Title: Understanding the Houston, Texas Sample Founder Stock Purchase Agreement between Machine Communications, Inc. and Peter D. Olson Introduction: The Houston, Texas Sample Founder Stock Purchase Agreement between Machine Communications, Inc. and Peter D. Olson serves as a legally binding document outlining the terms and conditions of the stock purchase transaction between the two parties. This agreement is designed to protect both parties involved and ensure a smooth transfer of ownership and rights. Let's explore the main components of this agreement and shed light on any potential variations. 1. Parties Involved: The agreement involves Machine Communications, Inc., a prominent Houston-based communication firm, and Peter D. Olson, an individual actively participating in the stock purchase transaction. Providing a clear identification and role of each party in the Agreement ensures transparency and reduces potential confusion. 2. Purpose of the Agreement: This section highlights the main purpose of the agreement, which is the purchase and transfer of founder stocks from Machine Communications, Inc. to Peter D. Olson. The Agreement outlines the terms, conditions, and considerations for this transaction. 3. Purchase Details: This section includes key details such as the number of founder stocks being sold, the purchase price per stock, and the total purchase price. These details need to be clearly stated to avoid any ambiguity during the transaction. 4. Payment Terms: The agreement describes the payment terms and schedule for Peter D. Olson, specifying the method and timing of payment. Establishing clear payment guidelines ensures a smooth financial transaction and minimizes potential disputes. 5. Representations and Warranties: Both parties make representations and warranties to ensure the accuracy of information provided and the legality of the agreement. This section assures Machine Communications, Inc. that Peter D. Olson is legally eligible to purchase the founder stocks and that no misunderstandings or misrepresentations have occurred during the negotiation. 6. Closing Arrangements: This section outlines the closing arrangements, including the location, date, and time of the stock purchase transaction. Additionally, any requirements or documents needed for the successful completion of the transaction are specified. This ensures a well-organized process and a finality to the agreement. Different Types of Houston, Texas Sample Founder Stock Purchase Agreements between Machine Communications, Inc. and Peter D. Olson: While variations can exist depending on specific circumstances, the primary focus of a Founder Stock Purchase Agreement remains consistent. Some potential types or variations may include: 1. Vesting Schedule Variation: The agreement might include provisions related to a vesting schedule, which outlines the gradual transfer of founder stocks to Peter D. Olson over time, contingent upon certain milestones or time periods. 2. Stock Option Agreement: In some cases, the agreement may pertain to stock options instead of immediate stock purchase, offering Peter D. Olson the right to purchase founder stocks at a predetermined price within a specified period. 3. Shareholders' Agreement: This agreement could extend beyond the stock purchase to address additional governance matters, shareholder rights, dispute resolution mechanisms, and board representation. Conclusion: The Houston, Texas Sample Founder Stock Purchase Agreement between Machine Communications, Inc. and Peter D. Olson represents a legally binding document governing the transfer of founder stocks. By understanding the key components and potential variations in this agreement, both parties can negotiate and complete the stock purchase transaction smoothly and efficiently. Always consult legal professionals for expert advice tailored to your specific situation.

Houston Texas Sample Founder Stock Purchase Agreement between MachOne Communications, Inc. and Peter D. Olson

Description

How to fill out Houston Texas Sample Founder Stock Purchase Agreement Between MachOne Communications, Inc. And Peter D. Olson?

Preparing legal documentation can be difficult. Besides, if you decide to ask an attorney to draft a commercial agreement, papers for ownership transfer, pre-marital agreement, divorce paperwork, or the Houston Sample Founder Stock Purchase Agreement between MachOne Communications, Inc. and Peter D. Olson, it may cost you a fortune. So what is the best way to save time and money and draft legitimate documents in total compliance with your state and local laws? US Legal Forms is a great solution, whether you're searching for templates for your individual or business needs.

