Orange, California Pooling and Servicing Agreement is a legal contract established between Credit Suisse First Boston Mortgage Securities Corp., Washington Mutual Bank F.A., and Bank One, outlining the terms and conditions for pooling and servicing mortgage loans. This agreement is crucial for mortgage-backed securities (MBS) transactions and ensures the smooth operation and management of the underlying mortgage loans. The Orange, California Pooling and Servicing Agreement governs the relationship and responsibilities of the parties involved, including the issuer (Credit Suisse First Boston Mortgage Securities Corp.), the depositor (Washington Mutual Bank F.A.), and the master service (Bank One). It provides a comprehensive framework for the administration and execution of various tasks, such as loan origination, mortgage payment collection, reporting, and investor distribution. Keywords related to this agreement may include mortgage-backed securities, pooling, servicing, loan origination, mortgage payment collection, investor distribution, Credit Suisse First Boston Mortgage Securities Corp., Washington Mutual Bank F.A., Bank One, Orange California. Different types of Orange, California Pooling and Servicing Agreements between these entities might include variations based on specific loan types, such as residential or commercial mortgages. Additionally, there may be different agreements based on the specific portfolio or asset class being securitized, for example, prime, subprime, or jumbo mortgage loans. These varying agreements might address specific risk factors, structure, and investor preferences associated with different types of mortgage loans. However, it should be noted that the specific types of Orange, California Pooling and Servicing Agreements between Credit Suisse First Boston Mortgage Securities Corp., Washington Mutual Bank F.A., and Bank One may vary based on the specific transactions and legal requirements of each deal, as dictated by the prevailing market conditions and regulatory guidelines.

Orange California Pooling and Servicing Agreement between Credit Suisse First Boston Mortgage Securities Corp., Washington Mutual Bank F.A. and Bank One

Description

How to fill out Orange California Pooling And Servicing Agreement Between Credit Suisse First Boston Mortgage Securities Corp., Washington Mutual Bank F.A. And Bank One?

Laws and regulations in every sphere differ throughout the country. If you're not a lawyer, it's easy to get lost in various norms when it comes to drafting legal paperwork. To avoid pricey legal assistance when preparing the Orange Pooling and Servicing Agreement between Credit Suisse First Boston Mortgage Securities Corp., Washington Mutual Bank F.A. and Bank One, you need a verified template valid for your county. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions online library of more than 85,000 state-specific legal forms. It's a great solution for professionals and individuals looking for do-it-yourself templates for various life and business scenarios. All the forms can be used multiple times: once you purchase a sample, it remains available in your profile for subsequent use. Thus, if you have an account with a valid subscription, you can just log in and re-download the Orange Pooling and Servicing Agreement between Credit Suisse First Boston Mortgage Securities Corp., Washington Mutual Bank F.A. and Bank One from the My Forms tab.

For new users, it's necessary to make a few more steps to obtain the Orange Pooling and Servicing Agreement between Credit Suisse First Boston Mortgage Securities Corp., Washington Mutual Bank F.A. and Bank One:

