A Salt Lake Utah Stockholders Agreement is a legally binding document that outlines the rights and responsibilities of the shareholders involved in the agreement. In this particular agreement between Schick Technologies, Inc. and its shareholders David Schick and Allen Schick, as well as Grey stone Funding Corp, the agreement focuses on various aspects such as ownership rights, decision-making processes, and potential disputes. The agreement begins by defining the parties involved and establishing their roles within the company. Schick Technologies, Inc. is the primary company in which David Schick and Allen Schick are shareholders, while Grey stone Funding Corp is another shareholder potentially involved in the agreement. Ownership rights are a crucial aspect of the Stockholders Agreement. This section clarifies the number and type of shares each shareholder holds, as well as limitations, if any, on transferring or selling the shares. It will also discuss any specific arrangements related to the voting rights attached to those shares. The decision-making processes and corporate governance are also addressed in the agreement. It may specify how key decisions are made, such as the appointment of directors or approval of major corporate actions. Additionally, it might outline the roles and responsibilities of each shareholder, including any special designations or rights afforded to them. To handle potential disputes, the agreement typically includes provisions for dispute resolution and mechanisms for settling conflicts. This may involve mandatory mediation or arbitration to avoid costly litigation and maintain amicable relations between the shareholders. Additionally, the Stockholders Agreement may outline any specific financial obligations or rights of the shareholders. This can include matters such as dividend distributions, capital contributions, or procedures for accessing company financial records. Sometimes, there can be variations or different types of Stockholders Agreements. For example, a Stock Purchase Agreement might focus on the sale or purchase of shares between the shareholders, while a Voting Agreement might center around voting decisions and agreements between the shareholders. These agreements serve to address specific aspects or situations that may arise within the broader framework of the overall Stockholders Agreement. In conclusion, a Salt Lake Utah Stockholders Agreement between Schick Technologies, Inc., David Schick, Allen Schick, and Grey stone Funding Corp is a comprehensive document that governs the rights and obligations of shareholders in their respective roles within the company. It outlines ownership rights, decision-making processes, dispute resolution mechanisms, and other relevant financial considerations. Different types of Stockholders Agreements may exist, each focusing on specific aspects or circumstances of the overall agreement.

Salt Lake Utah Stockholders Agreement between Schick Technologies, Inc., David Schick, Allen Schick, and Greystone Funding Corp

Description

How to fill out Salt Lake Utah Stockholders Agreement Between Schick Technologies, Inc., David Schick, Allen Schick, And Greystone Funding Corp?

Laws and regulations in every area vary from state to state. If you're not an attorney, it's easy to get lost in countless norms when it comes to drafting legal documentation. To avoid costly legal assistance when preparing the Salt Lake Stockholders Agreement between Schick Technologies, Inc., David Schick, Allen Schick, and Greystone Funding Corp, you need a verified template valid for your region. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions online collection of more than 85,000 state-specific legal templates. It's a perfect solution for specialists and individuals looking for do-it-yourself templates for various life and business situations. All the documents can be used multiple times: once you obtain a sample, it remains available in your profile for subsequent use. Thus, if you have an account with a valid subscription, you can simply log in and re-download the Salt Lake Stockholders Agreement between Schick Technologies, Inc., David Schick, Allen Schick, and Greystone Funding Corp from the My Forms tab.

For new users, it's necessary to make some more steps to obtain the Salt Lake Stockholders Agreement between Schick Technologies, Inc., David Schick, Allen Schick, and Greystone Funding Corp:

