Fulton Georgia Fast Packet Services Payment Plan Agreement is a legal contract between Fast Packet Services and its customers, governing the terms and conditions of payment for the services provided. This agreement outlines the details of how payments will be made, the amount to be paid, and the duration of the payment plan. In this Fast Packet Services Payment Plan Agreement, customers residing in Fulton, Georgia, can enter into a mutually agreed upon payment plan to fulfill their financial obligations. This allows customers to make payments in installments over a predetermined period, rather than paying the entire amount upfront. The Fulton Georgia Fast Packet Services Payment Plan Agreement ensures transparency and clarity in financial matters, protecting the rights of both the service provider and the customer. By agreeing to this payment plan, customers can manage their finances effectively, while Fast Packet Services receives timely payments for the services rendered. Different types of Fulton Georgia Fast Packet Services Payment Plan Agreements may include variations in payment schedules and terms. Some examples of these agreement types are: 1. Monthly Payment Plan: Customers can choose to pay the outstanding balance in equal monthly installments until the entire amount is settled. This allows for easier budgeting and financial planning. 2. Bi-weekly Payment Plan: This type of agreement divides the outstanding balance into bi-weekly payments, providing customers with more frequent payment options. 3. Lump Sum Payment Plan: Customers who prefer to pay off their balances in one payment can negotiate a discounted rate or incentive with Fast Packet Services. This allows for quicker resolution of financial obligations. 4. Deferred Payment Plan: In certain situations, customers may face short-term financial challenges. This agreement type allows them to delay payments for a specific period, providing temporary relief until they can resume regular payments. 5. Customized Payment Plan: In some cases, customers may need a unique payment plan tailored to their specific circumstances. Fast Packet Services can work with customers to create a personalized agreement that meets their financial needs. Overall, the Fulton Georgia Fast Packet Services Payment Plan Agreement provides flexibility for customers to manage their payments effectively, ensuring a mutually beneficial relationship between Fast Packet Services and its customers in Fulton, Georgia.

