The Oakland Michigan Master Agreement between Credit Suisse Financial Products and Bank One National Association is a comprehensive legal document that outlines the terms and conditions governing various financial transactions and business dealings between the two entities. This agreement serves as a foundational document for their ongoing relationship and establishes a framework for conducting business in a mutually beneficial and legally binding manner. The agreement covers a wide range of aspects, including but not limited to, financial transactions, risk management, regulatory compliance, dispute resolution, and confidentiality. It sets out the roles and responsibilities of both parties, ensuring a clear understanding of each party's obligations and facilitating smooth coordination of operations. Within the Oakland Michigan Master Agreement, there may be different variations or types tailored to specific financial products and services provided by Credit Suisse Financial Products and Bank One National Association. These variations may include: 1. Securities Trading Agreement: This type of agreement focuses on transactions involving securities, such as stocks, bonds, and derivatives. It outlines the specific terms and conditions applicable to the buying, selling, and trading of these securities, including pricing mechanisms, settlement periods, and transactional documentation requirements. 2. Hedging Agreement: This agreement type pertains to risk management strategies, primarily aimed at mitigating the exposure to adverse market movements. It outlines how Credit Suisse Financial Products and Bank One National Association will collaborate to hedge against potential risks using various financial instruments and techniques, such as options, futures contracts, or swaps. 3. Financing Agreement: In case Bank One National Association requires financing to support its operations, this agreement defines the terms and conditions under which Credit Suisse Financial Products will provide loans or credit facilities. It covers interest rates, repayment schedules, collateral requirements, and any associated fees or charges. 4. Structured Product Agreement: This type of agreement deals with structuring and offering complex financial products that combine multiple securities or derivative instruments. It outlines the specific terms related to these products, such as payment obligations, valuation methods, and any special features or conditions that govern their performance. It is important to note that the specific variations of the Oakland Michigan Master Agreement can vary based on the needs, preferences, and applicable regulations of both Credit Suisse Financial Products and Bank One National Association. These agreements are typically prepared by legal teams from both parties, who work closely to tailor the content to the specific requirements of each transaction or business activity.

Oakland Michigan Master Agreement between Credit Suisse Financial Products and Bank One National Association

Description

How to fill out Oakland Michigan Master Agreement Between Credit Suisse Financial Products And Bank One National Association?

Drafting documents for the business or individual demands is always a big responsibility. When creating an agreement, a public service request, or a power of attorney, it's important to take into account all federal and state regulations of the specific region. However, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it tense and time-consuming to create Oakland Master Agreement between Credit Suisse Financial Products and Bank One National Association without expert assistance.

It's possible to avoid spending money on attorneys drafting your documentation and create a legally valid Oakland Master Agreement between Credit Suisse Financial Products and Bank One National Association by yourself, using the US Legal Forms online library. It is the largest online catalog of state-specific legal documents that are professionally cheched, so you can be certain of their validity when choosing a sample for your county. Earlier subscribed users only need to log in to their accounts to download the needed document.

If you still don't have a subscription, adhere to the step-by-step guideline below to obtain the Oakland Master Agreement between Credit Suisse Financial Products and Bank One National Association:

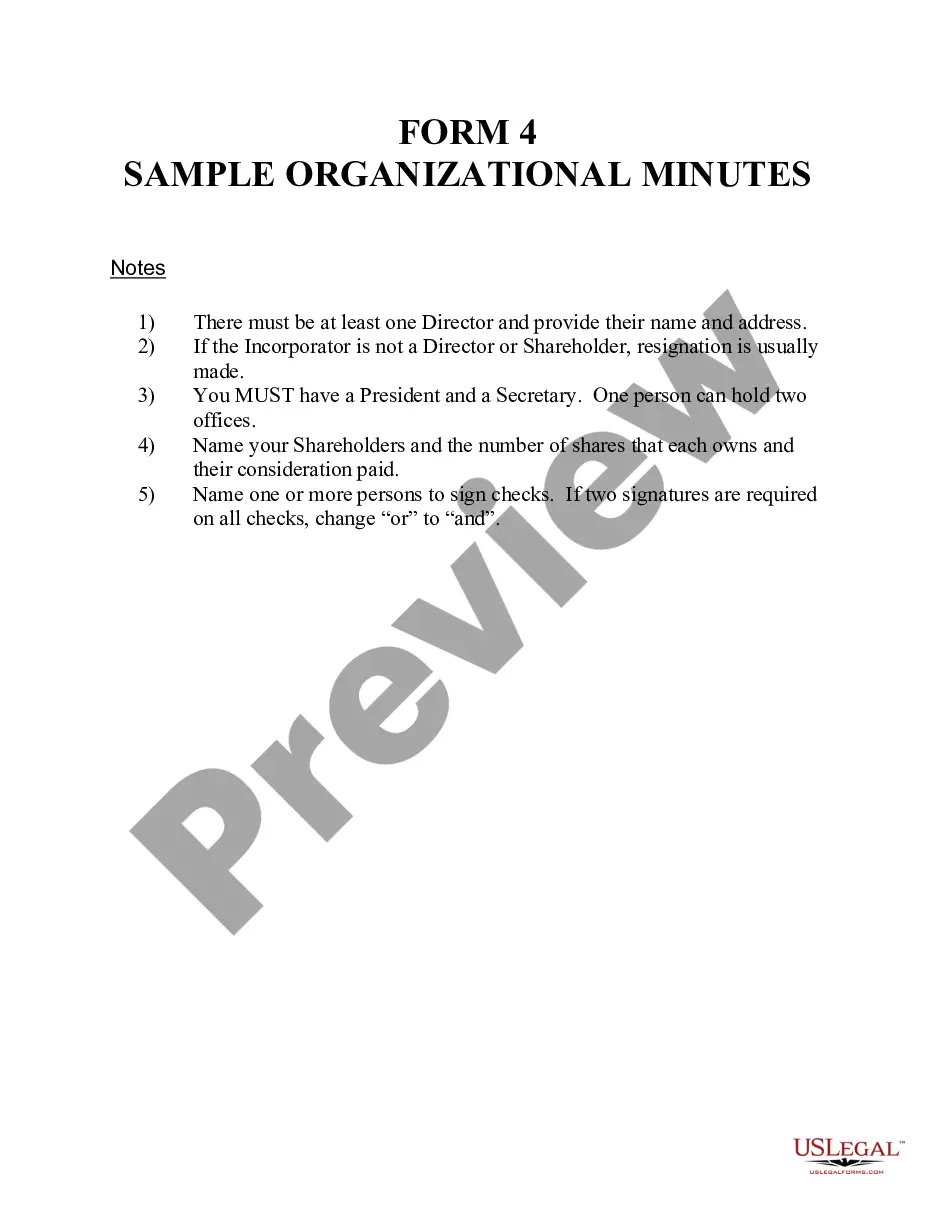

- Look through the page you've opened and verify if it has the document you require.

- To do so, use the form description and preview if these options are presented.

- To find the one that fits your requirements, utilize the search tab in the page header.

- Recheck that the sample complies with juridical standards and click Buy Now.

- Opt for the subscription plan, then log in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever acquired never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and easily get verified legal forms for any scenario with just a couple of clicks!