The Philadelphia Pennsylvania Investment Transfer Affidavit and Agreement is a legal document used in the city of Philadelphia to establish ownership and transfer of investments. It ensures that the transfer of investments complies with the applicable laws and regulations in Philadelphia. This affidavit and agreement play a crucial role in safeguarding the interests of all parties involved in the transfer process. The document outlines the specific details of the investments being transferred, including the type, value, and relevant account information. It also includes the identities of the transferor (the current owner of the investments) and the transferee (the prospective new owner). By signing the affidavit and agreement, both parties acknowledge their understanding of the terms and conditions of the transfer. This agreement serves as a legally binding contract that protects the parties while facilitating the smooth transfer of investments. There might be various types of investment transfer affidavits and agreements in Philadelphia, depending on the specific nature of the investments being transferred. Some common types include: 1. Stock Investment Transfer Affidavit and Agreement: This document is used when transferring ownership of stocks or shares in a company. It encompasses details such as the number of shares being transferred, the stock symbol(s), and relevant account information. 2. Real Estate Investment Transfer Affidavit and Agreement: In cases where real estate investments are being transferred, this type of affidavit and agreement is utilized. It includes information about the property, its address, legal description, and any associated mortgages or liens. 3. Mutual Fund Investment Transfer Affidavit and Agreement: This document is relevant for transferring ownership of mutual fund investments. It includes details of the mutual fund company, the specific funds being transferred, and any relevant account information. Regardless of the specific type, the Philadelphia Pennsylvania Investment Transfer Affidavit and Agreement provide a clear framework for the legal and proper transfer of investments in the city. It ensures that the process is conducted transparently and in accordance with the laws governing investment transfers in Philadelphia.

Philadelphia Pennsylvania Investment Transfer Affidavit and Agreement

Description

How to fill out Philadelphia Pennsylvania Investment Transfer Affidavit And Agreement?

Creating legal forms is a must in today's world. Nevertheless, you don't always need to seek professional help to create some of them from the ground up, including Philadelphia Investment Transfer Affidavit and Agreement, with a service like US Legal Forms.

US Legal Forms has more than 85,000 forms to pick from in various categories varying from living wills to real estate paperwork to divorce papers. All forms are arranged based on their valid state, making the searching experience less overwhelming. You can also find information resources and guides on the website to make any activities related to paperwork completion straightforward.

Here's how you can purchase and download Philadelphia Investment Transfer Affidavit and Agreement.

