Wake North Carolina Pooling and Servicing Agreement is a legally binding contract between Credit Suisse First Boston Mortgage Securities Corp., Washington Mutual Bank F.A., and Bank One. This agreement outlines the terms and conditions under which these financial institutions collaborate to pool and service mortgage loans in the Wake County area of North Carolina. Keyword: Pooling and Servicing Agreement, Credit Suisse First Boston Mortgage Securities Corp., Washington Mutual Bank F.A., Bank One, Wake County, North Carolina This agreement serves as a mechanism for the three entities to combine their resources, expertise, and infrastructure to efficiently manage mortgage loans in Wake County. By pooling their funds, Credit Suisse First Boston Mortgage Securities Corp., Washington Mutual Bank F.A., and Bank One aim to increase liquidity and improve the overall performance of the mortgage-backed securities market. The Wake North Carolina Pooling and Servicing Agreement outlines the responsibilities and obligations of each party. Credit Suisse First Boston Mortgage Securities Corp., as the lead investor and service, takes the lead in managing the pool of mortgage loans. Washington Mutual Bank F.A. and Bank One act as investors, contributing capital to the pool. Through this agreement, the parties agree to adhere to certain eligibility criteria and loan servicing guidelines. These guidelines ensure fair and consistent practices such as proper loan documentation, timely payment collection, and borrower communication. The agreement also specifies the allocation of cash flows generated by the mortgage pool among the participating parties. In addition to the primary agreement, there might be variations or different types of Wake North Carolina Pooling and Servicing Agreements entered into by Credit Suisse First Boston Mortgage Securities Corp., Washington Mutual Bank F.A., and Bank One. These variations could include agreements tailored for specific loan types (fixed-rate, adjustable-rate, jumbo, etc.) or agreements intended for different time periods (short-term, long-term, etc.). Each variation would have its own terms and conditions based on the unique characteristics of the loans involved. Overall, the Wake North Carolina Pooling and Servicing Agreement between Credit Suisse First Boston Mortgage Securities Corp., Washington Mutual Bank F.A., and Bank One provides a framework for efficient mortgage loan pooling and servicing operations in Wake County. By collaborating under this agreement, these financial institutions can effectively manage mortgage-backed securities and contribute to the stability and growth of the local real estate market.

Wake North Carolina Pooling and Servicing Agreement between Credit Suisse First Boston Mortgage Securities Corp., Washington Mutual Bank F.A. and Bank One

