've been on the market for over 25 years and got a spotless reputation among our customers. Here's how you can become one of them and get the needed template without extra troubles.

- To start with, double-check if the Hennepin Pooling and Servicing Agreement between Credit Suisse First Boston Mortgage Securities Corp., Washington Mutual Bank F.A. and Bank One is tailored to your state's or county's regulations.

- In case the form has a desciption, make sure to check what it's suitable for.

- Start the searching process again if the form isn’t what you were looking for by utilizing the search box in the header.

- Choose the plan that is best suited for your needs and proceed to the payment.

- Select the format you would like to get your form in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already registered an account, you can easily log in to it, find the Hennepin Pooling and Servicing Agreement between Credit Suisse First Boston Mortgage Securities Corp., Washington Mutual Bank F.A. and Bank One template, and download it. To re-download the form, simply go to the My Forms tab.

It's easy to find and download legal forms if you use our services. In addition, the templates we offer are reviewed by industry experts, which gives you greater confidence when dealing with legal affairs. Try US Legal Forms now and see for yourself!