The Riverside California Investors' Rights Agreement between Velocity, Inc., Existing Holders, and Founders is a legally binding contract that outlines the rights and obligations of the investors, existing stockholders, and founders of the company. This agreement serves to protect the interests of all parties involved and ensures transparency, fairness, and proper governance within the company. The agreement covers various key aspects, including ownership rights, voting rights, information rights, and transfer restrictions. These provisions are designed to safeguard the investors' interests and enable them to actively participate in the decision-making processes of the company. Ownership rights are an essential component of the agreement. They define the percentage of ownership each investor holds and the capital they have invested. This information helps maintain clarity and fairness when assessing the value and distribution of shares. Voting rights grant investors the ability to influence important company decisions. The agreement specifies the voting power of each party based on their respective ownership percentages. Provisions may include voting on the appointment of board members, major transactions, or any other matters requiring shareholder approval. Information rights ensure that investors have access to accurate and timely information about the company's financial performance, business operations, and strategic decisions. It obligates Velocity, Inc. to provide regular updates, financial statements, and other relevant disclosures to existing holders and founders. Transfer restrictions are established to govern the sale or transfer of shares. These provisions prevent unfair dilution of existing shareholders' stake and maintain stability within the ownership structure. The agreement may impose restrictions on the transfer of shares, such as requiring prior approval from the board of directors or other shareholders. It is important to note that there may be different types of Riverside California Investors' Rights Agreements between Velocity, Inc., Existing Holders, and Founders. These can be tailored to suit the specific needs and circumstances of the company. Types can include: 1. Standard Investors' Rights Agreement: This is a basic agreement that outlines the fundamental rights and protections of investors and is commonly used in early-stage companies. 2. Series-Specific Investors' Rights Agreement: In cases where Velocity, Inc. has multiple rounds of financing or different classes of investors, separate agreements may be created for each series or class of stockholders. 3. Amended and Restated Investors' Rights Agreement: If there are significant changes in the ownership structure or business operations of Velocity, Inc., an amended and restated agreement may be drafted to update the rights and obligations of all parties involved. In conclusion, the Riverside California Investors' Rights Agreement is a crucial legal document that ensures fair treatment and protection for investors, existing holders, and founders of Velocity, Inc. The agreement outlines ownership rights, voting rights, information rights, and transfer restrictions to maintain transparency and establish a solid foundation for governance within the company. Different types of agreements may exist based on the specific needs and circumstances of Velocity, Inc.

Riverside California Investors' Rights Agreement between Telocity, Inc., Existing Holders, and Founders