US Legal Forms is largest online library of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any use case gathered all in one place. Therefore, if you need the latest version of the Houston Sample Founder Stock Purchase Agreement between MachOne Communications, Inc. and Peter D. Olson, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample using the Download button. If you haven't subscribed yet, here's how you can get the Houston Sample Founder Stock Purchase Agreement between MachOne Communications, Inc. and Peter D. Olson:

- Glance through the page and verify there is a sample for your region.

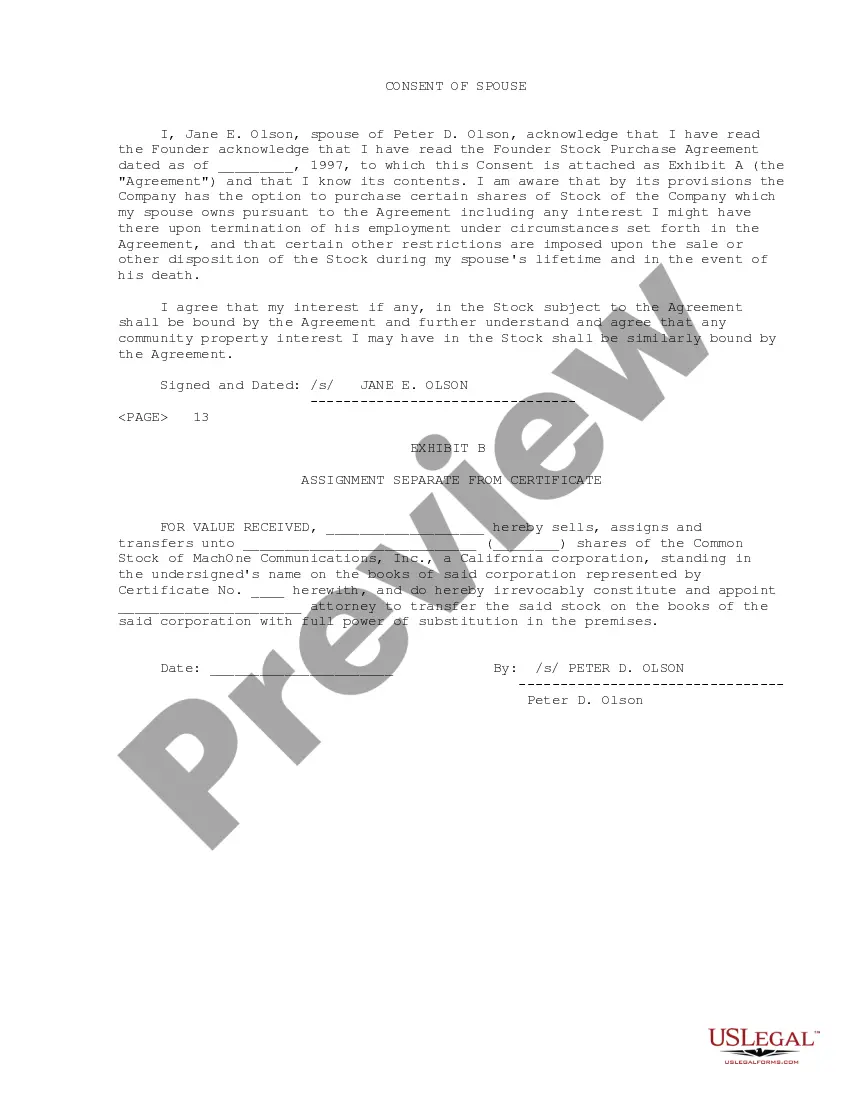

- Examine the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - look for the right one in the header.

- Click Buy Now once you find the required sample and pick the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a payment with a credit card or via PayPal.

- Opt for the file format for your Houston Sample Founder Stock Purchase Agreement between MachOne Communications, Inc. and Peter D. Olson and download it.

When finished, you can print it out and complete it on paper or upload the template to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the paperwork ever acquired multiple times - you can find your templates in the My Forms tab in your profile. Give it a try now!