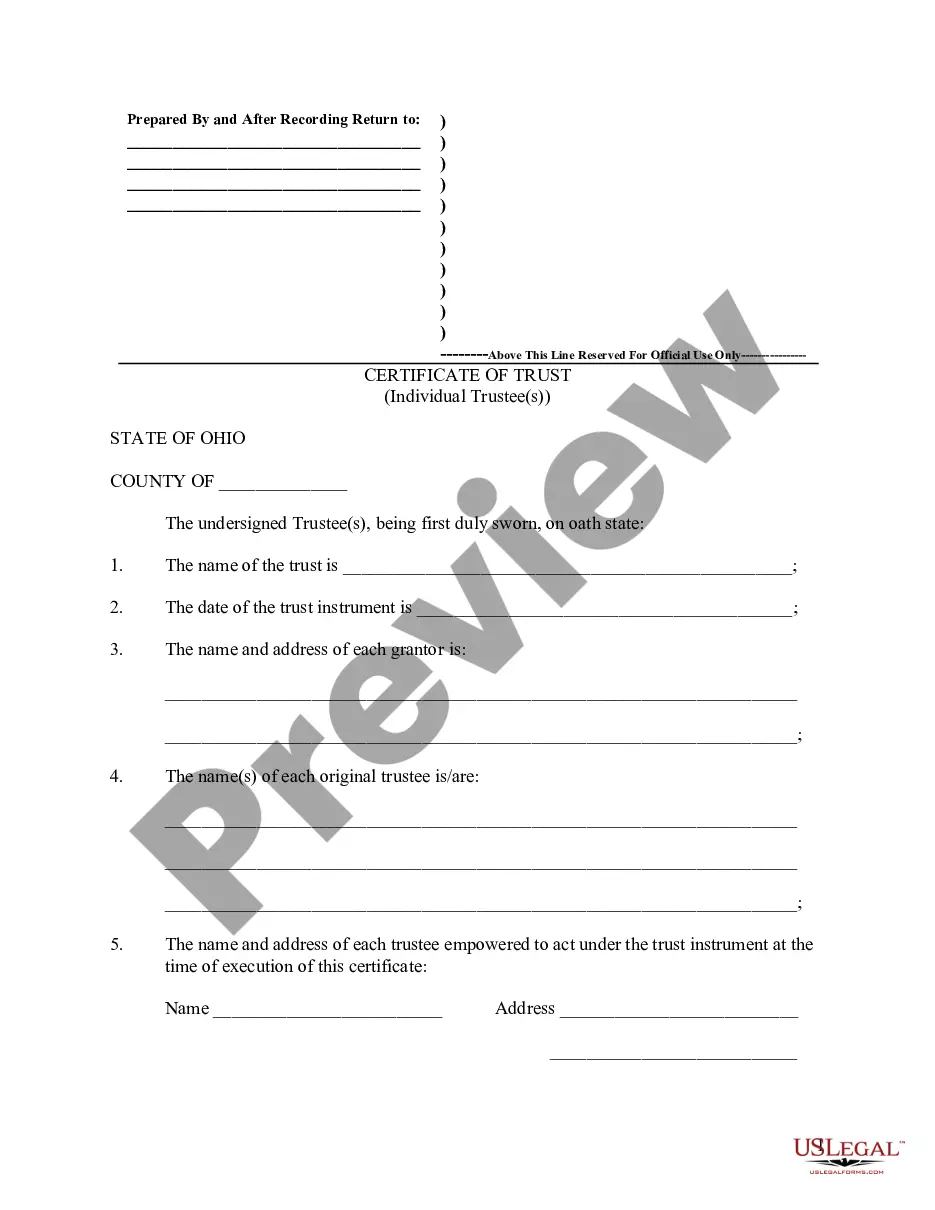

A Santa Clara California Granter Trust Agreement is a legal document that outlines the terms and conditions of an agreement between three entities: Credit Suisse First Boston Mortgage Securities Corp., Washington Mutual Bank FA, and Bank One, National Assoc. This agreement sets forth the rights, responsibilities, and obligations of each party involved. This particular type of granter trust agreement is commonly used in the financial industry and is designed to facilitate the transfer and management of assets such as mortgages, loans, or other financial instruments. It is often employed when banks or financial institutions want to separate and secure assets within a trust structure to mitigate risk or achieve specific financial objectives. The Santa Clara California Granter Trust Agreement between Credit Suisse First Boston Mortgage Securities Corp., Washington Mutual Bank FA, and Bank One, National Assoc., may come in various forms depending on the specific purpose or assets involved. Some of these variations may include: 1. Mortgage-backed Securities Trust Agreement: This type of agreement could pertain to the securitization of mortgage-backed securities, allowing the three entities to pool a portfolio of mortgage loans and subsequently issue securities to investors backed by these loan assets. 2. Collateralized Loan Obligation Trust Agreement: In this case, the agreement may involve the creation of a trust that holds a pool of loans, typically corporate or consumer loans, as collateral. The trust can then issue bonds or securities based on the underlying loan assets to investors. 3. Asset-Backed Security Trust Agreement: This agreement could involve the transfer and pooling of various types of financial assets, such as auto loans, credit card receivables, or student loans. The trust created would then issue securities backed by these assets to investors. 4. Residential Mortgage Loan Trust Agreement: This type of agreement may be specific to mortgage loans secured by residential properties. It allows the participating entities to transfer these loans into a trust, which then issues mortgage-backed securities based on the bundled residential mortgage loans. These are just a few examples of the potential types of Santa Clara California Granter Trust Agreements between Credit Suisse First Boston Mortgage Securities Corp., Washington Mutual Bank FA, and Bank One, National Assoc. Each agreement would have its own unique terms and conditions, outlining the specific assets, parties involved, and goals of the trust arrangement. It is essential for all parties entering into a trust agreement of this nature to consult legal professionals experienced in financial and trust law to ensure compliance with applicable regulations and to protect the rights and interests of all involved parties.