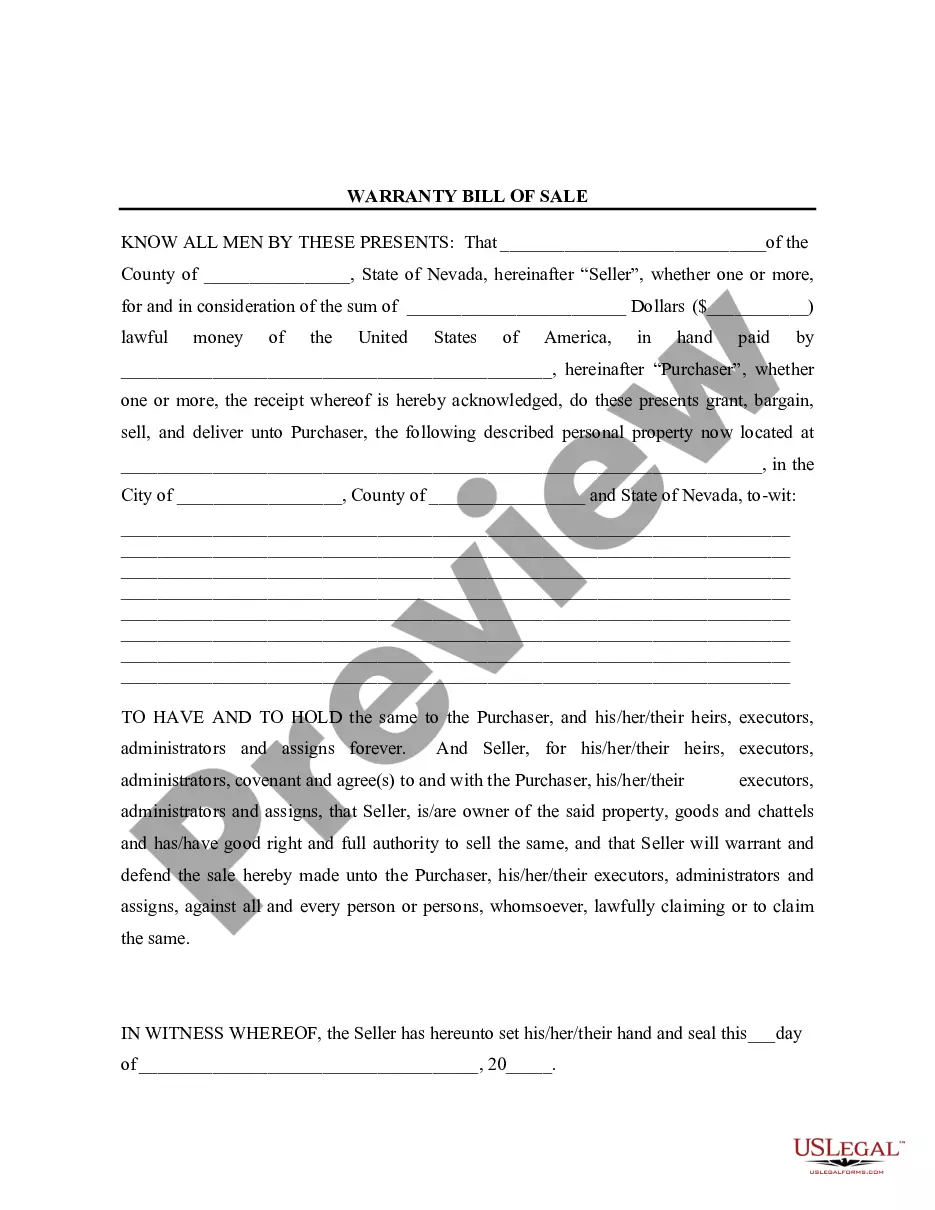

Description

How to fill out Riverside California Investors' Rights Agreement Between Telocity, Inc., Existing Holders, And Founders?

If you need to find a reliable legal paperwork provider to obtain the Riverside Investors' Rights Agreement between Telocity, Inc., Existing Holders, and Founders, consider US Legal Forms. Whether you need to launch your LLC business or take care of your asset distribution, we got you covered. You don't need to be knowledgeable about in law to find and download the appropriate template.

- You can select from more than 85,000 forms categorized by state/county and case.

- The self-explanatory interface, number of supporting materials, and dedicated support make it simple to locate and execute various paperwork.

- US Legal Forms is a trusted service offering legal forms to millions of customers since 1997.

Simply type to search or browse Riverside Investors' Rights Agreement between Telocity, Inc., Existing Holders, and Founders, either by a keyword or by the state/county the form is intended for. After finding the needed template, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's effortless to start! Simply find the Riverside Investors' Rights Agreement between Telocity, Inc., Existing Holders, and Founders template and check the form's preview and short introductory information (if available). If you're comfortable with the template’s legalese, go ahead and click Buy now. Create an account and select a subscription option. The template will be instantly available for download once the payment is completed. Now you can execute the form.

Handling your law-related affairs doesn’t have to be expensive or time-consuming. US Legal Forms is here to demonstrate it. Our comprehensive collection of legal forms makes these tasks less pricey and more reasonably priced. Create your first business, organize your advance care planning, draft a real estate contract, or complete the Riverside Investors' Rights Agreement between Telocity, Inc., Existing Holders, and Founders - all from the comfort of your home.

Sign up for US Legal Forms now!