Maricopa Arizona Investors' Rights Agreement is a legally binding contract entered into between Velocity, Inc. (the "Company"), Existing Holders, and Founders, defining the investor's rights and protections in relation to their investment in the Company. This agreement sets out the terms and conditions under which the investors can exercise their rights, receive information, and protect their interests. There are different types of Maricopa Arizona Investors' Rights Agreements that can be established based on the specific requirements and circumstances. Some of these variations include: 1. Standard Investors' Rights Agreement: This is the most common type of agreement that outlines the general rights and protections of the investors. It includes provisions related to information rights, consent rights, preemptive rights, registration rights, and transfer restrictions. 2. Founder-Friendly Investors' Rights Agreement: This type of agreement is typically more favorable towards the founders of the company. It may include certain provisions that provide additional protections or benefits to the founders, such as increased control or veto rights over major decisions. 3. Series-Specific Investors' Rights Agreement: In cases where the investment is made in multiple series or rounds, a series-specific agreement may be established. This agreement outlines the rights and protections specific to the investors in that particular series or round, addressing any unique considerations or preferences. 4. Investor-Friendly Investors' Rights Agreement: This type of agreement is designed to be more favorable towards the investors. It may include additional provisions that grant expanded rights or protections to the investors, such as increased board representation or preferential liquidation preferences. The Maricopa Arizona Investors' Rights Agreement typically covers key aspects such as: 1. Information Rights: The agreement outlines the investors' right to receive regular updates, financial statements, and other relevant information about the Company's performance and operations. 2. Consent Rights: It specifies the circumstances under which the investors' consent is required for certain major decisions, such as changes in the Company's capital structure, mergers, acquisitions, or executive appointments. 3. Preemptive Rights: The agreement defines the investors' right to participate in future financing rounds to maintain their ownership percentage in the Company and prevent dilution. 4. Registration Rights: It outlines the investors' right to request the registration of their shares with the relevant regulatory authorities, allowing them to freely sell or transfer their holdings. 5. Transfer Restrictions: The agreement details any restrictions or limitations on transferring shares, ensuring that the investors' interests are protected and that the Company maintains control over its ownership structure. The specific terms and conditions of the Maricopa Arizona Investors' Rights Agreement may vary depending on the negotiations and specific needs of the parties involved. It is essential for all parties to carefully review and understand the agreement before signing to ensure their rights and interests are adequately protected.

Maricopa Arizona Investors' Rights Agreement between Telocity, Inc., Existing Holders, and Founders

Description

How to fill out Maricopa Arizona Investors' Rights Agreement Between Telocity, Inc., Existing Holders, And Founders?