Santa Clara California Grantor Trust Agreement between Credit Suisse First Boston Mortgage Securities Corp., Washington Mutual Bank FA and Bank One, National Assoc.

Description

How to fill out Santa Clara California Grantor Trust Agreement Between Credit Suisse First Boston Mortgage Securities Corp., Washington Mutual Bank FA And Bank One, National Assoc.?

Preparing legal documentation can be burdensome. Besides, if you decide to ask a lawyer to write a commercial contract, documents for ownership transfer, pre-marital agreement, divorce paperwork, or the Santa Clara Grantor Trust Agreement between Credit Suisse First Boston Mortgage Securities Corp., Washington Mutual Bank FA and Bank One, National Assoc., it may cost you a fortune. So what is the best way to save time and money and draft legitimate forms in total compliance with your state and local laws and regulations? US Legal Forms is a great solution, whether you're searching for templates for your personal or business needs.

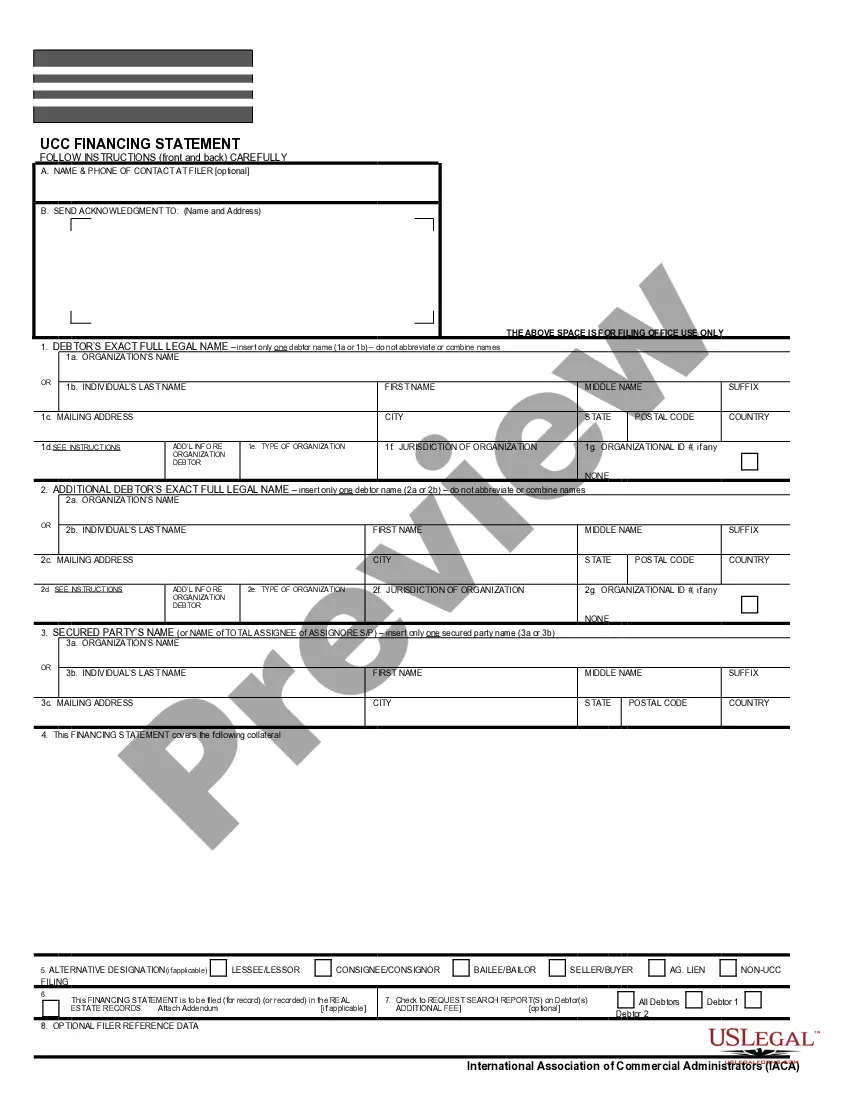

US Legal Forms is the most extensive online collection of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any scenario accumulated all in one place. Therefore, if you need the recent version of the Santa Clara Grantor Trust Agreement between Credit Suisse First Boston Mortgage Securities Corp., Washington Mutual Bank FA and Bank One, National Assoc., you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample using the Download button. If you haven't subscribed yet, here's how you can get the Santa Clara Grantor Trust Agreement between Credit Suisse First Boston Mortgage Securities Corp., Washington Mutual Bank FA and Bank One, National Assoc.:

- Look through the page and verify there is a sample for your region.

- Examine the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - look for the correct one in the header.

- Click Buy Now once you find the needed sample and select the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a payment with a credit card or through PayPal.

- Choose the document format for your Santa Clara Grantor Trust Agreement between Credit Suisse First Boston Mortgage Securities Corp., Washington Mutual Bank FA and Bank One, National Assoc. and save it.

Once done, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more practical fill-out. US Legal Forms enables you to use all the documents ever obtained many times - you can find your templates in the My Forms tab in your profile. Give it a try now!