Bronx, New York, is a vibrant borough located in New York City. It is home to a diverse population and offers a rich cultural heritage, exciting attractions, and a thriving business community. One notable aspect of the borough's business landscape includes the Nonqualified Stock Option Agreement offered by N(2)H(2), Inc. Let's explore the details of this agreement and outline its possible variations. A Nonqualified Stock Option Agreement is a contract between an employer, N(2)H(2), Inc. in this case, and an employee or certain individuals associated with the company. It grants the recipient the right to purchase a specific number of shares of the company's stock at a predetermined price over a particular period of time. This type of agreement is commonly used to provide employees with an additional incentive to contribute to the company's growth and success. Variations of the Bronx, New York Nonqualified Stock Option Agreement of N(2)H(2), Inc. may include different terms and conditions tailored to the needs of the company and the employees. These may include: 1. Standard Nonqualified Stock Option Agreement: This agreement outlines the general terms, such as the exercise price, vesting schedule, and expiration date. It sets a framework that is typically applied to most employees. 2. Executive Nonqualified Stock Option Agreement: This type of agreement is specifically designed for top-level executives within the company. It may include additional provisions, such as accelerated vesting or higher exercise prices, to attract and retain key talent. 3. Employee Incentive Nonqualified Stock Option Agreement: Employers may offer this agreement to employees as part of their compensation package or as a means to reward outstanding performance. It can serve as a valuable tool to motivate employees and align their interests with the company's growth. 4. Restricted Stock Unit (RSU) Nonqualified Stock Option Agreement: Instead of traditional stock options, this agreement grants employees a certain number of RSS that convert into stock after a predetermined vesting period. RSS may have different tax implications compared to regular stock options. When entering into a Bronx, New York Nonqualified Stock Option Agreement of N(2)H(2), Inc., it is crucial for both the employer and the recipient to thoroughly review the terms and seek professional advice if necessary. This ensures a transparent and mutually beneficial arrangement that can foster a positive work environment and drive the company's performance.

Bronx New York Nonqualified Stock Option Agreement of N(2)H(2), Inc.

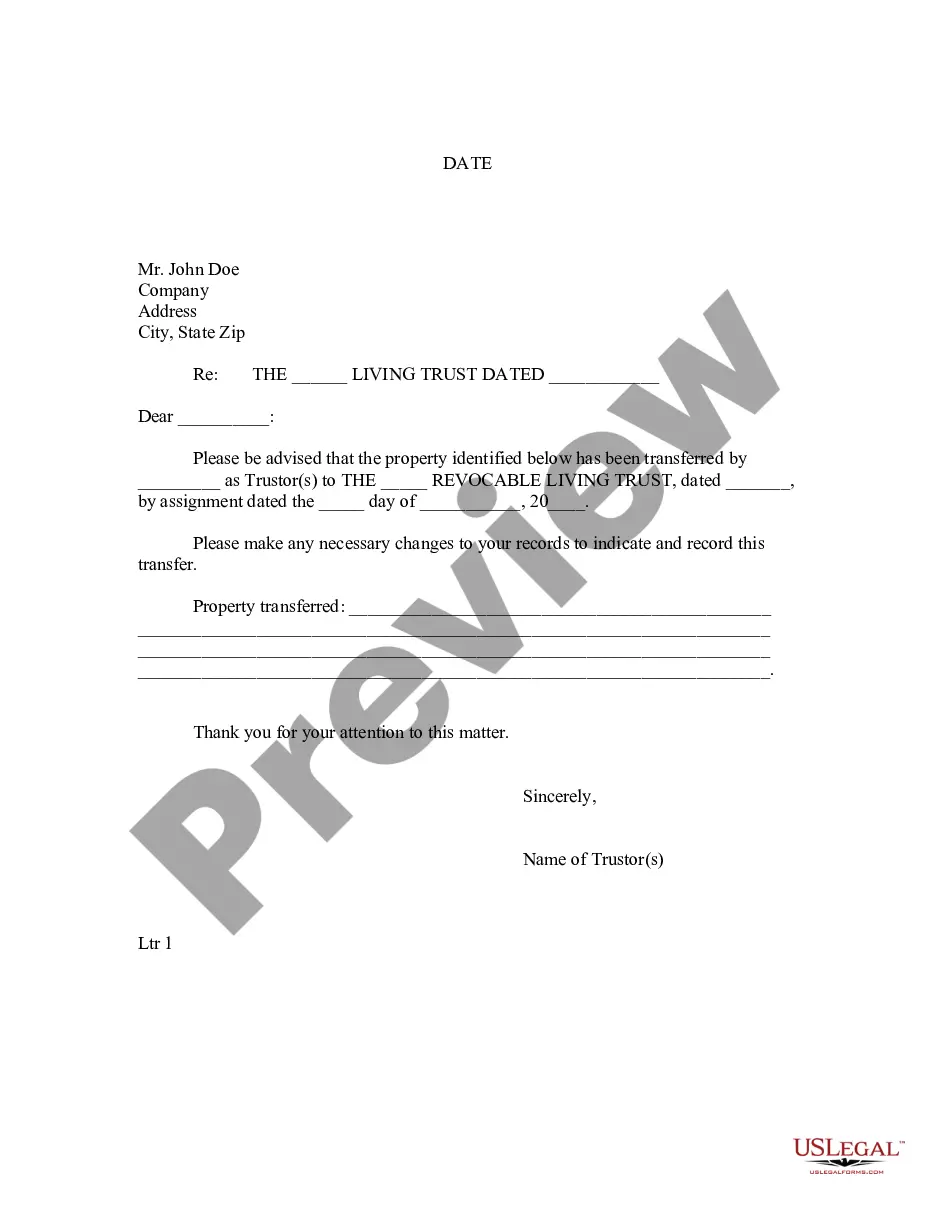

Description

How to fill out Bronx New York Nonqualified Stock Option Agreement Of N(2)H(2), Inc.?

Drafting documents for the business or personal demands is always a huge responsibility. When creating a contract, a public service request, or a power of attorney, it's essential to take into account all federal and state laws of the specific region. However, small counties and even cities also have legislative provisions that you need to consider. All these details make it tense and time-consuming to create Bronx Nonqualified Stock Option Agreement of N(2)H(2), Inc. without professional assistance.

It's possible to avoid wasting money on lawyers drafting your documentation and create a legally valid Bronx Nonqualified Stock Option Agreement of N(2)H(2), Inc. by yourself, using the US Legal Forms web library. It is the greatest online collection of state-specific legal templates that are professionally verified, so you can be sure of their validity when picking a sample for your county. Earlier subscribed users only need to log in to their accounts to download the required document.

In case you still don't have a subscription, adhere to the step-by-step guide below to obtain the Bronx Nonqualified Stock Option Agreement of N(2)H(2), Inc.:

- Look through the page you've opened and verify if it has the sample you need.

- To accomplish this, use the form description and preview if these options are presented.

- To locate the one that meets your needs, utilize the search tab in the page header.

- Double-check that the template complies with juridical standards and click Buy Now.

- Select the subscription plan, then log in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever acquired never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and easily get verified legal templates for any use case with just a few clicks!