The Orange California Master Agreement is a legally binding document that governs the relationship between Credit Suisse Financial Products (CSF) and Bank One National Association. This agreement outlines the terms and conditions under which both parties engage in financial transactions and other related activities in Orange, California. The Orange California Master Agreement is structured to accommodate different types of arrangements and services depending on the specific needs and objectives of CSF and Bank One National Association. Some key types of agreements within this framework include: 1. Orange California Master Agreement for Derivative Transactions: This type of agreement focuses on the trading of financial derivatives, such as options, futures, and swaps, between CSF and Bank One National Association. It outlines the terms for pricing, settlement, and other important considerations in these transactions. 2. Orange California Master Agreement for Security-Based Lending: In this agreement, CSF provides Bank One National Association with securities on a lending basis. The terms will include details of the collateral, interest rates, margin requirements, and loan duration. 3. Orange California Master Agreement for Foreign Exchange Transactions: This agreement pertains to the exchange of different foreign currencies between CSF and Bank One National Association. It specifies the terms for currency conversion, exchange rates, payment dates, and any associated fees. 4. Orange California Master Agreement for Structured Products: This agreement focuses on structured financial products, such as structured notes or certificates of deposit, offered by CSF to Bank One National Association. It outlines the terms and conditions of these products, including their features, maturity dates, and associated risks. 5. Orange California Master Agreement for Prime Brokerage Services: This type of agreement outlines the terms and conditions for prime brokerage services provided by CSF to Bank One National Association. It covers a range of services, including securities lending, margin trading, cash management, and settlement processing. In summary, the Orange California Master Agreement between Credit Suisse Financial Products and Bank One National Association encompasses various types of agreements, such as those related to derivative transactions, security-based lending, foreign exchange transactions, structured products, and prime brokerage services. By meticulously defining the terms and conditions, these agreements facilitate a clear and structured relationship between the parties involved.

Orange California Master Agreement between Credit Suisse Financial Products and Bank One National Association

Description

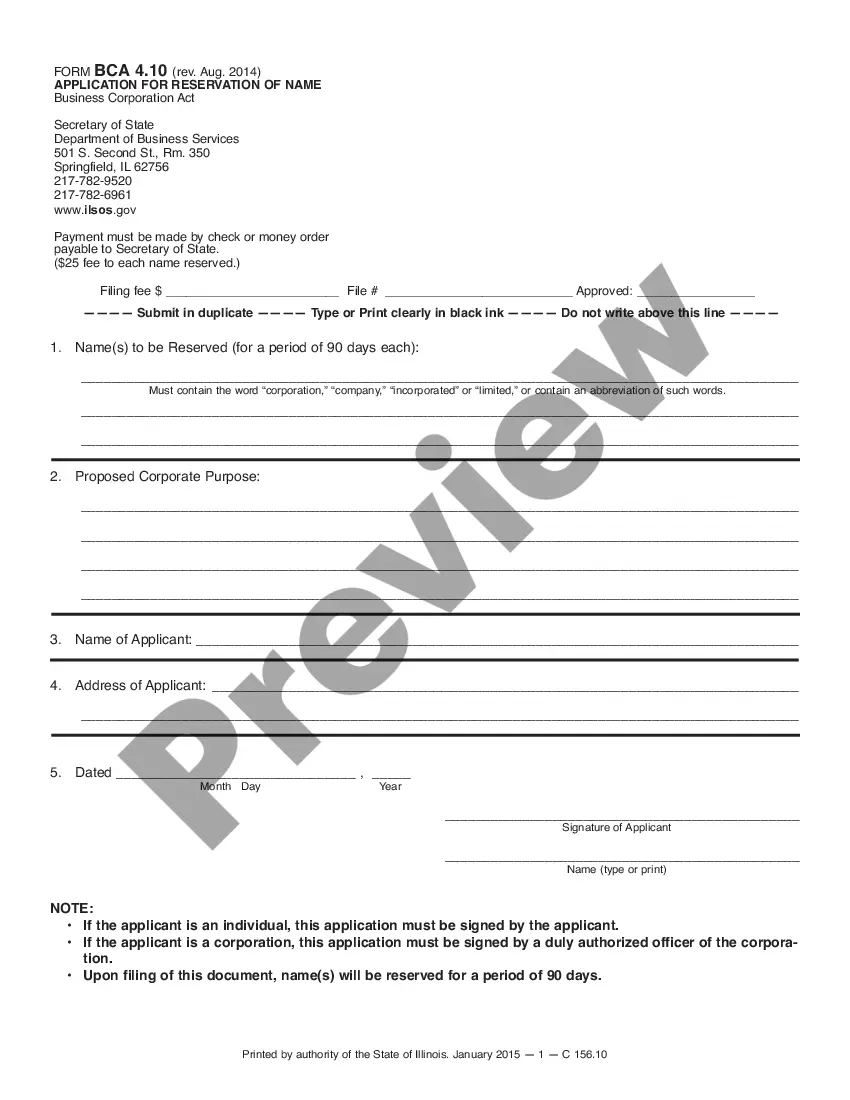

How to fill out Orange California Master Agreement Between Credit Suisse Financial Products And Bank One National Association?

Preparing legal paperwork can be burdensome. Besides, if you decide to ask a legal professional to draft a commercial agreement, documents for proprietorship transfer, pre-marital agreement, divorce papers, or the Orange Master Agreement between Credit Suisse Financial Products and Bank One National Association, it may cost you a lot of money. So what is the most reasonable way to save time and money and create legitimate forms in total compliance with your state and local laws and regulations? US Legal Forms is an excellent solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is biggest online library of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any use case collected all in one place. Consequently, if you need the latest version of the Orange Master Agreement between Credit Suisse Financial Products and Bank One National Association, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample with the Download button. If you haven't subscribed yet, here's how you can get the Orange Master Agreement between Credit Suisse Financial Products and Bank One National Association:

- Glance through the page and verify there is a sample for your area.

- Check the form description and use the Preview option, if available, to make sure it's the sample you need.

- Don't worry if the form doesn't suit your requirements - look for the right one in the header.

- Click Buy Now when you find the needed sample and select the best suitable subscription.

- Log in or register for an account to pay for your subscription.

- Make a payment with a credit card or via PayPal.

- Choose the document format for your Orange Master Agreement between Credit Suisse Financial Products and Bank One National Association and download it.

Once done, you can print it out and complete it on paper or upload the template to an online editor for a faster and more practical fill-out. US Legal Forms enables you to use all the paperwork ever acquired multiple times - you can find your templates in the My Forms tab in your profile. Give it a try now!