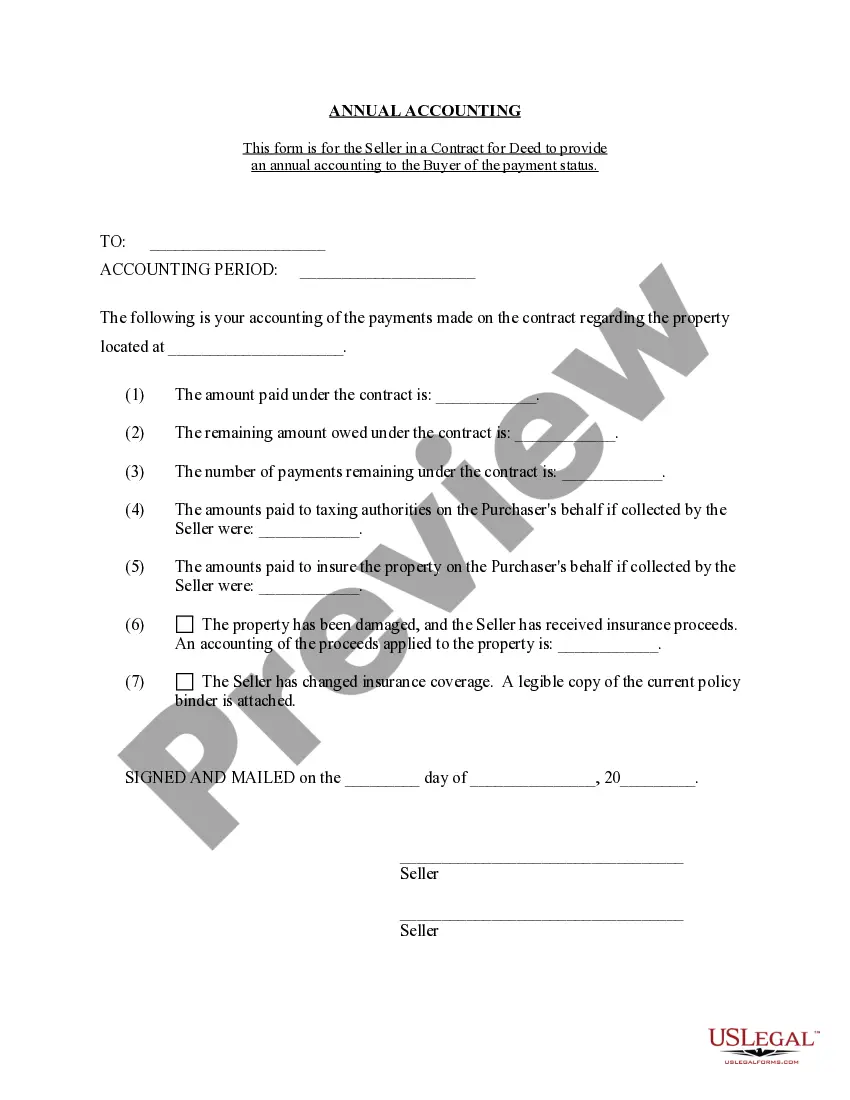

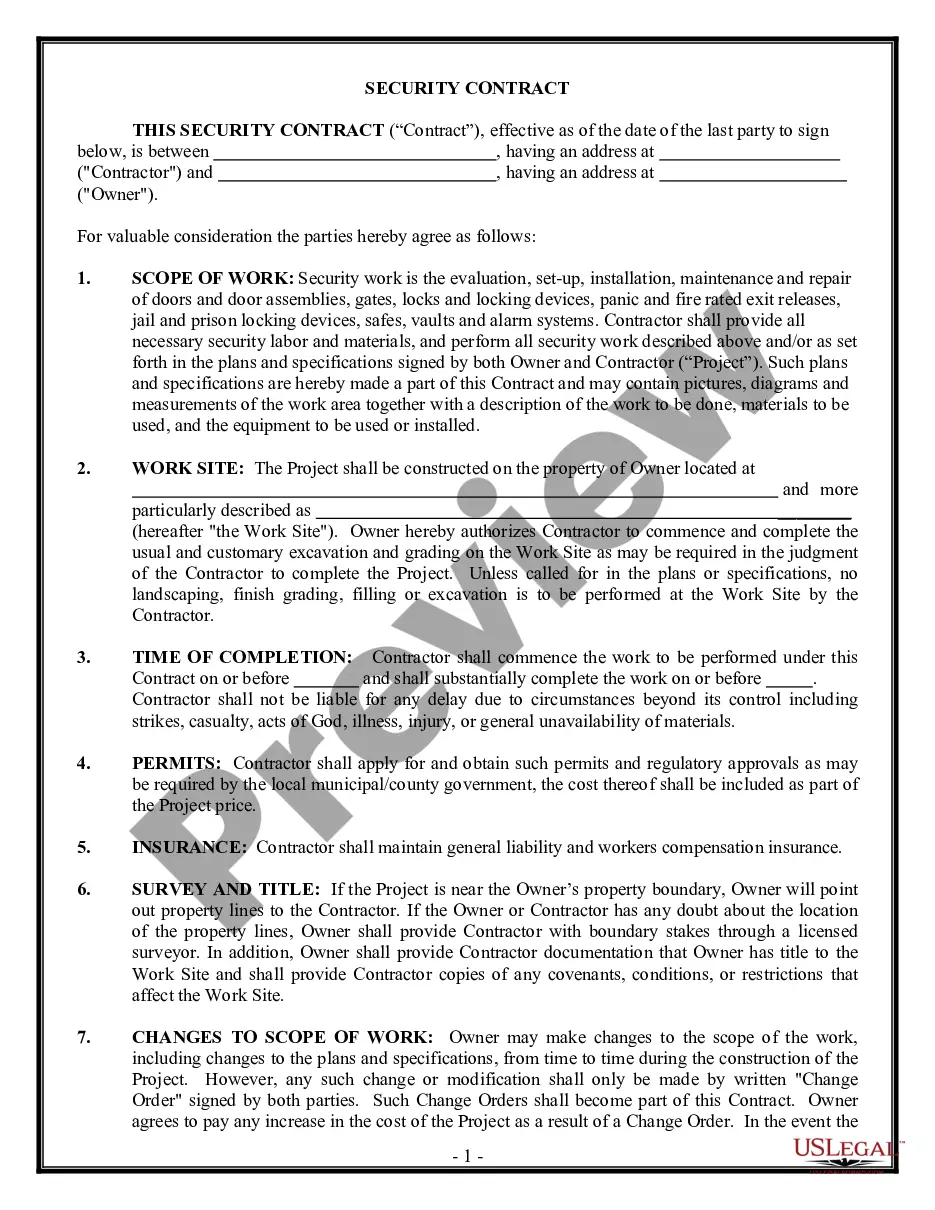

- Examine the page content to ensure you found the right sample.

- Use the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Use the Buy Now button to obtain the template when you find the appropriate one.

- Choose one of the subscription plans and log in or create an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Complete and sign the template on paper after printing it or do it all electronically.

That's the easiest and most economical way to get up-to-date templates for any legal purposes. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!