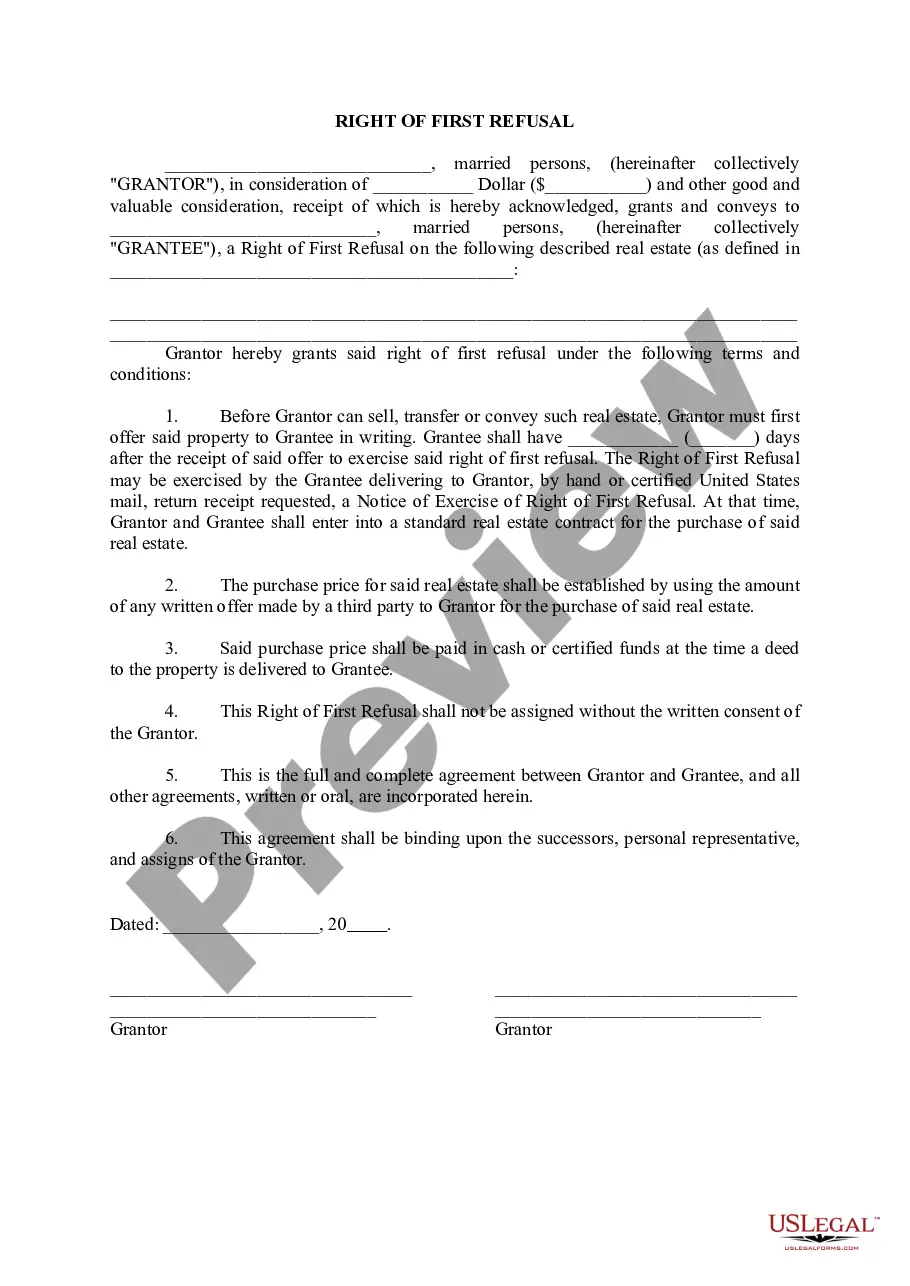

Description

How to fill out Wake North Carolina Pooling And Servicing Agreement Between Credit Suisse First Boston Mortgage Securities Corp., Washington Mutual Bank F.A. And Bank One?

Creating forms, like Wake Pooling and Servicing Agreement between Credit Suisse First Boston Mortgage Securities Corp., Washington Mutual Bank F.A. and Bank One, to manage your legal affairs is a difficult and time-consumming task. Many situations require an attorney’s participation, which also makes this task not really affordable. However, you can get your legal issues into your own hands and take care of them yourself. US Legal Forms is here to the rescue. Our website features more than 85,000 legal documents crafted for various scenarios and life circumstances. We ensure each document is in adherence with the regulations of each state, so you don’t have to be concerned about potential legal problems associated with compliance.

If you're already aware of our website and have a subscription with US, you know how effortless it is to get the Wake Pooling and Servicing Agreement between Credit Suisse First Boston Mortgage Securities Corp., Washington Mutual Bank F.A. and Bank One form. Go ahead and log in to your account, download the template, and personalize it to your requirements. Have you lost your document? No worries. You can get it in the My Forms folder in your account - on desktop or mobile.

The onboarding process of new customers is fairly easy! Here’s what you need to do before getting Wake Pooling and Servicing Agreement between Credit Suisse First Boston Mortgage Securities Corp., Washington Mutual Bank F.A. and Bank One:

- Make sure that your document is compliant with your state/county since the regulations for creating legal documents may differ from one state another.

- Discover more information about the form by previewing it or reading a brief description. If the Wake Pooling and Servicing Agreement between Credit Suisse First Boston Mortgage Securities Corp., Washington Mutual Bank F.A. and Bank One isn’t something you were hoping to find, then take advantage of the search bar in the header to find another one.

- Sign in or create an account to begin utilizing our service and download the form.

- Everything looks great on your side? Hit the Buy now button and choose the subscription plan.

- Select the payment gateway and enter your payment information.

- Your template is all set. You can try and download it.

It’s an easy task to locate and purchase the needed template with US Legal Forms. Thousands of businesses and individuals are already benefiting from our rich library. Subscribe to it now if you want to check what other perks you can get with US Legal Forms!