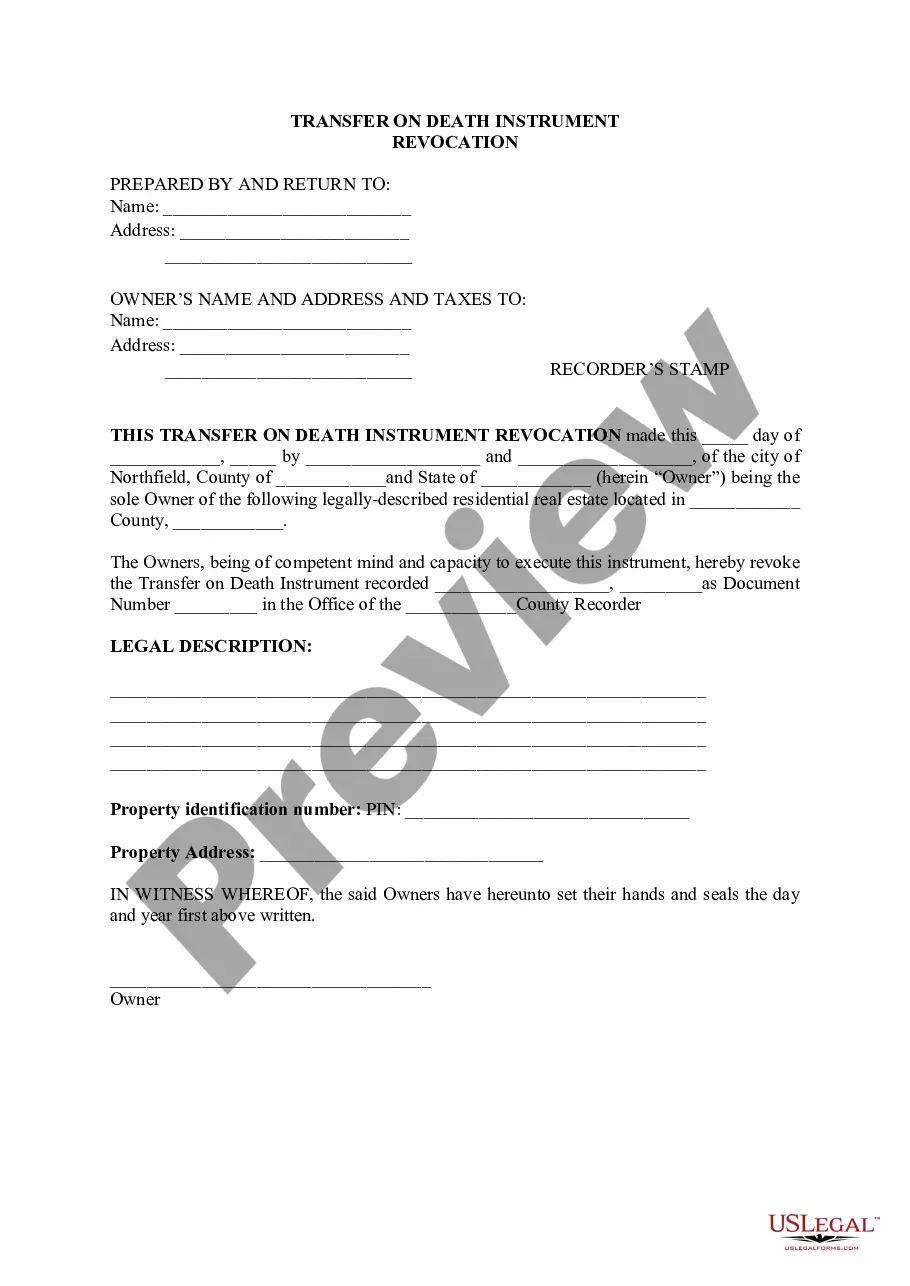

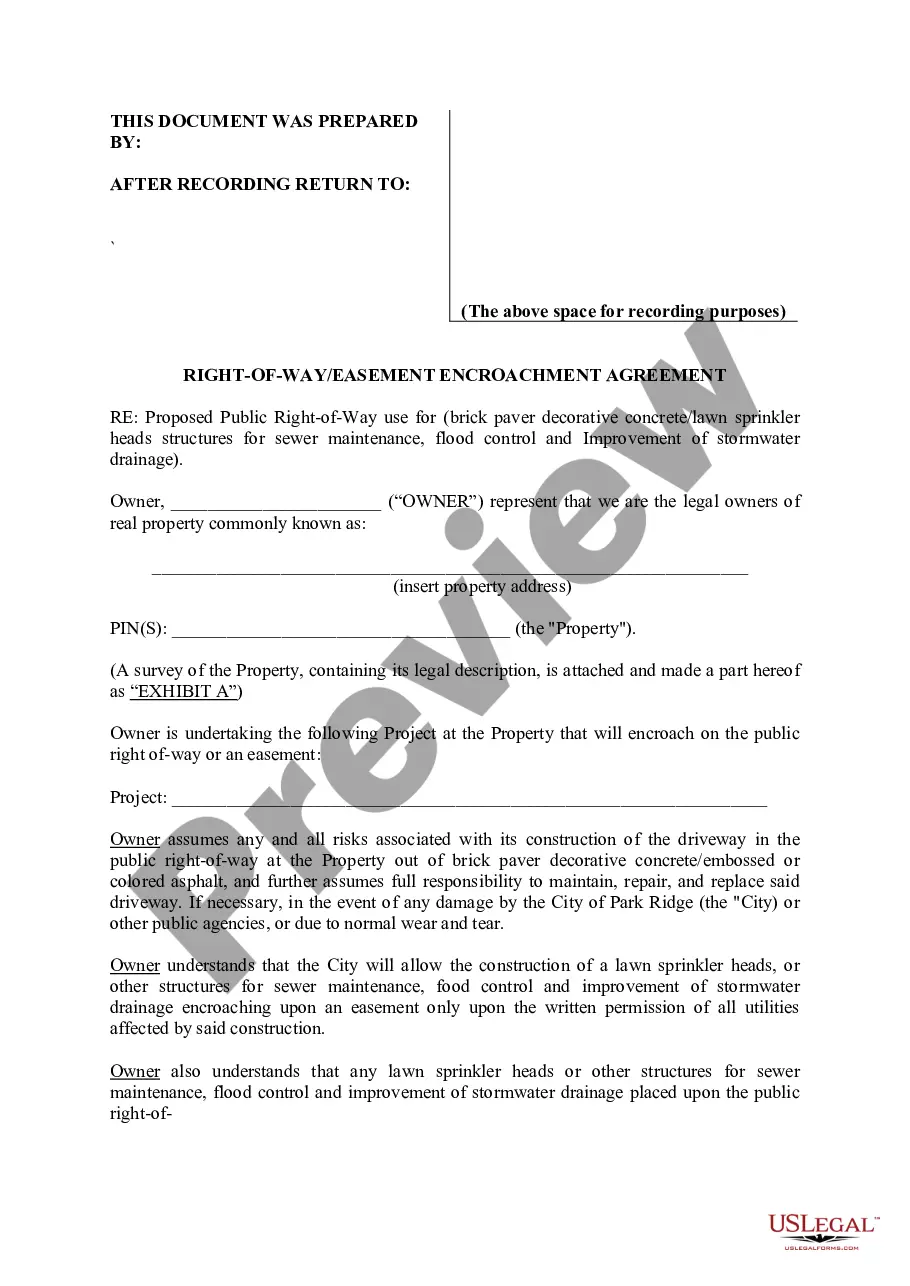

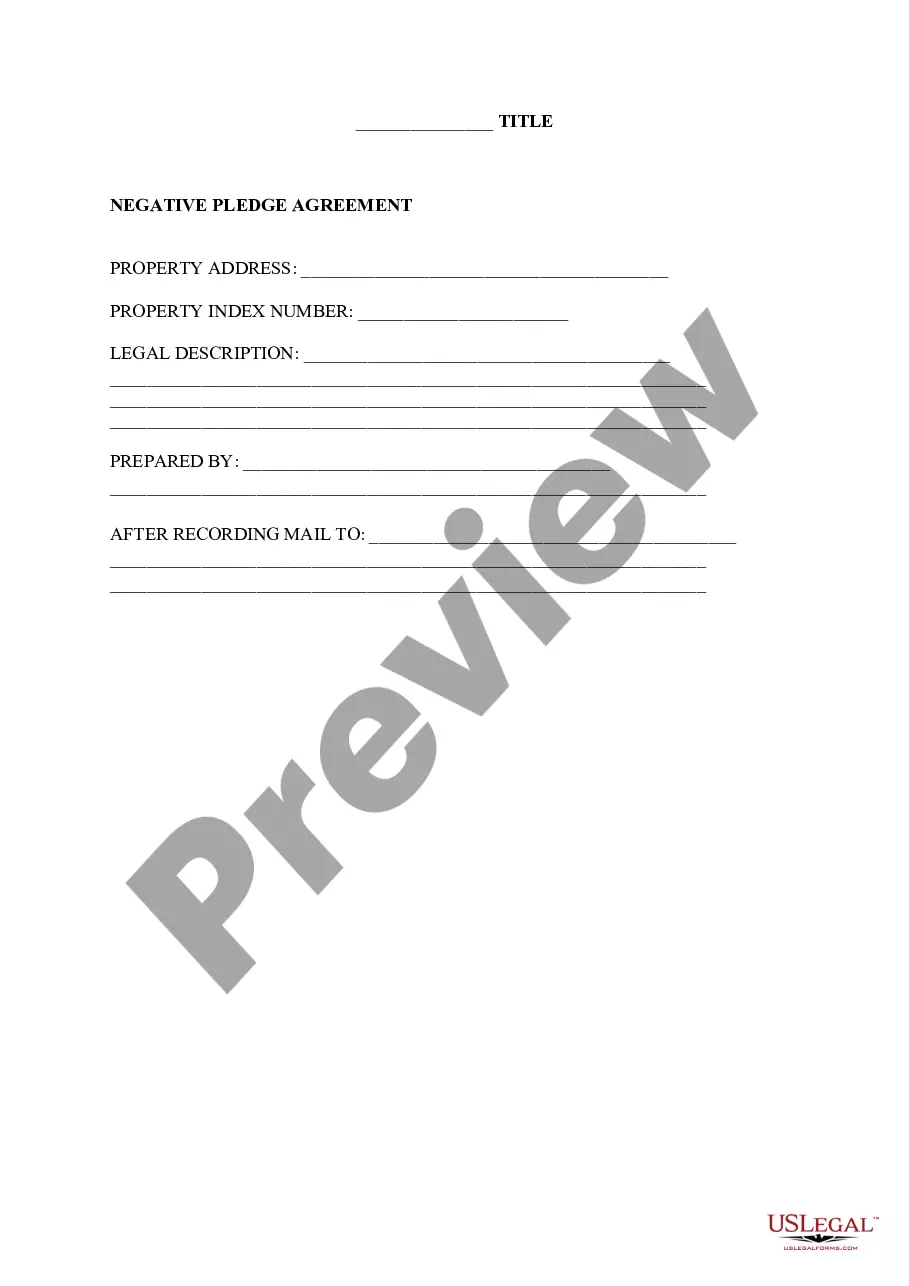

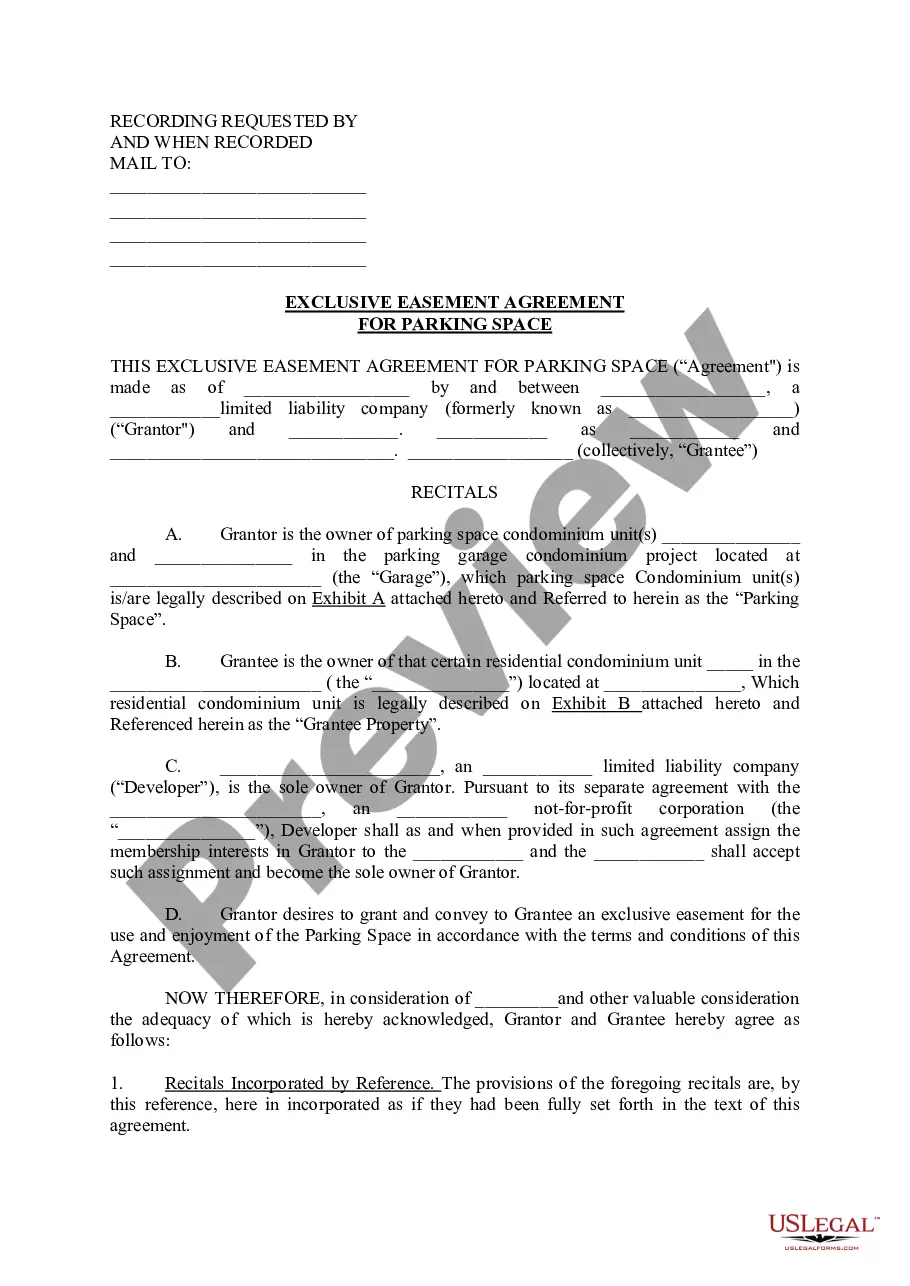

