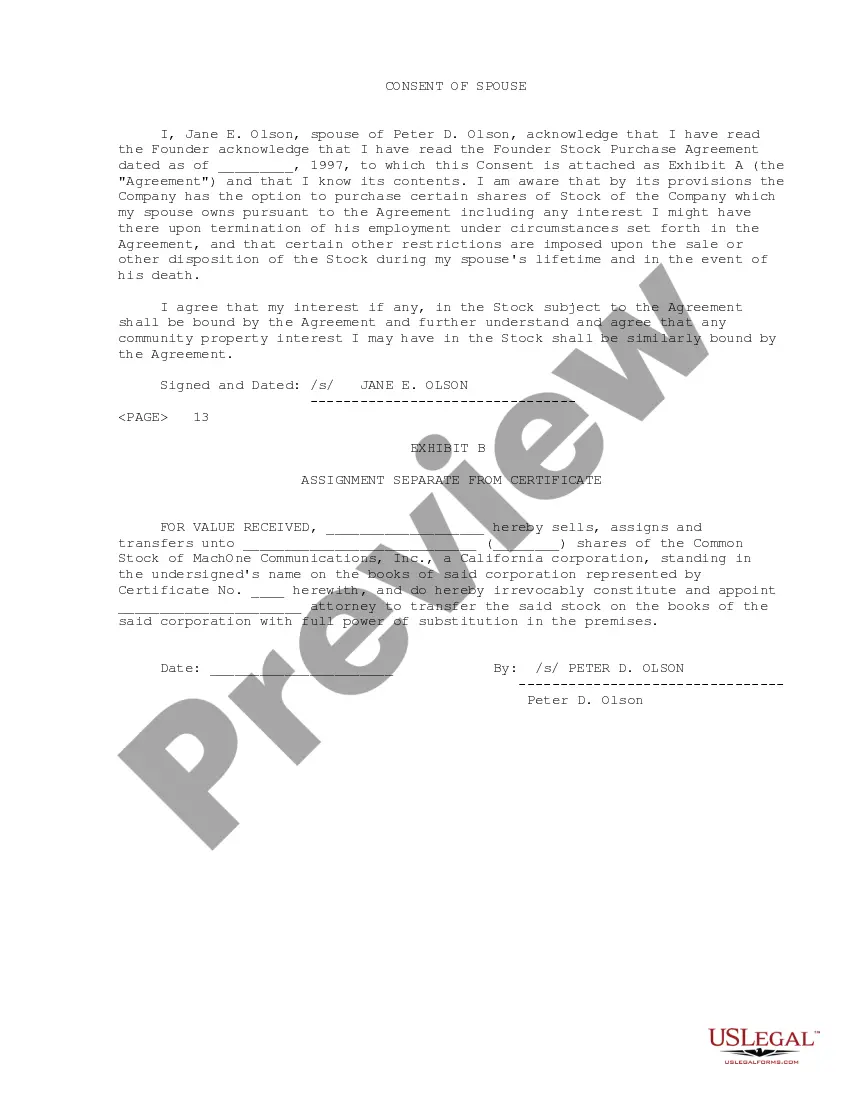

Allegheny Pennsylvania is a county located in the southwestern part of the state. It encompasses an area consisting of various cities, towns, and municipalities, including Pittsburgh, the county seat. Known for its rich history and diverse cultural offerings, Allegheny Pennsylvania attracts residents and visitors from around the region. The Sample Founder Stock Purchase Agreement between Machine Communications, Inc. and Peter D. Olson is a legally binding document that outlines the terms and conditions of the acquisition of company stock by Peter D. Olson, a founder of Machine Communications, Inc. The agreement serves as a framework to establish the rights, obligations, and restrictions associated with the purchase of founder stock. Keywords: Allegheny Pennsylvania, Sample Founder Stock Purchase Agreement, Machine Communications, Inc., Peter D. Olson, legally binding, terms and conditions, acquisition, company stock, founder, rights, obligations, restrictions. Different types of Allegheny Pennsylvania Sample Founder Stock Purchase Agreements between Machine Communications, Inc. and Peter D. Olson may include: 1. Restricted Stock Purchase Agreement: This type of agreement may incorporate specific restrictions on the transferability and sale of the purchased founder stock for a predetermined period. It aims to ensure that the stock remains within the control of the company and its founders. 2. Vesting Agreement: A vesting agreement may determine the schedule and terms under which the founder stock becomes fully owned by Peter D. Olson. It often includes a cliff or a gradual vesting period tied to the founder's continuous service or achievement of certain milestones. 3. Stock Option Agreement: In some cases, the agreement may grant Peter D. Olson the option to purchase additional founder stock at a predetermined price within a specified timeframe. This provides flexibility and potential for future stock acquisitions. 4. Buy-Sell Agreement: This type of agreement outlines the procedures and terms for buying or selling founder stock between Machine Communications, Inc. and Peter D. Olson or other shareholders in the event of certain triggering events, such as death, disability, or voluntary or involuntary departure. Keywords: Restricted Stock Purchase Agreement, Vesting Agreement, Stock Option Agreement, Buy-Sell Agreement, transferability, sale, vesting period, cliff, stock option, predetermined price, triggering events, shareholders.

Allegheny Pennsylvania Sample Founder Stock Purchase Agreement between MachOne Communications, Inc. and Peter D. Olson

Description

How to fill out Allegheny Pennsylvania Sample Founder Stock Purchase Agreement Between MachOne Communications, Inc. And Peter D. Olson?

If you need to find a trustworthy legal paperwork supplier to find the Allegheny Sample Founder Stock Purchase Agreement between MachOne Communications, Inc. and Peter D. Olson, look no further than US Legal Forms. No matter if you need to launch your LLC business or manage your belongings distribution, we got you covered. You don't need to be knowledgeable about in law to locate and download the appropriate form.

- You can select from more than 85,000 forms categorized by state/county and case.

- The intuitive interface, variety of learning resources, and dedicated support team make it easy to find and complete various paperwork.

- US Legal Forms is a trusted service providing legal forms to millions of customers since 1997.

You can simply type to look for or browse Allegheny Sample Founder Stock Purchase Agreement between MachOne Communications, Inc. and Peter D. Olson, either by a keyword or by the state/county the form is intended for. After finding the needed form, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's effortless to start! Simply locate the Allegheny Sample Founder Stock Purchase Agreement between MachOne Communications, Inc. and Peter D. Olson template and take a look at the form's preview and short introductory information (if available). If you're confident about the template’s terminology, go ahead and hit Buy now. Create an account and choose a subscription option. The template will be instantly ready for download once the payment is completed. Now you can complete the form.

Taking care of your legal matters doesn’t have to be expensive or time-consuming. US Legal Forms is here to prove it. Our comprehensive collection of legal forms makes these tasks less costly and more reasonably priced. Set up your first business, arrange your advance care planning, draft a real estate agreement, or execute the Allegheny Sample Founder Stock Purchase Agreement between MachOne Communications, Inc. and Peter D. Olson - all from the convenience of your home.

Join US Legal Forms now!