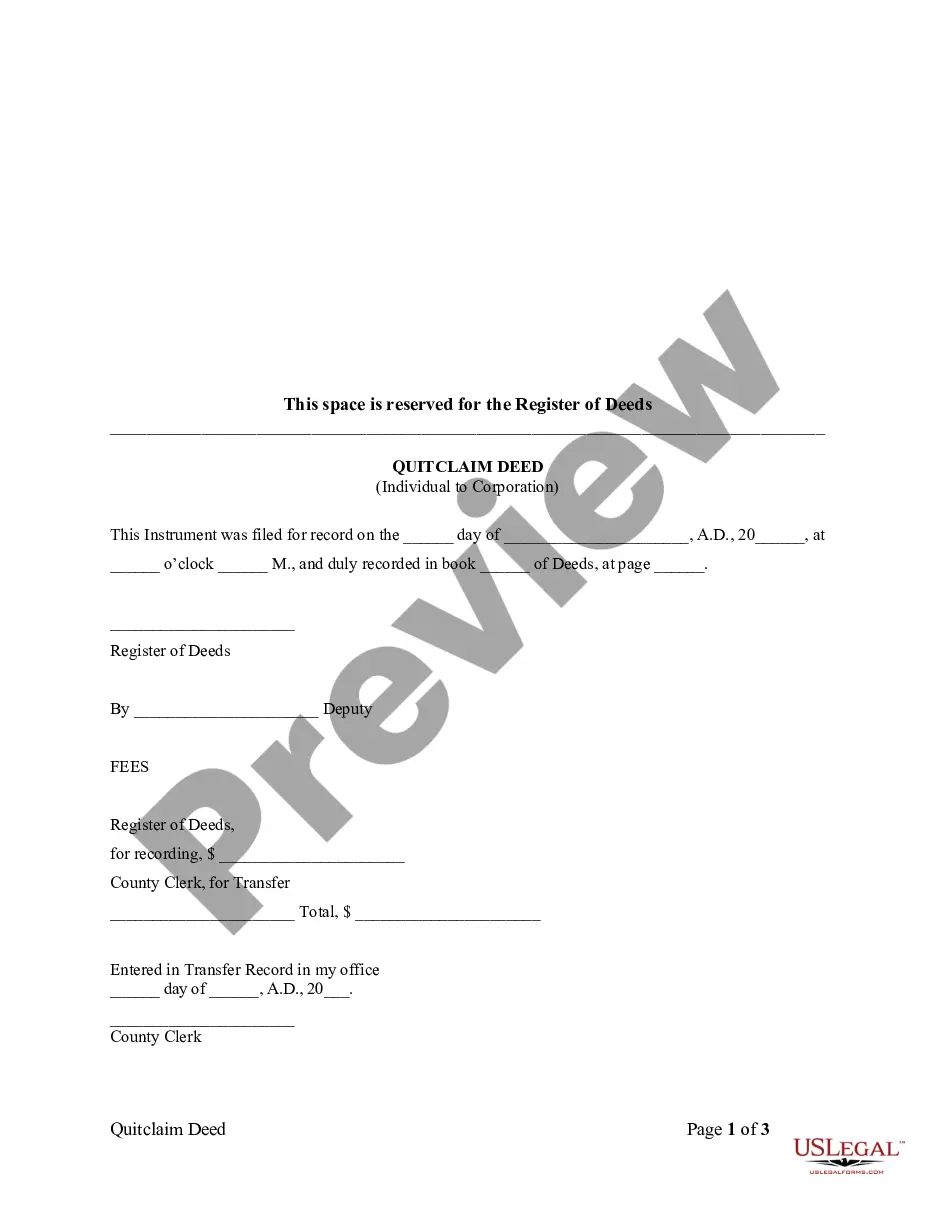

- Go over the document's preview and outline (if provided) to get a general idea of what you’ll get after downloading the form.

- Ensure that the document of your choice is adapted to your state/county/area since state regulations can affect the validity of some documents.

- Check the related document templates or start the search over to locate the right file.

- Click Buy now and create your account. If you already have an existing one, select to log in.

- Choose the option, then a needed payment method, and buy Philadelphia Investment Transfer Affidavit and Agreement.

- Choose to save the form template in any offered format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can locate the needed Philadelphia Investment Transfer Affidavit and Agreement, log in to your account, and download it. Needless to say, our platform can’t take the place of an attorney entirely. If you need to deal with an exceptionally challenging case, we advise getting a lawyer to review your form before executing and submitting it.

With more than 25 years on the market, US Legal Forms became a go-to platform for various legal forms for millions of customers. Become one of them today and get your state-specific documents with ease!

Form popularity

FAQ

To add, remove, or change a name on a deed, have a lawyer, title company, or other real estate professional prepare the deed. Then, record the new deed with the Department of Records. Note: We recommend that you do not prepare a deed on your own. We also recommend that you get title insurance.

Philadelphia and Montgomery County, PA accept electronic recording. Documents submitted for electronic recording are typically received back recorded within 1-2 days after submission. Counties that do not record electronically, such as Delaware and Chester County, PA, take 3-4 weeks to return recorded documents.

The State of Pennsylvania charges 1% of the sales price and the municipality and school district USUALLY charge 1% between them for a total of 2% (i.e. 2% X 100,000 = $2,000). By custom, the buyer and seller split the cost. 1% to buyer, 1% to seller; however payment is dictated by the sales contract.

Realty Transfer Tax The Commonwealth of Pennsylvania collects 1% while the City of Philadelphia collects 3.278% for a total of 4.278%. Luckily, it is customary (but not legally required) for the buyer and seller to split the transfer taxes evenly. In most cases, the buyer will pay 2.139% and the seller will pay 2.139%.

Transfer of property in relation to Property Settlement Agreement or Divorce Decree. deeds@phillydeeds.com. e090 Phone: (215) 989-4530. e103 Fax: (215) 701-9186.

Currently, the fee for filing the deed, which distributes the house from your Mother's estate into your own name, is $252.00. This amount is comprised of: $107 (Filing Fee), $107 (Philadelphia Housing Trust Fee), $. 50 (State Writ Tax), $2.00 (Philadelphia County Fee) and $35.50 (Access to Justice Fee).

To transfer property in Pennsylvania, you'll need to prepare and execute a deed and record it in the county where the property is located. If the transfer was in exchange for money, you'll have to pay transfer tax.

Our regular service will file your deed with any Pennsylvania county within 10 business days. Please check with us as many counties have COVID-related delays. Need it FAST? Your deed transfer will be filed the NEXT business day upon receipt of notarized deed if you choose our expedited service for an additional $300.