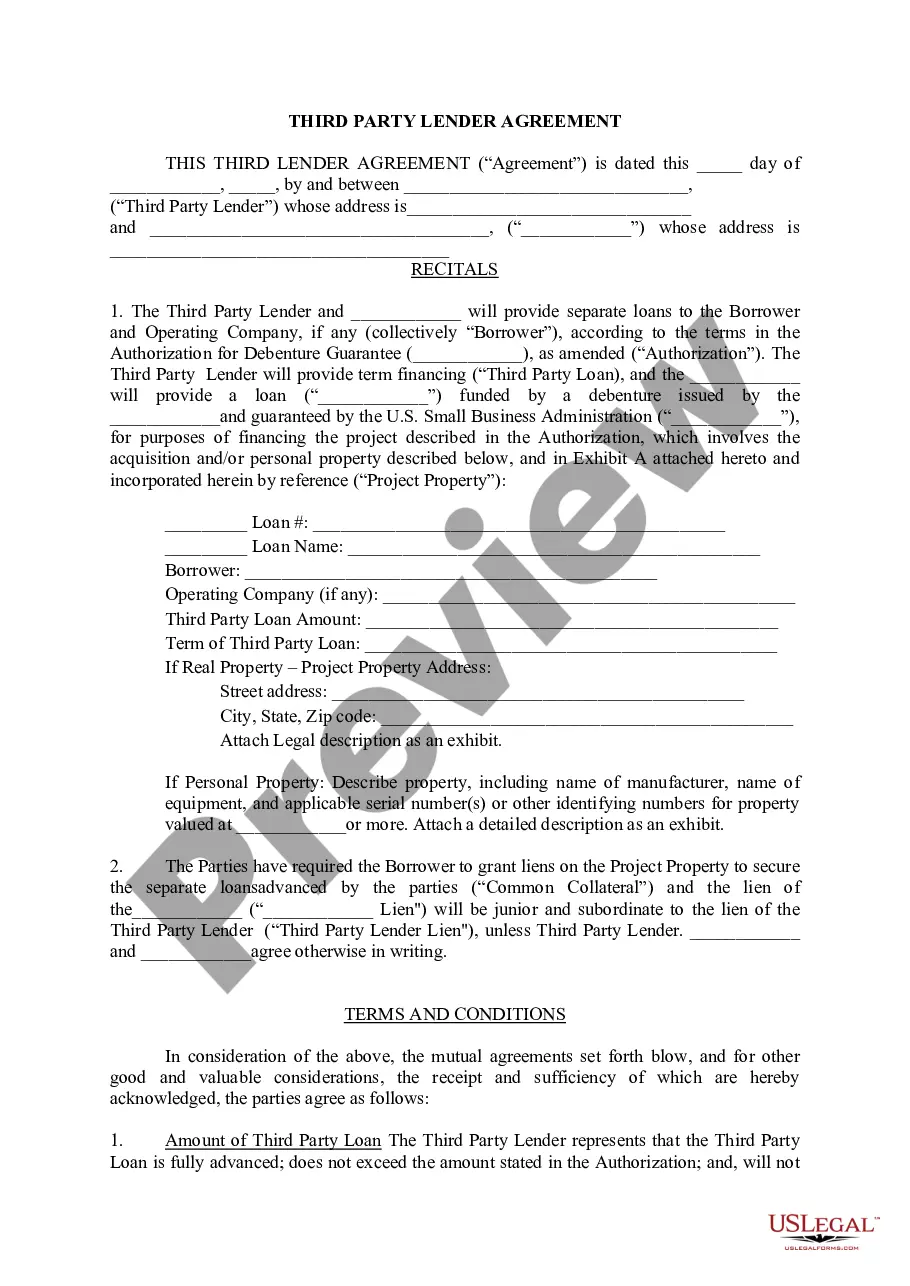

- Take a look at the page content to make sure you found the right sample.

- Utilize the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Utilize the Buy Now button to get the template once you find the proper one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Complete and sign the template on paper after printing it or do it all electronically.

That's the simplest and most cost-effective way to get up-to-date templates for any legal scenarios. Locate them all in clicks and keep your documentation in order with the US Legal Forms!