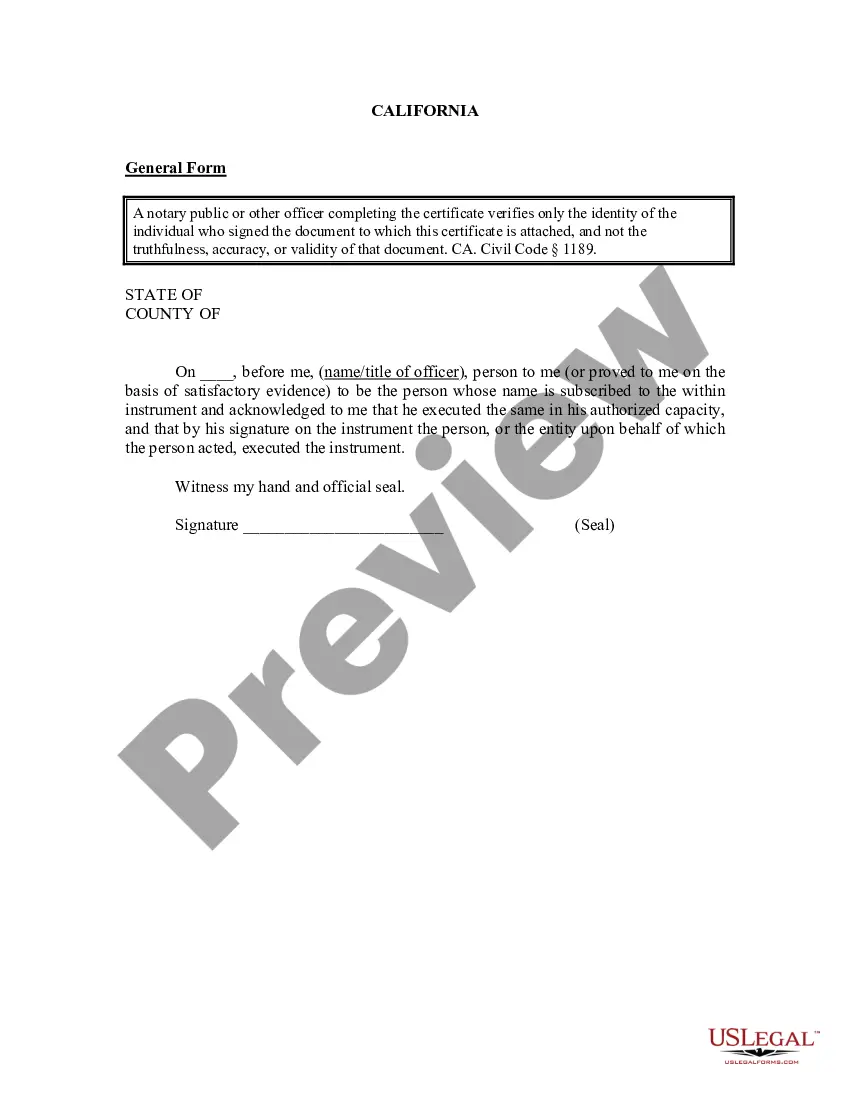

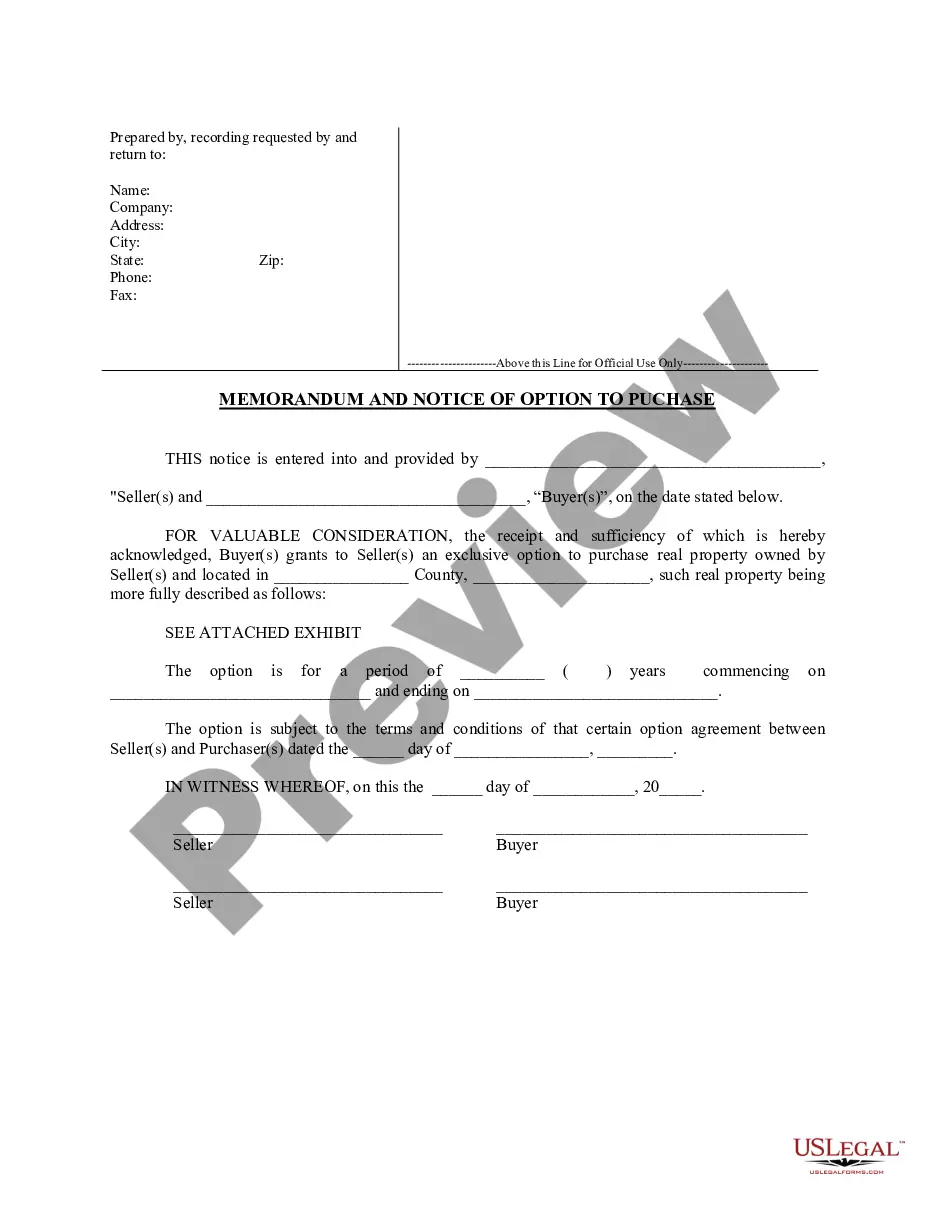

Laws and regulations in every area vary throughout the country. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal documentation. To avoid costly legal assistance when preparing the Maricopa Investors' Rights Agreement between Telocity, Inc., Existing Holders, and Founders, you need a verified template valid for your region. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions web collection of more than 85,000 state-specific legal templates. It's a perfect solution for professionals and individuals searching for do-it-yourself templates for various life and business occasions. All the forms can be used many times: once you obtain a sample, it remains available in your profile for further use. Thus, when you have an account with a valid subscription, you can simply log in and re-download the Maricopa Investors' Rights Agreement between Telocity, Inc., Existing Holders, and Founders from the My Forms tab.

For new users, it's necessary to make a few more steps to obtain the Maricopa Investors' Rights Agreement between Telocity, Inc., Existing Holders, and Founders:

- Examine the page content to ensure you found the correct sample.

- Take advantage of the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Utilize the Buy Now button to obtain the document once you find the proper one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Fill out and sign the document in writing after printing it or do it all electronically.

That's the easiest and most affordable way to get up-to-date templates for any legal purposes. Locate them all in clicks and keep your documentation in order with the US Legal Forms!