Middlesex Massachusetts is a county located in the state of Massachusetts, United States. It encompasses various cities and towns, including Cambridge, Lowell, Newton, and Lexington, among others. Known for its rich history, diverse population, and thriving economy, Middlesex Massachusetts is a significant hub for various industries, including technology, higher education, healthcare, and more. One of the legal documents commonly used in business transactions within Middlesex Massachusetts is the Sample Founder Stock Purchase Agreement. This agreement is a contractual agreement between Machine Communications, Inc. and Peter D. Olson, outlining the terms and conditions associated with the purchase of founder stock in the company. The agreement typically includes detailed provisions related to the purchase price, the number of shares being acquired, payment terms, and any restrictions on the sale or transfer of the stock. Different types of Middlesex Massachusetts Sample Founder Stock Purchase Agreements between Machine Communications, Inc. and Peter D. Olson may include variations such as: 1. Common Stock Purchase Agreement: This type of agreement pertains to the purchase of common stock, which represents the basic form of ownership in a corporation. Common stockholders typically have voting rights and are entitled to a share of the company's profits through dividends. 2. Preferred Stock Purchase Agreement: In contrast to common stock, preferred stock represents a higher level of ownership with certain preferential rights and privileges. Preferred stockholders generally receive a fixed dividend rate and have preferential treatment in case of liquidation or other corporate events. 3. Restricted Stock Purchase Agreement: This agreement pertains to the purchase of restricted stock, which is subject to various restrictions and conditions. These restrictions may include a vesting period before the stock can be fully owned by the purchaser, as well as limitations on transferability. 4. Stock Option Purchase Agreement: A stock option grants the holder the right to purchase a specific number of shares at a predetermined price at a future date. This agreement outlines the terms and conditions associated with the purchase of stock options by Peter D. Olson from Machine Communications, Inc. These different types of founder stock purchase agreements cater to specific scenarios and preferences, providing flexibility in structuring equity arrangements within the Middlesex Massachusetts business landscape. It is important to consult legal professionals familiar with the jurisdiction and specific business needs to draft an appropriate and enforceable agreement.

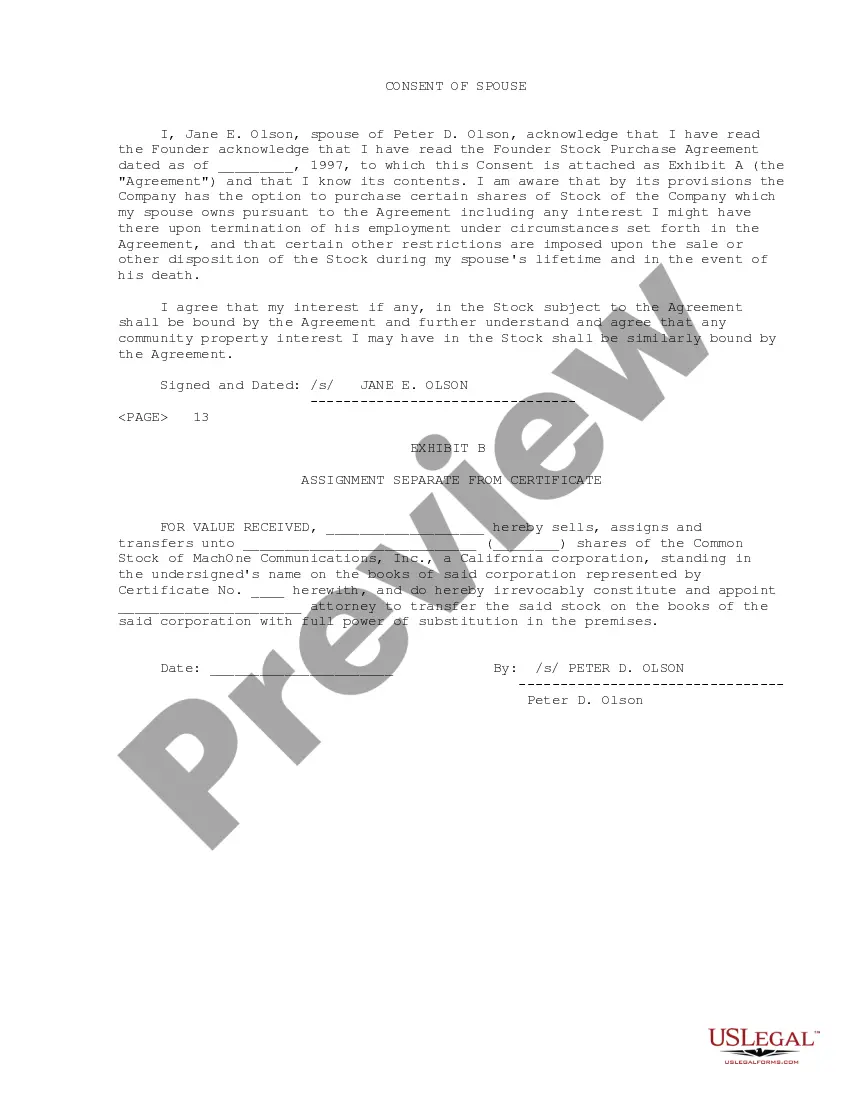

Middlesex Massachusetts Sample Founder Stock Purchase Agreement between MachOne Communications, Inc. and Peter D. Olson

Description

How to fill out Middlesex Massachusetts Sample Founder Stock Purchase Agreement Between MachOne Communications, Inc. And Peter D. Olson?

Creating forms, like Middlesex Sample Founder Stock Purchase Agreement between MachOne Communications, Inc. and Peter D. Olson, to manage your legal matters is a difficult and time-consumming task. Many circumstances require an attorney’s involvement, which also makes this task expensive. However, you can take your legal issues into your own hands and handle them yourself. US Legal Forms is here to save the day. Our website features over 85,000 legal documents intended for a variety of cases and life situations. We make sure each form is in adherence with the laws of each state, so you don’t have to worry about potential legal problems associated with compliance.

If you're already familiar with our services and have a subscription with US, you know how straightforward it is to get the Middlesex Sample Founder Stock Purchase Agreement between MachOne Communications, Inc. and Peter D. Olson template. Go ahead and log in to your account, download the form, and personalize it to your needs. Have you lost your form? Don’t worry. You can get it in the My Forms folder in your account - on desktop or mobile.

The onboarding process of new customers is just as simple! Here’s what you need to do before getting Middlesex Sample Founder Stock Purchase Agreement between MachOne Communications, Inc. and Peter D. Olson:

- Ensure that your form is specific to your state/county since the rules for writing legal papers may differ from one state another.

- Learn more about the form by previewing it or going through a quick intro. If the Middlesex Sample Founder Stock Purchase Agreement between MachOne Communications, Inc. and Peter D. Olson isn’t something you were looking for, then take advantage of the search bar in the header to find another one.

- Sign in or register an account to start using our service and download the document.

- Everything looks great on your end? Hit the Buy now button and choose the subscription plan.

- Pick the payment gateway and type in your payment details.

- Your form is good to go. You can try and download it.

It’s easy to find and purchase the needed document with US Legal Forms. Thousands of organizations and individuals are already benefiting from our extensive library. Subscribe to it now if you want to check what other perks you can get with US Legal Forms!