Fulton Georgia Fast Packet Services Payment Plan Agreement

Description

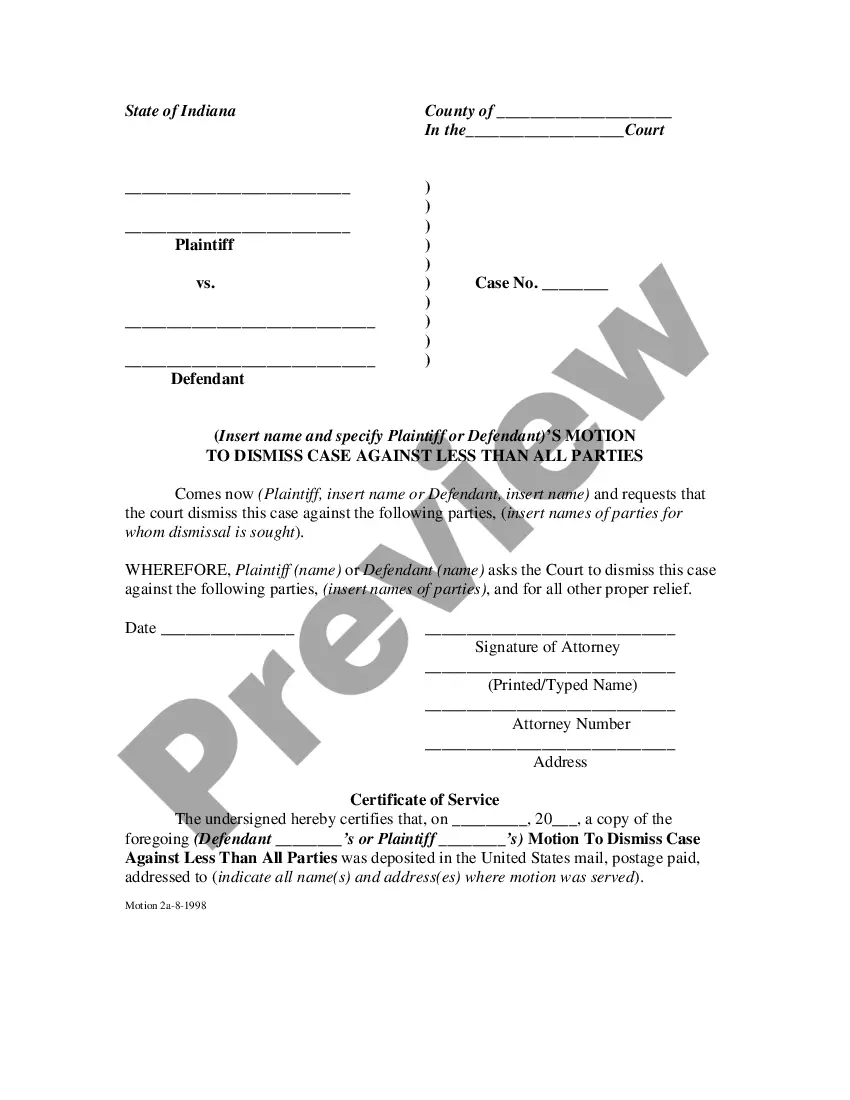

How to fill out Fulton Georgia Fast Packet Services Payment Plan Agreement?

Drafting papers for the business or individual needs is always a big responsibility. When creating an agreement, a public service request, or a power of attorney, it's essential to consider all federal and state regulations of the particular region. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it tense and time-consuming to generate Fulton Fast Packet Services Payment Plan Agreement without professional help.

It's easy to avoid spending money on lawyers drafting your documentation and create a legally valid Fulton Fast Packet Services Payment Plan Agreement on your own, using the US Legal Forms online library. It is the largest online collection of state-specific legal documents that are professionally verified, so you can be sure of their validity when choosing a sample for your county. Earlier subscribed users only need to log in to their accounts to download the needed document.

If you still don't have a subscription, follow the step-by-step instruction below to obtain the Fulton Fast Packet Services Payment Plan Agreement:

- Examine the page you've opened and verify if it has the sample you require.

- To accomplish this, use the form description and preview if these options are presented.

- To locate the one that suits your needs, use the search tab in the page header.

- Double-check that the template complies with juridical standards and click Buy Now.

- Select the subscription plan, then log in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever obtained never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and easily get verified legal forms for any use case with just a few clicks!

Form popularity

FAQ

If you are unable to revise an existing installment agreement online, call us at 800-829-1040 (individual) or 800-829-4933 (business).

To request an installment agreement, the taxpayer must complete Form 9465. Form 9465 can be included electronically with an e-filed return or paper-filed.

If it's been at least two weeks since you sent the payment to the IRS and your financial institution verifies that the check hasn't cleared your account, call the IRS's toll-free number at 800-829-1040 to ask if the payment has been credited to your tax account.

Contact your bank directly, share the IRS People First Initiative information, and ask them to temporarily stop deductions. Banks are required to comply with customer requests to stop recurring payments within a specified timeframe.

If you mail Form 9465, the IRS will respond to your request typically within 30 days but it may take longer during filing season. Installment agreements by direct debit and payroll deduction enable you to make timely payments automatically and reduce the possibility of default.

The user fee for requesting an installment agreement using Form 9465 is $225 with payment by check and $107 with payment by direct debit from your checking account. To qualify for a lower user fee, you can request an installment agreement using the IRS Online Payment Agreement tool.

You can use the Online Payment Agreement tool to make the following changes: Change your monthly payment amount. Change your monthly payment due date.

You can also confirm your installment agreement with the IRS by calling them at 1-800-829-1040 Monday - Friday, am - pm local time once your return has been fully processed (allow 2 weeks for processing).

The IRS does reject requests for payment plans sometimes ? if this happens to you, you have the right to appeal. You must request an appeal within 30 days of the rejection by submitting Form 9423, Collection Appeals Request.

You can view details of your current payment plan (type of agreement, due dates, and amount you need to pay) by logging into the Online Payment Agreement tool.