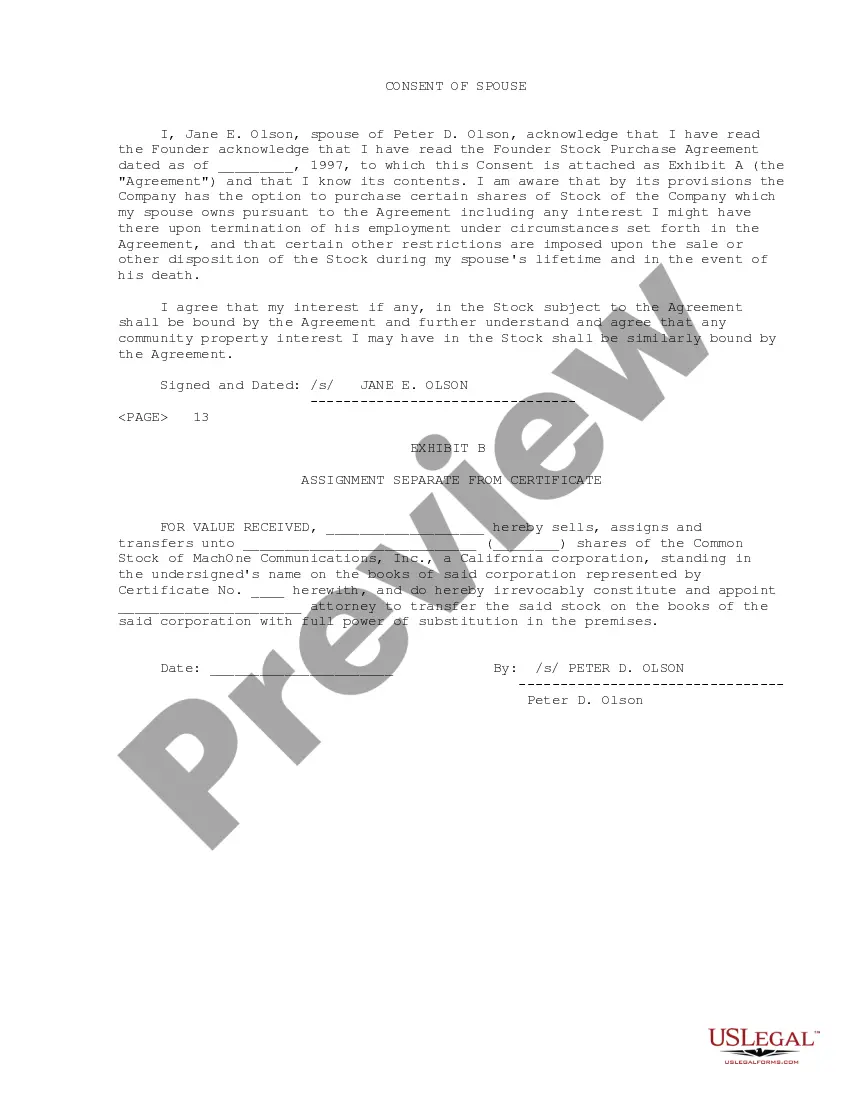

A Sample Founder Stock Purchase Agreement is an essential legal document used when a company, such as Machine Communications, Inc., sells or issues shares of stock to one of its founders, in this case, Peter D. Olson. The agreement outlines the terms and conditions of the stock purchase, protects the rights of both parties, and specifies the responsibilities and obligations involved in the transaction. In Chicago, Illinois, where Machine Communications, Inc. is located, the Sample Founder Stock Purchase Agreement serves as a legally binding contract between the company and its founder, Peter D. Olson. The agreement contains several important sections that safeguard the interests of both parties involved, such as: 1. Parties: Clearly identifies the parties involved in the agreement, naming Machine Communications, Inc. as the company and Peter D. Olson as the purchasing founder. 2. Purchase Price: Specifies the total purchase price for the founder's shares of stock. This section may also include provisions regarding the payment method and any installments or milestones agreed upon. 3. Stock Purchase: Details the number of shares being purchased and any relevant information, such as class or series of stock, that differentiates the acquired shares. 4. Representations and Warranties: Sets forth the representations and warranties made by both parties regarding their authority, ownership, and other aspects to ensure the validity of the transaction. 5. Closing Conditions: Outlines the conditions that must be satisfied by both parties before the stock purchase is considered complete and valid. This may include legal requirements, corporate approvals, and proper documentation. 6. Transfer Restrictions: Establishes any restrictions placed on selling, transferring, or assigning the purchased shares, ensuring that the company maintains control and stability. 7. Governing Law and Jurisdiction: Specifies the laws and jurisdiction under which any disputes will be resolved, which would typically be Illinois law due to the location of the company. There can be variations of the Chicago Illinois Sample Founder Stock Purchase Agreement based on specific circumstances or additional clauses required to protect the interests of both parties. Some examples of these variations can include agreements for preferred founder shares, vesting schedules, anti-dilution provisions, or provisions related to intellectual property ownership. It is crucial for both Machine Communications, Inc. and Peter D. Olson to carefully review and understand the terms laid out in the Sample Founder Stock Purchase Agreement before signing it. Consulting with legal professionals who specialize in contract law and corporate governance is advisable to ensure compliance with relevant regulations and to protect the interests of all parties involved.

Chicago Illinois Sample Founder Stock Purchase Agreement between MachOne Communications, Inc. and Peter D. Olson

Description

How to fill out Chicago Illinois Sample Founder Stock Purchase Agreement Between MachOne Communications, Inc. And Peter D. Olson?

Draftwing paperwork, like Chicago Sample Founder Stock Purchase Agreement between MachOne Communications, Inc. and Peter D. Olson, to take care of your legal affairs is a difficult and time-consumming process. A lot of circumstances require an attorney’s involvement, which also makes this task not really affordable. Nevertheless, you can acquire your legal issues into your own hands and take care of them yourself. US Legal Forms is here to save the day. Our website comes with over 85,000 legal documents crafted for various cases and life situations. We ensure each form is in adherence with the regulations of each state, so you don’t have to be concerned about potential legal pitfalls compliance-wise.

If you're already familiar with our website and have a subscription with US, you know how straightforward it is to get the Chicago Sample Founder Stock Purchase Agreement between MachOne Communications, Inc. and Peter D. Olson form. Simply log in to your account, download the template, and customize it to your needs. Have you lost your form? Don’t worry. You can get it in the My Forms folder in your account - on desktop or mobile.

The onboarding process of new customers is just as straightforward! Here’s what you need to do before downloading Chicago Sample Founder Stock Purchase Agreement between MachOne Communications, Inc. and Peter D. Olson:

- Make sure that your document is specific to your state/county since the rules for writing legal paperwork may vary from one state another.

- Discover more information about the form by previewing it or going through a brief intro. If the Chicago Sample Founder Stock Purchase Agreement between MachOne Communications, Inc. and Peter D. Olson isn’t something you were looking for, then use the header to find another one.

- Log in or register an account to begin using our website and download the form.

- Everything looks good on your side? Click the Buy now button and select the subscription plan.

- Pick the payment gateway and type in your payment information.

- Your form is all set. You can go ahead and download it.

It’s an easy task to find and buy the appropriate document with US Legal Forms. Thousands of organizations and individuals are already taking advantage of our extensive collection. Sign up for it now if you want to check what other advantages you can get with US Legal Forms!